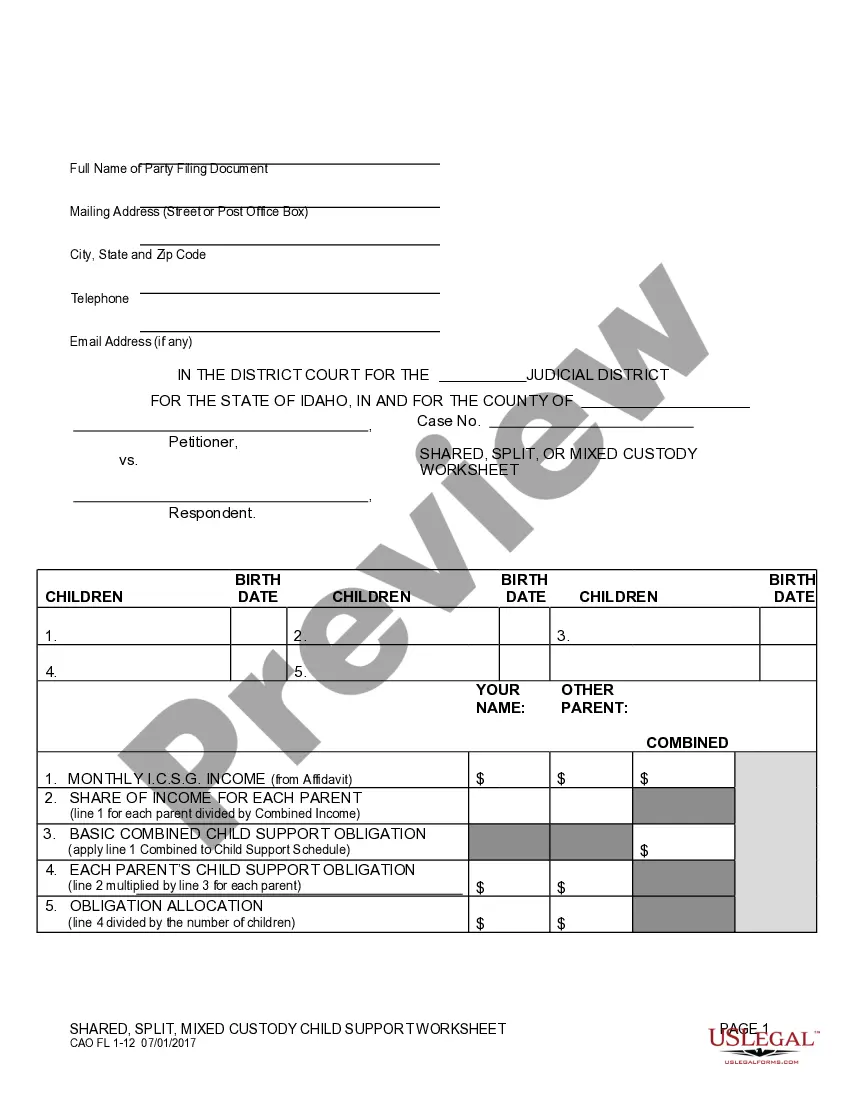

This is a Child Support Worksheet to be used by those parents where one has sole custody of their child or children. It is used in conjunction with the financial information supplied in the Child Support Affidavit in order to arrive at a correct amount of child support to be paid by the non-custodial parent.

Idaho Child Support Calculator Worksheet With Alimony

Description

How to fill out Idaho Child Support Worksheet For Sole Custody?

When you have to complete the Idaho Child Support Calculator Worksheet Including Alimony in line with your local state's statutes and regulations, there can be various options to choose from.

There's no requirement to scrutinize each document to ensure it satisfies all the legal prerequisites if you are a subscriber to US Legal Forms.

It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

Make use of the Preview mode and check the form description if available.

- US Legal Forms is the largest online repository with a collection of over 85,000 ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with each state's laws and regulations.

- Thus, when acquiring the Idaho Child Support Calculator Worksheet Including Alimony from our platform, you can be assured that you possess a valid and current document.

- Obtaining the required template from our platform is quite simple.

- If you already have an account, just Log In to the system, confirm your subscription is active, and save the chosen file.

- Later, you can access the My documents section in your profile and have access to the Idaho Child Support Calculator Worksheet Including Alimony at any time.

- If this is your first time using our website, please follow the instructions below.

- Review the suggested page and ensure it aligns with your needs.

Form popularity

FAQ

High-income individuals often face the most expensive child support based on their earnings. Some notable high-profile cases have showcased substantial support amounts, reflecting both a parent's financial capabilities and state laws. To make sense of your situation, the Idaho child support calculator worksheet with alimony can help you gain insights into potential obligations based on your income. This tool simplifies understanding potential payments.

The maximum child support amount can depend on various factors, including each state's guidelines and the parents' financial situations. Generally, many states have caps based on the income of the non-custodial parent. In Idaho, the child support calculator worksheet with alimony helps you find the best estimate based on your circumstances. This resource provides clarity on maximum support levels.

The minimum child support payment in Idaho varies based on the parents' income and the number of children. Using the Idaho child support calculator worksheet with alimony helps in determining the minimum requirements based on your specific situation. Generally, the state has established guidelines to ensure support is adequate. Therefore, you can rely on this tool to understand what your minimum obligations might be.

Child support in Idaho utilizes a straightforward calculation method based on the parents' incomes. The Idaho child support calculator worksheet with alimony simplifies this process, allowing parents to input their income details. The worksheet factors in expenses, healthcare costs, and child care needs to arrive at a support amount. This structured approach helps ensure that the final amount meets the children's needs.

Yes, alimony can play a role in determining child support in Idaho. The Idaho child support calculator worksheet with alimony takes into account the financial obligations of each parent, including alimony payments. This holistic approach ensures that all income sources and expenses are considered to establish a fair support amount. Thus, understanding your financial scenario can aid in accurately calculating your responsibilities.

In Idaho, child support calculations start with the combined income of both parents. The Idaho child support calculator worksheet with alimony provides a formula to determine each parent's financial responsibility. Factors like the number of children and any special needs also influence the outcome. By analyzing these elements, Idaho ensures fair support arrangements for children.

The three basic principles of the Melson formula are 1) parents are entitled to sufficient income to meet their basic needs; 2) parents shouldn't be permitted to retain more income than required to meet their basic needs; and 3) the child(ren) are entitled to share in any additional income and benefit from a

The court orders a flat percentage of 25% of the non-custodial parent's income to be paid in child support to the custodial parent.