Limited Liability Company With Example

Description

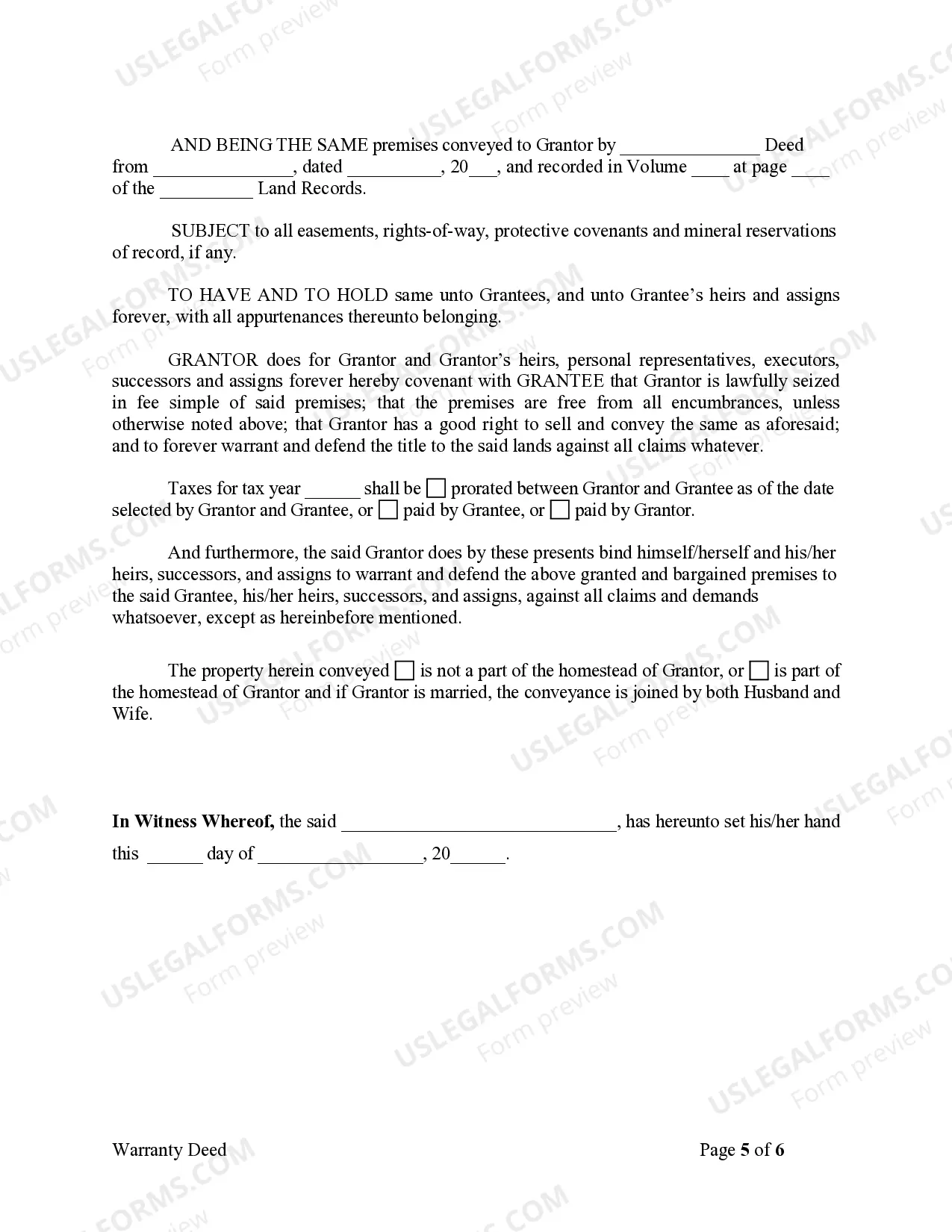

How to fill out Idaho Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

- Start by logging into your US Legal Forms account. If you’re a new user, create an account to begin.

- Browse the extensive form library and search for 'Limited Liability Company'. Review the preview and description carefully.

- If the selected template does not meet your needs, utilize the search tool to find an alternative that aligns with your requirements.

- Select the desired document and click on the 'Buy Now' button. Choose a suitable subscription plan to access the forms.

- Complete your purchase by providing your payment details. Options include credit card or PayPal.

- Download the completed template to your device. You can access it later in the 'My Forms' section of your account.

By following these straightforward steps, creating your LLC becomes a manageable task. US Legal Forms empowers users to generate legally acceptable documents efficiently.

Ready to simplify your legal paperwork? Explore US Legal Forms today and take the first step towards protecting your business!

Form popularity

FAQ

A single owner LLC files taxes as a sole proprietorship, meaning that the business income is reported on your personal tax return. This streamlined process simplifies your tax obligations while keeping the benefits of limited liability. Using USLegalForms can provide insights on how to maintain compliance with tax regulations. You should keep accurate records to ensure all income and expenses are properly accounted for.

If you do not file taxes for your limited liability company with example, you may face penalties and interest from the IRS. Failing to file can also jeopardize your LLC's status, leading to automatic dissolution in some states. It is essential to stay compliant and file taxes, even if your LLC does not generate income. Consulting with a tax professional can help you navigate this responsibility.

Yes, you can file your LLC separately from other business entities. Each LLC is recognized as a distinct legal entity, allowing you to separate personal and business liabilities. Using USLegalForms can simplify the process by providing proper forms tailored for state-specific regulations. This separation is crucial for protecting your personal assets from business risks.

