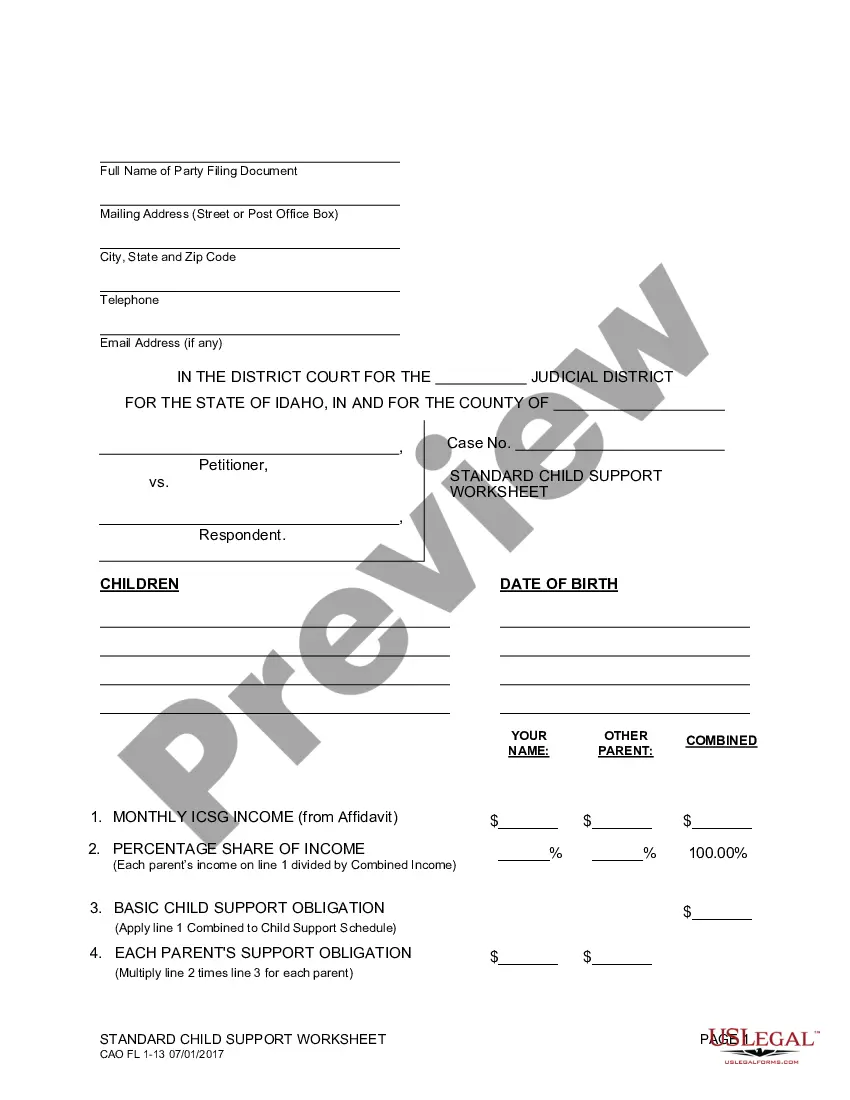

This is a Child Support Worksheet to be used by those parents whom share custody of their child or children. It is used in conjunction with the financial information supplied in the Child Support Affidavit in order to arrive at a correct amount of child support to be paid by the non-custodial parent.

Idaho Child Support Calculation Form

Description

How to fill out Idaho Child Support Worksheet For Shared Custody?

Navigating through the red tape of official documents and forms can be challenging, particularly if one does not engage in that field professionally.

Even locating the appropriate template for an Idaho Child Support Calculation Form can be laborious, as it must be accurate and valid to the very last digit.

However, you will need to invest considerably less time obtaining a suitable template from a resource you can depend on.

Obtaining the appropriate form in a few straightforward steps: Enter the document name in the search bar. Find the suitable Idaho Child Support Calculation Form in the results list. Review the sample outline or view its preview. When the template meets your requirements, click Buy Now. Choose your subscription plan. Use your email and create a password to register an account at US Legal Forms. Select a credit card or PayPal payment option. Save the template document to your device in your chosen format. US Legal Forms can save you significant time in verifying if the form you found online meets your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of searching for the necessary forms online.

- US Legal Forms serves as a single resource where you can find the most recent samples of documents, verify their usage, and download these samples to complete them.

- This is a compilation with over 85K forms that apply in diverse professional fields.

- When searching for an Idaho Child Support Calculation Form, you won't have to question its relevance as all the forms are verified.

- Having an account with US Legal Forms ensures that you have all the required samples at your fingertips.

- You can store them in your history or add them to the My documents catalog.

- Access your saved forms from any device by simply selecting Log In at the library site.

- If you do not have an account yet, you can always search for the template you need.

Form popularity

FAQ

Filing child support in Idaho involves a few clear steps. Start by gathering necessary documents like income statements and expenses. Then, complete the Idaho child support calculation form to understand your financial obligations before you file. You can submit your application online or in person at your local court, ensuring you meet all requirements for a smooth process.

Child support payments in Colorado vary widely depending on several factors, including income and the number of children involved. Typically, payments are calculated based on guidelines established by the state. Although this question targets Colorado, it is useful to compare these figures when considering your own payment obligations in Idaho. Remember, the Idaho child support calculation form can help you estimate your specific obligations accurately.

The best way to file for child support begins with understanding your state's requirements. You can gather relevant documents, such as your income and expenses, before submitting an application. Using the Idaho child support calculation form can streamline this process, ensuring you have accurate information to support your case. Consider consulting with legal resources for guidance tailored to your situation.

Deciding whether to file for child support or custody first depends on your situation. If your main concern is financial support for your child, filing for child support may be the priority. However, if you are primarily focused on securing custody, filing for custody first could be beneficial. Utilizing the Idaho child support calculation form can provide clarity on potential payments, supporting your argument whichever route you choose.

In Idaho, child support can take a portion of your income, which is determined by the court based on your financial situation. Generally, the court considers necessary living expenses and other obligations before deciding on an amount. If you're uncertain about how much you might owe, using the Idaho child support calculation form can help estimate deductions and obligations in a clear format.

Filling out a child support petition involves providing details about your income, expenses, and the care arrangement for your child. You should include information such as the other parent's details and any existing court orders. For assistance, the Idaho child support calculation form offers guidance on the financial aspects to include in your petition, ensuring a smooth filing process.

In Mississippi, the minimum child support is determined by the Income Shares Model and usually starts at a base rate. The state assesses the parents' combined income to define this minimum amount. If you want to explore child support obligations further, using the Idaho child support calculation form can give you invaluable insights tailored to your case.

Most child support payments in the U.S. vary significantly, depending on the state and individual circumstances. Typically, parents receive between 17% to 25% of the paying parent's income, providing necessary support for children's needs. To get a clear estimate for Idaho, refer to the Idaho child support calculation form to analyze your specific situation.

The maximum child support amount in Texas varies based on the paying parent's income. Generally, the Texas guidelines suggest a percentage of the parent’s income, which can go up to a maximum of $9,200 per month for one child, as this figure reflects the cap for total net resources. You can utilize the Idaho child support calculation form to understand how different incomes and expenses affect child support obligations.

To write a check to child support, start by entering the date on the top line. Write the name of the entity you're sending the payment to, usually a child support agency, on the next line. Clearly indicate the amount in numbers and words, and make sure to add 'Child Support' in the memo section for reference. By ensuring your check matches the amount indicated on the Idaho child support calculation form, you can avoid any confusion or delays.