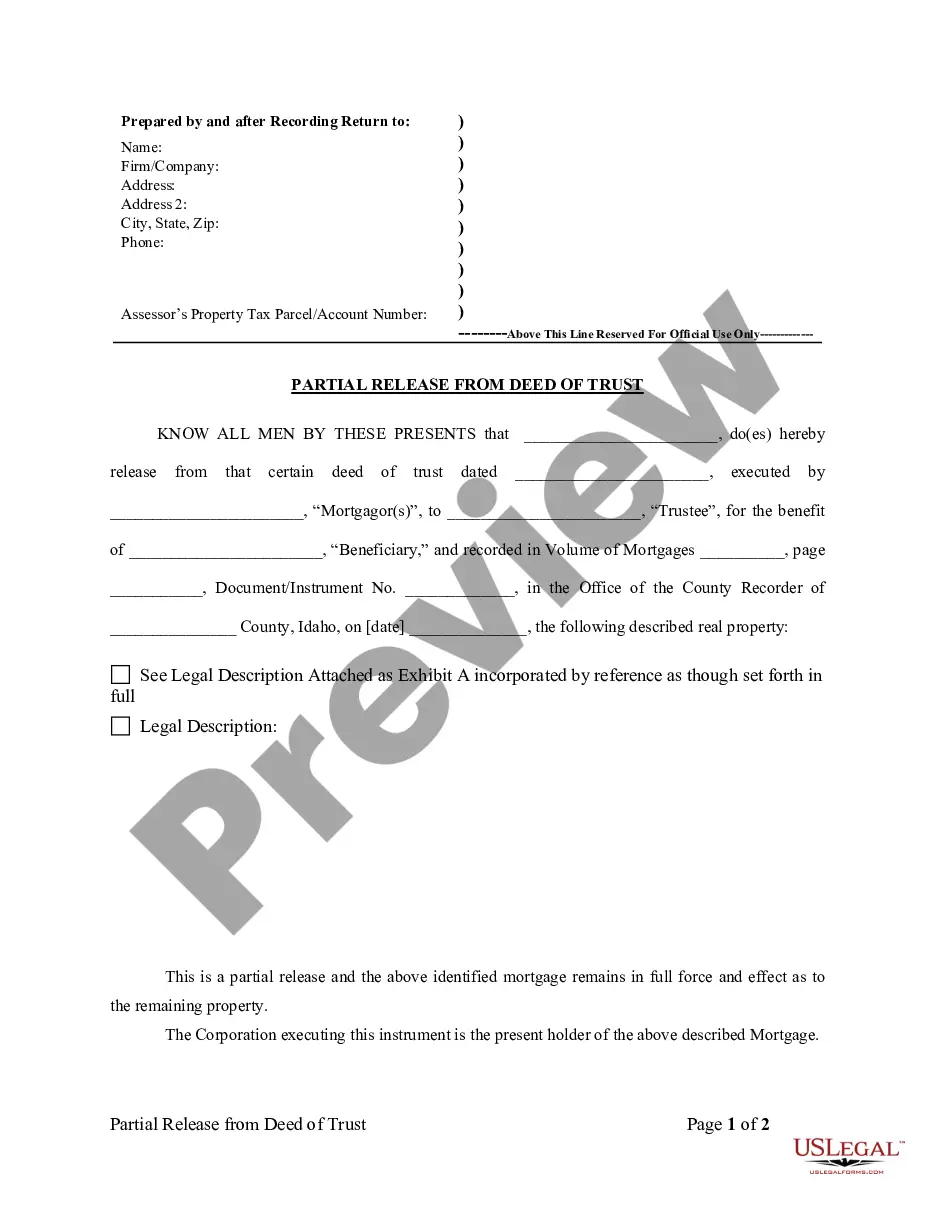

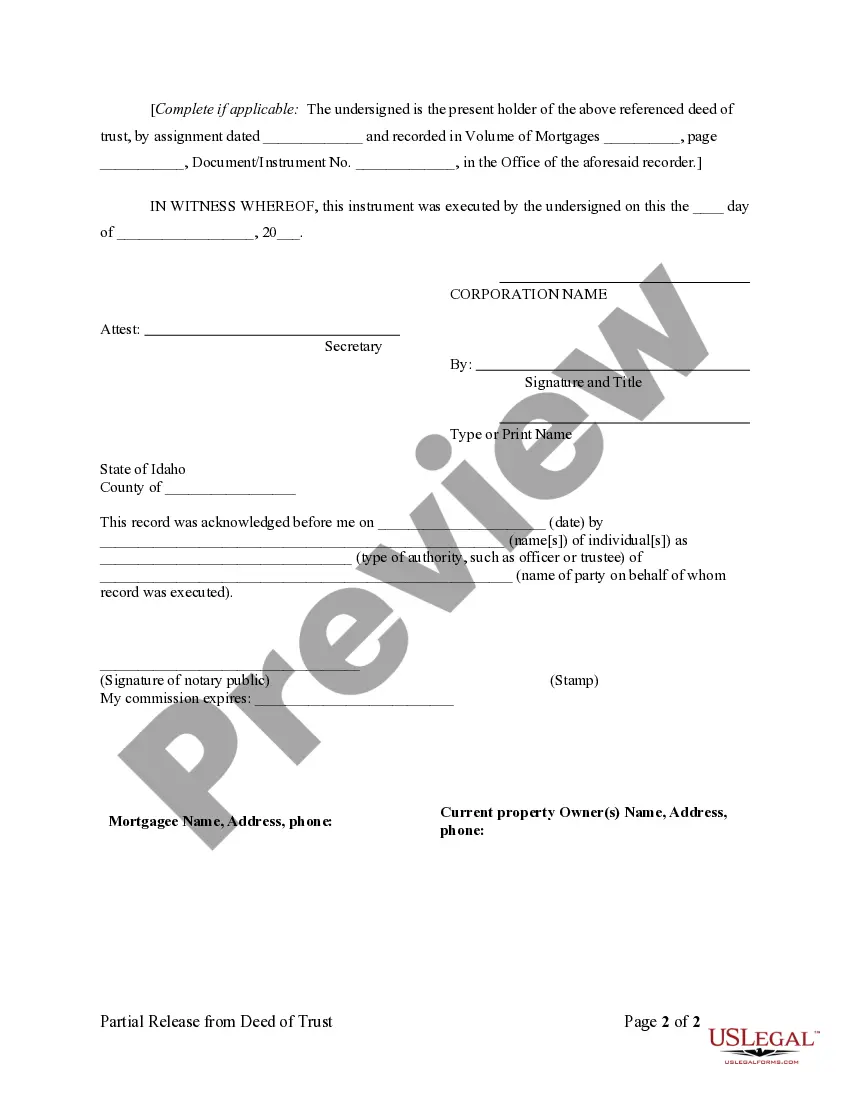

Idaho Release Form Withholding

Description

How to fill out Idaho Partial Release Of Property From Deed Of Trust For Corporation?

Whether you deal with paperwork frequently or you occasionally need to transmit a legal document, it is crucial to find an information source where all the examples are pertinent and current.

The first step with an Idaho Release Form Withholding is to confirm that it is the most recent version, as it determines if it can be submitted.

If you wish to simplify your quest for the most current document examples, search for them on US Legal Forms.

To acquire a form without an account, follow these instructions: Use the search menu to locate the form you need. Preview and describe the Idaho Release Form Withholding to make sure it is indeed the one you are looking for. After confirming the form, simply click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Enter your credit card information or PayPal account to complete the purchase. Select the document format for download and confirm it. Eliminate any uncertainty in handling legal paperwork. All your templates will be organized and authenticated with an account at US Legal Forms.

- US Legal Forms is a compilation of legal documents featuring nearly every type of form you might need.

- Search for the forms you need, assess their relevance immediately, and learn about their applications.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Obtain the Idaho Release Form Withholding examples in just a few clicks and save them to your profile at any time.

- A US Legal Forms profile will assist you in accessing all necessary samples conveniently and with less stress.

