Automobile Odometer Promissory For The Future

Description

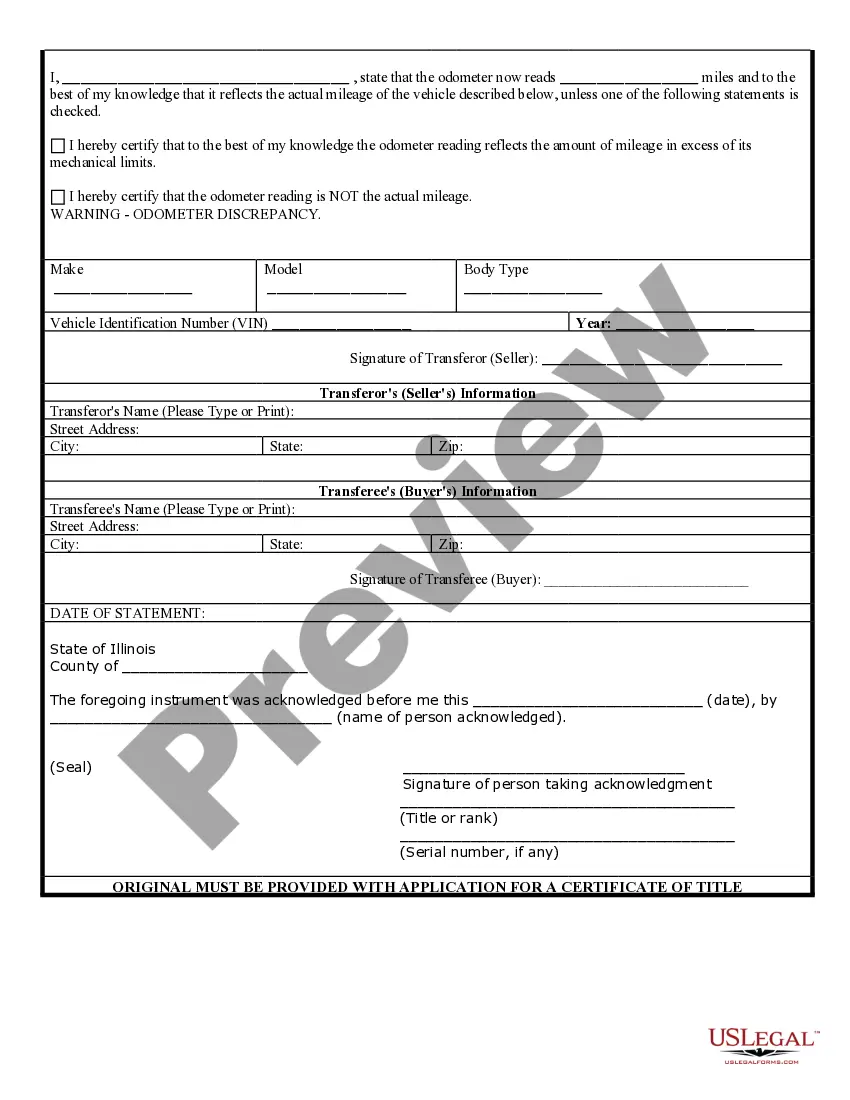

How to fill out Illinois Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

- If you already have an account, log in and access the necessary template. Ensure your subscription is active; if not, consider renewing it based on your preferred plan.

- For first-time users, begin by checking the Preview mode and form description. Confirm that the selected document satisfies your requirements and complies with local laws.

- If you find discrepancies, utilize the Search tab to locate an alternative template that suits your needs better.

- Once you find the appropriate form, click the Buy Now button and select your desired subscription plan. Creating an account is essential for accessing the full library.

- Complete your purchase by entering your credit card information or using PayPal, ensuring a smooth transaction.

- Finally, download your completed form to your device. You can access it anytime later through the My Forms section of your profile.

US Legal Forms empowers users by offering an extensive collection of over 85,000 legal forms, enhancing accessibility and efficiency in document preparation.

Take control of your legal document needs today with US Legal Forms and secure your automobile odometer promissory for the future!

