Illinois Deed In Trust

Description

How to fill out Illinois Lady Bird Or Enhanced Life Estate Deed - Individual To Individual?

Acquiring legal templates that comply with federal and local laws is essential, and the internet provides a variety of choices.

However, why spend time looking for the properly drafted Illinois Deed In Trust example online when the US Legal Forms library has collected such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for any professional and personal situation.

Review the template using the Preview option or through the text outline to confirm it meets your needs.

- They are easy to navigate with all documents categorized by state and intended use.

- Our specialists stay updated with legislative changes, ensuring your form is current and compliant when you obtain an Illinois Deed In Trust from our site.

- Acquiring an Illinois Deed In Trust is quick and straightforward for both existing and new users.

- If you already have an account with an active subscription, Log In and download the document sample you need in the appropriate format.

- If you are new to our site, follow the steps outlined below.

Form popularity

FAQ

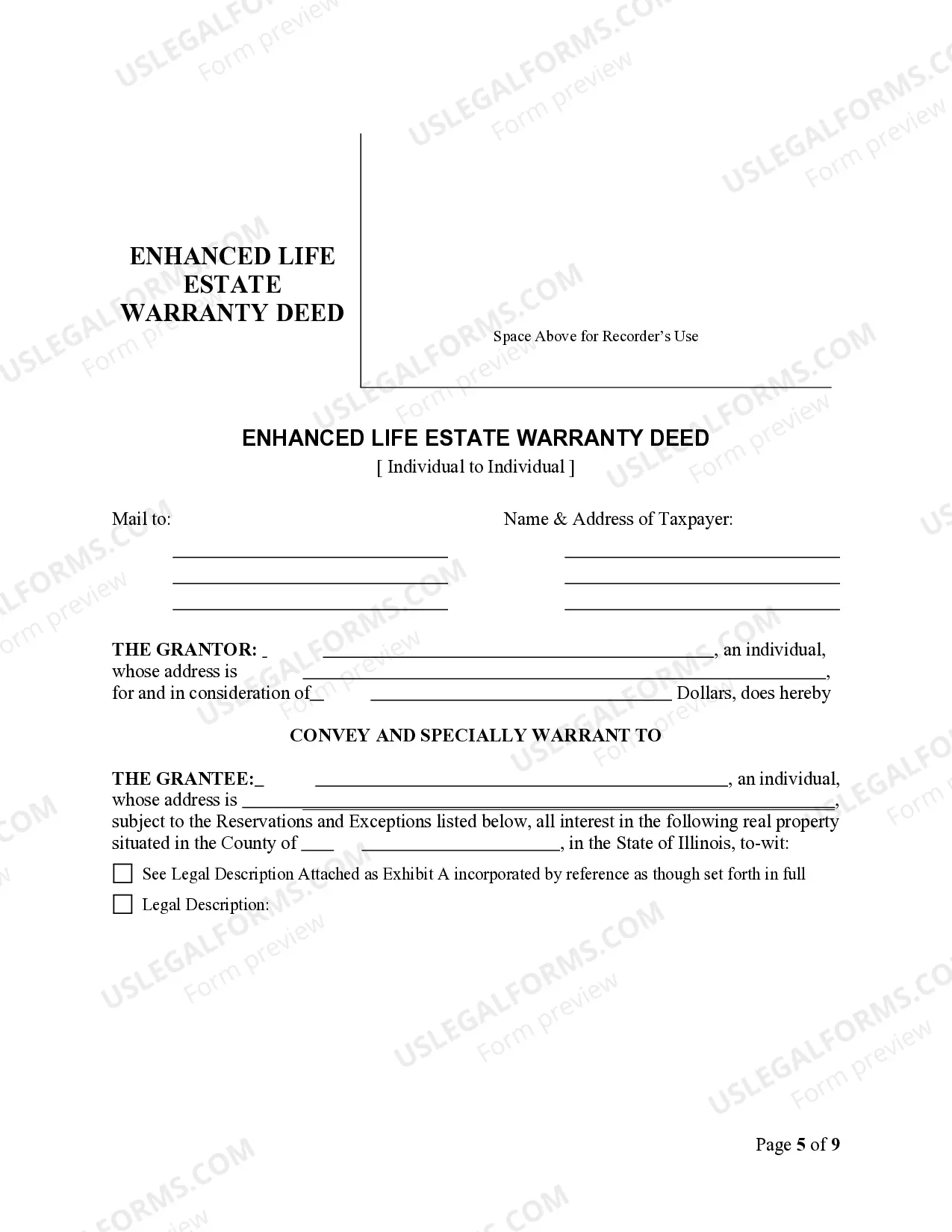

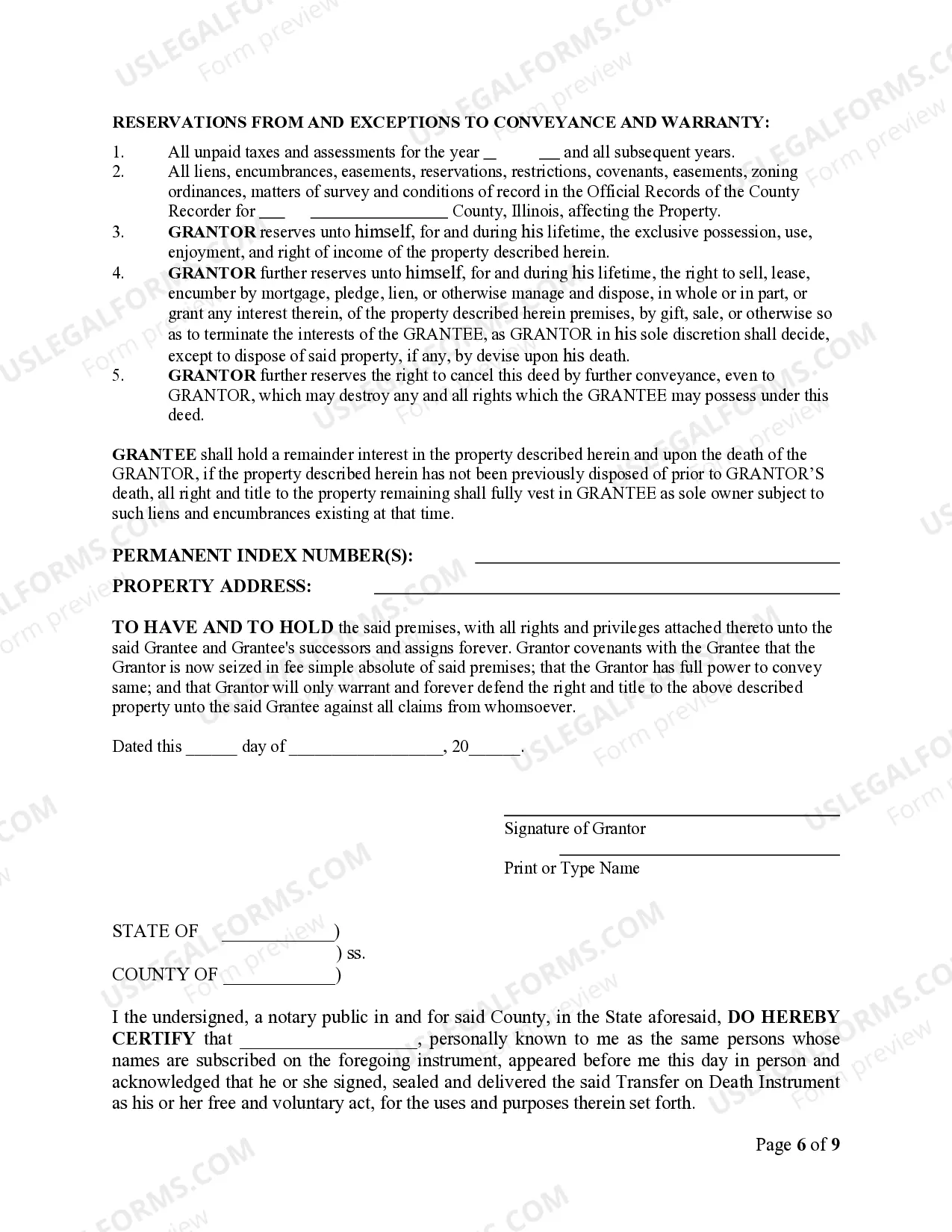

How to Create an Illinois Warranty Deed Form The names and address of the current owner and new owner; An accurate legal description of the real estate; A statement of consideration; and. Addresses for return of the recorded deed and for future tax statements (often the same address).

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

How Do I Set Up a Trust in the State of Illinois? Determining the type of trust you need. ... Take inventory of your investments, assets, and property. ... Select a trustee (the person who manages the trust). ... Have a lawyer draft your trust document. ... Sign your trust with a notary present who will notarize it.

Illinois allows the use of both a deed of trust and a mortgage. Illinois is a lien-theory state.