Collection Letter Template With Cc

Description

How to fill out Illinois Collection Letter By Contractor?

Managing legal papers and activities can be a lengthy addition to your schedule.

Collection Letter Prototype With Cc and similar documents often require you to locate them and comprehend how you can finalize them accurately.

Thus, regardless if you are addressing financial, legal, or personal issues, having a comprehensive and user-friendly online repository of forms readily available will significantly help.

US Legal Forms is the leading online platform for legal templates, providing more than 85,000 state-specific documents and an array of tools to help you complete your forms effortlessly.

Simply Log In to your account, locate Collection Letter Prototype With Cc and download it instantly from the My documents section. You can also access previously saved forms.

- Browse through the library of pertinent documents accessible with just a click.

- US Legal Forms offers state- and county-specific documents ready for download at any time.

- Secure your document management processes with exceptional support that enables you to prepare any form in minutes without extra or hidden fees.

Form popularity

FAQ

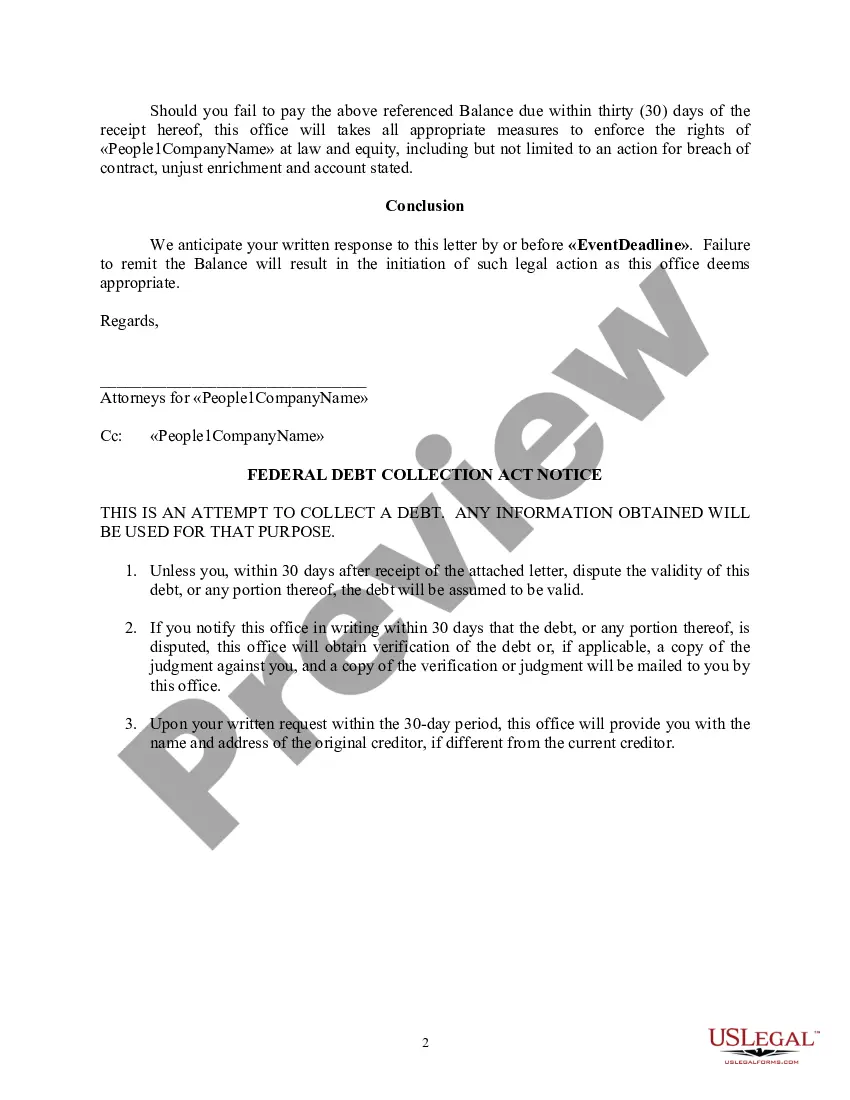

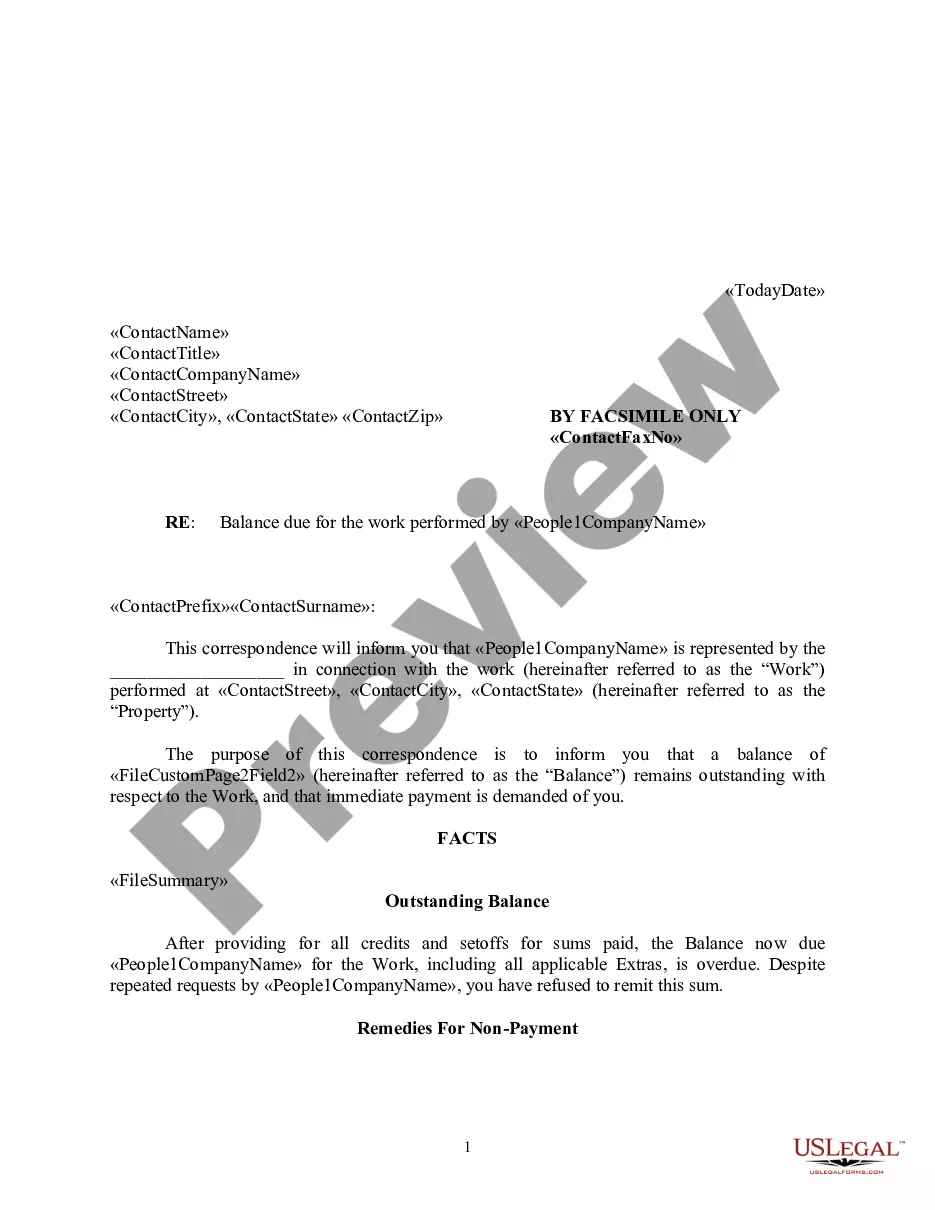

How to Write An Effective Collection Letter Reference the products or services that were purchased. ... Maintain a friendly but firm tone. ... Remind the payee of their contract or agreement with you. ... Offer multiple ways the payee can take action. ... Add a personal touch. ... Give them a new deadline.

Characteristics of Collection Letter The reason or the objective of writing a collection letter. Reference of the previous letters (if any). Name of the creditor or the company issuing loans. Name of the lender. Full debt amount. Additional costs or terms. Last deadline for the payment of the debt.

Collection letter sample template Dear [Client name], We're sending you this letter as a friendly reminder that your account in the amount of [amount due to you] is past due. Your invoice was due on [month, day and year their payment was originally due as stated in their invoice].

Paid-in-full sample letter Dear [Creditor], I have enclosed my final payment for my account [account number for the debt] with this letter. This letter signifies that my debt has been paid in full on [date], including any applicable interest, fees and penalties, and that I have satisfied my obligations for repayment.

The 5 Essential Components of a Collection Letter Formal Letterhead. State Your Case. List All Payments. Explain the Next Steps. Require a Signature.