Collection Letter Examples For Business

Description

How to fill out Illinois Collection Letter By Contractor?

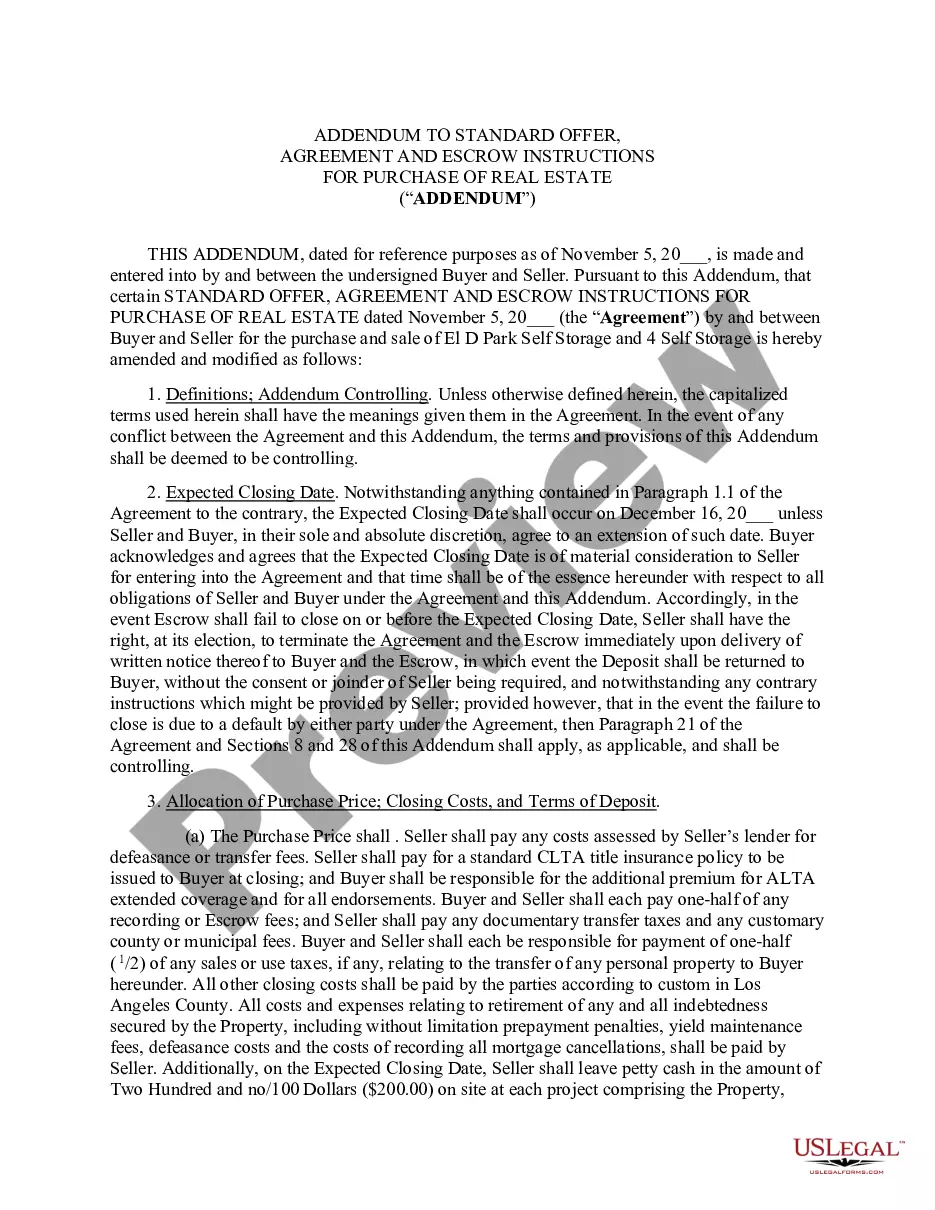

The Collection Letter Samples For Enterprises you observe on this page is a reusable legal format crafted by expert attorneys in compliance with federal and regional regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and lawyers with more than 85,000 certified, state-specific documents for any commercial and personal event. It’s the fastest, simplest, and most reliable method to acquire the paperwork you require, as the service assures bank-level data security and anti-malware safeguards.

