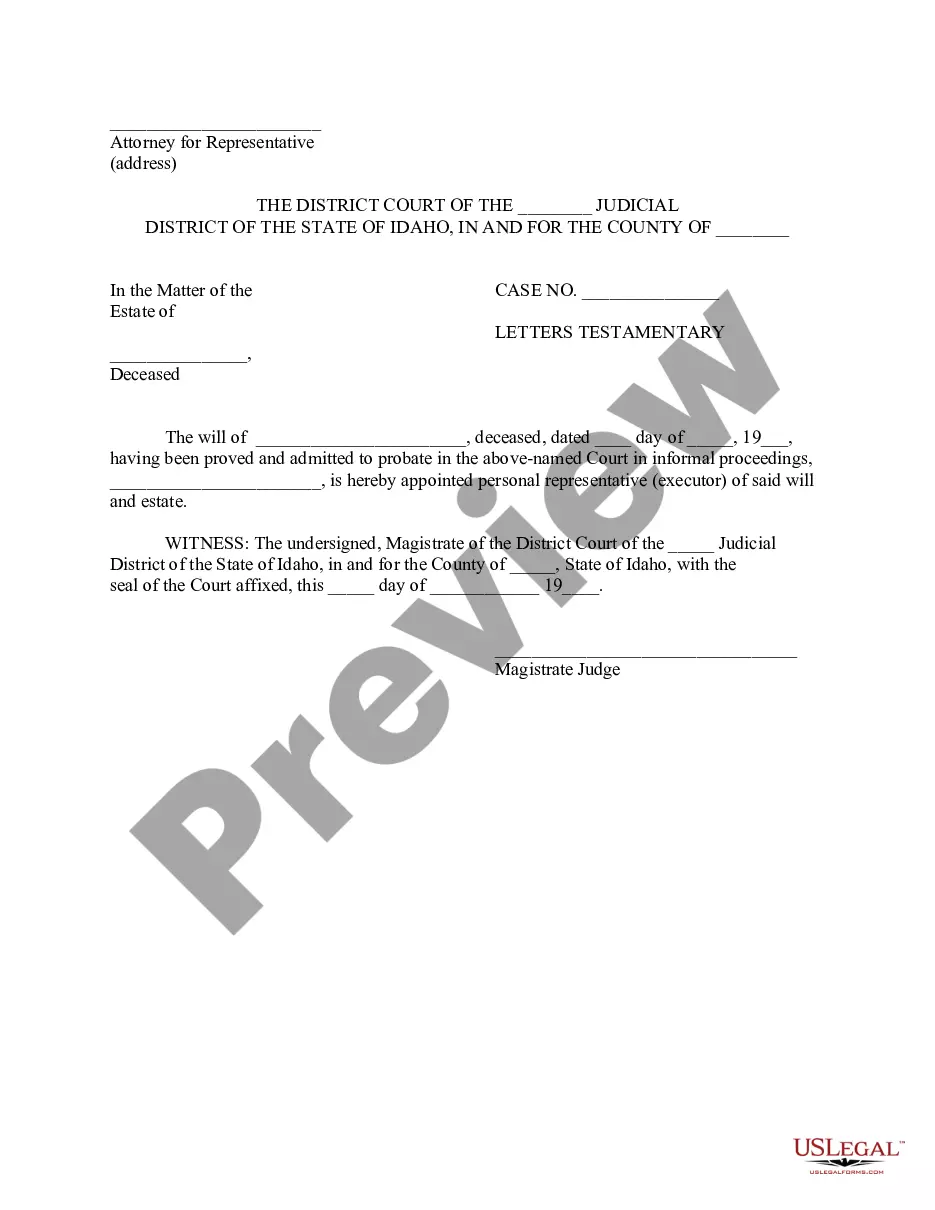

Letter Of Testamentary Idaho Form

Description

How to fill out Idaho Letters Testamentary?

When you need to finalize the Letter Of Testamentary Idaho Form that adheres to your local state's statutes, there can be various alternatives to choose from.

There's no necessity to scrutinize every form to ensure it satisfies all the legal requirements if you are a US Legal Forms subscriber.

It is a dependable resource that can assist you in acquiring a reusable and current template on any topic.

