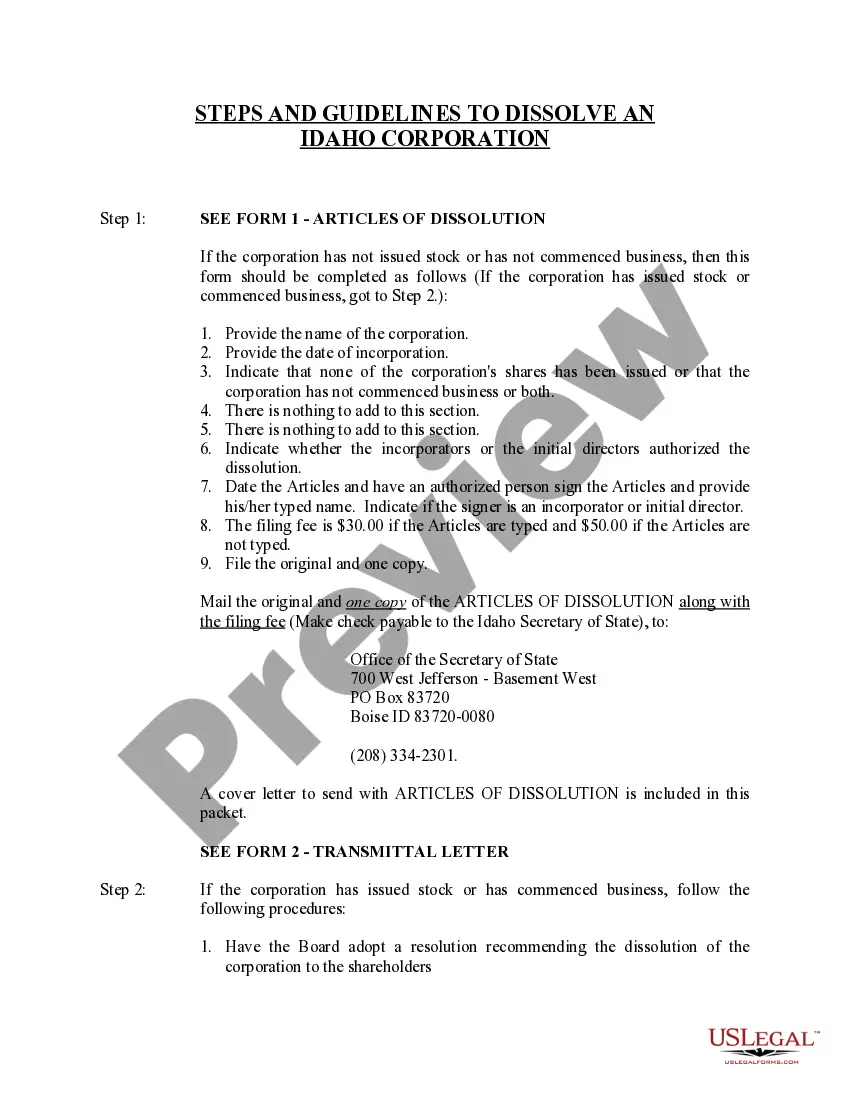

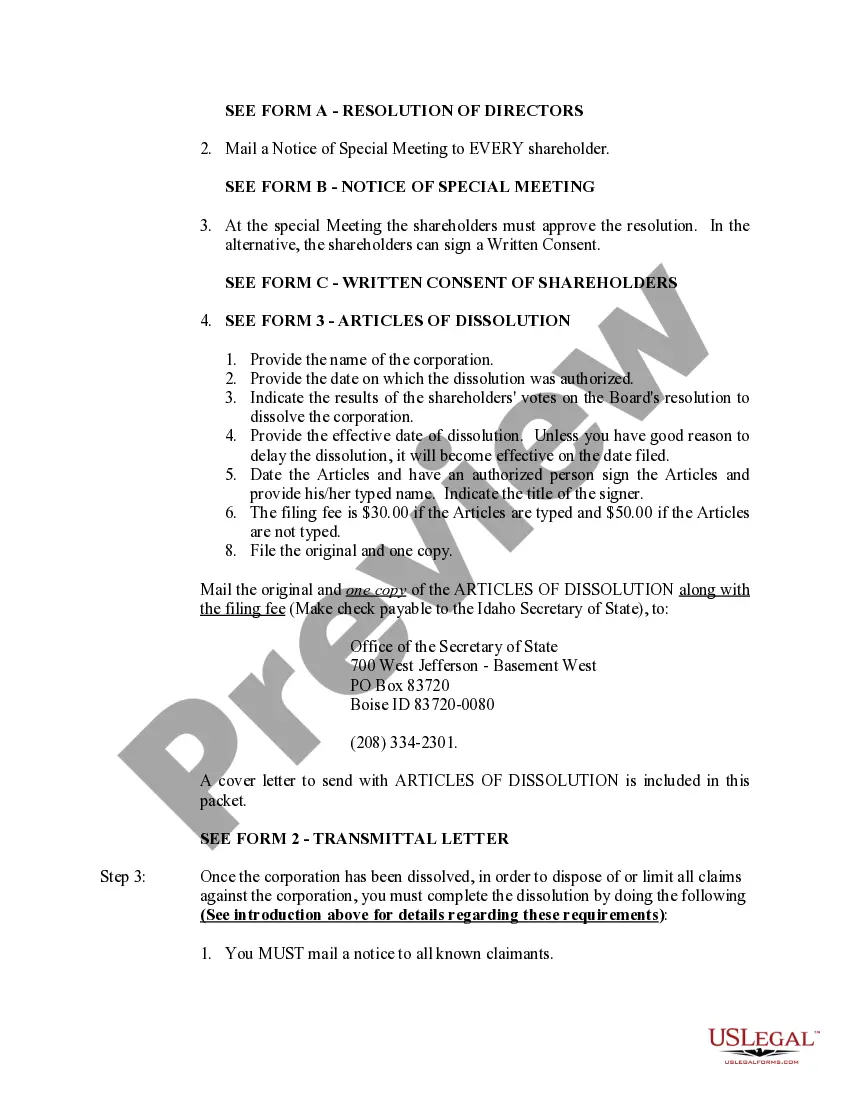

The dissolution of a corporation package contains all forms to dissolve a corporation in Idaho, step by step instructions, addresses, transmittal letters, and other information.

Idaho Foreign Corporation Withdrawal

Description

How to fill out Idaho Foreign Corporation Withdrawal?

Individuals usually link legal documentation with something complex that only an expert can handle.

In some sense, it's accurate, as drafting the Idaho Foreign Corporation Withdrawal necessitates considerable knowledge in subject matter, including state and county laws.

However, with US Legal Forms, processes have become simpler: pre-prepared legal documents for any personal and business scenario that adhere to state regulations are compiled in a single online repository and are now accessible to all.

All templates in our collection are reusable: once acquired, they remain saved in your account. You can access them anytime needed via the My documents section. Explore all the benefits of utilizing the US Legal Forms platform. Subscribe now!

- Ensure the page content aligns with your requirements.

- Review the form description or check it using the Preview feature.

- If the prior example does not meet your needs, search for a different template using the Search bar at the top.

- Click on Buy Now once you identify the correct Idaho Foreign Corporation Withdrawal.

- Select a pricing plan that suits your requirements and financial situation.

- Create an account or Log In to move forward to the payment page.

- Complete your subscription payment using PayPal or a credit card.

- Choose the format for your document and click Download.

- Print your document or open it in an online editor for quicker completion.

Form popularity

FAQ

Using a PO Box as your LLC address in Idaho is not permitted. You must provide a physical street address for your LLC, which must be in Idaho. This requirement helps to maintain transparency and allows for official document delivery. You may consider alternative solutions, such as using a registered agent for your business.

Withdrawing from a foreign LLC in Colorado requires you to file a Certificate of Withdrawal with the Colorado Secretary of State. Make sure to include details about your LLC and settle any outstanding state business. Once approved, you will receive confirmation of your withdrawal. This ensures you are no longer held to Colorado’s business obligations.

Yes, if you operate your business in Idaho and are not based there, you must register as a foreign entity. This process involves filing specific documentation with the Idaho Secretary of State. By doing this, you ensure your business complies with local laws. It’s vital for a smooth operation and protects your business interests.

