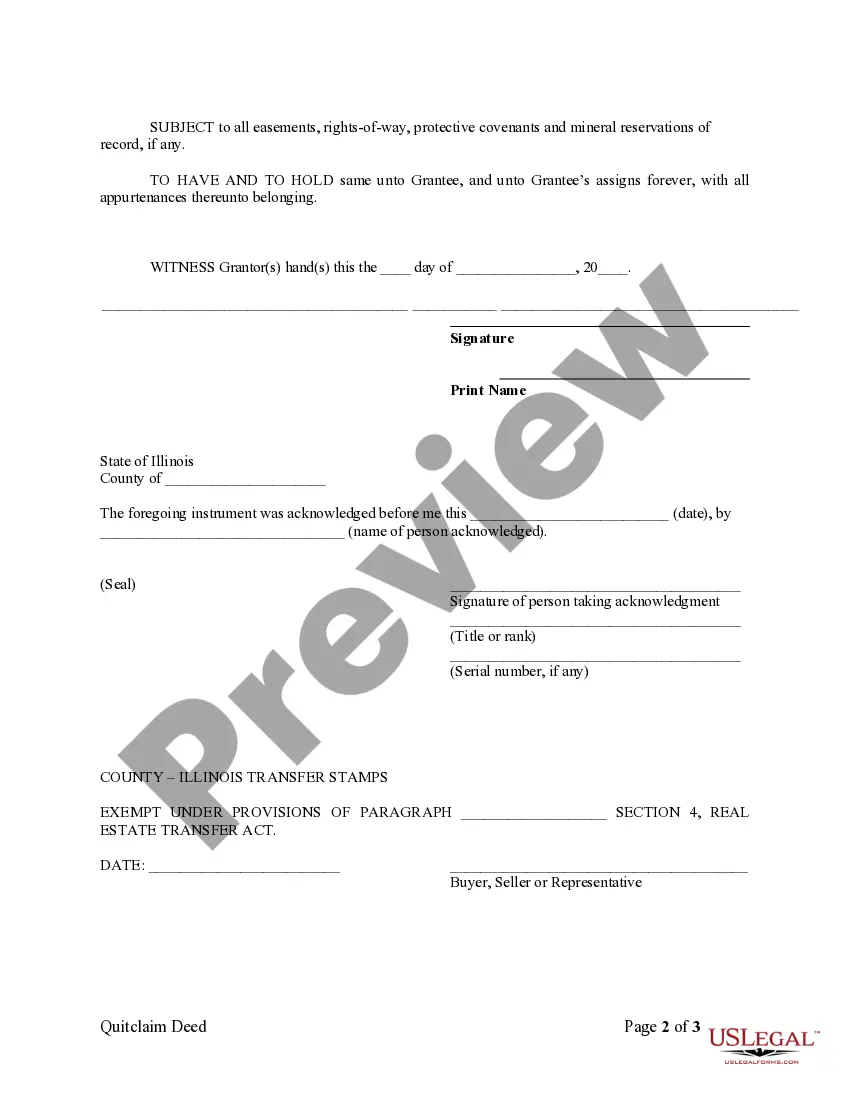

Quitclaim Deed In Illinois

Description

How to fill out Illinois Quitclaim Deed From Individual To LLC?

Dealing with legal documents and processes can be a lengthy addition to your schedule. Quitclaim Deed In Illinois and similar forms often require you to search for them and understand how to fill them out accurately. As a result, if you are managing financial, legal, or personal affairs, having a comprehensive and straightforward online collection of forms readily available will be extremely beneficial.

US Legal Forms is the premier online resource for legal templates, providing over 85,000 state-specific documents and various tools to help you finalize your paperwork effortlessly. Browse the collection of relevant documents accessible to you with just a single click.

US Legal Forms offers state- and county-specific documents available at any time for downloading. Safeguard your document management processes with high-quality support that enables you to create any form in minutes without incurring extra or hidden fees. Simply Log In to your account, search for Quitclaim Deed In Illinois, and obtain it instantly from the My documents section. You can also retrieve previously downloaded documents.

Is it your first time using US Legal Forms? Register and set up your account in just a few minutes, and you’ll gain access to the form collection and Quitclaim Deed In Illinois. Then, follow the steps outlined below to complete your document.

US Legal Forms has 25 years of expertise assisting clients with their legal documents. Find the form you need today and simplify any process without breaking a sweat.

- Verify you have the correct form using the Preview feature and reviewing the form details.

- Select Buy Now when ready, and choose the subscription plan that fits your needs.

- Click Download then fill out, sign, and print the form.

Form popularity

FAQ

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The fee is $150 (or $160 if paid by credit card). It will be your responsibility to get the transfer stamps (if necessary) and get the deed recorded with the County Recorder. There is nothing legal about obtaining the municipal stamp and recording the deed.

How do you file a quitclaim deed form in New York? A legal description and address of the property being deeded. The county the property is located in. The date of the transfer. The grantor's (person relinquishing ownership) name. The grantee's (person receiving ownership) name.

Before you file the deed, get a tax stamp from the local municipality where the property is located. When you're ready to file the deed, bring it to the County Recorder of Deeds, where they will stamp and file the deed. You'll have to pay a fee for recording, or filing, the deed.

How Do Homeowners Add Spouses to Property Deeds? One of the most common ways property owners add spouses to real estate titles is by using quitclaim deeds. Once completed and filed, quitclaim deed forms effectually transfer a share of ownership from the owners, or grantors, to their spouses, or the grantees.

If you're preparing the quitclaim deed yourself, make sure to enter the property description just as it appears on an older deed of the property. If you can't find an old deed, check with the County Recorder of Deeds in the county where the property is located. They can tell you where to get a copy of an earlier deed.