Lady Bird Deed In Illinois

Description

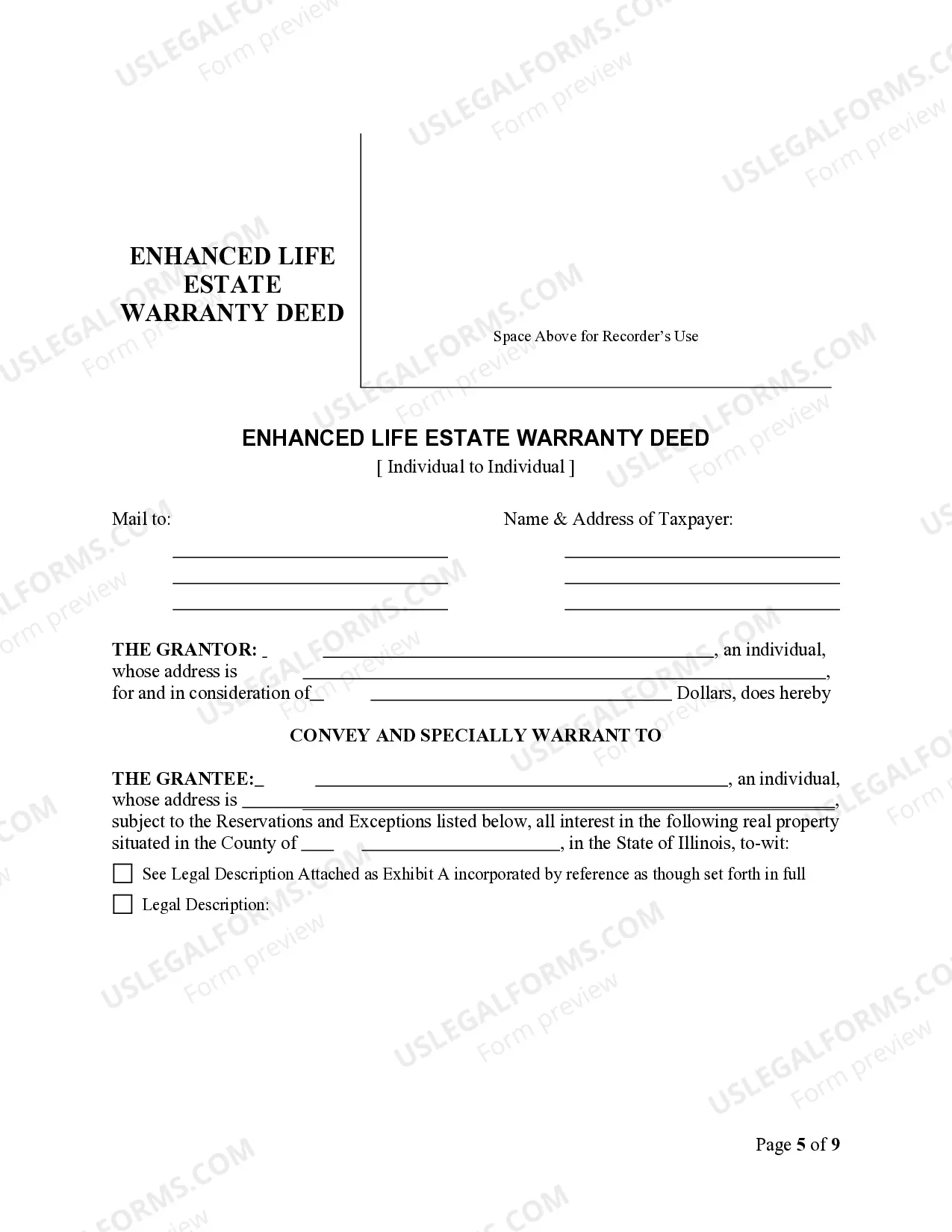

How to fill out Illinois Lady Bird Or Enhanced Life Estate Deed - Individual To Individual?

