A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice of Creditors, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now. USLF control number ID-16016

Creditors Form With Deceased Estates

Description

How to fill out Creditors Form With Deceased Estates?

Well-prepared official documentation is one of the key assurances for preventing problems and legal disputes, yet acquiring it without legal assistance might require time.

Whether you need to swiftly locate an up-to-date Creditors Form For Deceased Estates or any other documents for work, family, or business matters, US Legal Forms is consistently available to assist.

The procedure is even simpler for current users of the US Legal Forms library. If your subscription is active, you merely need to Log In to your account and click the Download button adjacent to the chosen file. Furthermore, you can retrieve the Creditors Form For Deceased Estates at any moment since all documents previously obtained on the platform stay accessible within the My documents tab of your profile. Conserve time and resources on drafting official documents. Experience US Legal Forms today!

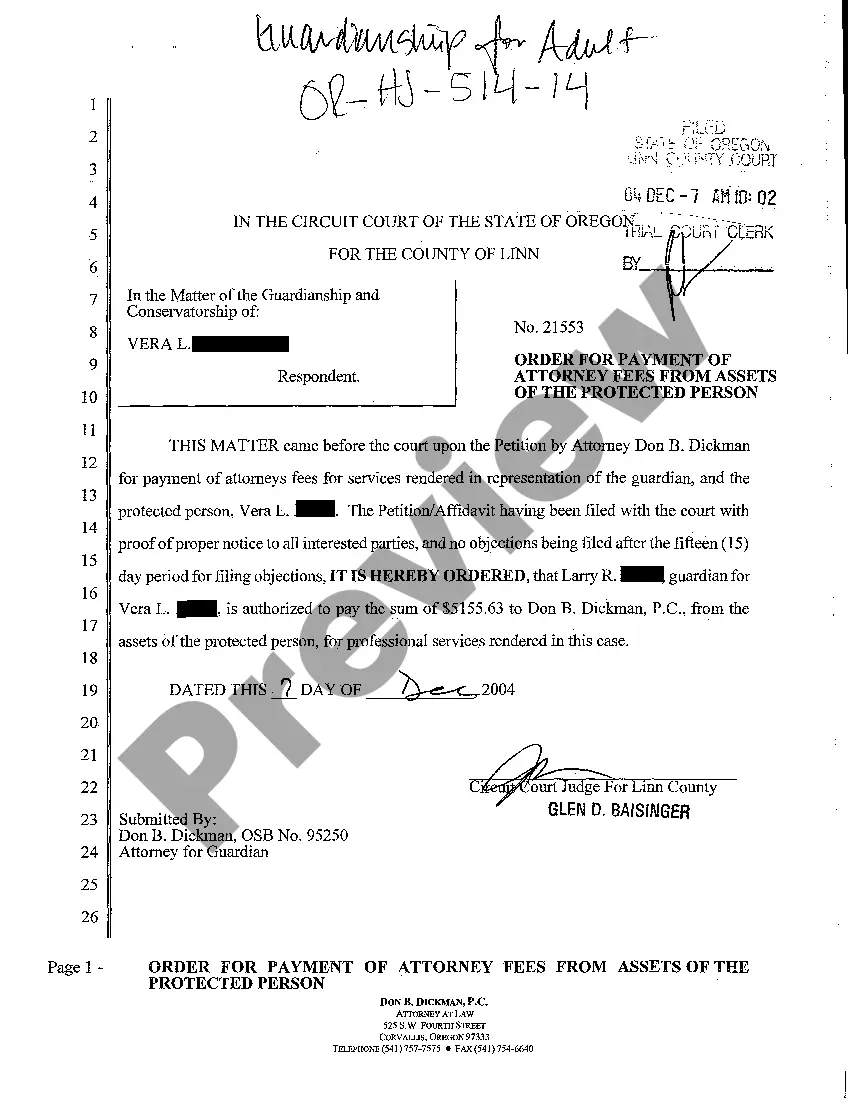

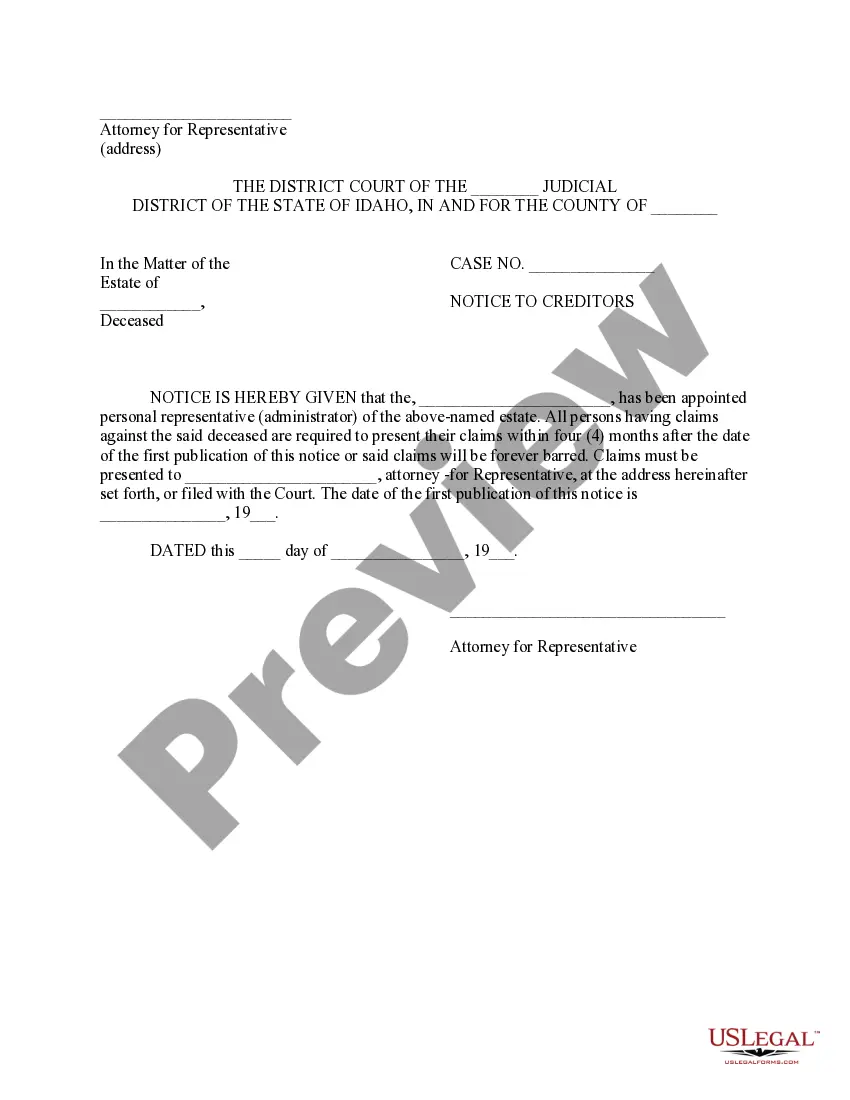

- Confirm that the document is appropriate for your circumstances and area by reviewing the description and preview.

- Search for an additional example (if necessary) using the Search bar in the header of the page.

- Hit Buy Now when you find the correct template.

- Select the pricing option, Log Into your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX format for your Creditors Form For Deceased Estates.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

When addressing creditors regarding a deceased estate, it is crucial to clearly notify them of the individual's passing. Start the letter by stating the deceased's full name, date of passing, and any relevant account details. Include a statement indicating that the estate is in the process of being settled, and mention that any outstanding debts will be managed according to the law. Using a creditors form with deceased estates can streamline this communication, ensuring that you address all necessary details efficiently.

The J243 form is designated for the heirs and beneficiaries of an estate to claim their share according to legal provisions. This form assists in formalizing claims against the estate, which might be necessary if the deceased had multiple creditors. Understanding how to complete this form is essential, especially when using a creditors form with deceased estates to manage creditor notifications.

The J190 form is utilized for reporting and claiming against an estate when the deceased had outstanding debts at the time of passing. Creditors must fill out this form to participate in the estate settlement process. It complements the creditors form with deceased estates, ensuring that all financial obligations are met prior to distributing any assets.

