Promissory Note Template Idaho For Line Of Credit

Description

How to fill out Idaho Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

There's no longer a necessity to waste time searching for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in one location and optimized their availability.

Our platform offers over 85k templates for various business and personal legal situations categorized by state and purpose.

To do so, utilize the Search bar above to find another sample if the current one does not meet your needs.

- All forms are expertly crafted and validated for authenticity, ensuring you receive a current Promissory Note Template Idaho For Line Of Credit.

- If you are acquainted with our service and already possess an account, make sure your subscription is active before accessing any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit any obtained documents whenever necessary by accessing the My documents tab in your profile.

- For those using our service for the first time, the process will involve additional steps to finish.

- Here's how new users can find the Promissory Note Template Idaho For Line Of Credit in our catalog.

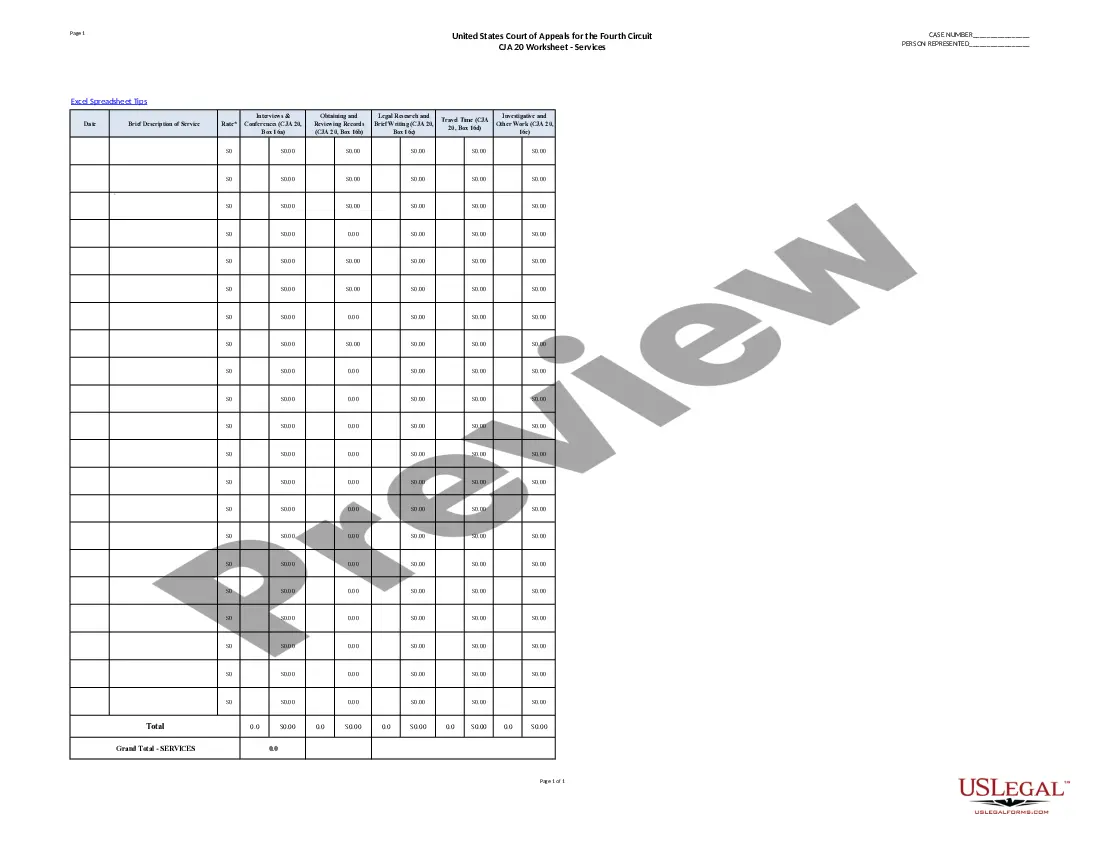

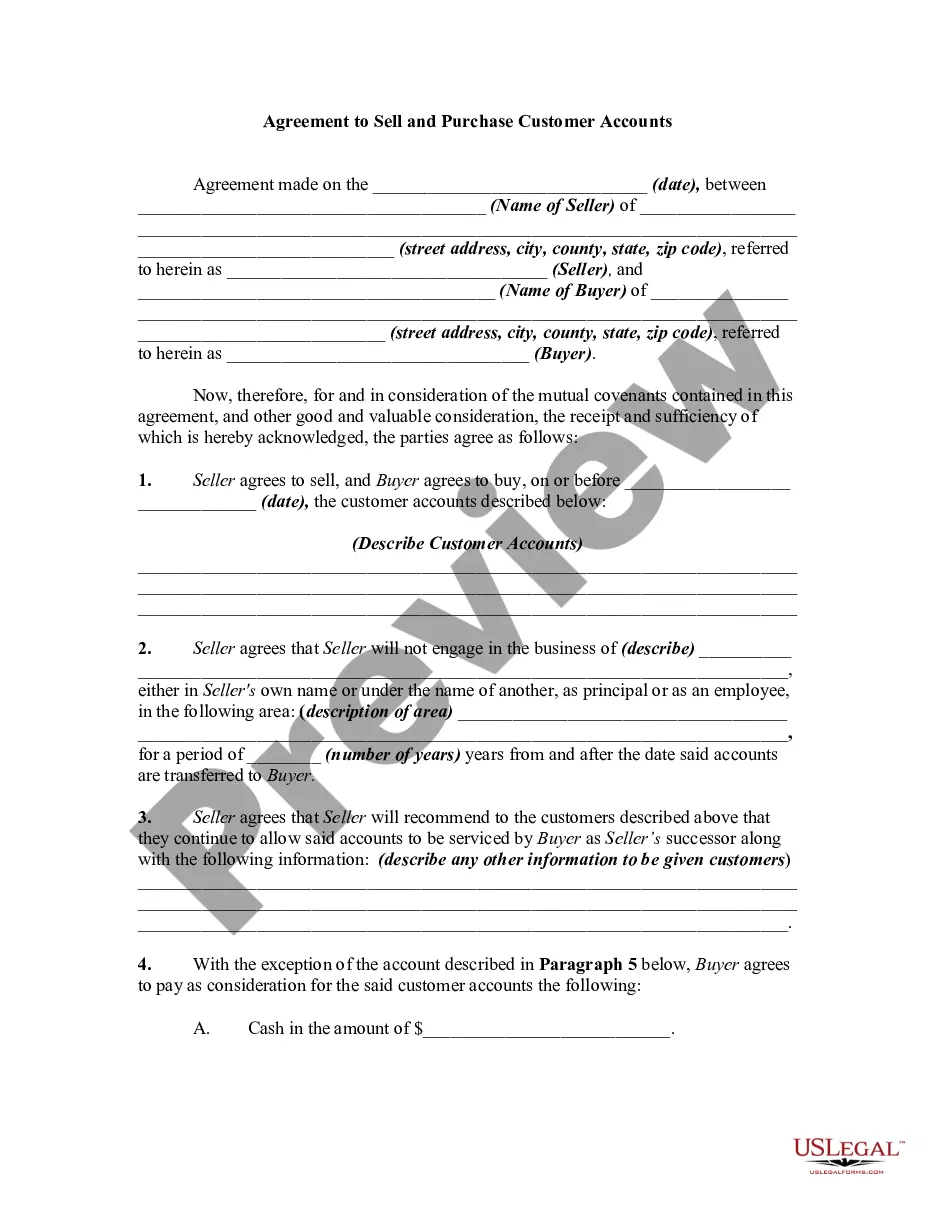

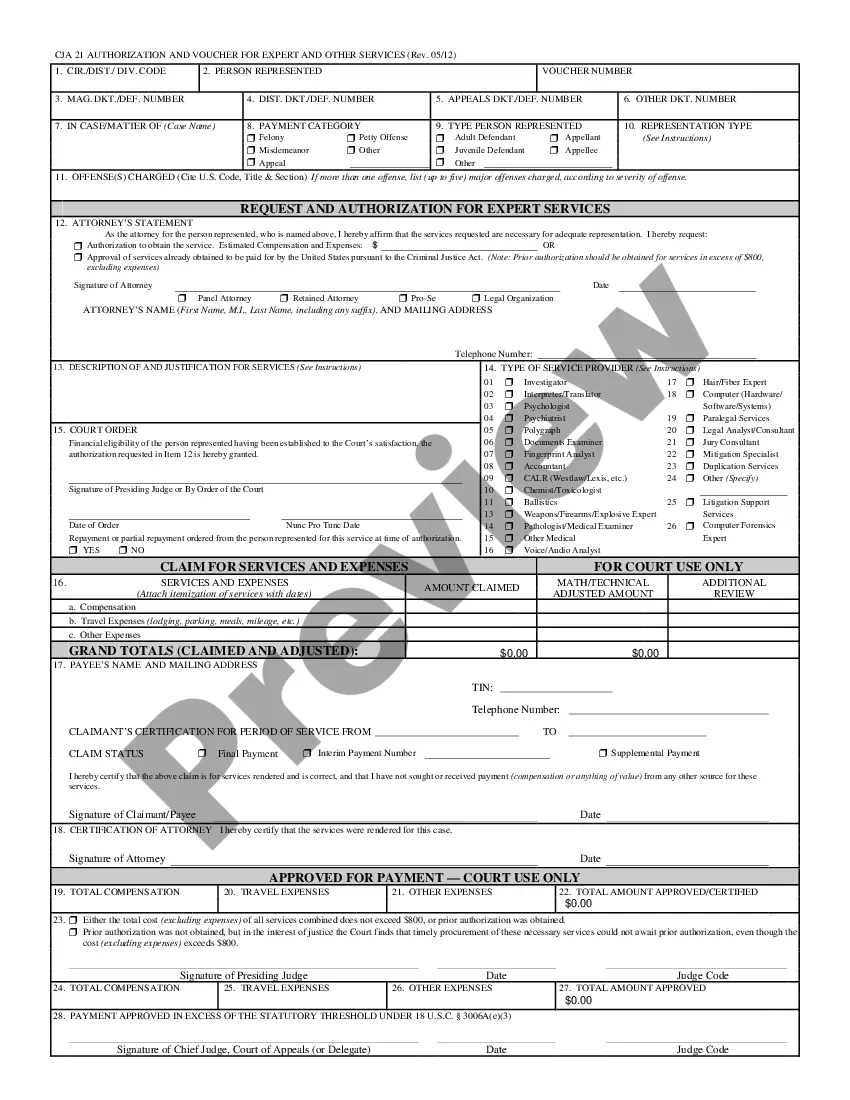

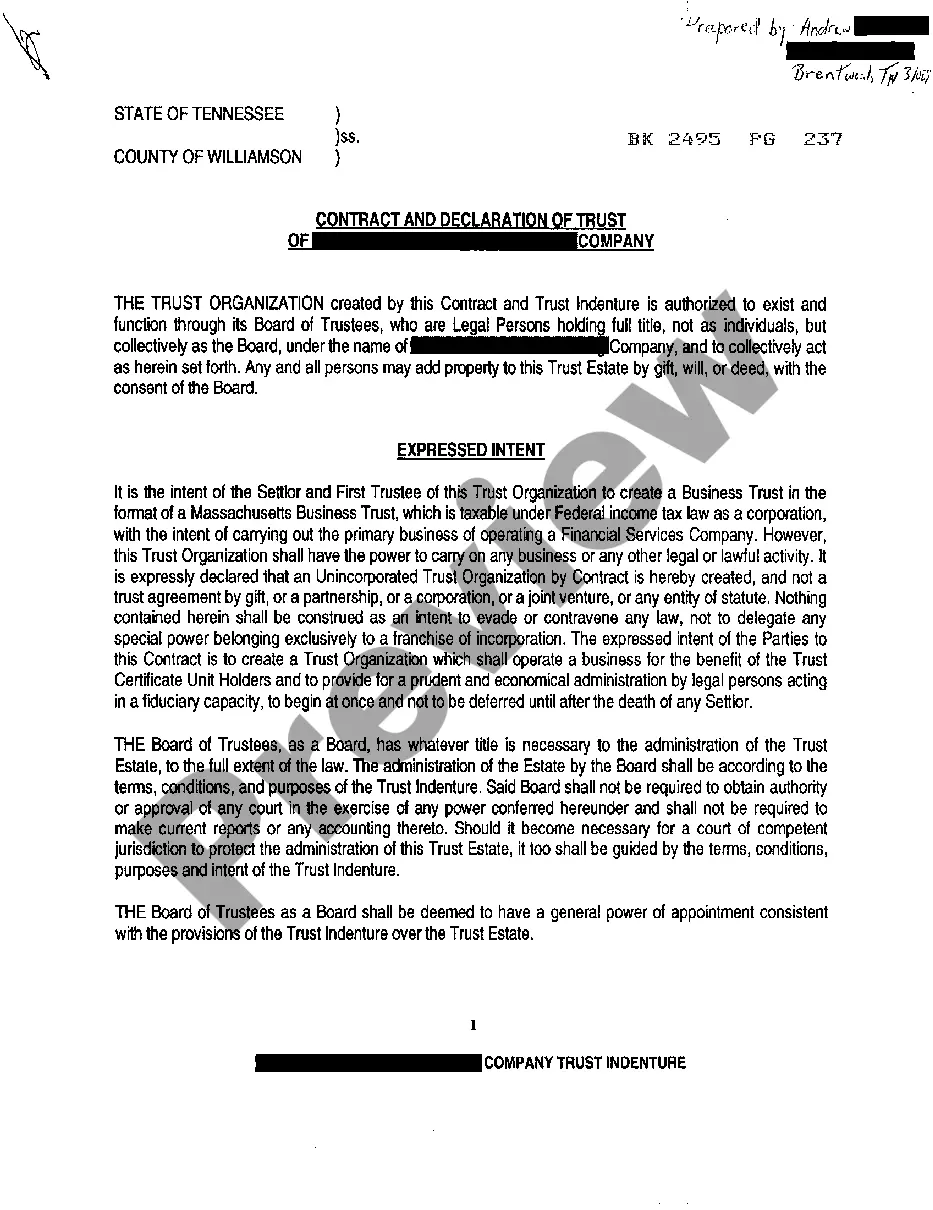

- Carefully read the page content to verify it includes the sample you need.

- Use the form description and preview options if available.

Form popularity

FAQ

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Like most loans, HELOCs feature a legally binding promissory note borrowers sign promising to repay the loan. While a promissory note alone does not constitute a HELOC, it's the most important document contained in the loan.