Subscribe to US Legal Forms to have verified legal templates for all of life’s events right at your fingertips.

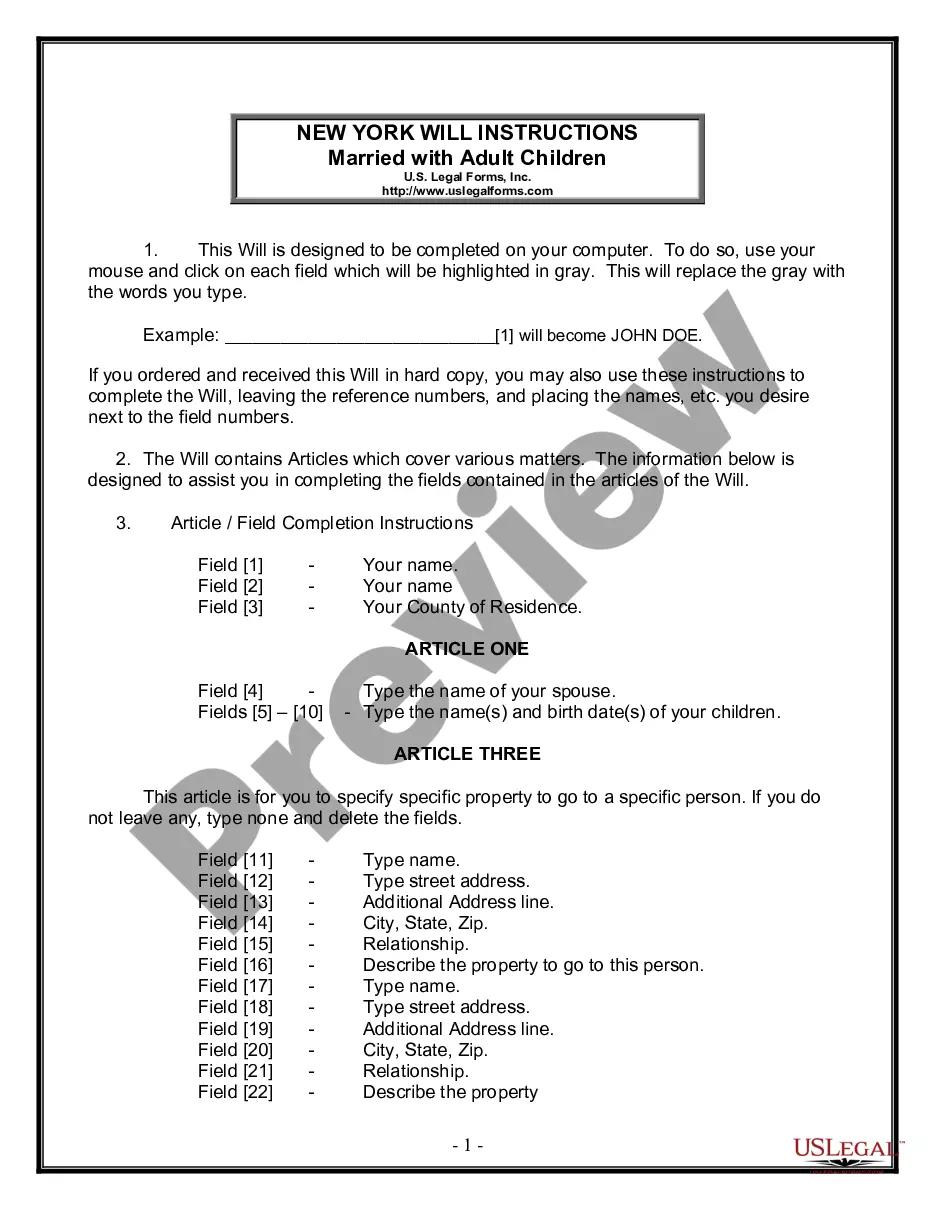

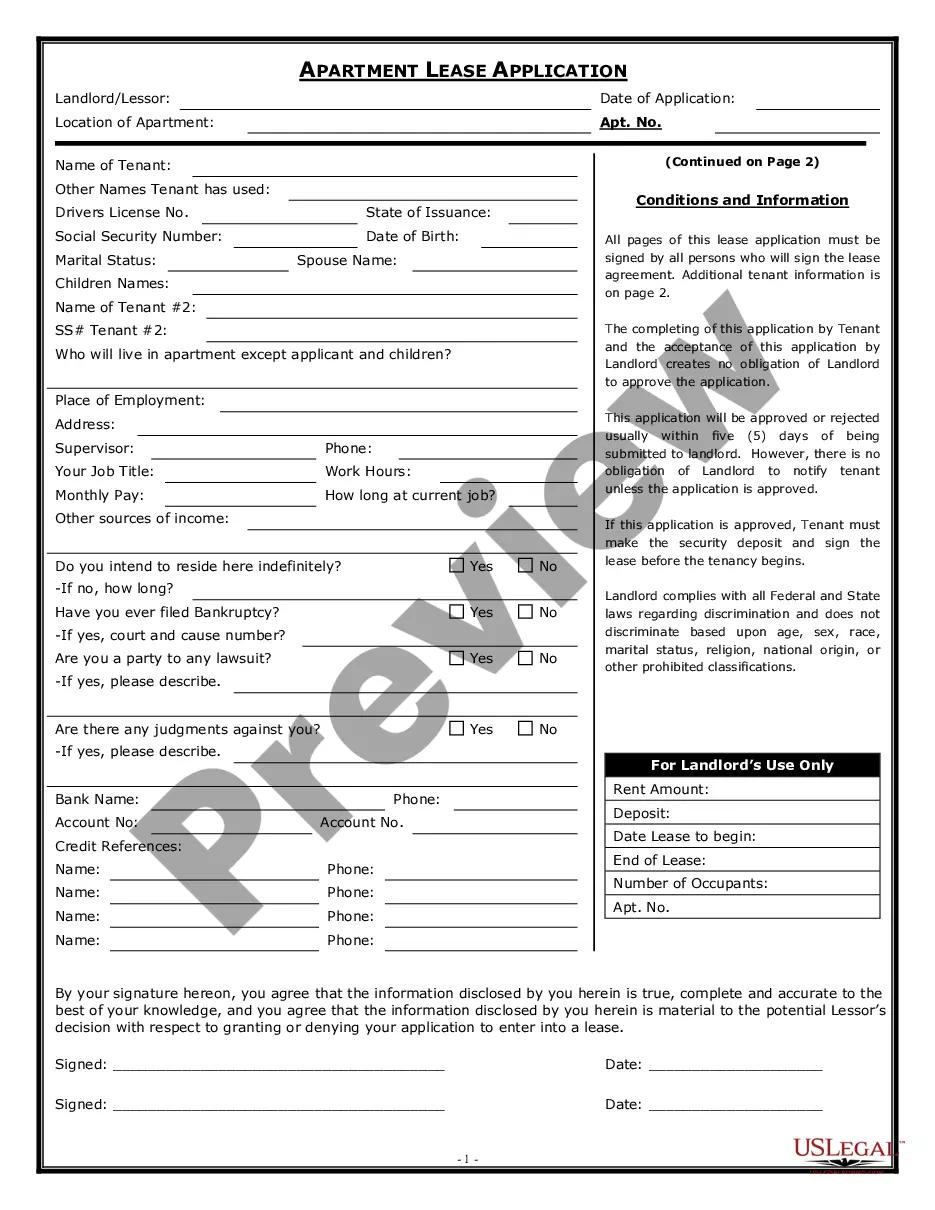

- Explore the document you require and review it.

- Browse the example you searched and preview it or examine the form description to confirm it meets your requirements. If it does not, use the search bar to find the right one. Click Buy Now once you have found the template you need.

- Register and Log In.

- Choose the subscription plan that fits you and set up an account. Utilize PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Acquire the fillable template.

- Select the format you desire for your Collection Letter Samples For Enterprises (PDF, Word, RTF) and save the document on your device.

- Fill out and sign the document.

- Print the template to complete it by hand. Alternatively, use an online versatile PDF editor to quickly and accurately fill out and sign your form with a legally binding electronic signature.

- Redownload your documents again.

- Access the same document whenever necessary. Navigate to the My documents tab in your profile to redownload any previously acquired documents.