- Simply click Log In in the header of the website and navigate to the My documents section with all the required forms at your fingertips.

- You will not need to spend time searching for the ideal template or verifying its authenticity.

Form popularity

FAQ

Form 39-R is an Idaho Supplemental Schedule For Form 40, Resident Returns Only. It is simply a worksheet for posting your Form 40. View the IDAHO SUPPLEMENTAL SCHEDULE Form 39R. Form-39R is a supplemental form to Idaho's Form-40.

Multiply the wages for the pay period by the number of pay periods in the calendar year. Subtract the Idaho Child Tax Credit allowances from the gross wages to determine the amount subject to withholding. Use this figure and the annual tables to compute the amount of withholding required.

Claim allowances for you or your spouse.If you're married filing jointly, only one of you should claim the allowances. The other should claim zero allowances. If you work for more than one employer at the same time, you should claim zero allowances on your W-4 with any employer other than your principal employer.

You don't have to withhold Idaho income tax in any of the following situations: The employee isn't a resident of Idaho and earns less than $1,000 in Idaho in a calendar year. You employ an agricultural laborer who earns less than $1,000 in a calendar year. The employee is exempt from federal withholding.

Steps to take NOW:Use the withholding estimator at IRS.gov to estimate your federal withholding. Update the federal Form W-4 with that information.Use page 2 of the Form ID W-4 to estimate your Idaho withholding. Fill out Form ID W-4 with that information.Give both W-4 forms to your employer.