When you are required to finalize a Lady Bird Deed In Illinois according to your local state's laws, there could be numerous options to choose from.

There's no necessity to review every document to confirm it meets all the legal requirements if you are a subscriber of US Legal Forms.

It is a dependable service that can assist you in obtaining a reusable and current template on any topic.

Obtaining professionally crafted official documents becomes easy with US Legal Forms. Furthermore, Premium users can also take advantage of the strong integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms is the most extensive online repository with a compilation of over 85,000 ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state's regulations.

- Consequently, when downloading Lady Bird Deed In Illinois from our platform, you can be assured that you possess a valid and current document.

- Acquiring the necessary sample from our site is quite simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile and have access to the Lady Bird Deed In Illinois at any time.

- If this is your first interaction with our library, kindly follow the instructions below.

- Visit the recommended page and verify it for conformity with your requirements.

Form popularity

FAQ

A transfer on death deed in Illinois must fulfill specific criteria to be valid. The owner must draft the deed with their name, the names of beneficiaries, and a clear description of the property. It's essential to sign and record the deed in the appropriate local office prior to the owner's death. For guidance in preparing such documents, consider visiting uslegalforms to access customizable templates tailored to your needs.

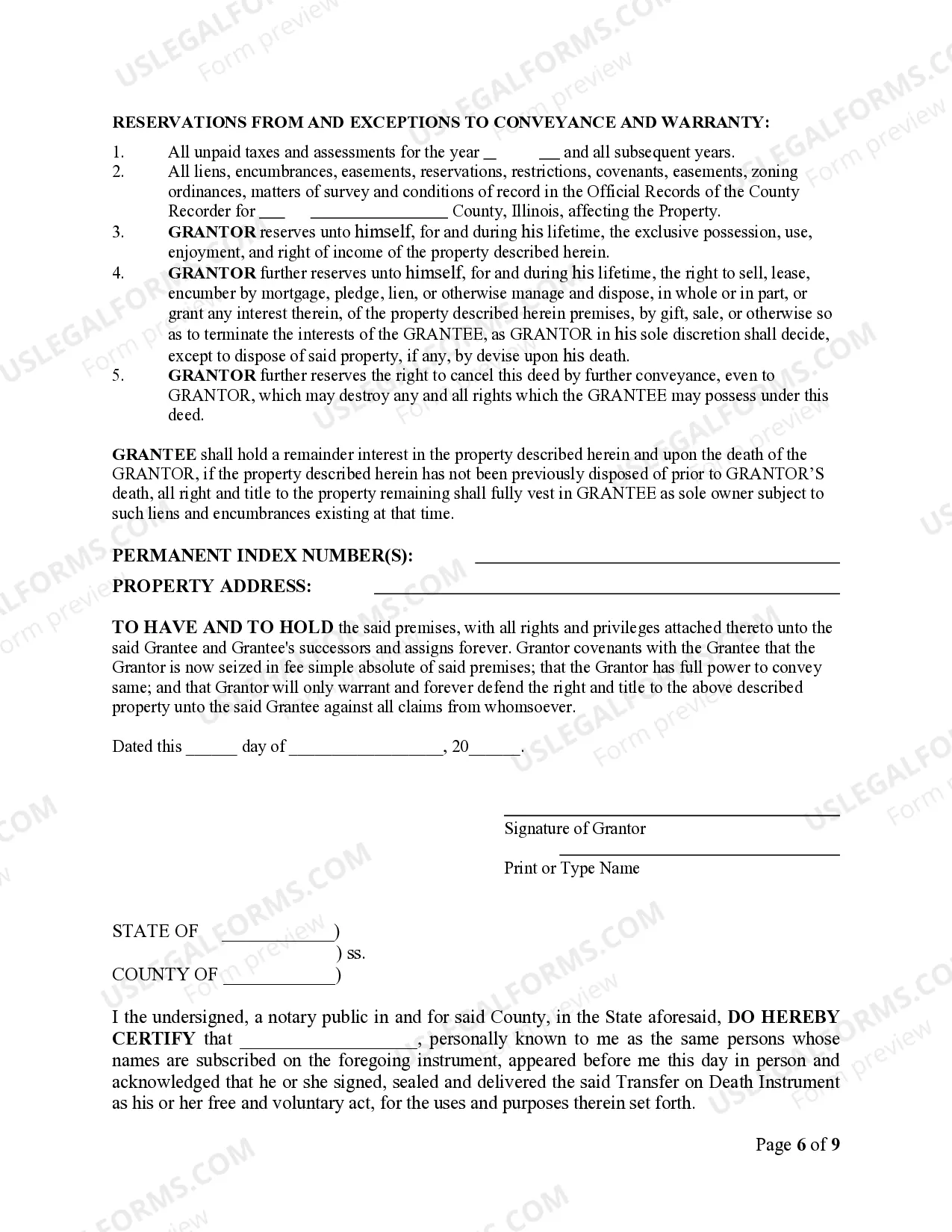

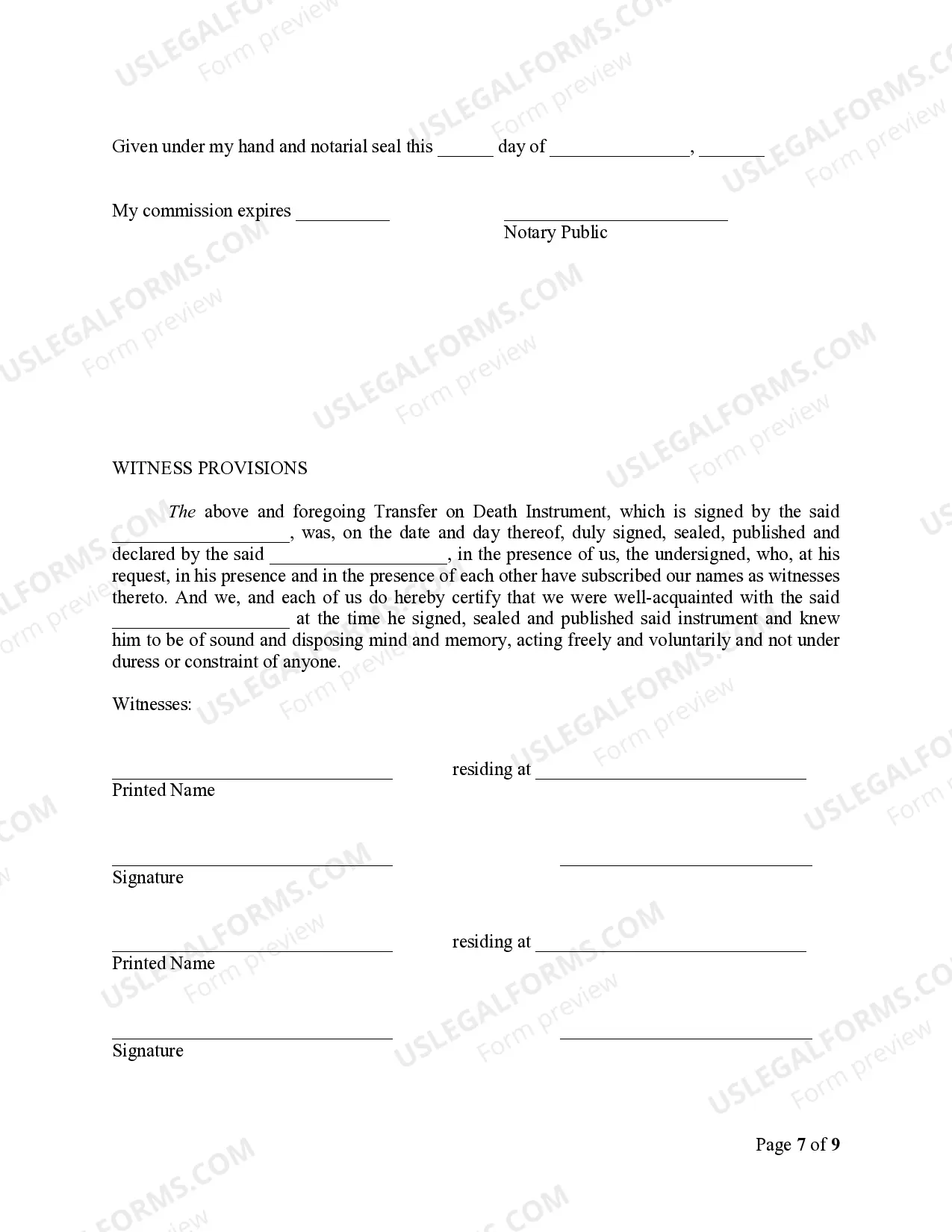