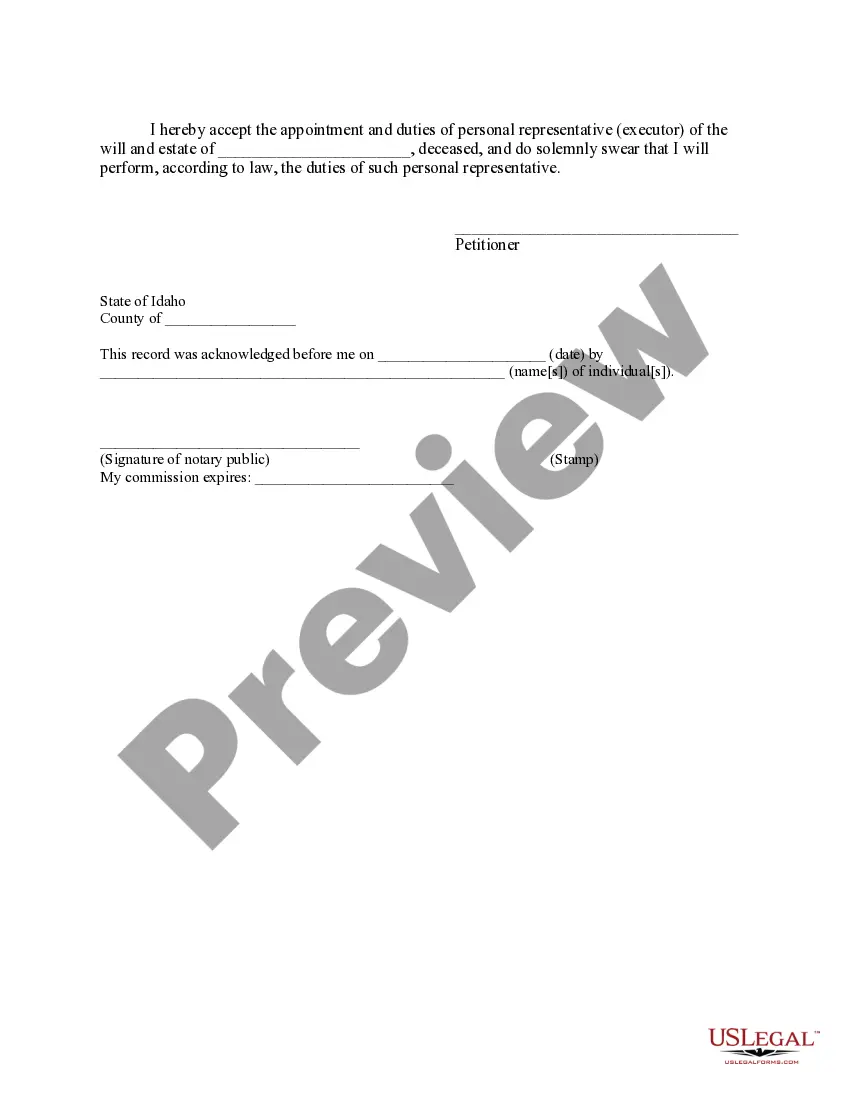

Browse the suggested page and verify it for alignment with your needs. Use the Preview mode and read the form description if available. Search for another sample via the Search field in the header if necessary. Click Buy Now once you identify the appropriate Letter Of Testamentary Idaho Form. Select the most suitable pricing plan, sign in to your account, or create a new one. Pay for a subscription (payment methods include PayPal and credit cards). Download the template in your desired file format (PDF or DOCX). Print the document or fill it out electronically using an online editor. Obtaining properly drafted official documents becomes easy with US Legal Forms. Furthermore, Premium users can take advantage of the robust integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms is the most extensive online repository with an archive of over 85k accessible documents for business and personal legal matters.

- All templates are confirmed to meet each state's statutes.

- Thus, when you download the Letter Of Testamentary Idaho Form from our website, you can be assured that you possess a valid and updated document.

- Acquiring the necessary sample from our platform is very simple.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can open the My documents tab in your profile and maintain access to the Letter Of Testamentary Idaho Form at any time.

- If it's your first time using our library, please follow the guidelines below.

Form popularity

FAQ

An example of testamentary is a will that outlines how a person's assets should be distributed after their death. This document specifies beneficiaries and may include particular wishes regarding property and finance. The testamentary process begins with obtaining a letter of testamentary, which provides the legal authority to execute the will. For proper management of estates in Idaho, using the Letter of Testamentary Idaho form is recommended.

An alternative to a letter of testamentary is a small estate affidavit. This document can be used when the total value of the estate falls below a specified amount, allowing for a simplified process. With a small estate affidavit, heirs can directly claim assets without going through formal probate. However, using the Letter of Testamentary Idaho form may be necessary if the estate exceeds the limit set by the state.

Yes, letters of testamentary are typically considered public documents. Once filed with the court, anyone can request to view these documents. This transparency allows interested parties to verify the authority of the executor and the validity of the will. When you file your Letter of Testamentary Idaho form, you contribute to this public record, ensuring clear communication about the estate’s management.

A letter of testamentary typically includes the name of the deceased, the executor's name, and the court's approval. It states that the executor has been appointed to administer the estate and has the authority to execute legal documents related to the estate. This letter often serves as proof when dealing with banks, insurance companies, and other institutions. You can easily access the Letter of Testamentary Idaho form to ensure all details are accurately captured.

Testamentary costs can vary based on several factors, including court fees and any required legal assistance. Generally, fees may cover the filing of the letter of testamentary Idaho form, publication costs, and additional administrative expenses. It's important to budget for these potential costs to avoid surprises later. Using resources from USLegalForms can help you anticipate and manage these expenses effectively.

Letters of testamentary and letters of administration serve similar purposes but apply in different situations. A letter of testamentary is issued when the deceased left a will, while letters of administration are granted when there is no will. Understanding which letter you need can streamline the probate process. Utilizing a comprehensive letter of testamentary Idaho form helps clarify your responsibilities regardless of the letter type.

Yes, it is possible to obtain a letter of testamentary without hiring a lawyer in Idaho, but it may require more effort on your part. You will need to understand the legal process and complete the letter of testamentary Idaho form accurately. While you can file independently, consider the complexities involved in navigating the court system. Resources like USLegalForms can guide you through the required steps.

The process of obtaining a letter of testamentary in Idaho typically takes several weeks. After filing the necessary paperwork with the court, you may attend a hearing where the judge reviews your application. Factors such as court schedules and document completeness can influence the timing. To speed up the process, ensuring that you have a complete letter of testamentary Idaho form is essential.

Another name for a letter of testamentary is a 'letter of authority.' This term highlights the document's role in giving an executor legal power to act on behalf of the deceased's estate. Understanding the different terminology can be helpful when discussing estate management options.

In Idaho, an estate typically must exceed $100,000 in total gross value to require probate. However, smaller estates might qualify for simplified procedures. It is crucial to evaluate the total value of the estate, including assets like property and bank accounts, to determine if a letter of testamentary is necessary.