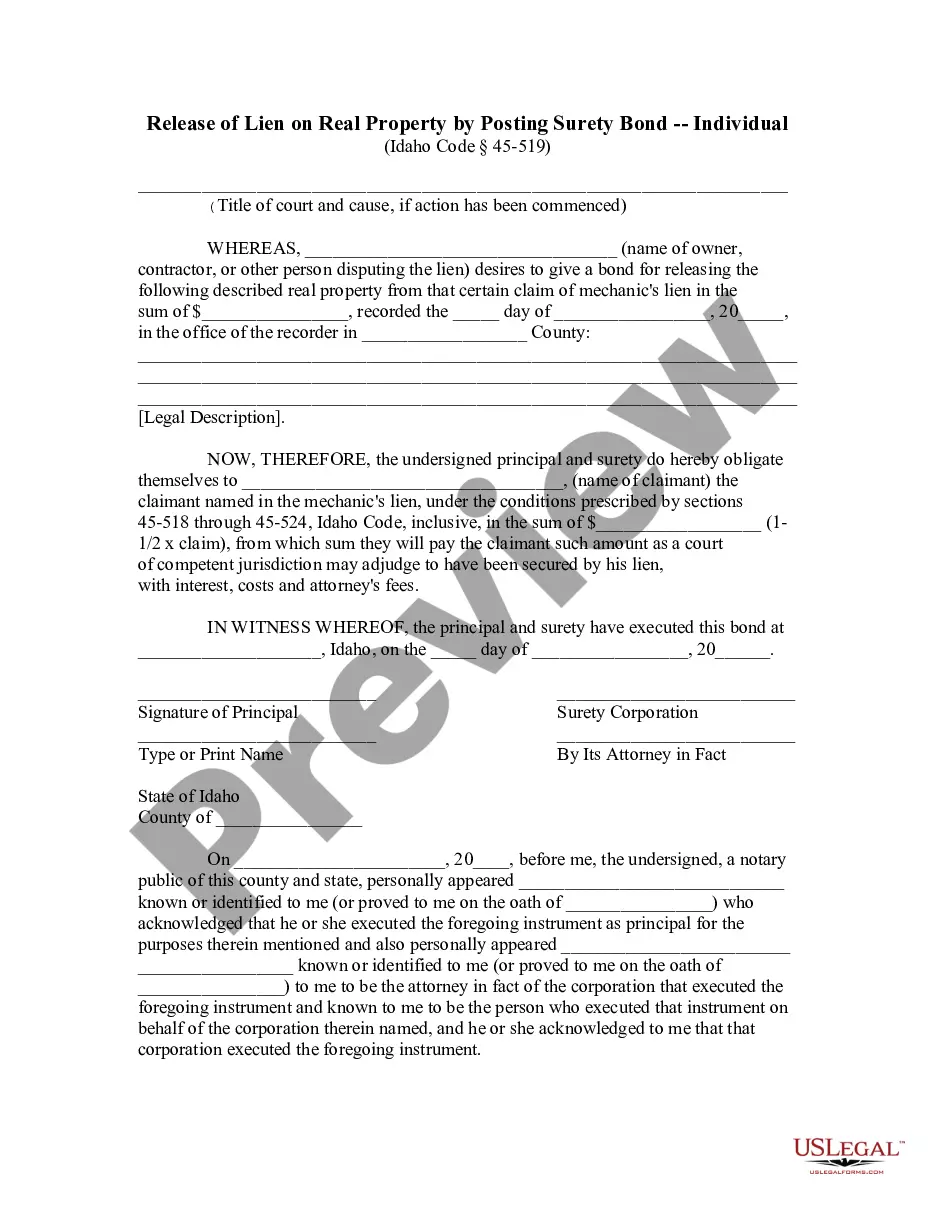

Idaho Surety Bond Form

Description

How to fill out Idaho Release Of Lien By Posting Of Surety Bond - Individual?

Whether you handle documentation regularly or occasionally need to submit a legal report, it is essential to find a resource where all samples are relevant and current.

The first step with an Idaho Surety Bond Form is to ensure it is the most recent version, as this determines its eligibility for submission.

If you want to simplify your search for the most recent document examples, look for them on US Legal Forms.

Utilize the search menu to locate the form you need. Review the preview and description of the Idaho Surety Bond Form to confirm it is the correct one. After confirming the form, select Buy Now. Choose a suitable subscription plan. Create an account or Log In to your existing one. Use your credit card information or PayPal account to finalize the purchase. Choose the download file format and affirm it. Eliminate the confusion when dealing with legal documents. All your templates will be sorted and authenticated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents featuring nearly every document example you may need.

- Search for the templates you require, evaluate their relevance immediately, and learn more about their application.

- With US Legal Forms, you can access over 85,000 form templates across various fields.

- Find the examples of Idaho Surety Bond Form in just a few clicks and save them in your account anytime.

- A US Legal Forms account will assist you in obtaining all the samples you need with ease and less hassle.

- Simply click Log In at the top of the website and visit the My documents section to have all necessary forms handy, eliminating the need to spend time searching for the correct template or verifying its use.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

A surety bond document is a legally binding agreement that ensures a party will fulfill its obligations. In the case of the Idaho surety bond form, it acts as a safeguard for compliance with rules and regulations. This document typically involves three parties: the principal, the obligee, and the surety. When you use the Idaho surety bond form, you provide assurance that your obligations will be met.

Filing a surety claim involves notifying the surety company about the default or breach of contract. You will need to complete the required documentation, which often includes the Idaho surety bond form, and provide supporting evidence for your claim. Following your initial contact, the surety will investigate the circumstances before making a decision. Utilizing professional guidance can streamline this process and help ensure that your claim is filed correctly.

To obtain a surety bond in Idaho, you first need to fill out the appropriate application, which can often be done online. You may also want to gather necessary documents, such as financial statements or business licenses. Once you submit your application, the surety will review it and provide a quote. By using the Idaho surety bond form available at uslegalforms, you simplify the process and ensure compliance with state regulations.

A $1000 surety bond means that the surety guarantees up to $1000 in compensation for the obligee if the principal fails to meet their obligations. This bond essentially provides a financial safety net for the obligee, ensuring they will be compensated for potential losses. Understanding this concept helps you recognize the level of security offered by the Idaho surety bond form.

Filling out a surety bond application involves providing details about the principal and the obligations they are undertaking. You will need information such as the amount of the bond and the terms of the agreement. It is crucial to use accurate and complete data to avoid delays. To make this process easier, visit uslegalforms for the Idaho surety bond form, and follow their step-by-step instructions.

Surety bonds work by providing a financial safety net. If a person or business does not complete a job or follow the law, the surety bond protects the other party by compensating them for any losses. Think of it as a promise that ensures parties keep their commitments. For your specific needs, using the Idaho surety bond form streamlines this process.

Once you fill out the Idaho surety bond form, you will submit it to your chosen bond provider. They will review your application and verify your information. After approval, you will receive your surety bond, typically by mail or electronically. US Legal Forms can assist you at every step, ensuring you have a seamless experience from form completion to bond delivery.