Name Change Ordered With Cra

Description

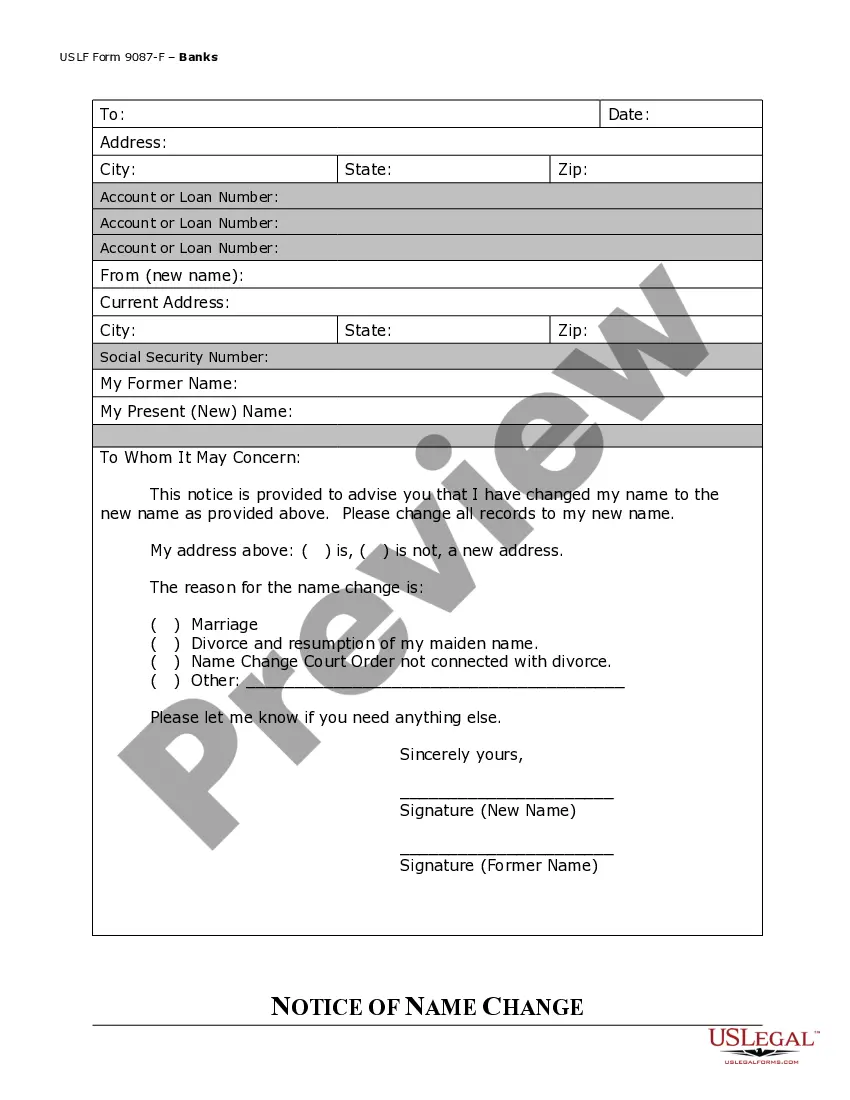

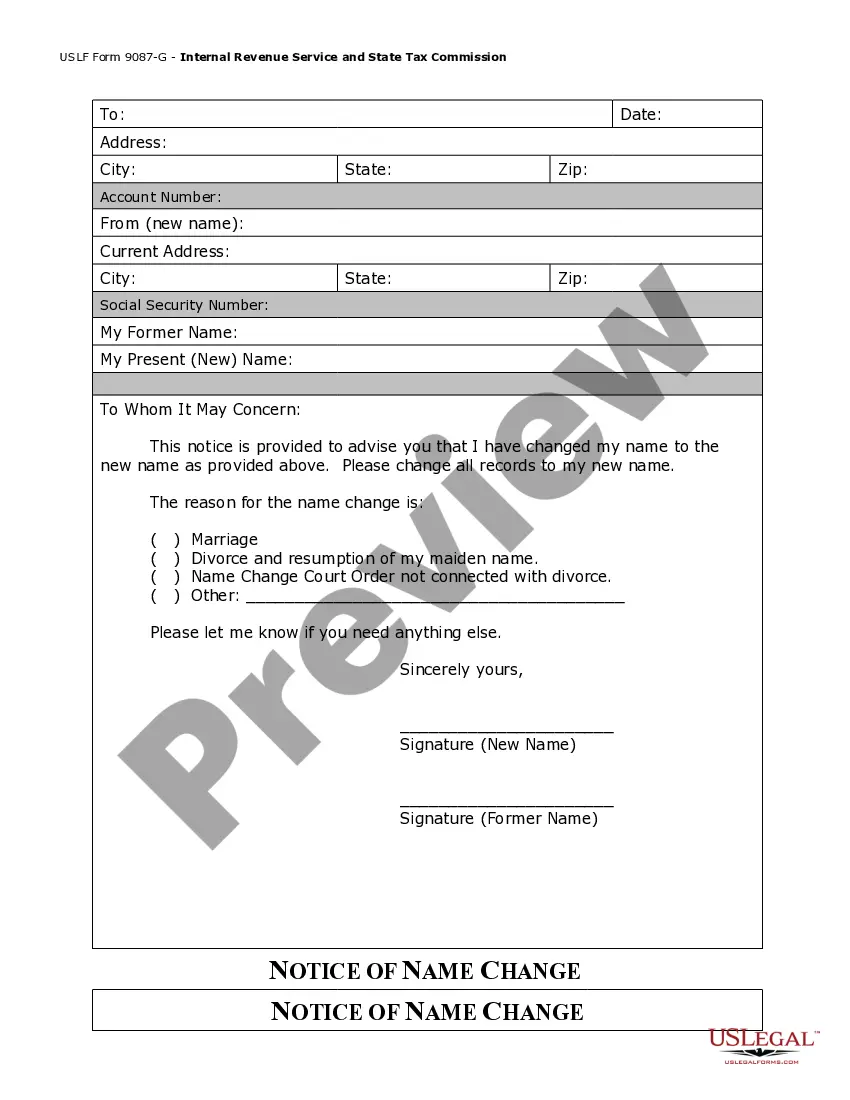

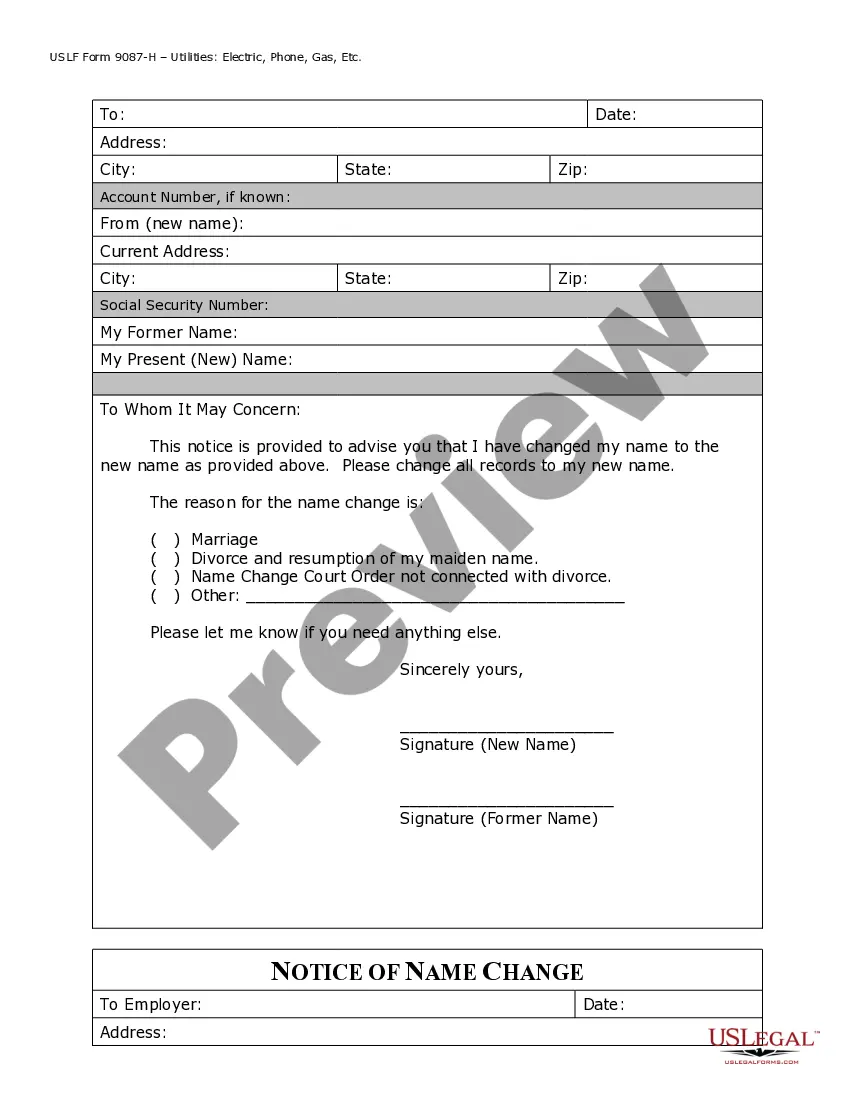

How to fill out Illinois Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

It's clear that one cannot become a legal authority overnight, nor can one swiftly learn to effectively draft a Name Change Ordered With Cra without a particular skill set.

Drafting legal documents is a lengthy process that necessitates specific training and expertise. So why not delegate the preparation of the Name Change Ordered With Cra to the experts.

With US Legal Forms, featuring one of the largest collections of legal templates, you can find everything from court documents to templates for internal organizational communication.

If you need a different document, restart your search.

