Limited Liability Company With The Ability To Establish Series

Description

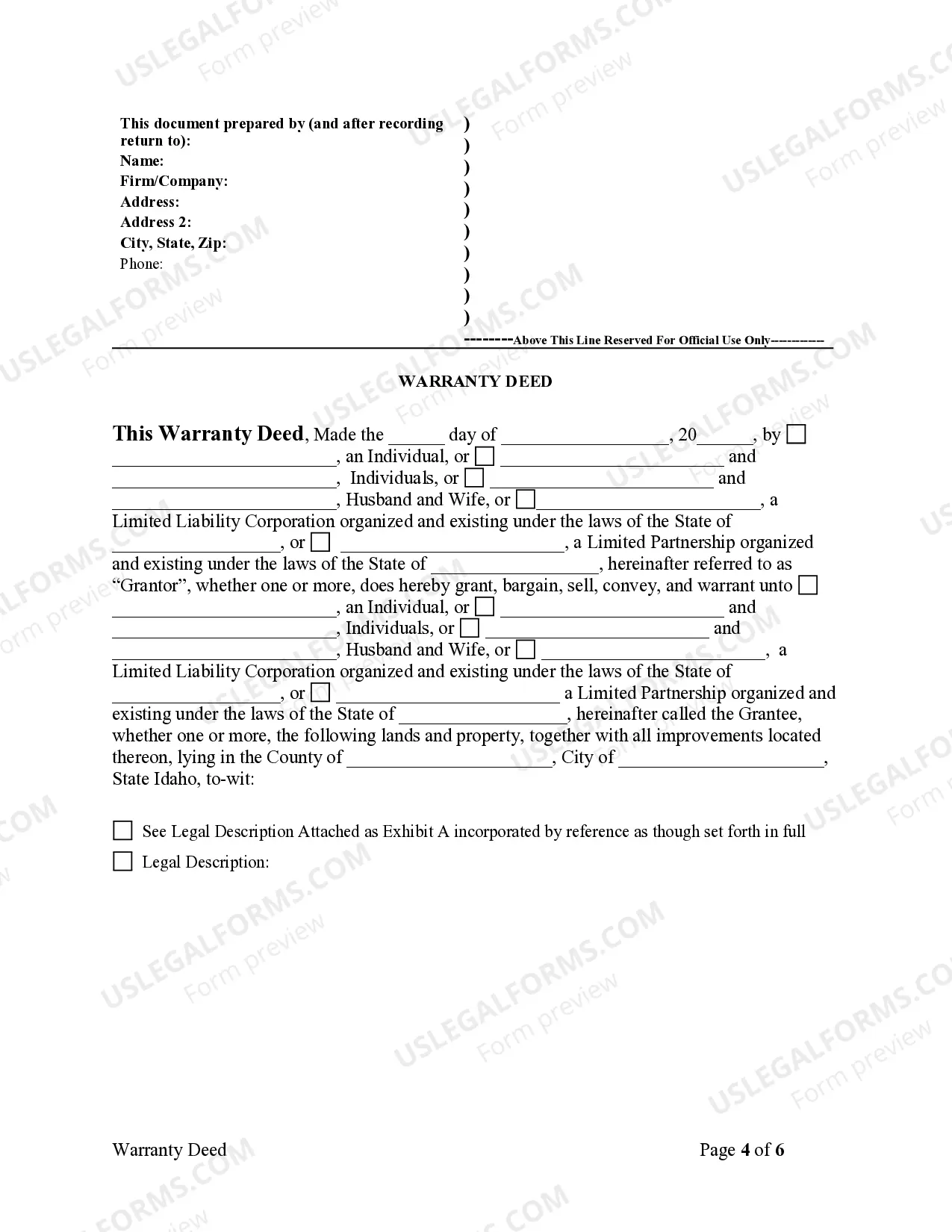

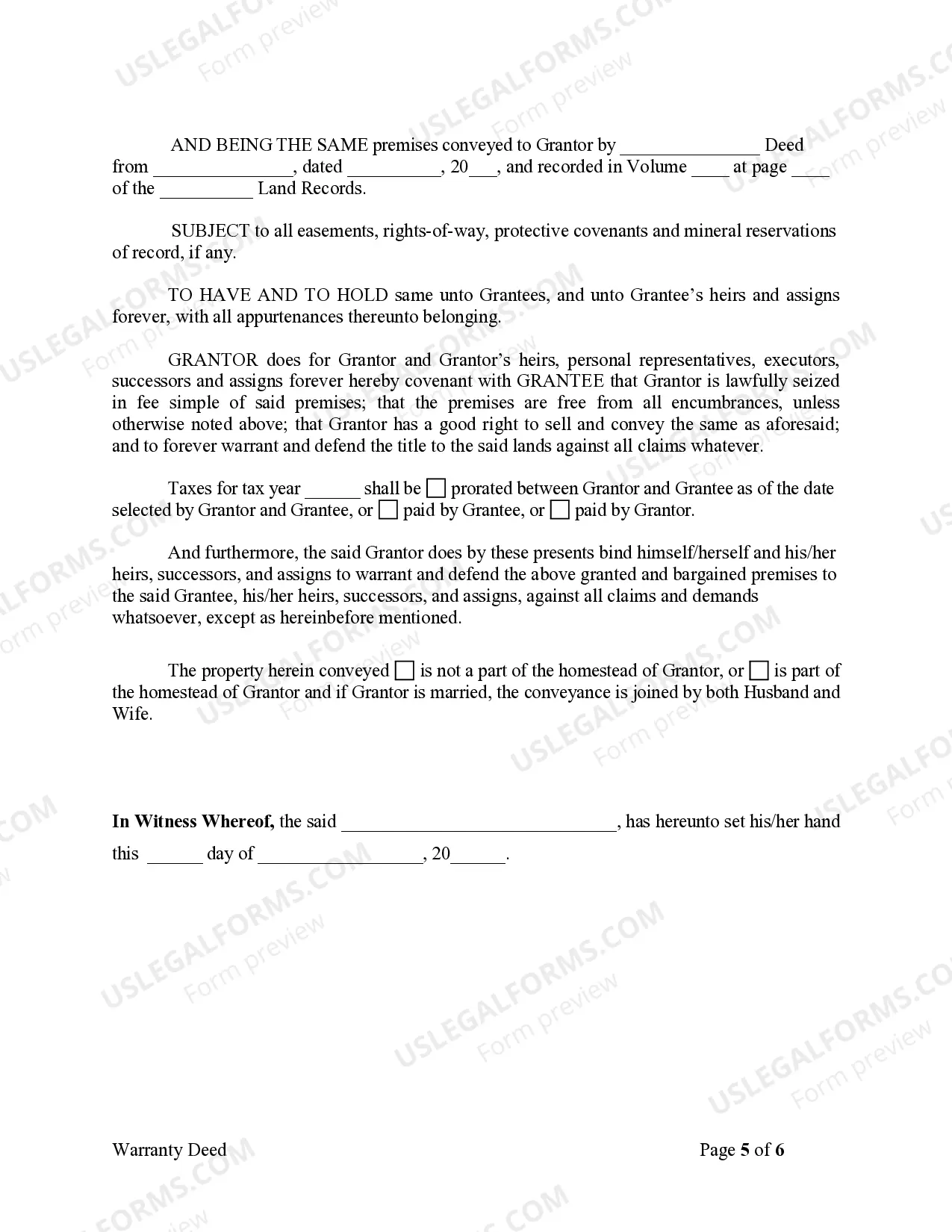

How to fill out Idaho Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

- If you are a returning user, log in to your account and navigate to the required form template. Ensure your subscription is active; otherwise, renew your payment plan.

- For first-time users, start by browsing the extensive library. Use the Preview mode to review the form and verify its applicability to your jurisdiction.

- If required, utilize the Search tab to locate additional templates that align with your needs. Confirm that all criteria are met.

- Purchase your selected document by clicking the Buy Now button and choosing your preferred subscription plan. You'll need to create an account to access the resources.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Download the form to your device, allowing you to fill it out easily. Access it anytime through the My Forms section of your profile.

By utilizing US Legal Forms, you can ensure a smooth and efficient process for establishing your LLC. With over 85,000 forms at your fingertips, you can create legally sound documents tailored to your business needs.

Start taking control of your business today—visit US Legal Forms to find the resources you need!

Form popularity

FAQ

The main purpose of a limited liability company with the ability to establish series is to create a flexible structure for managing multiple business ventures under a single umbrella. This allows you to compartmentalize liabilities and assets, minimizing risk across different series. Additionally, it can streamline administrative tasks and reduce costs associated with separate LLC formations. Consider leveraging services like uslegalforms to help create and organize your Series LLC efficiently.

Filing taxes for a limited liability company with the ability to establish series can be intricate. Generally, each series within the LLC can be treated as a separate entity for tax purposes, requiring individual filings. However, consult with a tax professional to navigate the specific regulations that apply to your series LLC in your state. Platforms like uslegalforms can provide tax-related resources to simplify this process.

While a limited liability company with the ability to establish series offers many benefits, it also has some potential downsides. For instance, not all states recognize Series LLCs, which can limit their usability across state lines. Additionally, complexities in management and liability separation can arise if not handled properly. It's essential to weigh these factors and consider consulting a legal expert for tailored advice.