To create a valid lady bird deed in Illinois, certain requirements must be met. The property owner must clearly state their intent to transfer the property upon death, while retaining the right to use and control it during their lifetime. Additionally, the deed must be signed, dated, and properly witnessed before being recorded with the county clerk. Utilizing our platform, uslegalforms, can simplify this process and ensure compliance with all legal standards.

While transfer on death (TOD) accounts offer several advantages, they do come with specific challenges. These accounts can result in conflicts among beneficiaries if not properly managed or clearly stated in the owner's wishes. Moreover, like with a Lady Bird deed in Illinois, having TOD accounts does not prevent creditors from claiming against the assets. It's essential to weigh these potential pitfalls when planning your estate.

A transfer on death deed can be unfavorable in certain situations. For instance, it does not provide any asset protection during the owner's lifetime, leaving the property susceptible to claims from creditors. Additionally, if the beneficiaries have disagreements or conflict arises, the situation may lead to complications after the property owner's death. It's crucial to have a solid understanding of these potential issues before proceeding.

While a transfer on death deed, often referred to as a Lady Bird deed in Illinois, has many advantages, it also presents some downsides. One disadvantage might be the lack of control over the property after the transfer, which could lead to potential disputes among heirs. Additionally, it does not provide any protections against creditors, which could complicate your estate in certain scenarios. It's wise to consider these factors carefully.

Absolutely, Illinois allows transfer on death deeds. This specific type of deed provides property owners with a straightforward way to pass on real estate without going through probate. Many residents find this particularly beneficial for ensuring their assets efficiently reach their intended heirs. Thus, it's a favorable option for estate planning in Illinois.