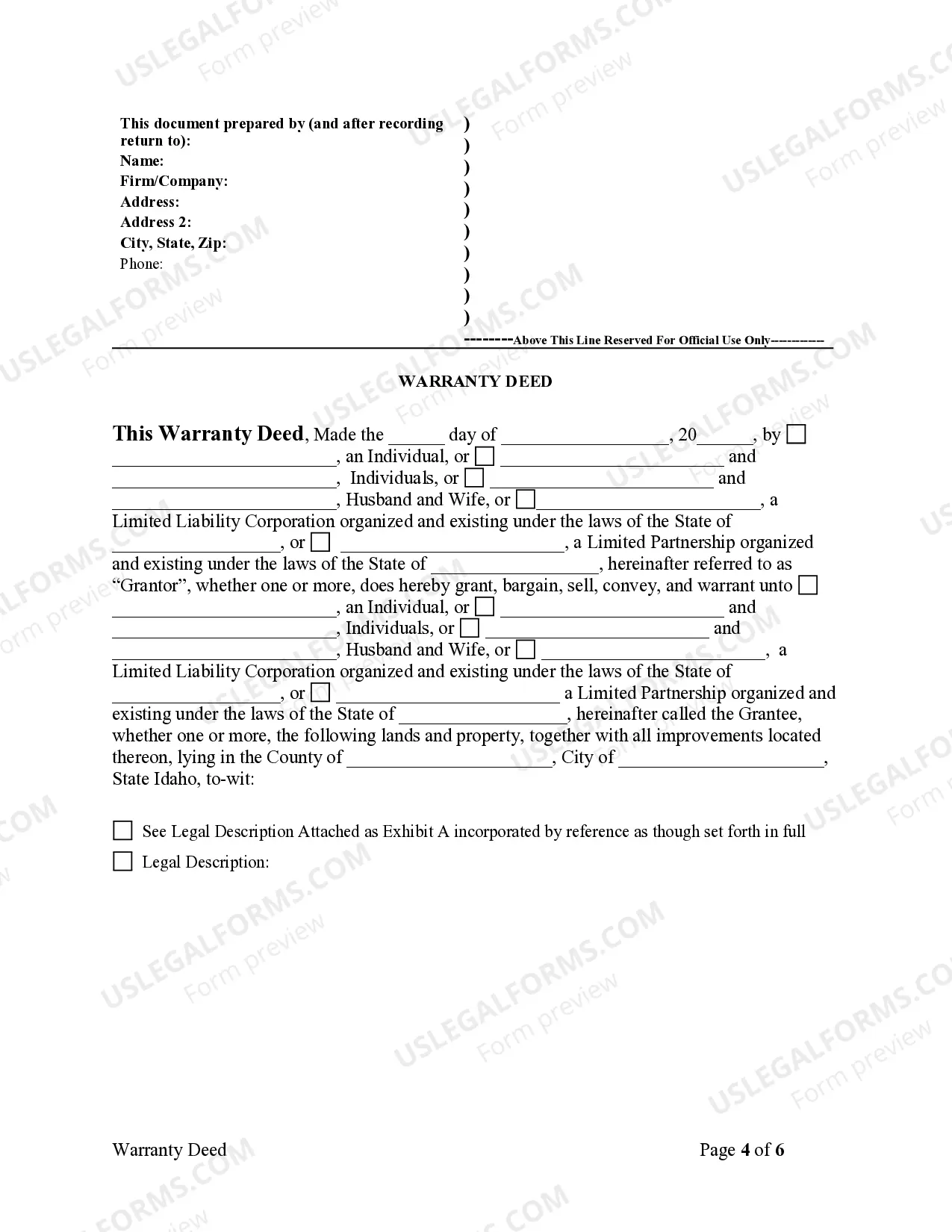

To write a limited liability company with example, you need to draft an operating agreement. This document outlines the rules and structure of your LLC, including member roles and profit sharing. You can use USLegalForms for templates that guide you in crafting your agreement according to state laws. This clarity helps prevent disputes among members.

Yes, you can establish a limited liability company with example setup, and choose not to operate it. However, it is essential to maintain your LLC by complying with any state requirements, such as annual reports or fees. Neglecting these responsibilities may lead to penalties or the dissolution of your LLC. Keeping it in good standing can be beneficial if you decide to use it later.

Yes, you can file your LLC by itself. However, it is important to follow your state's process for forming a limited liability company, with example forms available on platforms like USLegalForms. They provide step-by-step guidance to ensure you complete all necessary paperwork correctly. Proper filing protects your personal assets from business liabilities.

A limited company is a business entity that limits the liability of its owners, protecting their personal assets. An example would be a local consulting firm that operates as an LLC, offering services without placing the owner's home at risk. This structure is advantageous for many business types, making a limited liability company with an example a wise choice for new entrepreneurs.

A limited company qualifies based on its structure, allowing its owners to limit personal liability for business debts. This often includes most LLCs and corporations, which provide distinct benefits. For example, a limited liability company with example can shield owners from personal financial risk while enabling efficient business operations.

No, Amazon is not an LLC; it is incorporated as a corporation. However, small businesses might consider forming a limited liability company with examples relevant to their needs. The LLC structure can present advantages, such as protecting personal assets for owners while allowing flexibility in management.

The main difference lies in terminology; 'LLC' refers specifically to a limited liability company that provides liability protection to its owners. In contrast, a 'limited company' can refer to various forms of companies that limit owner liability. Understanding these differences is crucial for business owners deciding the best structure, like a limited liability company with an example of an ecommerce business.