The J238 form is a specific legal document used to claim a share of a deceased person's estate. This form assists creditors in formally notifying the estate about their claims. Submitting a J238 form along with a creditors form with deceased estates ensures that all debts are accounted for during the settlement process.

A late estate refers to the estate of a deceased person that is in the process of being settled. It includes all property, assets, and liabilities that the deceased left behind. Handling a late estate involves determining how to distribute the assets among rightful beneficiaries, which often requires the completion of a creditors form with deceased estates to notify creditors.

Starting as an executor involves several key steps. First, you should locate the will and apply for probate in the appropriate court. Once probate is granted, ensure to notify beneficiaries and creditors using the creditors form with deceased estates to manage outstanding debts effectively. This proactive approach will help you carry out your duties smoothly and provide peace of mind to all parties involved.

Choosing the right executor is crucial for effective estate management. Typically, the best candidate is someone responsible, organized, and trustworthy. This person should be able to handle financial matters and communicate effectively with beneficiaries and creditors. By selecting the right person and utilizing tools like the creditors form with deceased estates, you can ensure that your estate is managed efficiently after your passing.

An estate executor has several forms to complete, including the probate application and the inventory of assets. Alongside these, the executor may need to file a creditors form with deceased estates to inform creditors of the estate's passing and provide them an opportunity to submit claims. It's essential that the executor properly organizes these forms to ensure a smooth administration of the estate.

In Canada, the timeline for distributing funds after probate can vary based on the estate's complexity. Typically, once probate is granted, the executor can begin to settle debts and distribute assets. However, it is important to wait until all creditors have been properly notified and have had a chance to make claims. Utilizing a creditors form with deceased estates can help streamline this process and ensure that all obligations are met before distribution.

Notifying creditors in deceased estates involves a formal process to inform them of the probate proceedings. The executor must publish a notice in a local newspaper and send direct notifications to known creditors. This ensures that all interested parties, including creditors, are aware of the estate's administration. Using a creditors form with deceased estates is essential for providing all necessary details, allowing creditors to submit their claims efficiently.