Illinois Divorce Pension Formula

Description

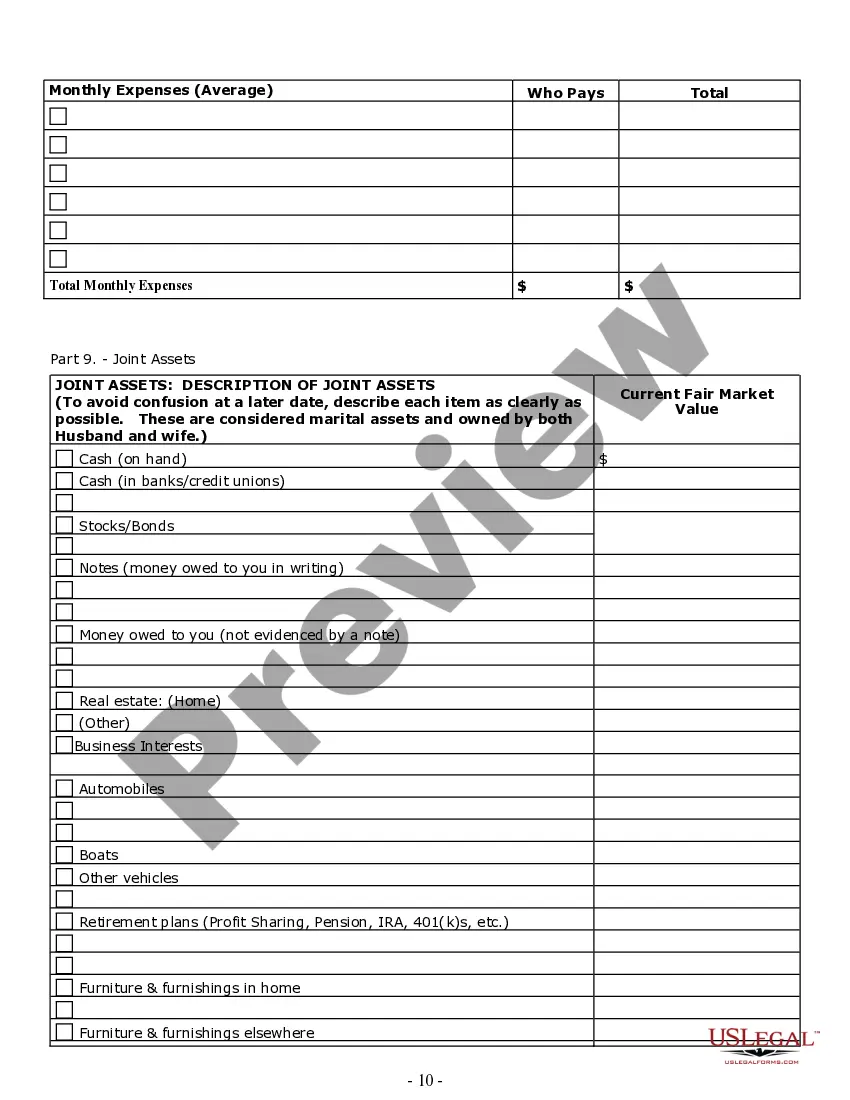

How to fill out Illinois Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

It's clear that you cannot become a legal authority instantly, nor can you learn how to swiftly prepare the Illinois Divorce Pension Formula without a specialized background.

Compiling legal documents is a lengthy endeavor that necessitates specific education and expertise.

So why not entrust the creation of the Illinois Divorce Pension Formula to the specialists.

You can revisit your documents through the My documents tab at any time.

If you are an existing client, you can simply Log In, and find and download the template from the same tab.

- Locate the form you seek using the search bar at the top of the webpage.

- View it (if this feature is available) and examine the accompanying description to ascertain whether the Illinois Divorce Pension Formula aligns with your needs.

- Initiate your search again if another form is required.

- Create a free account and choose a subscription plan to purchase the form.

- Click Buy now. After the payment is processed, you can obtain the Illinois Divorce Pension Formula, complete it, print it out, and deliver or mail it to the appropriate individuals or entities.