To transform your LLC into a series LLC, you must file specific documents with your state that indicate your intention to establish series. This often includes amending your operating agreement to outline how you will manage each series. Also, ensure that you meet any state regulations regarding Series LLCs to maintain compliance. Using platforms like uslegalforms can streamline the paperwork process and provide the necessary templates.

Yes, you can convert your existing LLC into a limited liability company with the ability to establish series. This process typically involves filing the necessary paperwork with your state, along with adhering to state-specific requirements. It's important to ensure that your original operating agreement is updated to reflect this change. Consulting with a legal professional can guide you through the process effectively.

Yes, a limited liability company with the ability to establish series can create multiple series within its structure. Each series operates independently while still being governed by the same parent LLC, which allows for flexibility and asset protection. This structure is advantageous for businesses looking to diversify holdings and mitigate risks.

To get an EIN for your Series LLC, you can use the IRS online application just like a traditional LLC. You will need to apply for an EIN for both the parent company and each individual series you plan to establish. This ensures that financial and tax matters are organized and easily managed for each component of your business.

Yes, the IRS does recognize the structure of a series LLC. However, it is essential to note that not all states treat series LLCs the same way. Therefore, understanding the specifics of your state’s regulations, along with consultation from resources like US Legal Forms, can help ensure you make informed decisions.

If your limited liability company with the ability to establish series does not have an EIN, it may face challenges with tax filings and banking. Without an EIN, you cannot open a business bank account, hire employees, or file certain tax returns. It’s essential to obtain an EIN to ensure compliance and smooth business operations.

Yes, each entity in a series LLC requires its own EIN for tax purposes. This means that while your main limited liability company with the ability to establish series holds an EIN, each series you create under that umbrella will also need one. This ensures proper tax reporting for each individual series.