This is a Child Support Affidavit. It is used to certify to the Court the income of both parties, for the purpose of establishing the correct amount of child support to be paid by the non-custodial parent.

Idaho Child Support Forms Withholding Limits

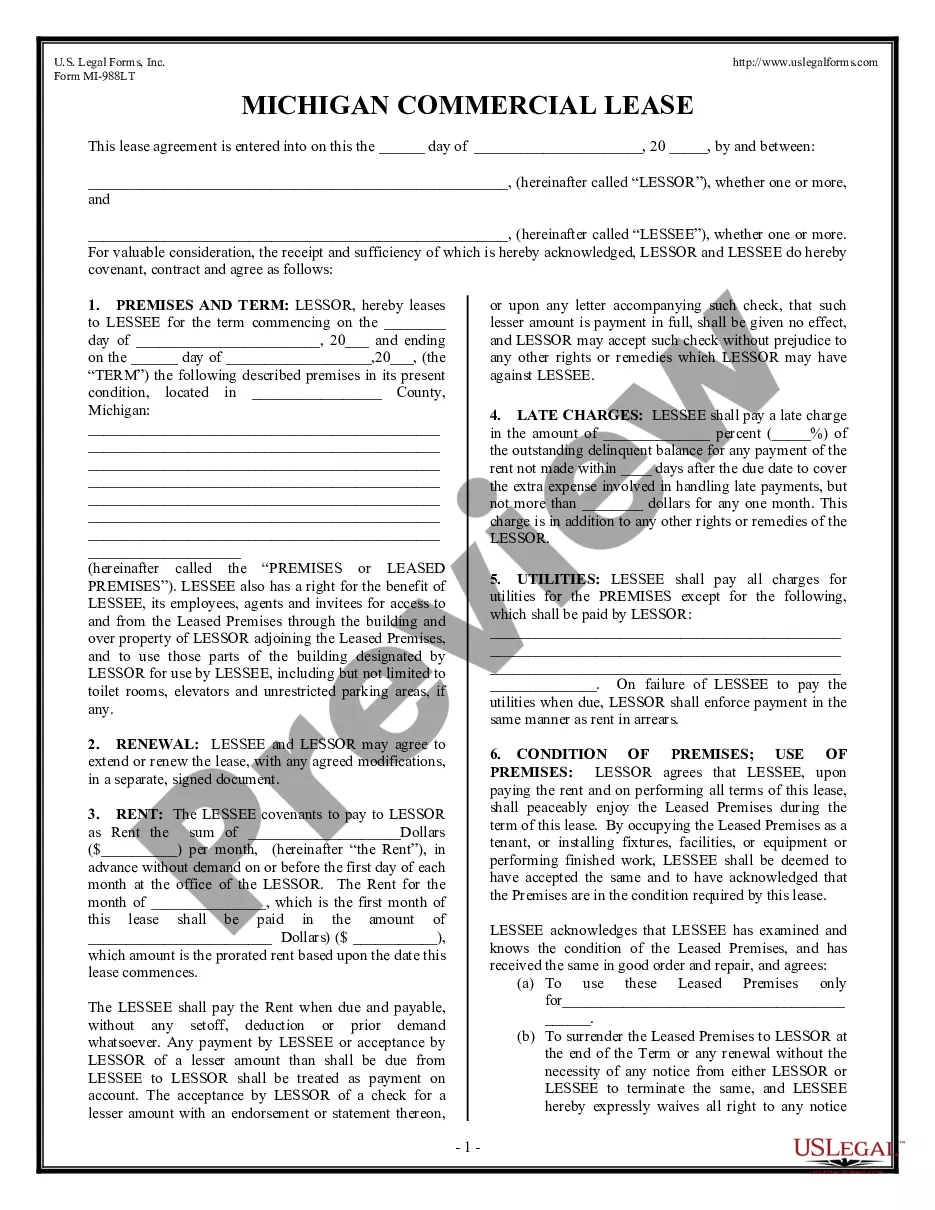

Description

How to fill out Idaho Child Support Affidavit?

Drafting legal paperwork from scratch can sometimes be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more affordable way of creating Idaho Child Support Forms Withholding Limits or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual library of over 85,000 up-to-date legal forms covers virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-compliant forms carefully prepared for you by our legal specialists.

Use our website whenever you need a trustworthy and reliable services through which you can easily find and download the Idaho Child Support Forms Withholding Limits. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes minutes to register it and explore the catalog. But before jumping straight to downloading Idaho Child Support Forms Withholding Limits, follow these tips:

- Review the document preview and descriptions to make sure you have found the document you are looking for.

- Check if form you select conforms with the requirements of your state and county.

- Pick the best-suited subscription option to get the Idaho Child Support Forms Withholding Limits.

- Download the file. Then complete, certify, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us today and transform form completion into something easy and streamlined!

Form popularity

FAQ

Idaho's Statute of Limitations on Back Child Support Payments (Arrears) Idaho's statute of limitations for child support arrears is 5 years from the child's emancipation or reaching the age of majority.

Child support obligations in Idaho are calculated using the Income Shares Model. The idea is to estimate the amount of support that the children would have received if the marriage hadn't failed. This support amount is then divided between the parents in proportion to their respective incomes.

Payments are sent directly to the other parent or guardian through a direct deposit or on a debit card known as the Idaho Family Support Card. There is no fee for non-enforcement services, but the court order and basic contact information must be provided to Child Support Services to open a case.

Idaho Wage Garnishment Rules Re child support orders, the maximum amount that can be withheld runs between 50 (if the employee is supporting another spouse and/or children) and 65% (if the employee is not supporting another spouse and/or children and is at least 12 weeks in arrears in making support payments).

A child support order can be reviewed for a change in support: After three years at the request of either parent. Or if there has been a substantial change in circumstance that has been maintained for at least six months.