Toward Payment Idaho With Cities

Description

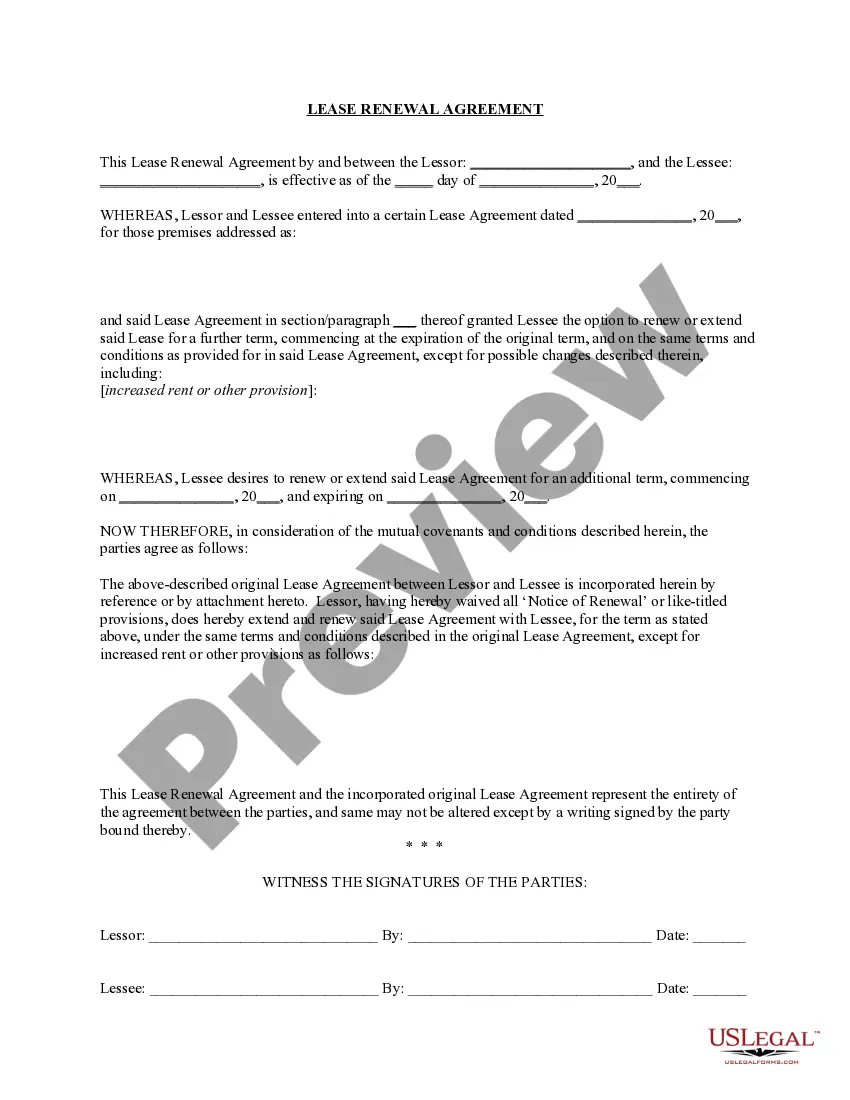

How to fill out Idaho Contract For Deed Package?

- Log in to your account if you are a returning user. If you are new, start by exploring our wide variety of legal forms tailored for your jurisdiction.

- Preview the selected templates carefully. Verify that the form aligns with your specific requirements and adheres to local laws.

- Use the search function if you need a different document. Our database is extensive, and finding the right form is simple and straightforward.

- Make a purchase by selecting the Buy Now option and choosing a subscription plan that fits your needs. Account registration is required to access our library.

- Complete your transaction securely by entering your payment details, either through credit card or PayPal.

- Download your selected form and save it to your device. You can access it anytime in the My Forms section of your profile dashboard.

US Legal Forms stands out with its unparalleled library of over 85,000 fillable and editable legal forms. Our commitment to user convenience is matched by our expert support, ensuring that your documents are completed accurately and legally.

Experience the ease of legal documentation with US Legal Forms today. Visit our website and start accessing the legal forms you need!

Form popularity

FAQ

Yes, Idaho does offer property tax exemptions specifically aimed at seniors. Eligible seniors must meet certain income thresholds and apply through their local county office. By taking advantage of this exemption, many seniors find relief from property tax burdens. For assistance in navigating these exemptions toward payment Idaho with cities, uslegalforms can provide valuable resources.

Idaho has a rich tapestry of towns and cities that range from the bustling Boise to charming small towns like McCall and Sandpoint. An alphabetical list of towns includes places such as Ammon, Boise, Coeur d'Alene, Idaho Falls, and Twin Falls, among many others. Understanding the variety of towns in Idaho can enrich your experience, and make your search for information toward payment Idaho with cities more manageable.

In Idaho, homeowners can qualify for a property tax exemption if they meet specific criteria, including owning and residing in the home as their primary residence. The program primarily benefits those who may be facing financial difficulties. To determine your eligibility and start saving on your taxes, consider reviewing your options through official resources on property tax exemptions toward payment Idaho with cities.

The amount remaining after taxes on an income of $100,000 in Idaho depends on various factors, including your filing status and deductions. Generally, the effective tax rate can give you an estimate of what to expect after state and federal taxes. It’s a good idea to use a tax calculator to project your net income accurately. Planning your finances wisely will help you with budgeting toward payment Idaho with cities.

Yes, Idaho does require estimated tax payments for individuals who expect to owe a certain amount in taxes. This requirement applies mainly to self-employed individuals or those with significant income not subject to withholding. Making estimated payments ensures that you are meeting your tax obligations throughout the year. For specific guidance on this, tools and resources for tax management toward payment Idaho with cities can assist you.

In Idaho, there is no specific age at which seniors stop paying property taxes entirely. However, seniors may qualify for property tax relief programs that can significantly reduce their tax liability. It is advisable to check local laws that outline criteria for these programs to see if you qualify. This information about property taxes is crucial for understanding your expenses toward payment Idaho with cities.

Idaho Form 910 is specifically used to apply for a sales tax exemption. This form is essential for those who qualify, allowing them to participate in exemptions that can reduce purchasing costs. As you assess your financial strategies, leveraging tools like USLegalForms can help you navigate towards payment Idaho with cities efficiently.

The 910 form in Idaho serves as an application for a sales tax exemption certificate. This form allows eligible individuals and organizations to apply for exemptions on their purchases. If you're exploring ways to save while managing expenses, understanding the 910 form can be beneficial as you work toward payment Idaho with cities.

Yes, Idaho sales tax exemption certificates do expire under certain circumstances. Businesses should regularly review their certificates to confirm their validity and ensure compliance. Staying updated on this information is crucial, especially when working toward payment Idaho with cities, as it helps avoid unnecessary tax liabilities. You can find tools and resources on USLegalForms to keep your records accurate.

Determining how many allowances to claim in Idaho depends on your personal financial circumstances. Typically, more allowances reduce the amount of tax withheld from your paycheck, while fewer allowances increase it. To ensure that your withholding aligns with your tax obligations, you may consider guidance from resources that explain Idaho's tax regulations, particularly if you are looking toward payment Idaho with cities.