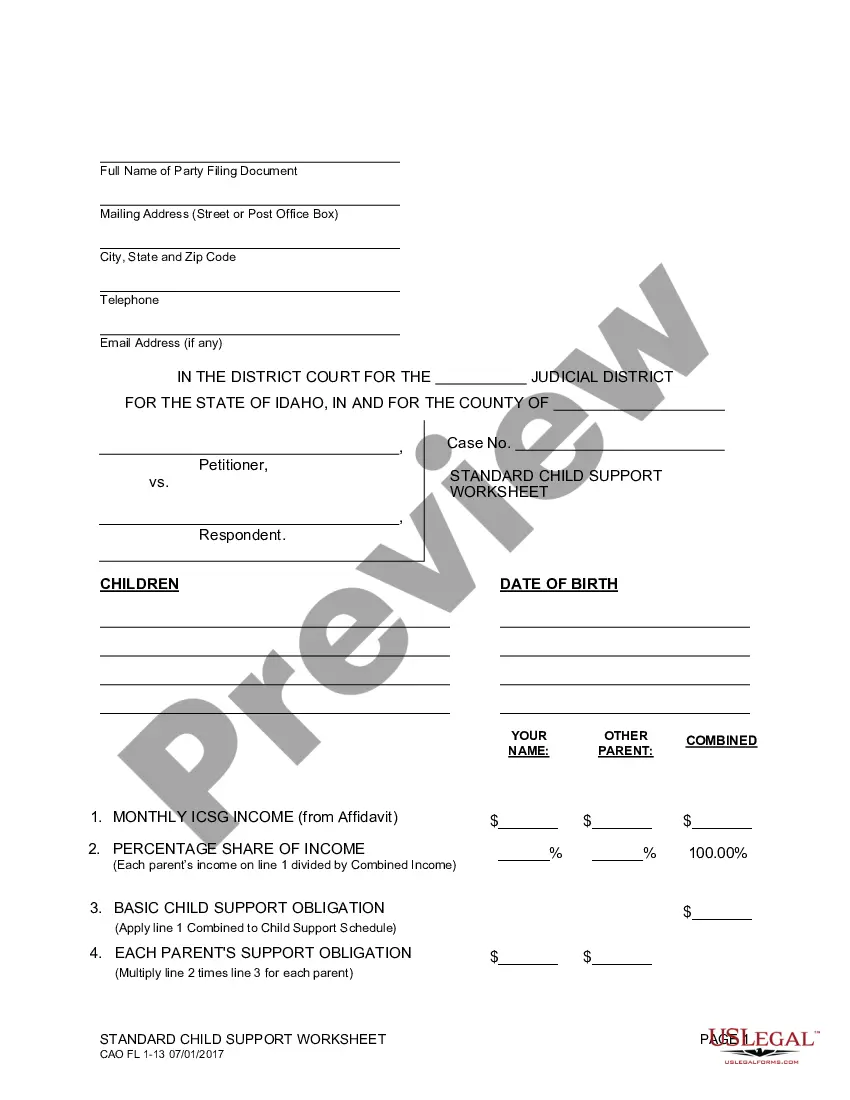

This is a Child Support Worksheet to be used by those parents whom share custody of their child or children. It is used in conjunction with the financial information supplied in the Child Support Affidavit in order to arrive at a correct amount of child support to be paid by the non-custodial parent.

Idaho Child Support Calculator With 50 50 Custody With Get 50/50

Description

How to fill out Idaho Child Support Worksheet For Shared Custody?

It’s well known that you cannot rapidly become a legal expert, nor can you swiftly learn how to effectively create the Idaho Child Support Calculator With 50 50 Custody With Get 50/50 without a distinct background.

Drafting legal documents is a lengthy process that necessitates specific education and expertise. So why not entrust the preparation of the Idaho Child Support Calculator With 50 50 Custody With Get 50/50 to the experts.

With US Legal Forms, which boasts one of the most extensive legal template collections, you can locate anything from court papers to templates for internal communication.

You can access your documents again from the My documents tab at any time. If you’re a current client, simply Log In, and locate and download the template from the same tab.

Regardless of the intent behind your paperwork—be it financial, legal, or personal—our platform is here to assist you. Experience US Legal Forms today!

- Understand the document you need by employing the search bar at the top of the page.

- View it (if this feature is available) and review the accompanying description to determine whether Idaho Child Support Calculator With 50 50 Custody With Get 50/50 meets your needs.

- Start your search anew if you require a different form.

- Create a free account and choose a subscription plan to purchase the form.

- Click Buy now. Once the purchase is finalized, you can download the Idaho Child Support Calculator With 50 50 Custody With Get 50/50, complete it, print it, and send or mail it to the relevant individuals or organizations.

Form popularity

FAQ

Child support in Idaho can take a portion of your paycheck, commonly up to 50% of your disposable income, depending on individual circumstances and calculations. The Idaho child support calculator with 50 50 custody with get 50/50 provides an accurate assessment based on both parents' incomes and shared responsibilities. Understanding these figures helps ensure that payment amounts are both fair and manageable.

All employers with business operations in the state of Ohio are required to report all independent contractors, newly hired, or rehired employees who live or work in Ohio within twenty (20) days of the employees' first day on the job.

Employees working in Ohio must be paid at least semimonthly, but daily or weekly pay periods are also permitted. Longer periods are permitted if customary in the employer's type of business. Semimonthly paydays must occur by the first or fifteenth of each month for the prior month's wages.

9 form. An 9 form is used to verify an employee's identity and eligibility to work within the United States.

How to Fill out a Job Application - YouTube YouTube Start of suggested clip End of suggested clip Application. Make sure that your printing is neat and legible. Step 2 communicate your education andMoreApplication. Make sure that your printing is neat and legible. Step 2 communicate your education and work history accurately. Being sure to explain any gaps.

All employers must establish employment eligibility and the identity of new employees by completing Form I-9.

How to structure an effective job application form Name of applicant. Contact information (phone and email) Education. Work experience. Professional references (optional) Availability (e.g., weekends, night shift) Applicant's signature and date.

9 Form. One of the most important forms you have to give to a new hire that walks into your office is an 9 form. ... W4 Form. The next form you will have to give a new employee is the W4 form. ... W9 Form. ... New Hire Reporting. ... Ohio State ncome Tax. ... Unemployment nsurance. ... Workers' Compensation. ... Final Thoughts.