Occupancy Affidavit

Description

How to fill out Illinois Affidavit Of Occupancy And Financial Status?

- If you're a returning user, log in to your account and select your needed occupancy affidavit template from the collection. Ensure your subscription remains active or renew it if necessary.

- For first-time users, start by browsing the library. Review the form description and verify that it aligns with your jurisdiction requirements.

- If needed, utilize the Search tab to find an alternative template that fits your needs and proceed once you're satisfied.

- To purchase the document, click on the Buy Now button and choose your preferred subscription plan. You'll need to register for an account to access the complete resources.

- Complete your payment using a credit card or PayPal, and once processed, download the occupancy affidavit to your device. You can access it anytime in the My Forms section of your profile.

By following these simple steps, you'll have your occupancy affidavit ready in no time. US Legal Forms simplifies the process and offers support to ensure your documents are accurate and legally sound.

Start today and take advantage of US Legal Forms' extensive library. Your legal efficiency is just a few clicks away!

Form popularity

FAQ

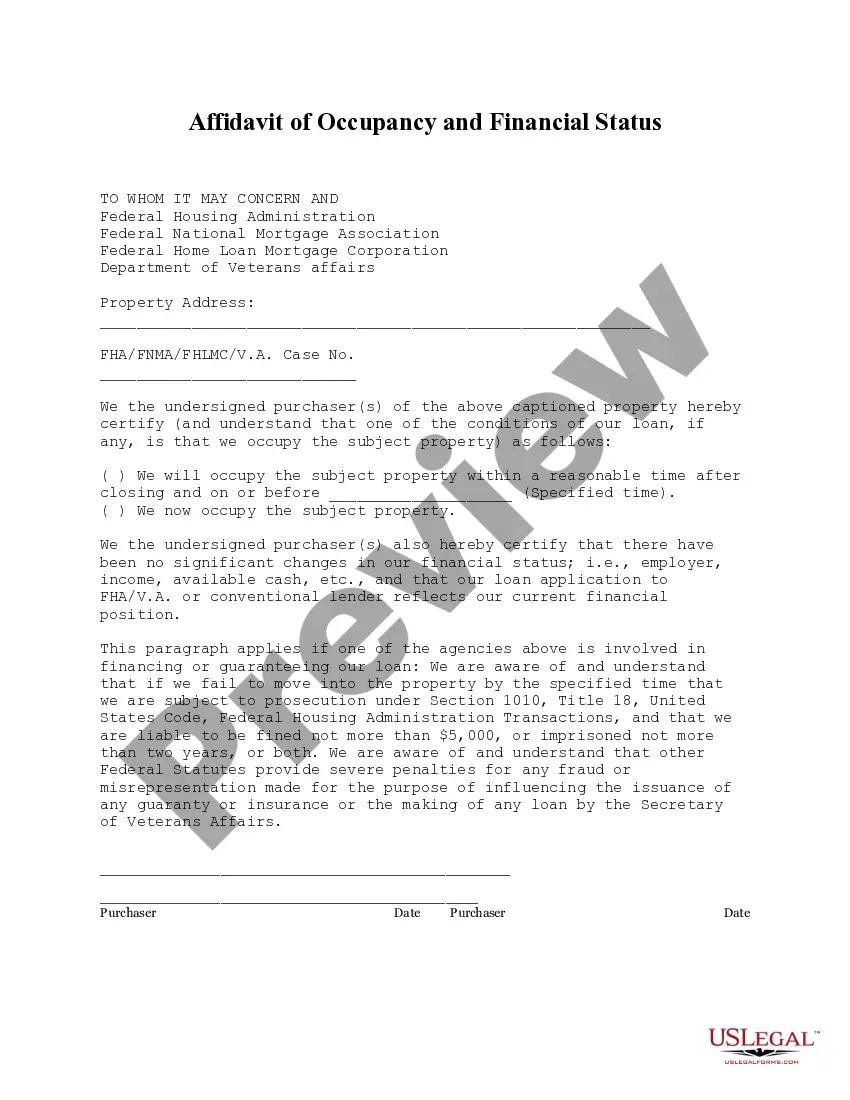

Filling out an occupancy affidavit requires clear and precise information about your residency status. Typically, you will need to provide your name, property address, and affirm that you occupy the property as your primary residence. Platforms like USLegalForms offer customizable templates, making the process simpler and more compliant.

Lenders verify occupancy through a combination of documentation and inspections. In addition to the occupancy affidavit, they might assess mortgage applications, tax statements, and utility records. This thorough approach ensures that borrowers meet eligibility requirements and reside in the financed property.

Lenders employ various methods to verify owner occupancy, including reviewing the occupancy affidavit and examining supporting documentation. They may also perform a physical inspection of the property to confirm the owner’s presence. This process helps lenders protect their investments and comply with regulations.

To prove that a property is owner-occupied, you can provide several pieces of evidence. This may include an occupancy affidavit, utility bills in your name, and tax records showing your permanent address. By accurately compiling this information, you can effectively prove your property's status to lenders.