To dissolve an LLC in the USA, you typically start by reviewing your operating agreement for specific instructions. You will need to file dissolution paperwork with the state where your LLC was formed. It's also important to settle any remaining debts and distribute any assets appropriately. If your LLC is a foreign entity in other states, plan for potential Idaho foreign corporation withdrawal procedures as needed.

If your LLC is formed outside of Colorado and intends to engage in business activities within the state, you must register as a foreign LLC in Colorado. This registration process helps you avoid legal issues and allows you to enjoy the benefits of operating in Colorado. Check the state regulations to ensure proper compliance. Keep in mind that if you plan to withdraw from Colorado, you will need to complete an Idaho foreign corporation withdrawal, if applicable.

Yes, if your business is incorporated outside of Idaho and plans to conduct business within the state, you need to register as a foreign corporation in Idaho. The registration process is essential for compliance with state laws. It allows you to operate legally while protecting your business from penalties. Be mindful that filing for an Idaho foreign corporation withdrawal requires you to follow the proper withdrawal procedures when closing your business.

To dissolve a foreign LLC in Colorado, you need to file the appropriate paperwork with the Colorado Secretary of State. You must complete the Application for Withdrawal as a Foreign Entity, along with any required fees. This process allows you to officially withdraw your foreign corporation status while ensuring that all obligations are settled. If your business is registered in multiple states, be sure to check the specific requirements for each location.

To close a foreign entity operating in Idaho, you must file a certificate of withdrawal with the Idaho Secretary of State. This document formally indicates your decision to cease business in the state. Using resources like U.S. Legal Forms can guide you through the complex steps, ensuring a proper Idaho foreign corporation withdrawal, so you can complete the process without complications.

Yes, in Idaho, you must renew your LLC every year by filing an Annual Report. This report confirms that your business details are up to date with the state. If you ever decide on Idaho foreign corporation withdrawal, this renewal process differs, but keeping your LLC active is essential while you are conducting business in Idaho.

To start an LLC in Idaho, you need to choose a unique name for your business, designate a registered agent, and file the Articles of Organization with the Secretary of State. You'll also need to obtain an Employer Identification Number (EIN) from the IRS, if applicable. Utilizing platforms like U.S. Legal Forms can simplify this process and ensure that you have all necessary documents, especially if you consider Idaho foreign corporation withdrawal in the future.