Waiver of Lien to Date - Mechanic Liens

Note: This summary is not intended to be an all inclusive discussion of Illinois’ construction lien laws, but does include basic provisions.

In Illinois, what statutes govern mechanic’s liens on private works?

Illinois Mechanic’s Liens for Private Works are governed by the “Illinois Mechanic’s Lien Act” contained in Chapter 770, Act 60, of the Compiled Statutes of Illinois. The Mechanic’s Lien Act contains the basic mechanisms and procedures for perfecting and enforcing mechanics lien.

Who is Eligible to be a Lien Claimant?

In Illinois, a party that provides services, labor or materials for a construction project pursuant to a contract to improve property has a lien upon the real property being improved. A lien claimant will not be permitted to enforce its lien until it has properly recorded a valid lien in compliance with the requirements of the Act. 770 ILCS 60/1(a).

The requirements of the Act differ depending on whether the party is classified as a “contractor” or “subcontractor” under the Lien Act. A “contractor” is any party who has a contract directly with the owner or “with one whom the owner has authorized or knowingly permitted to contract,” regardless of the status of that party. 770 ILCS 60/1(a). On the other hand, a “subcontractor” is any party that furnishes labor, services or material “for the contractor.” 770 ILCS 60/21(a). The term “subcontractor” as used in the Act also includes second- and third-tier subcontractors.

The Lien Claim

The mechanics lien claims of both contractors (Forms IL-04-09 and IL-04A-09) and subcontractors (Forms IL-07-09 and IL-07A-09) must be verified by the affidavit of the claimant and must contain:

A brief statement of the claimant’s contract;

The balance due after taking into account all credits; and

A description of the lot, lots or tracts of land sufficient to identify them. 770 ILCS 60/7

Since some requirements hinge on completion of claimant’s work, the lien claim should state the claimant’s last date of work on the project or, if the claimant’s work is ongoing, that the claimant’s performance under the contract is not yet complete.

Perfecting the Mechanics Lien

Even if a claimant has properly prepared its lien, the claimant will not be able to enforce its lien against the interests of third parties (such as subsequent purchasers or lenders) until the lien has been perfected. To properly perfect a mechanics lien, both contractors and subcontractors must record their liens within four months of their last date of work. 770 ILCS 60/7

In addition, subcontractors must comply with certain notice requirements. Subcontractors working on an existing, owner-occupied, single-family residence, for example, must serve a notice on the occupant of the residence within 60 days from their first day of work. This notice must state:

The name and address of the subcontractor or materialman;

The date on which the claimant started to work or deliver materials;

The type of work done and to be done or the type of materials delivered; and

The name of the contractor requesting the work.

See 770 ILCS 60/5.

The notice must also contain language substantially similar to the warning language set forth in section 5 of the Act advising the home occupant of the subcontractor’s right to file a mechanics lien in the event of nonpayment. 770 ILCS 60/5(b)(ii).

Subcontractors on all private construction projects (including owner-occupied, single-family residential projects) must also give notice to the owner or his agent, architect, or superintendent having charge of the property, and the lending agency, if known, of their intent to file a lien. Subcontractors must give this notice within 90 days following their last date of work, and the notice should be consistent with the form provided in 770 ILCS 60/24(b) of the Act. The Act requires this notice to be sent via registered or certified mail, restricted delivery, return receipt requested. 770 ILCS 60/24(a).

Recording The Mechanics Lien

The claim for lien may be filed “at any time after the contract is made.” Contractors and subcontractors generally wait until they have performed at least some portion of the work before recording a mechanics lien. 770 ILCS 60/7.

As noted above, contractors and subcontractors must record their lien within four months after their last date of work in order for the lien to be perfected. All mechanics liens must be recorded in the office of the recorder of the county in which the subject property is located.

Enforcing The Mechanics Lien

To enforce a mechanics lien, a lien claimant must file suit within two years after its last date of work on the project. Note, however, that the lien will not be enforceable against third parties unless the lien is properly perfected as described above. A claimant does so by means of a foreclosure action in which the lien claimant asks the court to order the property that is subject to the mechanics lien to be sold and to apply the proceeds of the sale to the claimant’s unpaid claim. Subcontractors who choose to file a foreclosure action must sue the owner and the contractor jointly for the amount due.

Note that the two-year time period for filing suit may be accelerated by a demand made pursuant to section 34 of the Act. If a lien claimant receives a section 34 Demand to File Suit, the lien claimant must initiate suit to enforce its lien within 30 days or forfeit its lien. See 770 ILCS 60/34 and forms IL-08-09 and IL-08A-09.

Owner’s Liability For Subcontractor Claims

If judgment is entered against the owner on a subcontractor’s lien claim, the owner will be liable for no more than the amount that was due or to become due from the owner on the underlying owner/contractor agreement at the time the owner received notice of the subcontractor’s claim. If that amount is less than the total amount of perfected lien claims, then each subcontractor lien claimant will recover its claim on a pro rata basis. Notwithstanding the foregoing, an owner that pays in good faith reliance on the amounts set forth in the Contractor’s Sworn Statement will not be liable for lien claims in excess of the amount shown on the sworn statement, regardless of whether that amount is correct. 770 ILCS 60/21(d).

