Illinois 5 Day Form Withholding

Description

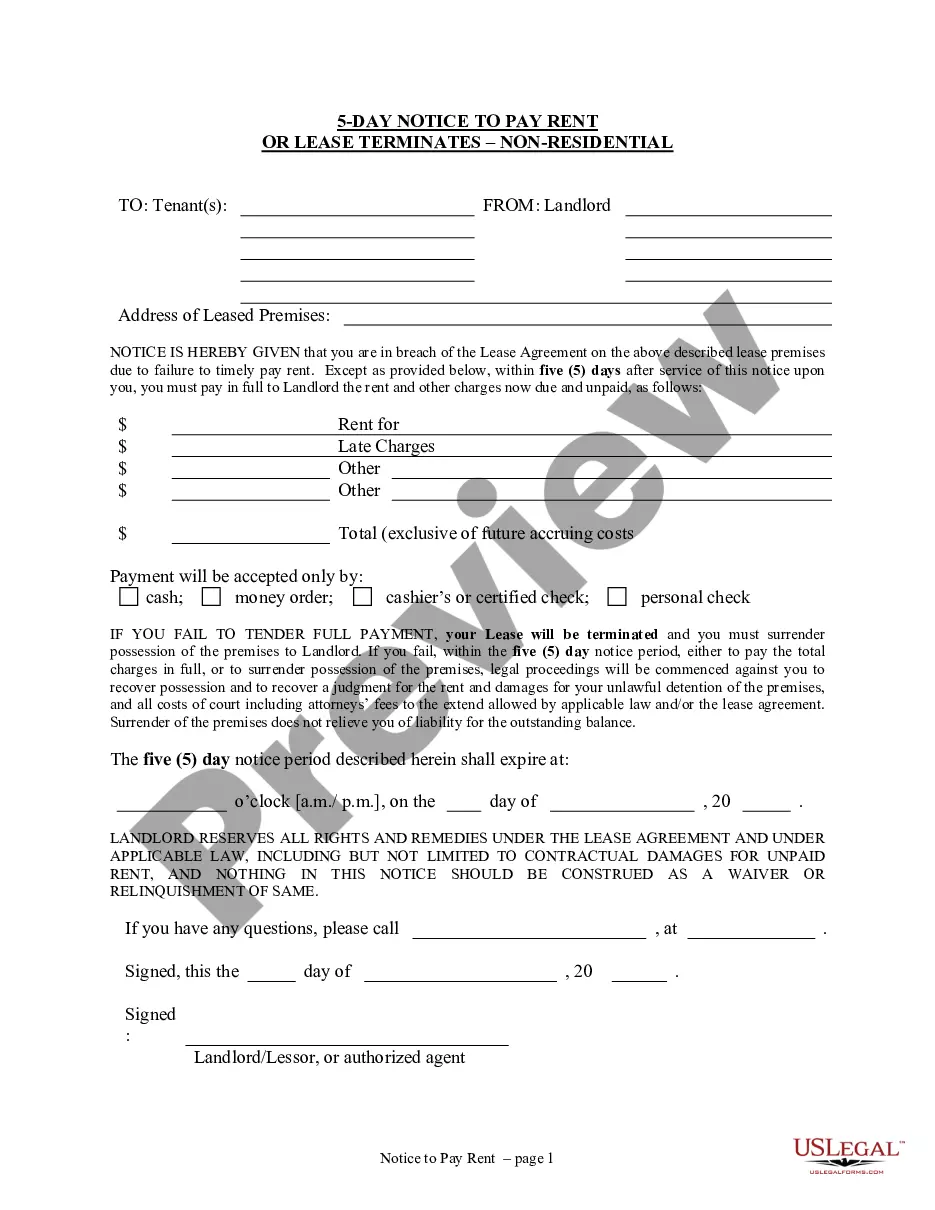

How to fill out Illinois 5 Day Notice To Pay Rent Or Lease Terminates - Nonresidential Or Commercial?