Lenders assess various documents to determine if a property is your primary residence. These may include tax returns, utility bills, and the occupancy affidavit. By reviewing these documents, lenders can verify your claimed residency and ensure compliance with financing requirements.

Yes, the FHA requires verification of owner occupancy in order to secure certain types of financing. Typically, they require borrowers to sign an occupancy affidavit, confirming that the property is their primary residence. FHA guidelines emphasize the importance of this verification to maintain program integrity and prevent fraud.

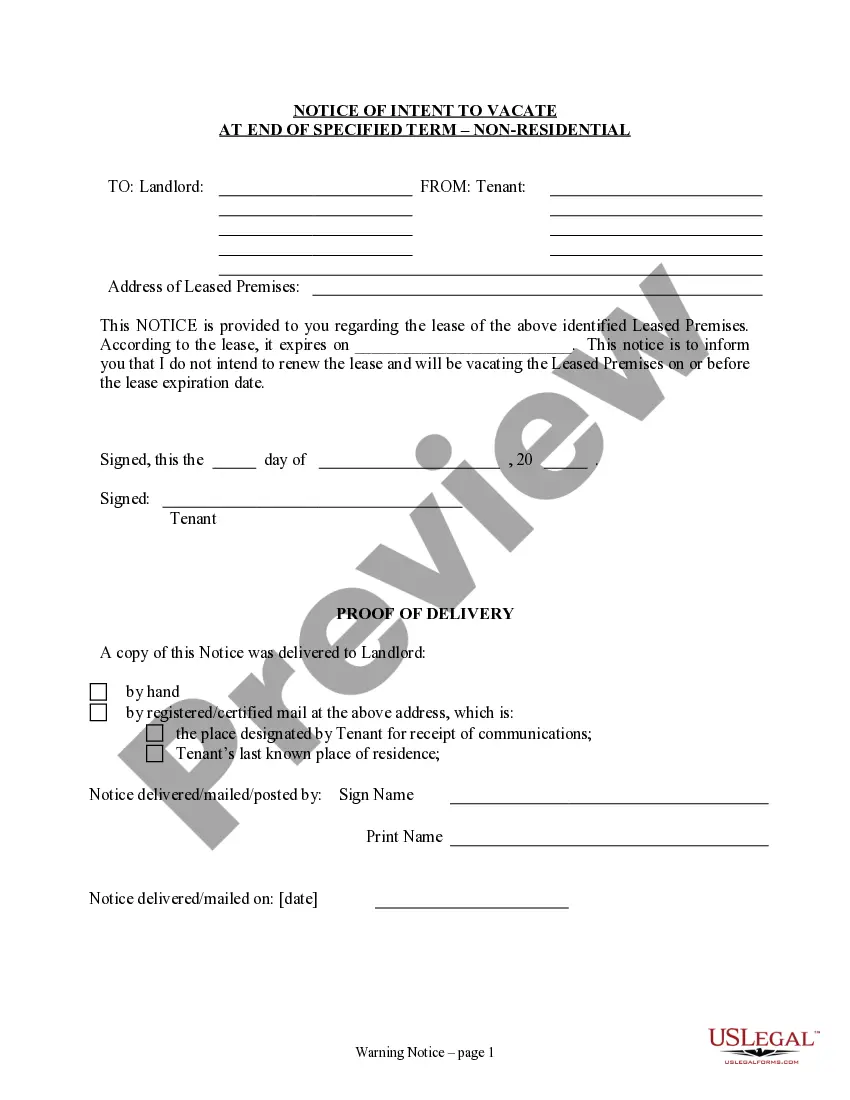

An affidavit for rental property is a similar legal document used by landlords to verify tenant occupancy. This affidavit serves as proof of residency and compliance with local housing regulations. Landlords may use this document to support their claims in rental agreements and disputes. Utilizing UsLegalForms can simplify this process, providing you with the necessary templates to ensure accuracy and legal compliance.

To prove occupancy, homeowners often provide documents such as utility bills, lease agreements, or the occupancy affidavit. These documents help establish a definitive link between you and the property, reassuring lenders of your residency. Additionally, some mortgage companies may require personal visits or third-party verification for increased assurance. Being prepared with the proper documentation simplifies the process.

A rental affidavit is a type of occupancy affidavit that verifies details about a rental agreement between a landlord and tenant. It provides proof of the rental arrangement, including terms of the lease and the identity of the occupants. This document can protect both parties in case of disputes or legal inquiries related to the rental property. The US Legal Forms platform offers templates to help you draft a rental affidavit that meets your specific needs.

No, an occupancy affidavit is not the same as a title. While a title establishes ownership of a property, an occupancy affidavit specifically confirms who occupies that property. It is a useful tool when dealing with rental agreements, property sales, or disputes regarding occupancy. For creating a clear occupancy affidavit, consider using resources from the US Legal Forms platform.