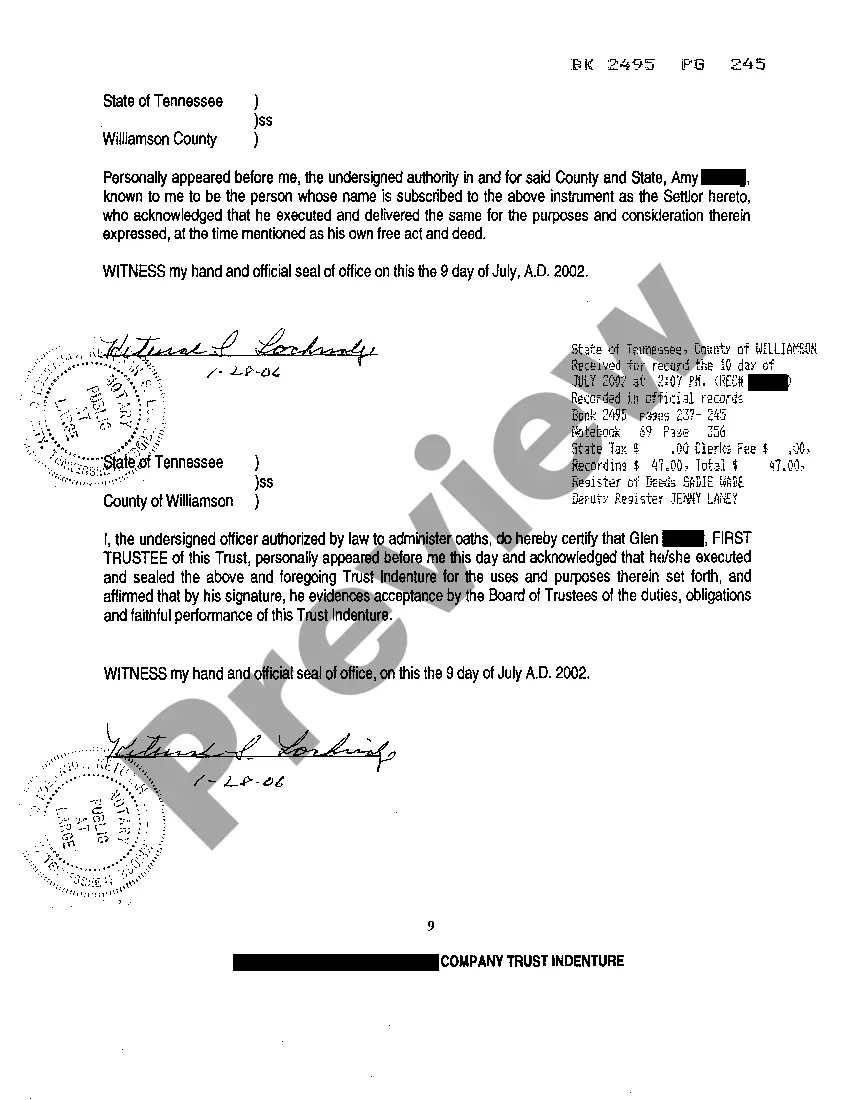

Agreement And Declaration Of Trust With Mortgage

Description

How to fill out Tennessee Contract And Declaration Of Trust?

How to obtain professional legal documents that complies with your state regulations and prepare the Agreement And Declaration Of Trust With Mortgage without enlisting the help of a lawyer.

Numerous services online offer templates to address various legal situations and formalities. However, it might require time to determine which of the accessible samples meet both your application and legal standards.

US Legal Forms is a reliable service that assists you in locating formal paperwork crafted in accordance with the latest state law revisions and helps you save on legal fees.

If you are not registered with US Legal Forms, follow the guide below: Review the webpage you have opened to confirm if the form meets your requirements. Utilize the form description and preview options if available. Search for another template in the header by your state if necessary. Click the Buy Now button upon finding the appropriate document. Select the most suitable pricing plan, then Log In or register for an account. Choose the payment method (using a credit card or PayPal). Select the file format for your Agreement And Declaration Of Trust With Mortgage and click Download. The downloaded documents remain yours: you can always access them in the My documents section of your profile. Join our platform and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not an ordinary web library.

- It is a compilation of over 85,000 validated templates for diverse business and personal situations.

- All documents are categorized by area and state to expedite and simplify your search.

- Additionally, it features powerful tools for PDF editing and electronic signatures, allowing users with a Premium subscription to conveniently complete their documentation online.

- Obtaining the necessary paperwork requires minimal effort and time.

- If you already possess an account, Log In and confirm your subscription status.

- Download the Agreement And Declaration Of Trust With Mortgage using the applicable button adjacent to the file name.

Form popularity

FAQ

A mortgage in trust may be something that you have never previously considered, but it may be appropriate. Anyone who owns property can put their mortgage in a revocable living trust so as to not deal with the probate process after death and utilize other estate planning benefits.

So, to summarize, it's fine to put your house into a revocable trust to avoid probate, even if that house is subject to a mortgage.

Deed Of Trust Vs. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid. In the event of default on the loan, the trustee is responsible for starting the foreclosure process.

To put your home in the trust, only two simple forms are required in California.Obtain a California grant deed from a local office supply store or your county recorder's office.Complete the top line of the deed.Indicate the grantee on the second line.Enter the trustees' names and addresses.More items...

Declaration of trust is the document used to establish the primary details of a trust. While some states allow oral declarations, many states require a written declaration of trust outlining the essential pieces of the trust in order for it to be legally recognized.