Form popularity

FAQ

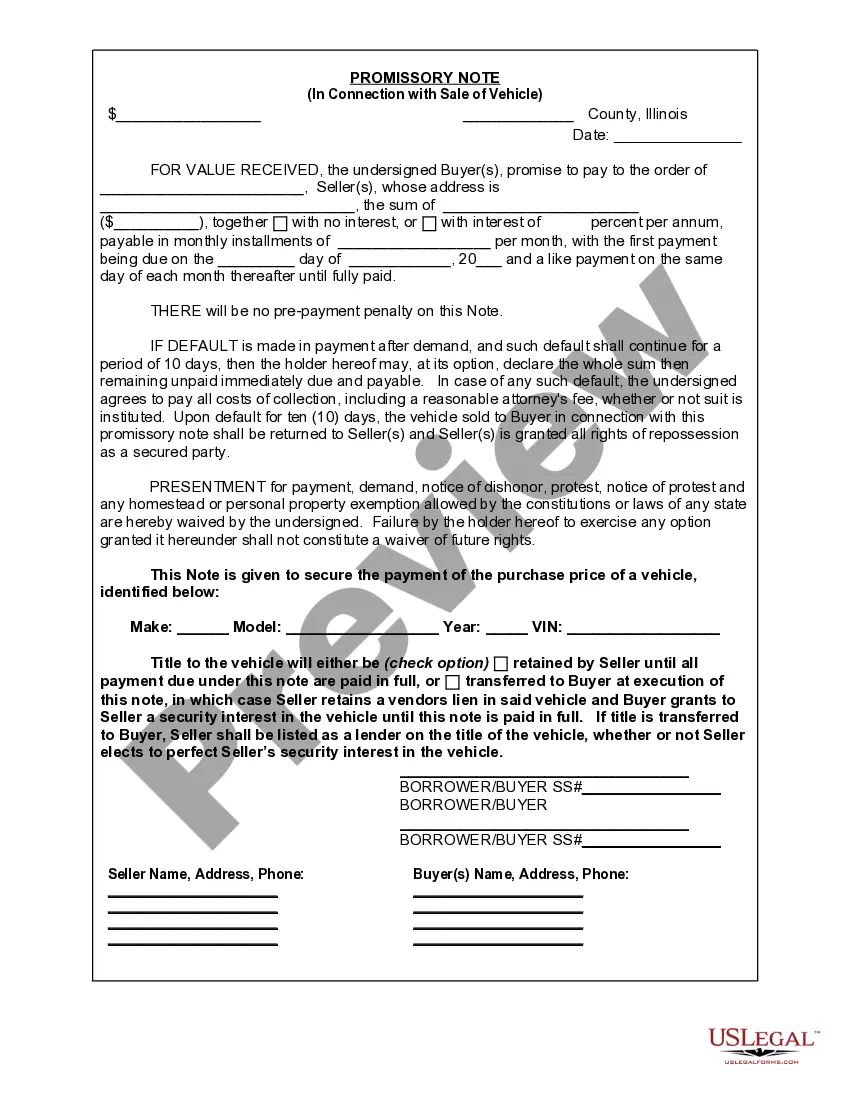

To fill out a promissory note, clearly print the necessary details in the designated sections. You'll need to specify the borrower's name, the amount loaned, the interest rate, and the repayment schedule. Ensure that both parties sign and date the document to validate the automobile odometer promissory for the future.

To fill out a promissory demand note, start by writing the title and date. Next, include the names and addresses of the borrower and the lender. Then, state the borrowed amount, repayment terms, and the condition for payment. Utilizing a platform like US Legal Forms can simplify this process, especially when it's related to an automobile odometer promissory for the future, ensuring that all details are correctly captured and legally binding.

A standard promissory note should include essential elements such as the title 'Promissory Note,' the date, and the names and addresses of the borrower and lender. It should clearly state the amount borrowed, the repayment schedule, and any interest that accrues. Remember, when dealing with an automobile odometer promissory for the future, including specific terms can help safeguard your interests.

A promissory note is generally enforceable as long as it meets specific legal requirements. When you create an automobile odometer promissory for the future, it should clearly state the terms, including payment amounts and dates. Ideally, both parties must sign the document, which adds to its enforceability in court. If you ever face disputes, using a reliable platform like US Legal Forms can help ensure your agreements meet necessary legal standards and protect your interests.

A promissory note does not necessarily need to be notarized to be deemed legal, but notarization can provide an additional layer of protection. While the signature of both parties usually suffices, having a notary can help resolve disputes by verifying identities and dates. This added security may be beneficial especially when creating an automobile odometer promissory for the future, as it assures both parties of the note's authenticity.

Yes, a promissory note can be handwritten, provided that it includes all necessary details such as the amount, terms, and signatures from both parties. While typed documents are often preferred for clarity, handwritten notes are still legally binding if they meet standard requirements. Therefore, whether you choose to write a promissory note by hand or use an online template, it should effectively document your agreement for an automobile odometer promissory for the future.

To write a promissory note for a car, you should start by clearly stating the names of the borrower and the lender. Next, include detailed information regarding the automobile, such as its make, model, and vehicle identification number (VIN). Then, outline the repayment terms, including the total amount, interest rate, and due dates. This structured approach is crucial to facilitate a smooth transaction, especially for an automobile odometer promissory for the future.

A valid promissory note must have clear terms that include the principal amount, interest rate, and repayment schedule. It should be signed by both parties to ensure mutual agreement. Additionally, it needs to specify the date of issuance and any relevant conditions for repayment. This document serves as an assurance for both the borrower and lender, particularly when dealing with an automobile odometer promissory for the future.