Rent To Non-resident Landlord

Description

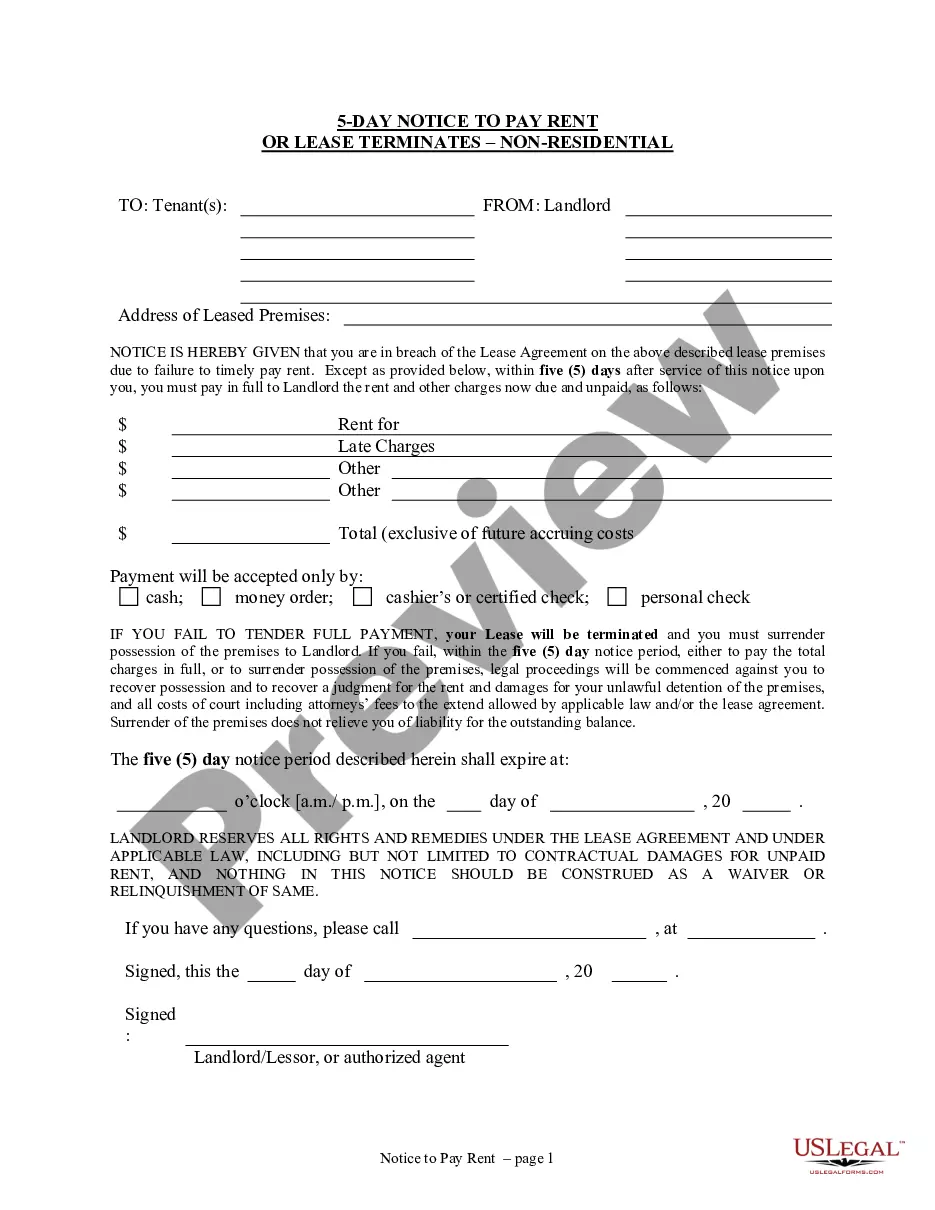

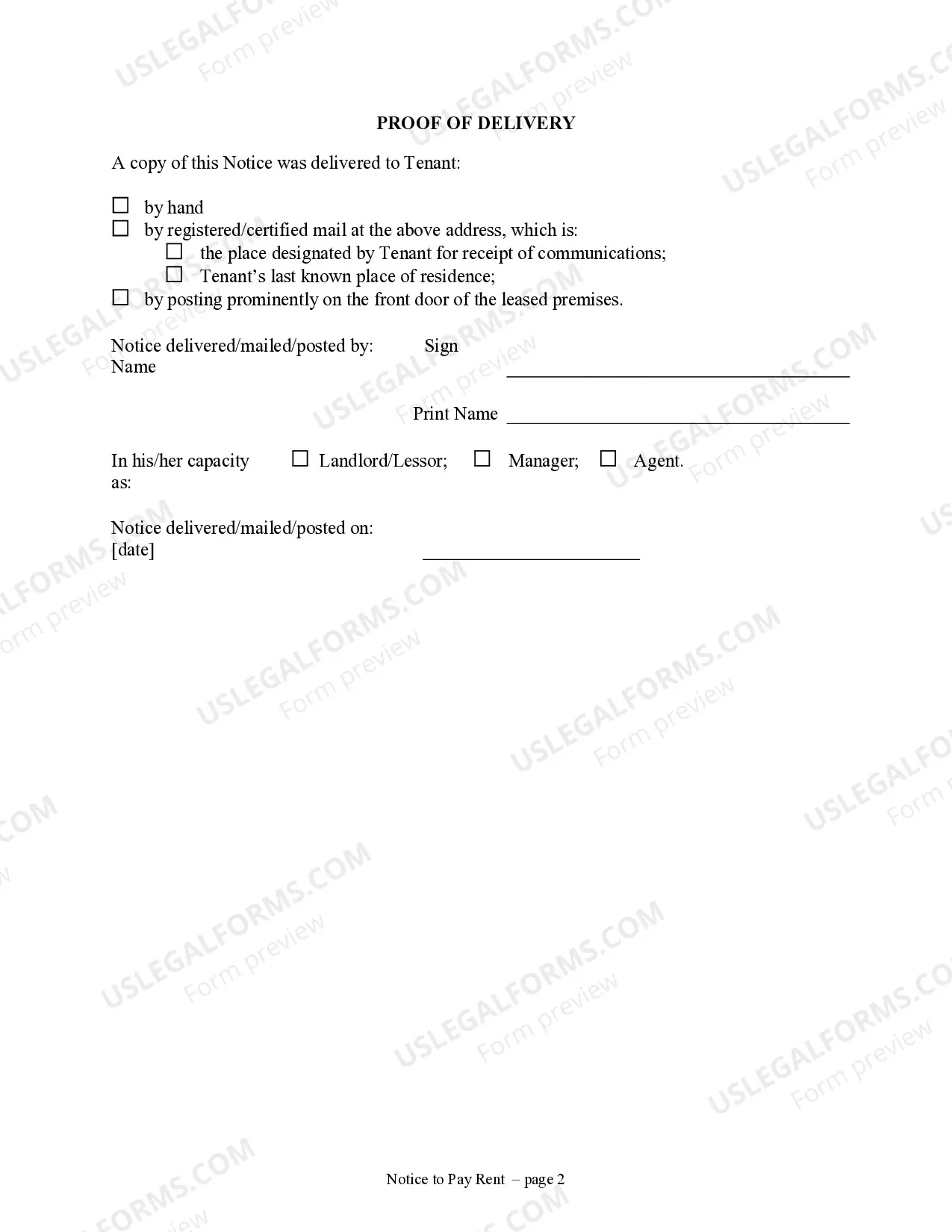

How to fill out Illinois 5 Day Notice To Pay Rent Or Lease Terminates - Nonresidential Or Commercial?

- Log in to your US Legal Forms account if you're a returning user. If not, create a new account.