Form popularity

FAQ

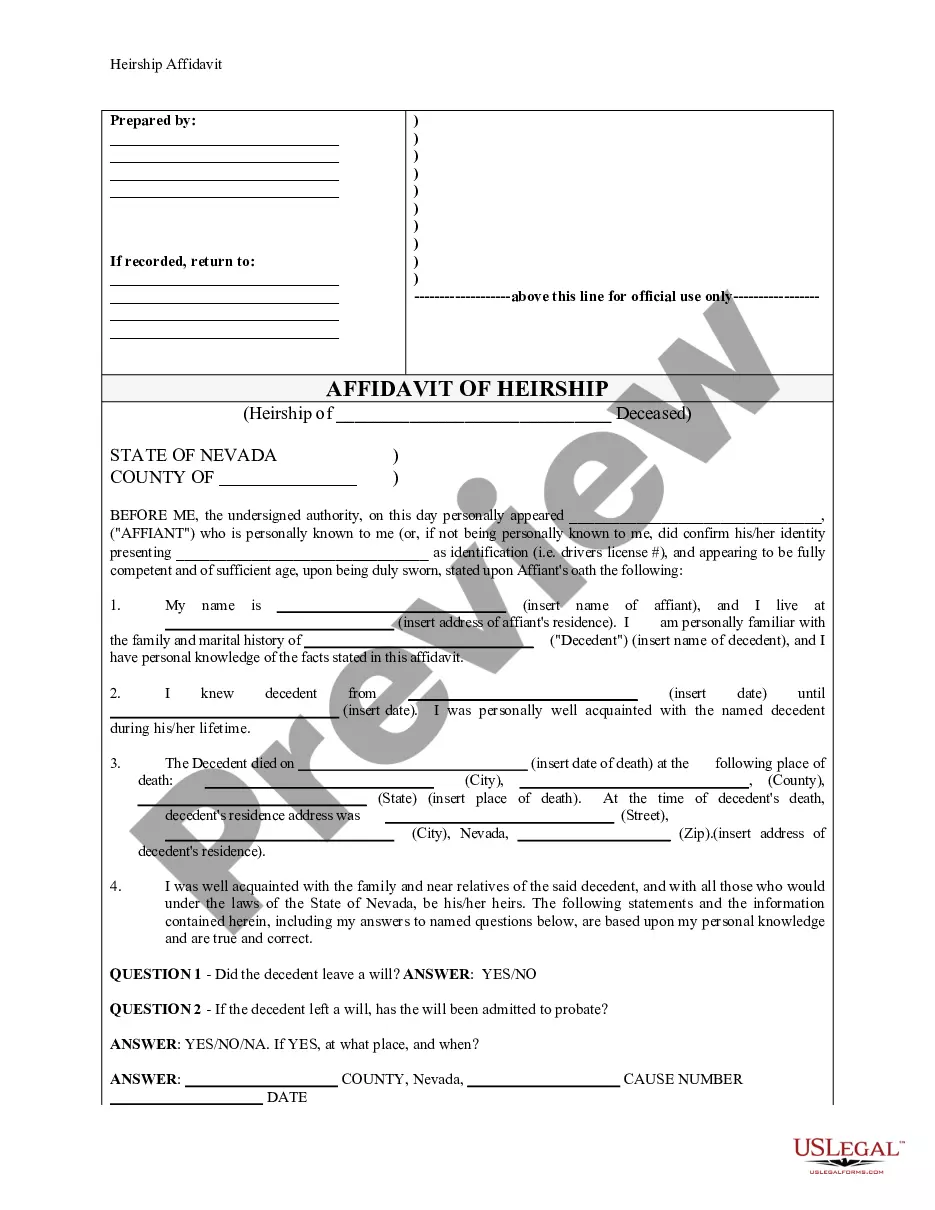

To claim your ex-husband's pension after divorce, you’ll need to review the divorce decree and understand your rights. Often, you will have to submit a Qualified Domestic Relations Order (QDRO) to the pension plan administrator to initiate the transfer of benefits. Understanding the Illinois divorce pension formula can aid you in determining your entitled share. Seeking assistance from legal professionals familiar with pension claims can simplify this process.

You can apply for federal tax exemption with the IRS. They will in turn send you a Letter of Determination stating your tax exempt status if granted after the long review process. Once you have Federal tax exempt 501c3 status you can work with the Department of Revenue to apply for Louisiana tax exemptions.

Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

Form L-3 Transmittal is used to transmit copies of Information Returns (Federal Forms W-2, W-2G and 1099) to Louisiana Department of Revenue (LDR). Form L-3 must be filed at the end of the year or if a business terminates during the year.

Most Requested Louisiana Tax Forms Please contact the Dept. of Revenue at 1-888-829-3071 to receive a form by mail or click here to request a form.

What/who is the Office of Debt Recovery (ODR)? Act 399, through La. R.S. 76, established the ODR as a centralized debt collection unit authorized and required to collect delinquent debt owed to the state of Louisiana. What statutes created and govern the operations of ODR?

Louisiana Debt Collection Law Mail one notice per month. Make up to four personal contacts with the purpose of settling the debt. Contact any person to find what property the debtor has if the creditor has a judgment against the debtor. Make an amicable demand for payment. File a lawsuit for nonpayment.

Employers are required to withhold income tax on all wages that are subject to Louisiana income tax as follows: Employers located in Louisiana?income tax must be withheld on all employee wages earned in Louisiana regardless of whether the employee is a resident or not.

You only need to file your personal tax return (Federal Form 1040 and Louisiana Form IT-540) and include your LLC profits on the return. Multi-Member LLC taxed as a Partnership: Yes. Your LLC must file an IRS Form 1065 and a Louisiana Partnership Return (Form 565 for non-residents and Form IT-540 for residents).