Limited Liability Company With Example

Description

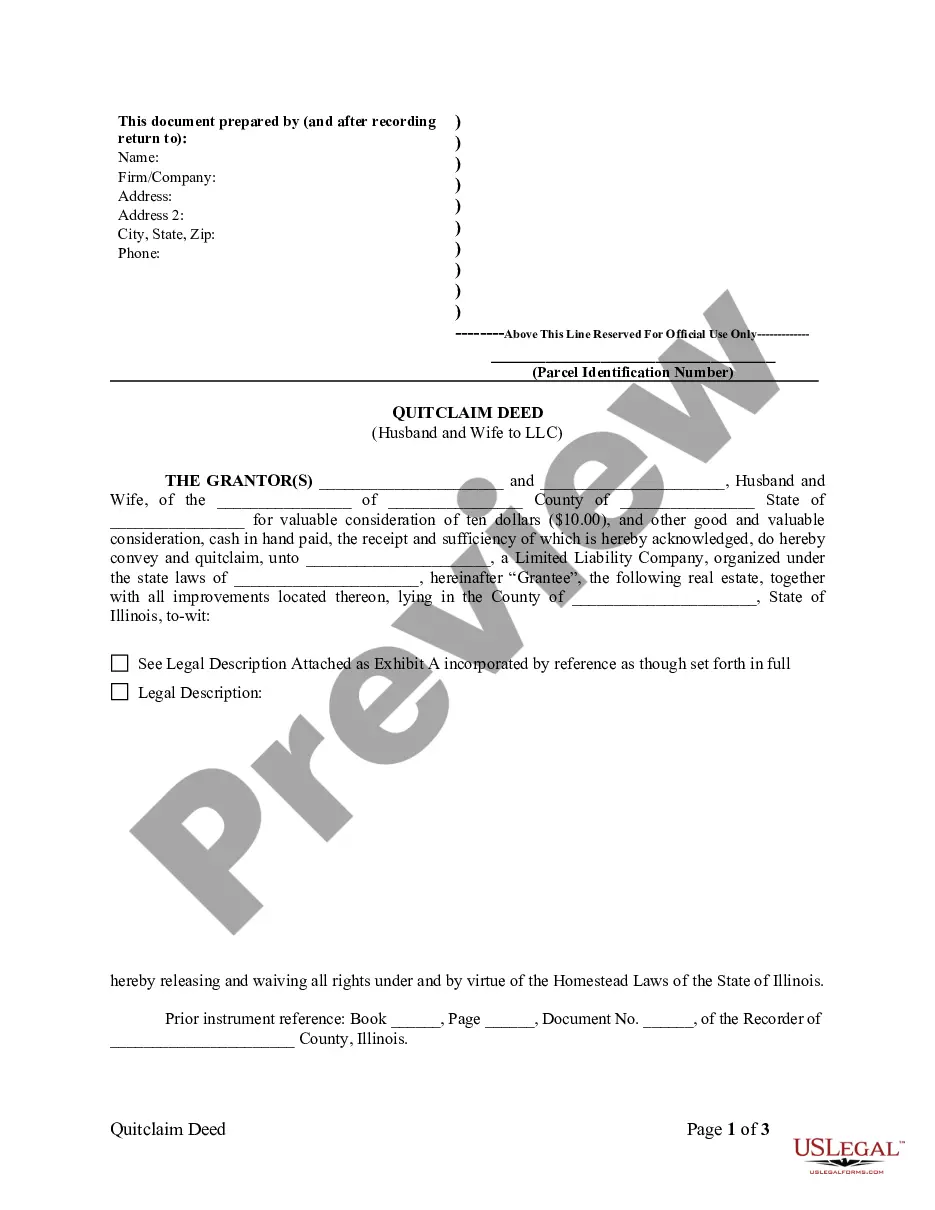

How to fill out Illinois Quitclaim Deed From Husband And Wife To LLC?

- If you have an existing account, log in to access your documents. Ensure your subscription is active; if not, renew it as per your payment plan.

- Review the available forms in Preview mode and check the descriptions to pick the one that meets your requirements under local jurisdiction.

- If you don’t find what you need, utilize the Search function to discover additional templates that suit your situation.

- Purchase your chosen document by clicking the Buy Now button and select your preferred subscription plan. You will need to create an account for full access.

- Complete your payment using your credit card or PayPal account to finalize your purchase.

- Download the required form and save it on your device. Access it anytime under the My Forms section of your profile.

By following these straightforward steps, you can efficiently set up your LLC while ensuring compliance with legal requirements. US Legal Forms makes it easy to navigate the complexities of legal documentation, giving you peace of mind during the process.

Take the first step towards launching your LLC today with US Legal Forms!

Form popularity

FAQ

When writing an LLC example, clearly include key details like the company name, purpose, members, and management structure. For instance, you might say, 'ABC Solutions, LLC, is a limited liability company focused on delivering innovative tech solutions.' This simple structure provides clarity on the nature of the limited liability company while showcasing its mission. Using a platform like US Legal Forms can help you draft a precise LLC example tailored to your needs.

While a limited liability company offers many benefits, such as personal asset protection, it also has downsides to consider. One primary concern is the potential for self-employment taxes, which can affect your income more significantly than other business structures. Additionally, some states require ongoing fees and compliance that could add to your operational costs. Understanding these factors is crucial before forming your limited liability company with example scenarios in mind.

Getting a limited liability company involves several clear steps, including selecting a unique name and preparing to file the necessary forms with your state. After completing the Articles of Organization, you'll often need an Operating Agreement to outline the management structure. To ease this process, US Legal Forms provides templates and guidance that can simplify forming your limited liability company.

Yes, you can form a limited liability company even if you haven't started any business activities yet. Establishing the LLC can provide a legal structure for future endeavors while protecting your personal assets. It is common for entrepreneurs to register their limited liability company before launching their services or products. Consider tools like US Legal Forms to ensure your registration is compliant and organized.

Various businesses utilize the LLC structure, including restaurants, consulting firms, and e-commerce stores. Entrepreneurs often choose an LLC because it combines the flexibility of partnership with the limited liability of a corporation. This structure works well for businesses aiming to protect personal assets while benefiting from pass-through taxation. If you're considering forming an LLC, US Legal Forms offers resources to guide your journey.

A limited company typically refers to a corporation or a limited liability company. For instance, XYZ Tech LLC can serve as an example, providing its owners with protection from personal liability for the company's debts. This structure allows owners to enjoy the benefits of running a small business while securing their personal assets. If you want to establish an LLC, tools like US Legal Forms can help streamline the process.

Google is a corporation, specifically a subsidiary of Alphabet Inc. Understanding the difference between an LLC and a corporation is crucial for anyone considering starting a business. While both structures offer benefits, a limited liability company with example is often preferred by small business owners for simpler tax treatment and liability protection.

No, Google is not an example of a limited liability company; it is part of a corporation. However, individuals often refer to LLCs because they provide liability protection and tax advantages. A common example of an LLC is a local restaurant or retail store that benefits from these features. This structure makes it easier for small businesses to operate while protecting owners' personal assets.

Amazon is not a limited liability company; it is incorporated as a corporation. While many startups and small businesses choose the LLC structure for its benefits, large companies like Amazon opt for a corporate structure to manage operations and growth effectively. If you're interested in small business structures, a limited liability company with example could provide valuable insights.

No, Google is not a limited liability company. Instead, it operates as a subsidiary of Alphabet Inc., which is a corporation. However, companies can choose to form a limited liability company with benefits like personal asset protection and tax flexibility. If you're looking to understand how an LLC works, consider referencing common LLC examples for better clarity.