Idaho Gift Deed Form

Description

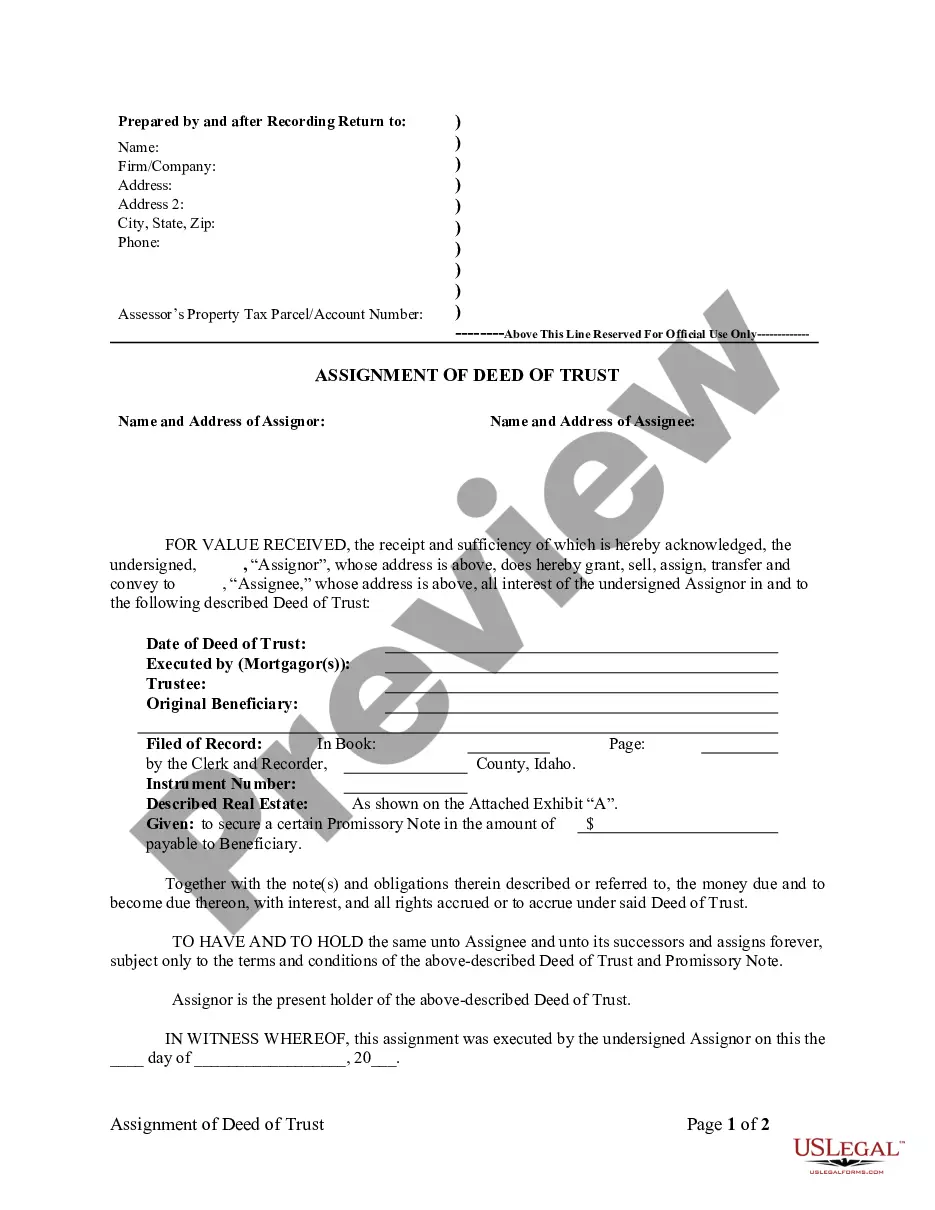

How to fill out Idaho Assignment Of Deed Of Trust By Individual Mortgage Holder?

How to locate professional legal documents that adhere to your state's regulations and complete the Idaho Gift Deed Form without consulting a lawyer.

Numerous services online offer templates to address various legal situations and formalities. However, it may require time to determine which of the accessible samples meet both your needs and legal standards.

US Legal Forms is a distinguished service that assists you in finding official documents crafted according to the most recent state law revisions and saves you money on legal support.

If you do not have an account with US Legal Forms, then adhere to the instructions below: Review the webpage you have opened and verify if the form meets your requirements. To do this, utilize the form description and preview options if available. Search for another template in the header indicating your state if necessary. Press the Buy Now button when you discover the appropriate document. Select the most suitable pricing plan, then sign in or create an account. Choose the payment method (by credit card or through PayPal). Select the file format for your Idaho Gift Deed Form and click Download. The acquired templates remain yours: you can always return to them in the My documents tab of your profile. Register for our platform and create legal documents independently like a skilled legal professional!

- US Legal Forms is not a typical online directory.

- It consists of over 85,000 validated templates for diverse business and personal situations.

- All documents are categorized by sector and state to expedite and enhance your search experience.

- It also incorporates robust tools for PDF editing and electronic signatures, allowing users with a Premium subscription to swiftly finalize their paperwork online.

- Acquiring the necessary documents takes minimal effort and time.

- If you already possess an account, Log In and confirm the validity of your subscription.

- Download the Idaho Gift Deed Form using the corresponding button adjacent to the file title.

