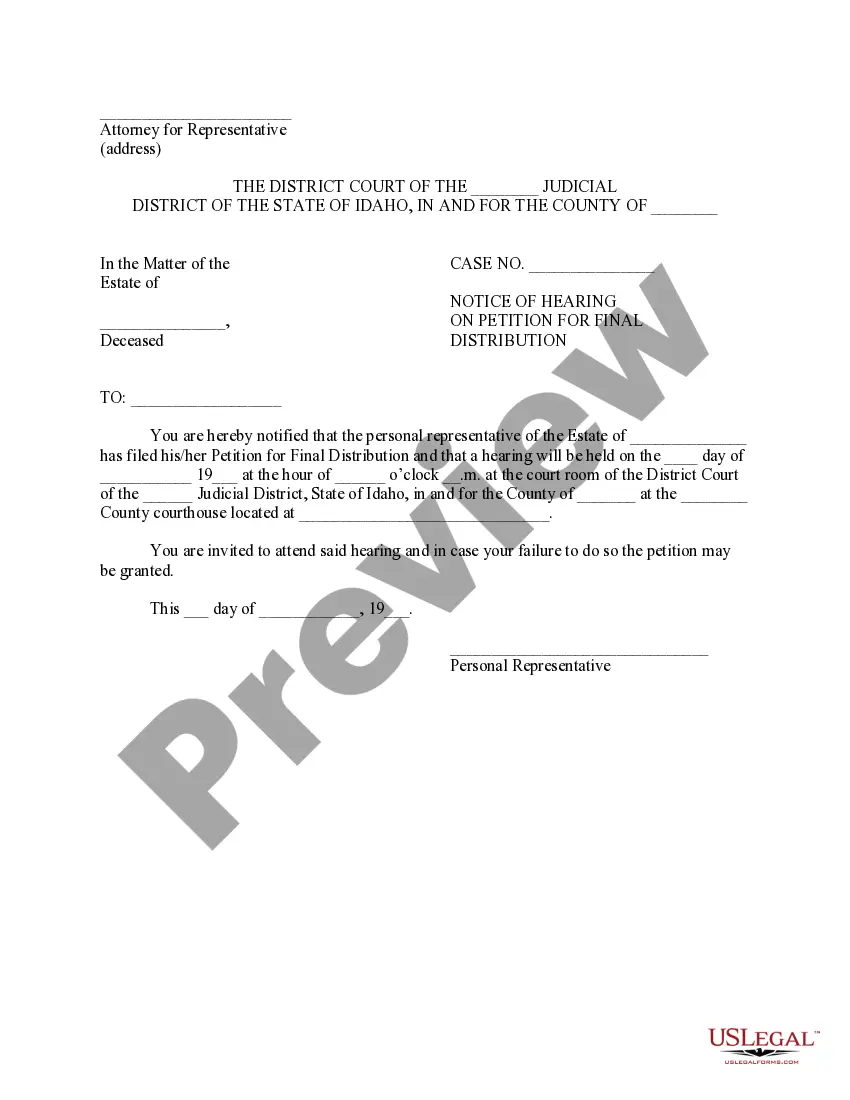

Estate Final Release Form

Description

How to fill out Idaho Notice Of Hearing On Petition For Final Distribution?

How to locate professional legal documents that adhere to your state's regulations and complete the Estate Final Release Form without consulting an attorney.

Numerous services online provide templates for various legal circumstances and requirements. However, it might require time to determine which of the available samples meet both your intended use and legal standards.

US Legal Forms is a trustworthy platform that assists you in finding official documentation crafted in compliance with the latest state law amendments and helps you save costs on legal services.

If you do not have an account with US Legal Forms, please follow the steps below: Explore the webpage you have opened to confirm whether the form meets your requirements. To accomplish this, utilize the form description and preview options if they are accessible. Search for an additional template using the header that provides your state if necessary. Click the Buy Now button when you identify the suitable document. Choose the most appropriate pricing plan, then sign in or create an account. Select your payment method (by credit card or through PayPal). Alter the file format for your Estate Final Release Form and click Download. The acquired documents will remain with you: you can always access them in the My documents section of your profile. Register on our platform and draft legal documents independently like a seasoned legal expert!

- US Legal Forms is not an average online library.

- It consists of over 85,000 validated templates for diverse business and personal scenarios.

- All documents are categorized by area and state to expedite your search process.

- It also features integration with robust tools for PDF editing and electronic signatures, enabling users with a Premium subscription to effortlessly complete their paperwork online.

- It requires minimal time and effort to obtain the necessary documents.

- If you already hold an account, Log In and verify that your subscription is valid.

- Download the Estate Final Release Form using the relevant button located beside the file name.

Form popularity

FAQ

Use the not so simple method to close the estate, Send Notice of Filing of Declaration of Completion, Wait until the expiration of the 30-day notice period, and. THEN MAKE DISTRIBUTION AFTER your Declaration of Completion has become final and the time for filing any Objection has expired.

An estate can be closed in one of four fashions: (1) the funds can simply be distributed directly by the Executor or Administrator to estate beneficiaries; (2) the funds can be distributed to heir(s) after each signs a Release and Refunding Bond waiving his or her right to a formal accounting; (3) distribution can be

North Carolina has no separate state estate tax, inheritance tax nor gift tax. Close the estate. Close the estate bank account after all debts are paid and assets are distributed. Once all claims against the estate have been satisfied, file a final accounting with the probate court and ask that the estate be closed.

The final accounting is a summary of accounts filed by the probate executor, showing details of important financial undertakings during the accounting period. This form may not outline all the information, but those records are kept for future use.