Create a free account and select a subscription plan to purchase the form. Click Buy now. After your payment is processed, you can download the Name Change Ordered With Cra, fill it out, print it, and send it to the appropriate recipients or organizations. You can revisit your documents from the My documents tab at any time. If you are a returning customer, you can simply Log In and find and download the template from the same tab. Regardless of the purpose of your documents—whether financial, legal, or personal—our website has you covered. Experience US Legal Forms today!

- We recognize the importance of compliance and adherence to both federal and state regulations.

- That’s why, on our platform, all templates are specific to your location and current.

- Begin by visiting our website and obtaining the form you need in just a few minutes.

- Locate the document you require using the search bar at the top of the page.

- Examine it (if this option is available) and read the relevant description to see if the Name Change Ordered With Cra meets your needs.

Form popularity

FAQ

To determine if an email is genuine, check the sender's email address carefully. Emails from the CRA will have a specific format. Be cautious of poor grammar and spelling, as these are often indicators of misleading emails. Remember, if you receive unexpected communication regarding a name change ordered with CRA, you should verify its authenticity with the CRA directly.

Penalties for tax evasion and tax fraud If you have not filed a tax return, you could be charged with a summary offence under the Income Tax Act. If you are found guilty, the penalties can include substantial fines and a prison sentence.

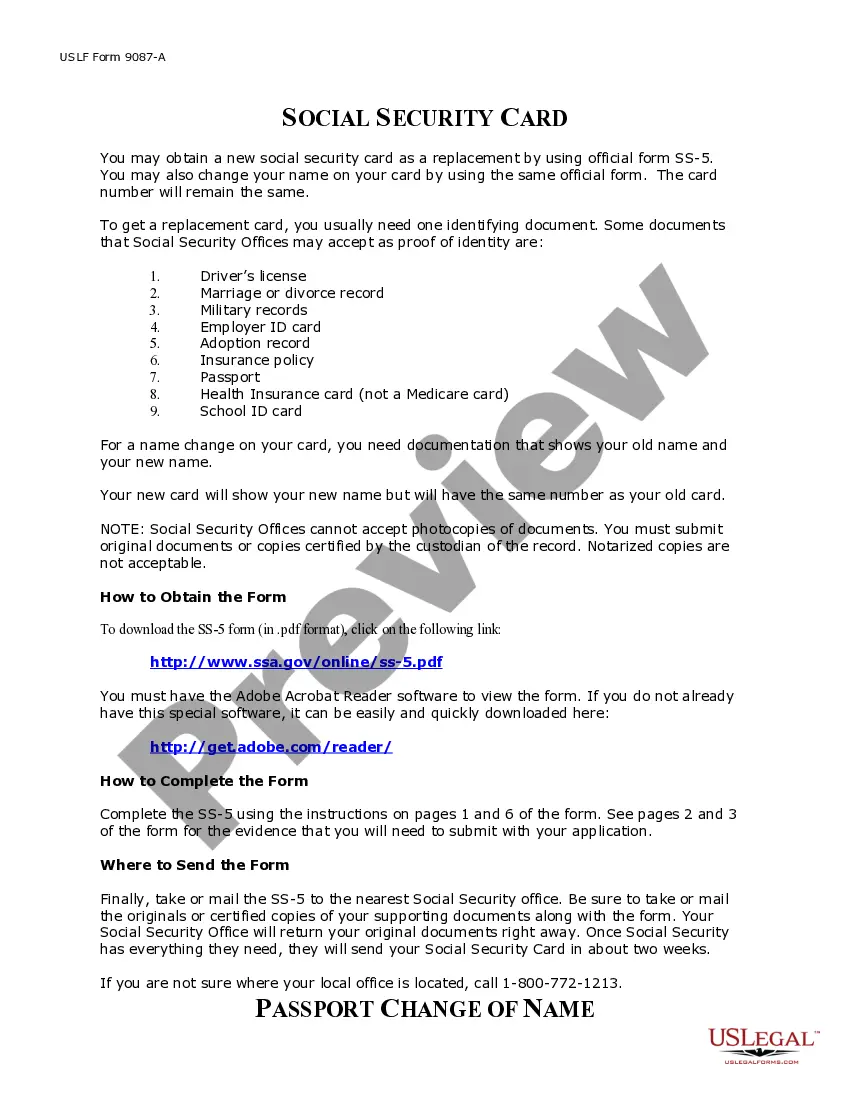

To officially change your name, you need to submit a Form SS-5, Application for a Social Security Card. You can find this form and the instructions online at SSA.gov. Allow a minimum of 10 days after the SSA updates your records before you file a tax return.

Ing to the CRA, a taxpayer has 10 years from the end of a calendar year to file an income tax return. The longer you go without filing taxes, the higher the penalties and potential prison term. Whether you are late by one year, five years, or even ten years, it is crucial that you file immediately.

As per Section 238 of the Income Tax Act, if you fail to file your tax returns, it can result in a fine of $1,000 to $25,000. Plus, you will also face up to one year in prison.

The prescribed limitation period in the Income Tax Act is 10 years; this means that after 10 years, the Canada Revenue Agency is legally prevented from collecting on a tax debt.