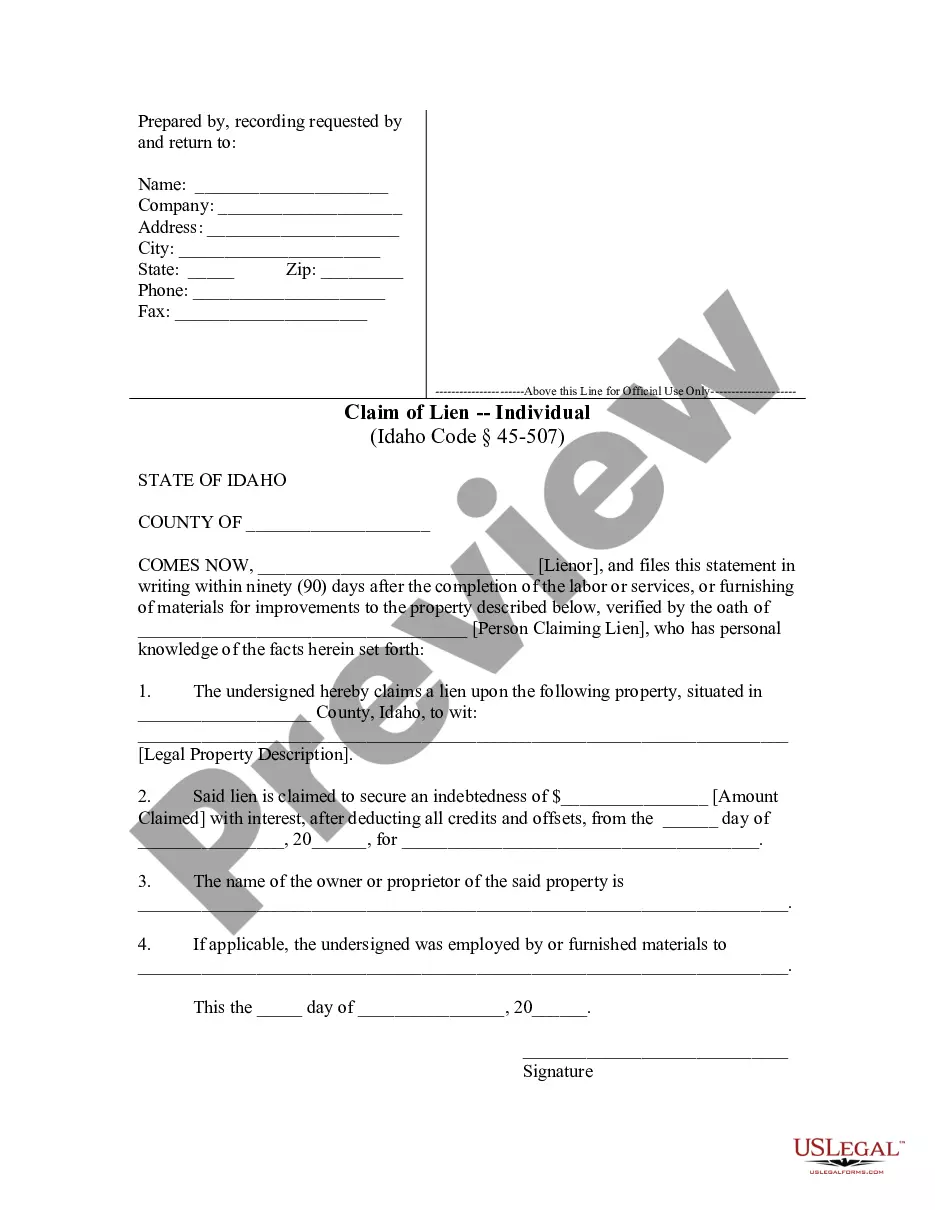

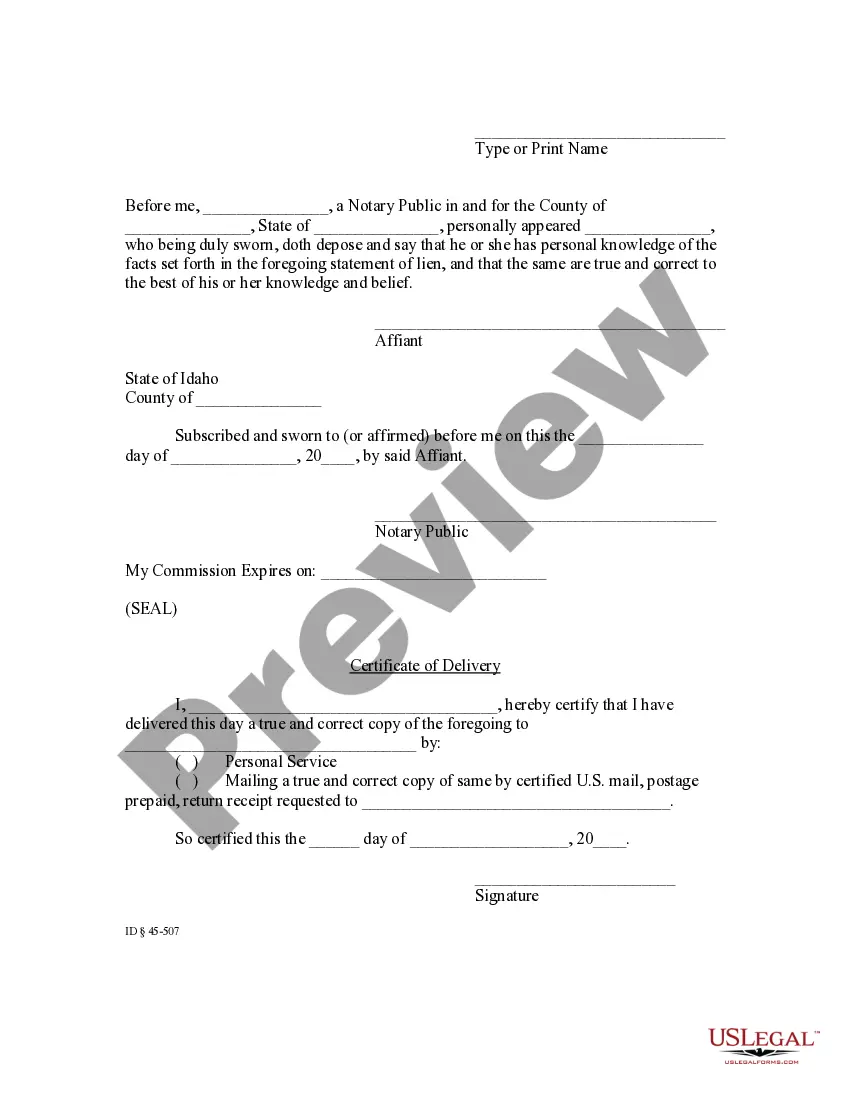

Any person claiming a lien must, within ninety (90) days after the completion of the labor or services or furnishing of materials, file for record with the county recorder for which the property is situated a claim containing a statement of his demand. The claim must be verified by the oath of the claimant and a true and correct copy must be served on the owner or reputed owner by personal service or certified mail.

Claim Of Lien Form Idaho Withholding

Description

Form popularity

FAQ

Looking up liens in Idaho can be done through the local county recorder’s office, where public records are kept. Many counties also have online portals that allow residents to search for property lien information. Familiarity with the Claim of lien form Idaho withholding can assist you in your search and understanding of property obligations.

Yes, Idaho has a state withholding form that is used for various financial transactions. Understanding these forms is important, especially for property tax and lien transactions. For issues relating to property withholding, the Claim of lien form Idaho withholding is a useful resource.

Yes, it is possible to buy tax liens in Idaho. Investors can participate in tax lien auctions where tax debts are sold to the highest bidders. Understanding how the Claim of lien form Idaho withholding works can help you make informed decisions about participating in these investments.

In Idaho, property taxes can go unpaid for a maximum of five years before a tax lien is automatically initiated. This timeline allows property owners a chance to bring their taxes up to date before facing any serious ramifications. Understanding this timeframe is crucial, especially when dealing with the Claim of lien form Idaho withholding.

To place a lien on someone's property in Idaho, you must first complete the appropriate legal documents, including the Claim of lien form Idaho withholding. Once this form is filled out accurately, you can file it with the county recorder’s office. Proper filing ensures your claim is officially recognized and enforceable.