Yes, Illinois does allow Transfer on Death (TOD) deeds. These deeds provide a mechanism for transferring property to beneficiaries without the need for probate, but they come with some limitations. Unlike the Lady Bird Deed in Illinois, which allows you to maintain control over your property, a TOD deed might not offer the same level of flexibility. Evaluating your options can help ensure you choose the right method for transferring your property.

Deciding whether to place your house in a trust in Illinois depends on your specific circumstances. Trusts can be beneficial for avoiding probate and providing detailed instructions for your assets after your death. However, a Lady Bird Deed in Illinois might serve your needs with fewer complications while still allowing for a direct transfer of property. It's wise to explore both options to determine which will work best for your estate planning.

Indeed, Illinois does allow the use of Lady Bird Deeds as an estate planning tool. This provision enables homeowners to transfer ownership of their property while still retaining the rights to live in or sell it during their lifetime. It's important to understand the advantages, as this option can significantly reduce the need for probate. By utilizing the Lady Bird Deed in Illinois, you can ensure your property transitions smoothly to your beneficiaries.

Yes, the Lady Bird Deed is available in Illinois and is increasingly recognized for its benefits. This unique type of deed allows property owners to retain control of their property while ensuring it transfers to their chosen beneficiaries upon their passing. It offers flexibility and avoids probate, which makes it an appealing option for many Illinois residents. Consider exploring the Lady Bird Deed in Illinois to simplify your estate planning.