Living Trust

Description

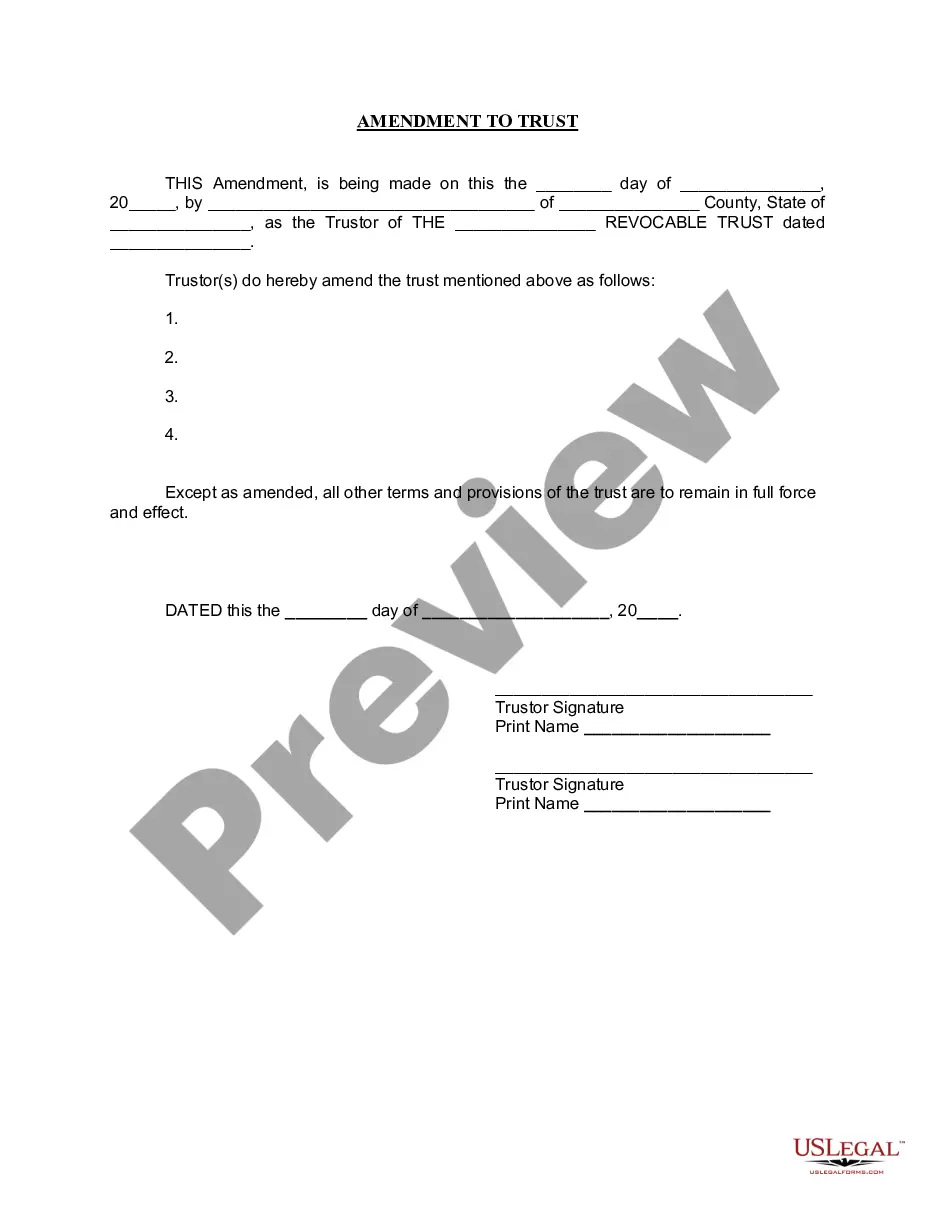

How to fill out Idaho Amendment To Living Trust?

- If you’re a returning user, log in to your account and download your desired living trust form by hitting the Download button. Ensure your subscription is current; renew it if necessary.