Form popularity

FAQ

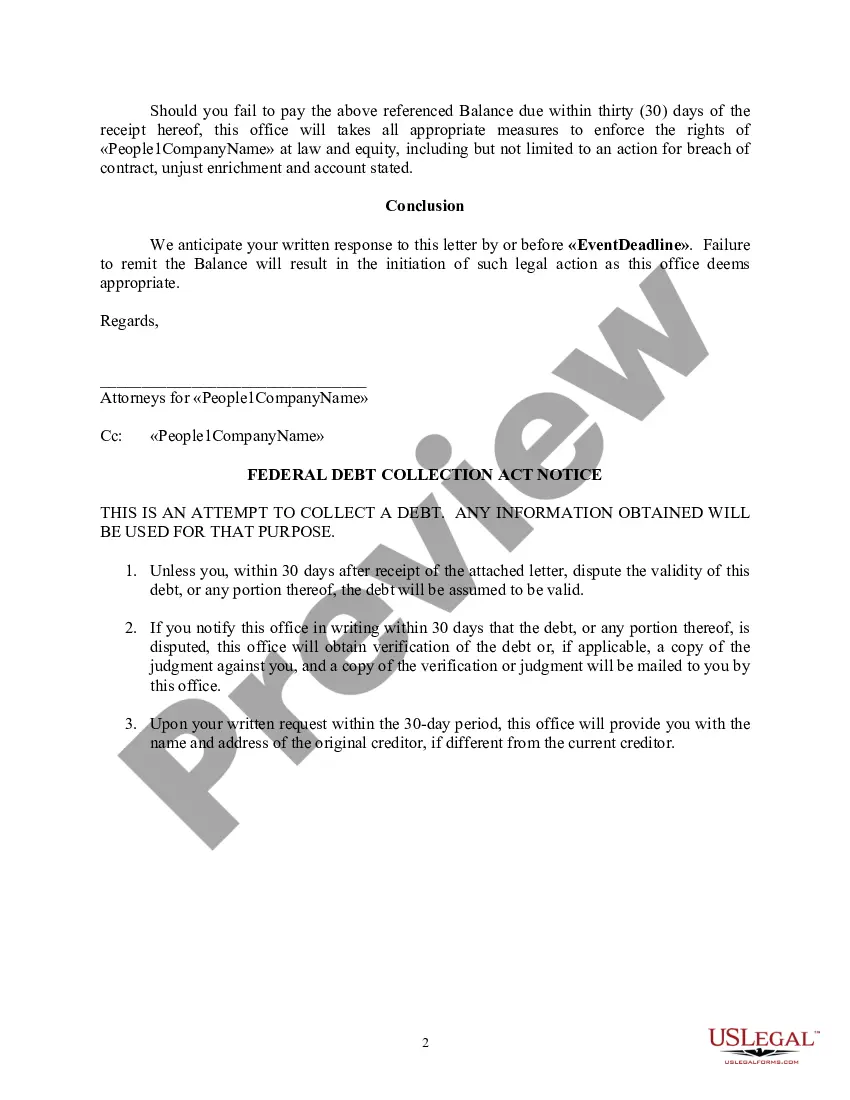

How to Write Debt Collection Letters: Main Points Get to the Point: Clearly state your purpose without unnecessary details. Maintain Politeness: Use a professional tone to avoid confrontations. Keep it Concise: Short letters are often more effective and clear. Ease of Payment: Provide clear payment instructions.

Dear [RECIPIENT'S NAME], Despite our previous reminders, the above amount due remains unpaid. As such, we would appreciate you making this payment as soon as possible. We regret to advise that unless payment is received by [DATE] this collection will be passed over to our debt collection agency/lawyer.

The First Collection Letter Template (Past-Due Notice) Clearly sate the number of days and the amount that's past due. Note previous attempts to collect. Provide a copy of the invoice with the communication. Provide payment options and what you'd like the customer to do next. Provide your contact information.

How to Write An Effective Collection Letter Reference the products or services that were purchased. ... Maintain a friendly but firm tone. ... Remind the payee of their contract or agreement with you. ... Offer multiple ways the payee can take action. ... Add a personal touch. ... Give them a new deadline.