Finding liens on a property in Idaho involves checking public records at your local county recorder’s office. Many counties offer online search options, allowing you to input the property owner's name or address. The Claim of lien form Idaho withholding can also be helpful in understanding what claims might be attached to a specific property.

To look up a tax lien in Idaho, you can begin by visiting the county auditor’s office or accessing their online databases. Most counties provide searchable records that include tax lien information. Ensure you have the property details handy, and consider referencing the Claim of lien form Idaho withholding for accurate information on outstanding claims.

Form 910 is a specific form used in Idaho primarily for property tax management. This form can be essential for filing claims related to property tax liens. For those interested in tax lien processes, familiarity with forms like the Claim of lien form Idaho withholding can streamline your interactions with state requirements.

When considering where to buy tax lien certificates, Idaho is often regarded as a solid choice due to its straightforward process and potential returns. Tax lien investments can yield attractive interest rates, which can provide a good return on your investment. By utilizing the Claim of lien form Idaho withholding, you can secure your interests in any properties that might fall into tax delinquency.

To file Idaho form 967, you must first complete the form accurately, ensuring all details are correct. Once the form is filled out, you can file it with the appropriate county recorder’s office. This formal step is vital to enforcing your rights under the Claim of lien form Idaho withholding statute. For a smooth filing experience, consider using resources from US Legal Forms to guide you through the entire process.