Form popularity

FAQ

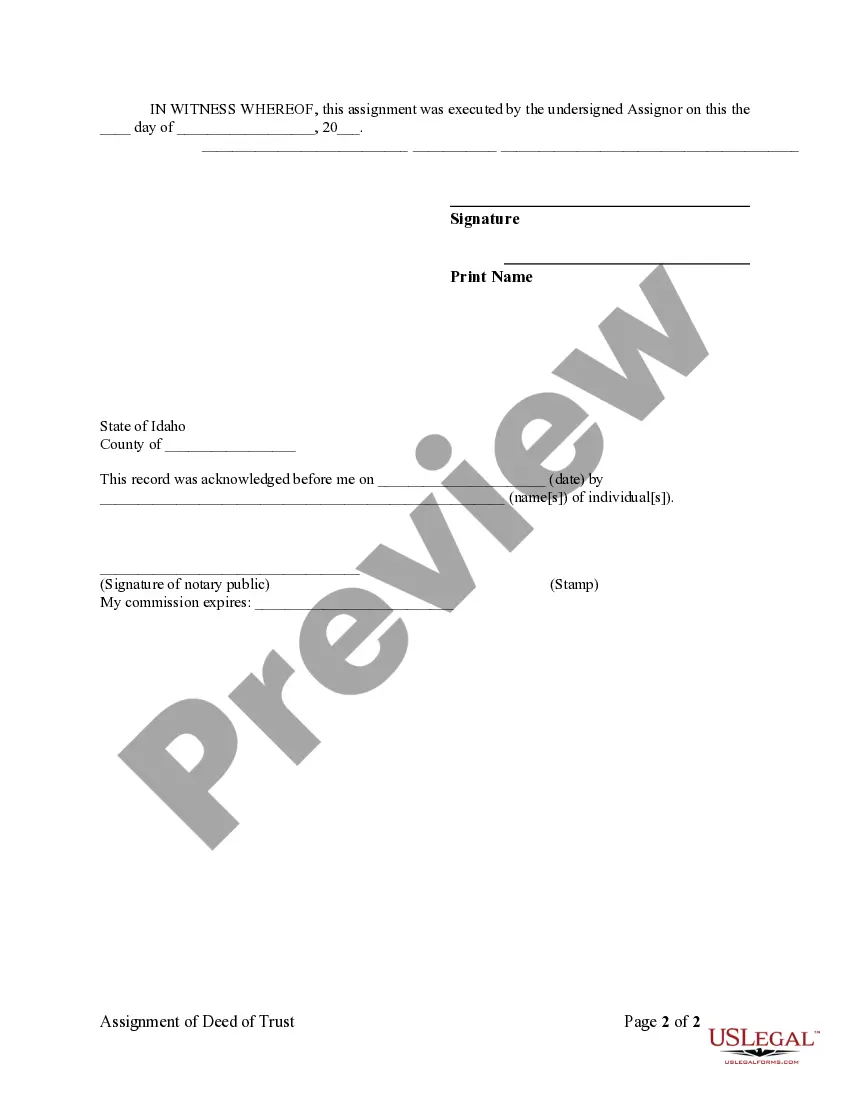

Yes, in Idaho, a quitclaim deed must be notarized to be legally valid. This requirement helps ensure that the parties involved are who they claim to be and that they willingly signed the document. After notarization, you can file the deed with the county recorder's office for proper documentation. Using an Idaho gift deed form can simplify the process and guide you through the notarization requirements.

Yes, a spouse's rights to property can change after signing a quitclaim deed in Idaho. If a spouse signs the deed, they may relinquish their claim to the property being given away. However, it is wise for both parties to fully understand the implications before signing any legal documents. Consulting with a legal expert or using an Idaho gift deed form can provide clarity about rights and responsibilities.

The person receiving the property benefits the most from a quitclaim deed. This type of deed allows for a straightforward transfer of ownership, especially when there is a trust between the parties involved, like family members. However, it is important for recipients to understand that a quitclaim deed transfers whatever interest the grantor has in the property, which may not always be clear. Using an Idaho gift deed form can help clarify intent and ensure proper documentation.

Filling out a quitclaim deed in Idaho involves several steps. First, obtain an Idaho gift deed form or a quitclaim deed form from a reliable source, such as UsLegalForms. Enter the required information, including the grantor's and grantee's names, property description, and consideration, if any. Finally, both parties must sign the form before a notary public to complete the process.

To gift a title in Idaho, you can use an Idaho gift deed form. This form legally transfers ownership of property from one person to another without payment. You will need to complete the form with the necessary details, such as the names of the donor and recipient, a description of the property, and any relevant legal language. After preparing the form, sign it in front of a notary public to ensure its validity.

Idaho does not levy a property transfer tax at the state level when transferring property through an Idaho gift deed form or other means. However, local jurisdictions may have specific fees or recording costs associated with property transfers. Always check with your local county office to ensure you understand any potential costs involved in your transfer. Understanding these fees can help you plan your transfer more effectively.

Filing a quitclaim deed in Idaho is a straightforward process that you can manage on your own. Start by downloading the appropriate forms, such as the Idaho gift deed form, and complete the required information. Ensure to sign the document in front of a notary, and then submit it to the county recorder's office. Following these steps will secure your property transfer legally.

To show a gift deed, you need to complete the Idaho gift deed form, indicating the intent to transfer property as a gift. This form should clearly detail the donor and recipient information, as well as a legal description of the property. After signing the form, it must be recorded with the local county office to make the transfer official. This form helps protect both parties by documenting the gift transaction.

Filing a quitclaim deed in Idaho involves preparing the necessary documentation and submitting it to the county recorder's office. You can obtain the required forms online, including the Idaho gift deed form, if gifting property. After completing the form, make sure to have it signed in front of a notary before submitting it. This step ensures the deed is recorded and legally binding.

You can transfer land without a lawyer by using forms available online, including the Idaho gift deed form. These forms provide the necessary structure for the transfer and usually include straightforward instructions. It is essential to fill these forms carefully and ensure you comply with local regulations to make the transfer valid. Remember to file these documents with the appropriate county office after completion.