Priority

A properly perfected mechanics lien attaches as of the date of the contract between the owner and the contractor. This fact is significant because the priority of a lien claim is determined by the date of its attachment to the real estate. Liens filed prior to the recording of other secured interests, for example, will have priority over those interests. Although this “first in time, first in right” principle is the general rule, mechanics liens are also given priority over certain interests that were recorded prior to the lien. For example, a mechanics lien will have priority over a previously recorded mortgage to the extent that the lienor can prove that its work enhanced the value of the property. 770 ILCS 60/16.

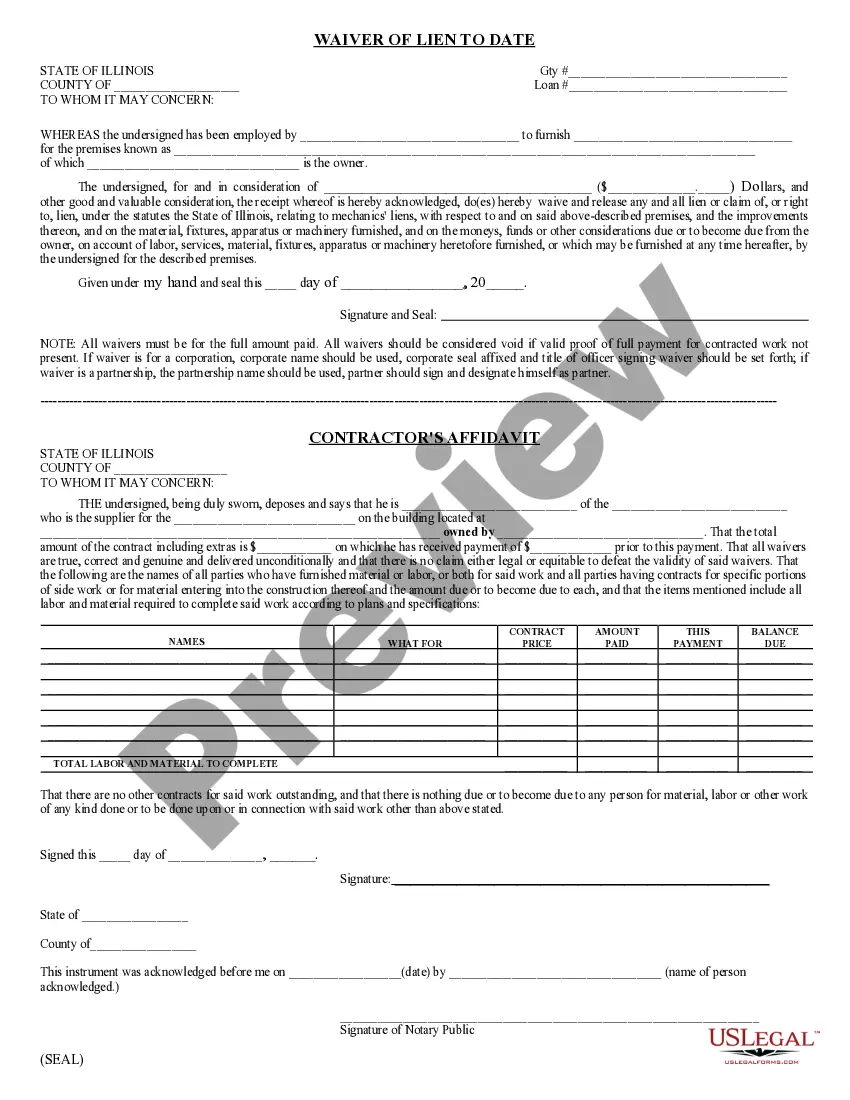

Waivers of Lien

An agreement, made in anticipation of or in consideration for the contract or subcontract to supply materials or services for the improvement of real property, to waive any right to enforce or claim any lien under the Mechanic’s Lien Act is against public policy and unenforceable. 770 ILCS 60/1(d). Subsequent to entering into its contract for the project, however, a party may waive its mechanics lien rights by way of a lien waiver. There are three main types of lien waivers. A “waiver of lien to date” (IL-11-09) waives a party’s right to lien for all amounts owed to that party under the contract, including all extras and change orders, as of the date stated in the lien waiver. A “waiver of lien to amount paid,” (IL-12-09) on the other hand, waives a party’s right to lien for the amount (specified in the waiver) that the party has been paid. Finally, a “final waiver of lien” (IL-13-09) completely waives a party’s right to file a mechanics lien for any amount due under its contract for the construction project, including all amounts due for extras and change orders. Note, however, that a waiver of mechanics lien rights does not waive a party’s right to pursue its other remedies under the law.

Of course, satisfaction or release of a lien upon payment is NOT prohibited. 770 ILCS 60/35(a). See also, forms IL-10-09(release of claim – Individual), IL-10A-09 (release of claim – Corporation).