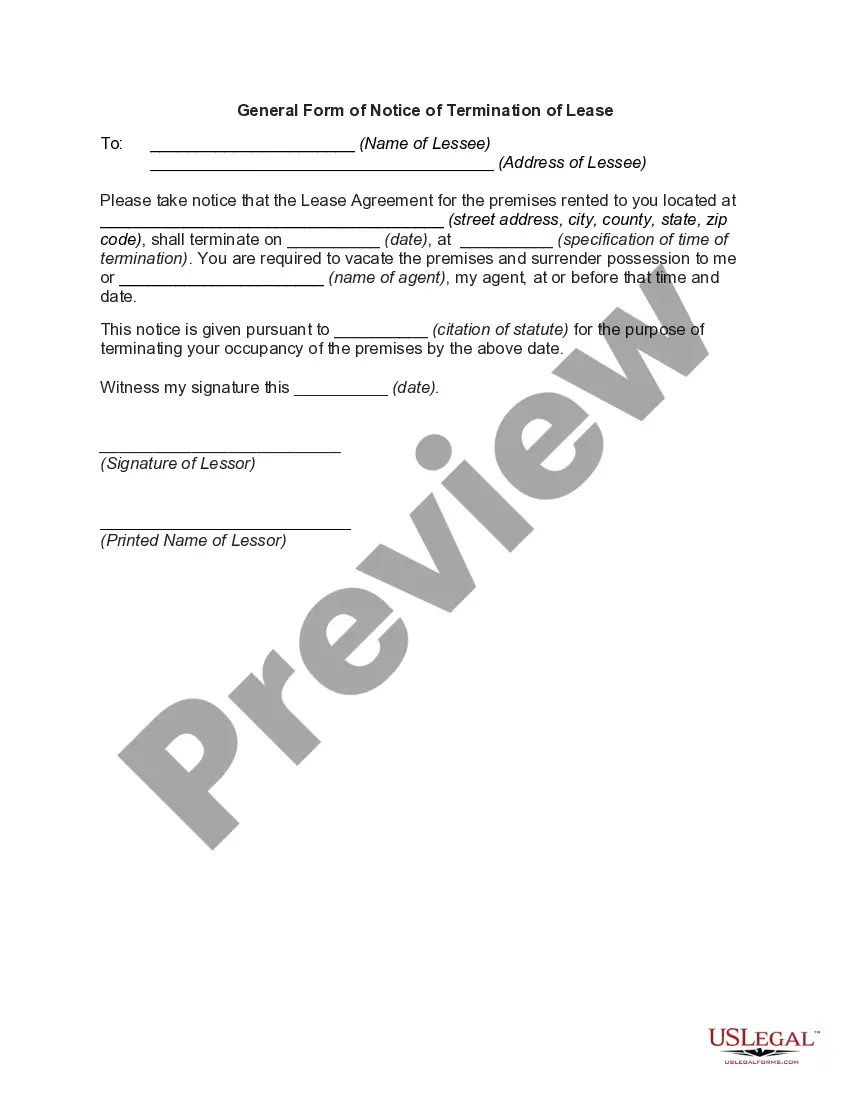

- Navigate to the extensive library and search for the appropriate rental form that aligns with your jurisdiction's requirements.

- Preview the chosen template to ensure it meets all necessary criteria before proceeding.

- Select a subscription plan that suits your needs and click on the Buy Now button.

- Complete your purchase using credit card details or your PayPal account.

- Download the completed form and save it on your device for easy access through the My Forms section.

Using US Legal Forms provides you with more than just documents; it ensures that you have access to a robust collection of over 85,000 forms tailored for various legal situations. The platform's easy-to-use interface means you can fill out and edit forms without hassle.

In conclusion, opting for US Legal Forms when renting to non-resident landlords streamlines the process and gives you peace of mind. Dive into our extensive library and empower your rentals today!

Form popularity

FAQ

It is not illegal to rent to non-US citizens, and many landlords choose to rent to international tenants. However, it is important to verify the tenant's ability to provide legal identification and uphold rental agreements. Understanding your rights and responsibilities as a landlord is essential, and resources from USLegalForms can assist you in drafting the necessary documents that comply with laws regarding renting to a non-resident landlord.

Yes, a landlord can technically rent to themselves, particularly in cases where the landlord holds the title of the property. However, this situation may raise questions about legality and proper documentation. It is crucial to maintain clear records and abide by local laws to ensure compliance. You can consult USLegalForms for templates and guidance that can help you navigate this situation properly.

If you lack rental history, it's essential to be transparent on the rental application and provide alternative evidence of reliability. This could include proof of steady income, references from employers, or even personal references. Many landlords are willing to consider applicants with no rental history if they demonstrate responsibility and financial stability, which can help you successfully rent to a non-resident landlord.

When managing rental property, you may need to fill out various forms, such as a lease agreement or IRS Form 1040NR for tax purposes. For a complete compliance suite, utilizing resources like US Legal Forms can help you access the required documents needed to formalize your rental arrangement effectively. This ensures that both your rights and those of your tenants are clear.

Non-resident income in the US can include various types, including wages and rental income, both taxed at different rates. Specifically, non-residents face income tax on their US-sourced income, which is subject to a withholding tax. Engaging in proper tax strategies is vital when you rent to non-resident landlords to ensure compliance with federal laws.

Foreigners who rent to a non-resident landlord must understand that rental income is generally taxed at a flat rate of 30%. This typically applies to gross income, meaning no deductions for expenses can reduce this tax. Nevertheless, filing a US tax return can allow for certain deductions, providing a potential tax relief for eligible individuals.

When you rent to a non-resident landlord, the rental income is subject to a 30% withholding tax on gross rental payments, unless a tax treaty applies. This tax implies that non-residents need to file a US tax return to report their rental income and potentially claim deductions. It’s essential to keep meticulous records of all income and expenses related to the property to optimize your tax situation.

Yes, non-residents can rent apartments in the U.S., provided they meet lease requirements set by landlords. Typically, proof of income and identity may be required. If you are a non-resident landlord, ensure you follow local laws and guidelines specific to your area.

The IRS can detect unreported income through various means, including audits and data matching. They utilize sophisticated computerized systems that analyze financial data. Always be diligent in reporting your income accurately, especially when you rent to a non-resident landlord.

Yes, landlords generally report rental income to the IRS using tax forms such as Schedule E. It is important for landlords, including those who rent to non-resident landlords, to report all income accurately. This helps to avoid legal issues with the IRS.