Managing legal documents can be daunting, even for experienced professionals.

If you are looking for an Illinois 5 Day Form Withholding and don't have the opportunity to spend time searching for the correct and current version, the process may become stressful.

US Legal Forms meets all your needs, from personal to business documentation, all in one location.

Utilize advanced tools to fill out and manage your Illinois 5 Day Form Withholding.

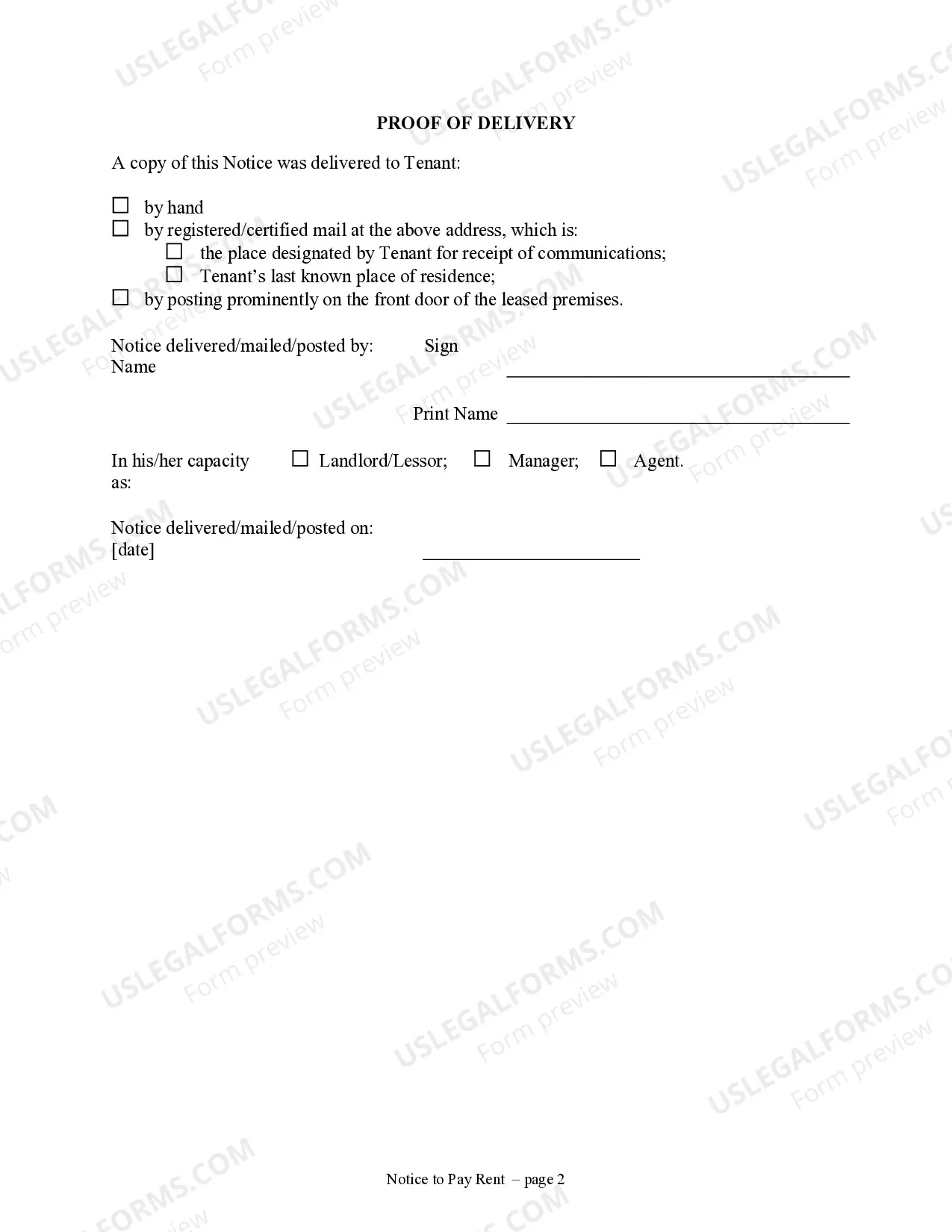

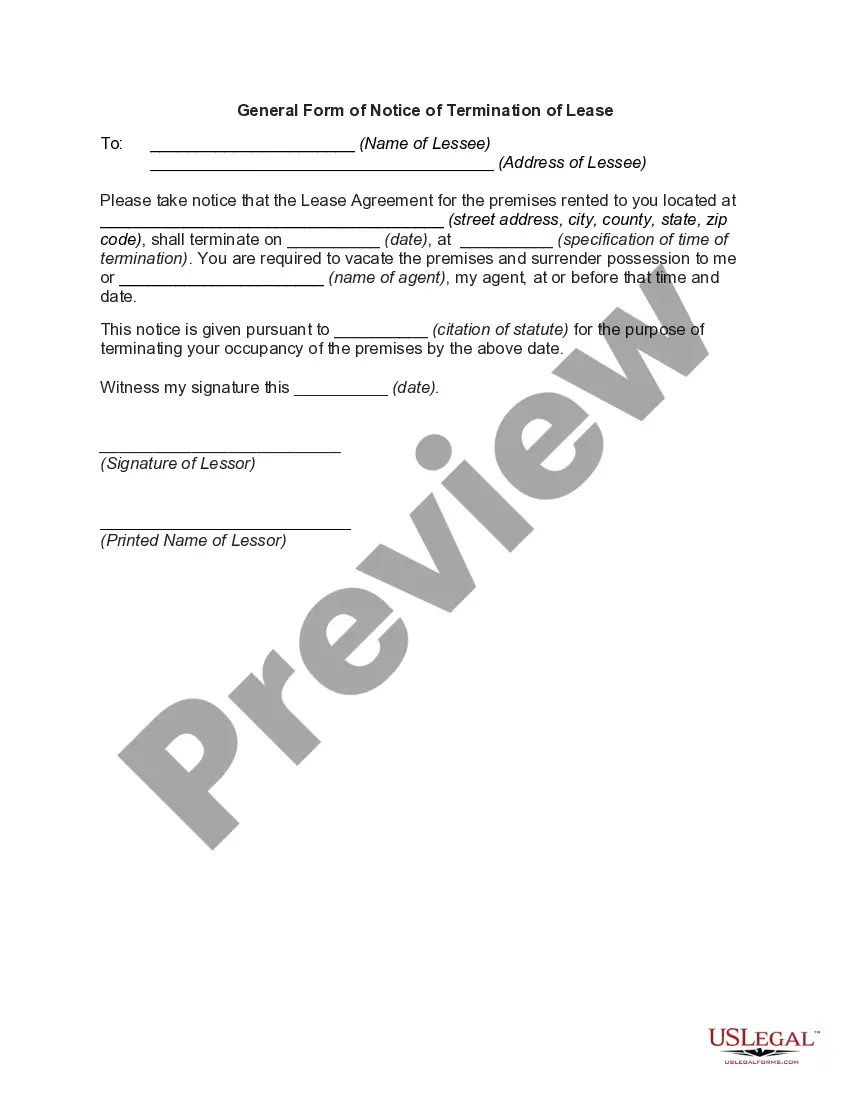

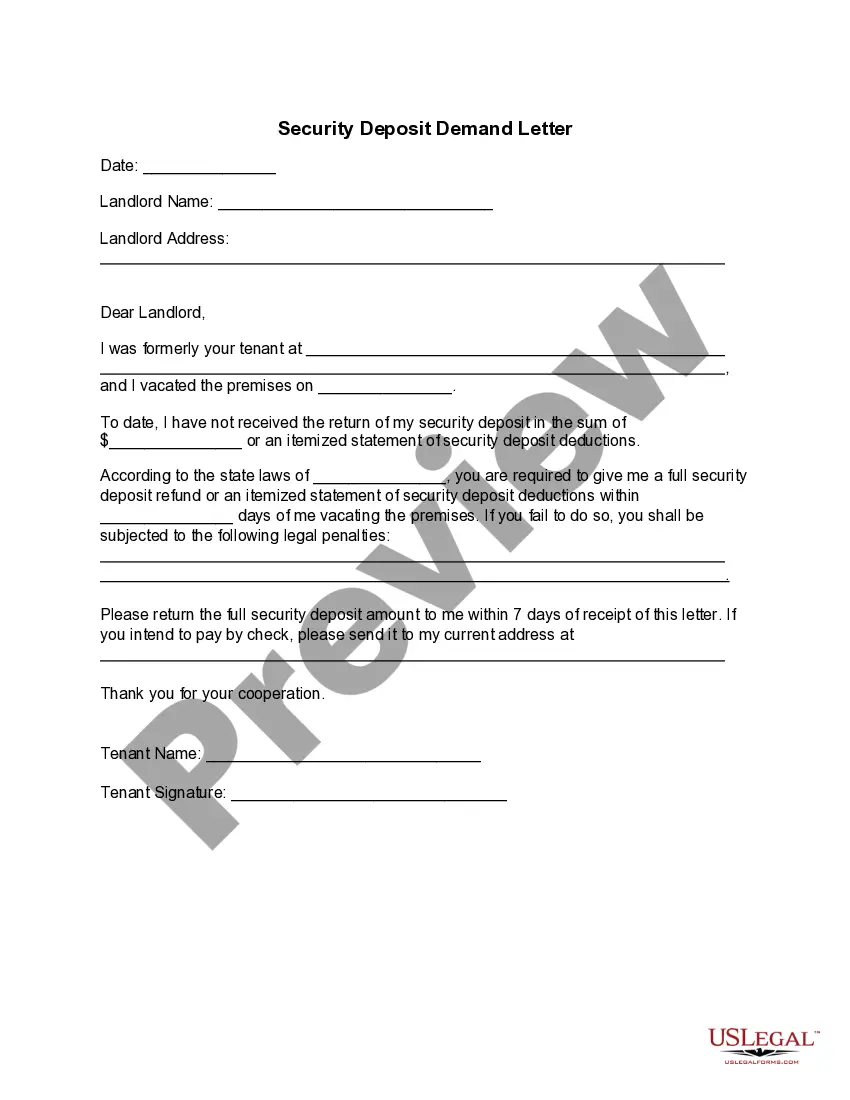

After opening the form you need, follow these steps: Confirm it is the correct form by previewing it and reviewing its description. Ensure that the document is valid in your state or county. Click Buy Now when you are prepared. Choose a monthly subscription plan. Select the format you wish, and Download, complete, eSign, print, and send your documents. Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and trustworthiness. Streamline your daily document management into a smooth and user-friendly process today.

- Access a valuable collection of articles, guides, and resources relevant to your circumstances and requirements.

- Save time and energy searching for the documents you need by using US Legal Forms’ advanced search and Preview tool to find the Illinois 5 Day Form Withholding and obtain it.

- If you hold a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to view the documents you have previously saved and manage your folders as you wish.

- If this is your first experience with US Legal Forms, create a complimentary account to gain unlimited access to all the benefits of the library.

- A robust online form library can significantly enhance the way individuals handle these matters.

- US Legal Forms stands as a leader in the online legal forms industry, offering over 85,000 state-specific legal documents available at your convenience.

- With US Legal Forms, you can access a variety of state or county-specific legal and business forms.

Form popularity

FAQ

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Write the total number of additional allowances you elect to claim on Line 9 and on Form IL-W-4, Line 2. withheld from your pay. On Line 3 of Form IL-W-4, write the additional amount you want your employer to withhold. Cut here and give the certificate to your employer.

How you fill out a W-4 can have a major effect on whether taxes are owed or a refund is given. Step 1: Enter your personal information. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings.

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they're not past the age of 19.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.