- For first-time users, start by exploring the Preview mode and form description. Verify that the living trust document aligns with your requirements and local regulations.

- If you need a different template, utilize the Search tab at the top. Find a suitable living trust form, then proceed to the next step.

- Purchase the desired document by clicking the Buy Now button and selecting a subscription plan. Registration is required to unlock access to the comprehensive library.

- Complete your purchase by entering your credit card information or signing in with your PayPal account.

- Download the living trust form to your device for completion, and access it anytime in the My Forms section of your account.

In conclusion, US Legal Forms makes it seamless to secure a living trust form. With a vast array of templates at your fingertips and expert assistance available, you are well-equipped to create legally sound documents.

Start your legal journey today and explore the extensive offerings at US Legal Forms!

Form popularity

FAQ

There is no specific minimum amount required to create a living trust; the decision is more about your needs and goals. If you have significant assets, a living trust can be a valuable tool for estate planning. On the other hand, if your estate is modest, you might not need the complexities of a trust. Evaluating your financial situation and consulting with a professional can help determine whether a living trust is right for you.

One downside to establishing a living trust is the complexity and responsibility it brings. Creating a trust requires careful planning and may involve legal fees, which can deter some individuals. Additionally, if the trust is not funded correctly, meaning assets must be transferred, it may not fulfill its intended purpose. It is crucial to make sure you complete all the necessary steps to enjoy the benefits of a living trust.

Putting your house in a living trust in Texas can provide significant benefits. A living trust not only helps you avoid probate for your home, but it also allows for easier management and transfer of the property upon your death. However, it is essential to weigh the pros and cons based on your specific situation. Consulting a legal expert may help ensure that this decision aligns with your financial goals.

A living trust can be deemed invalid for several reasons, including improper execution or lack of legal capacity during its creation. If the trust was not signed by the grantor or witnessed as required by state law, it may not hold up in court. Additionally, outdated terms or conflicting provisions can jeopardize its validity. To ensure your living trust remains robust, consider using services like UsLegalForms, which can guide you through the correct creation and management process.

You generally do not need to file your revocable living trust with the IRS, as it is treated as a pass-through entity during your lifetime. However, if your trust becomes irrevocable upon your passing or it generates income, you might be required to file a trust tax return. As your situation can vary, it is a good idea to review your trust documents and seek guidance from a legal professional specializing in living trusts.

Failing to file taxes on a trust can lead to penalties and interest from the IRS. When you have an irrevocable living trust that generates income, it is important to file accurate tax returns to avoid complications. If the IRS identifies noncompliance, they may levy fines or audit both your trust and personal filings. It is advisable to file appropriately and consult a legal expert if needed.

Yes, your living trust may be required to file a tax return, depending on its structure and source of income. If you have a revocable living trust, you typically do not need to file a separate return, as income is reported on your personal tax return. However, if the trust generates income or becomes irrevocable, it may require its own filing. Consulting a tax professional familiar with living trusts will ensure compliance with tax laws.

The best way to set up a living trust involves several key steps. First, gather information about your assets and decide how you want to manage and distribute them. Next, you should consult with a qualified estate planning attorney or use a reliable platform like US Legal Forms, which offers templates and guides for creating a living trust. Finally, ensure you properly fund the trust by transferring assets into it, as this step is crucial for your living trust to function as intended.

The best person to set up a living trust is usually an estate planning attorney. They have the expertise to guide you through the process, ensuring that your trust meets legal requirements and addresses your specific needs. Additionally, they can help you navigate the various options available for managing and distributing your assets. At US Legal Forms, you can find resources and forms that simplify the creation of a living trust, making this process easier for everyone.

Filling a living trust involves transferring the legal titles of assets into the name of the trust. This process typically includes identifying each asset, completing necessary paperwork, and ensuring that all legal actions comply with state laws. Using platforms like US Legal Forms can simplify this process by providing templates and guidance tailored to your specific needs.