Secure-low-rates

Description

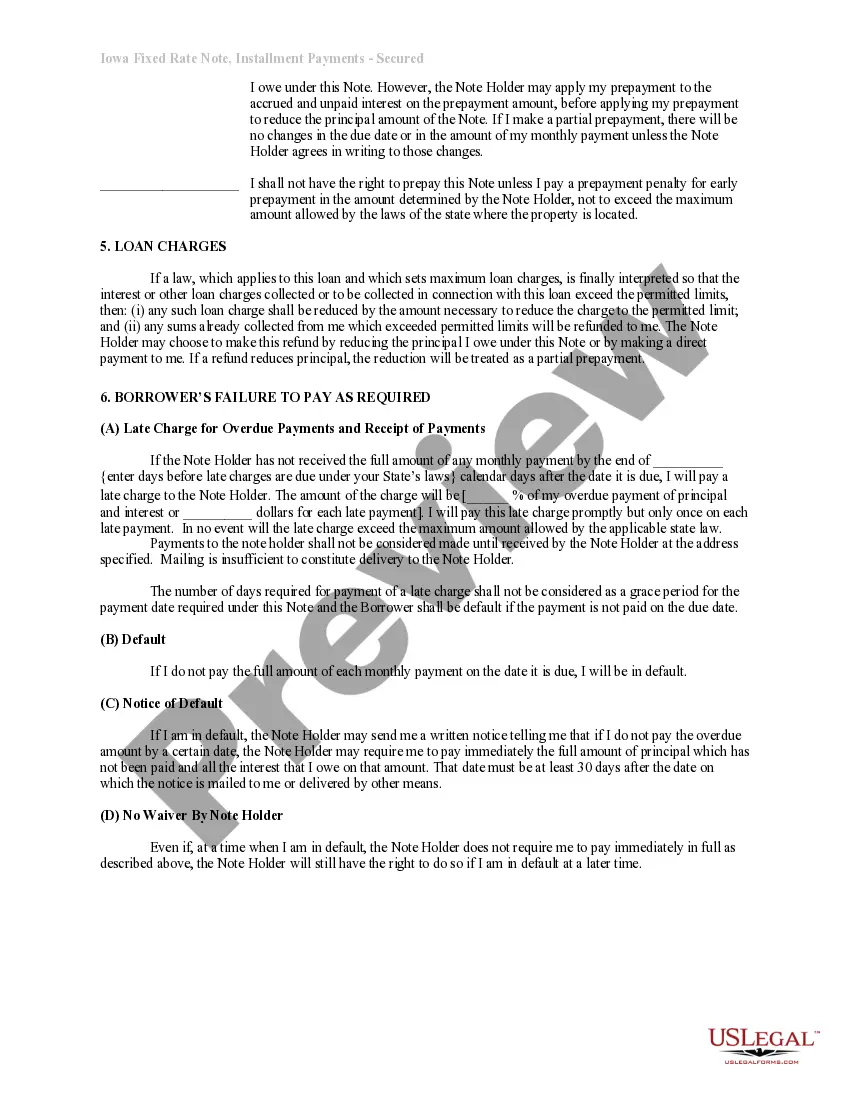

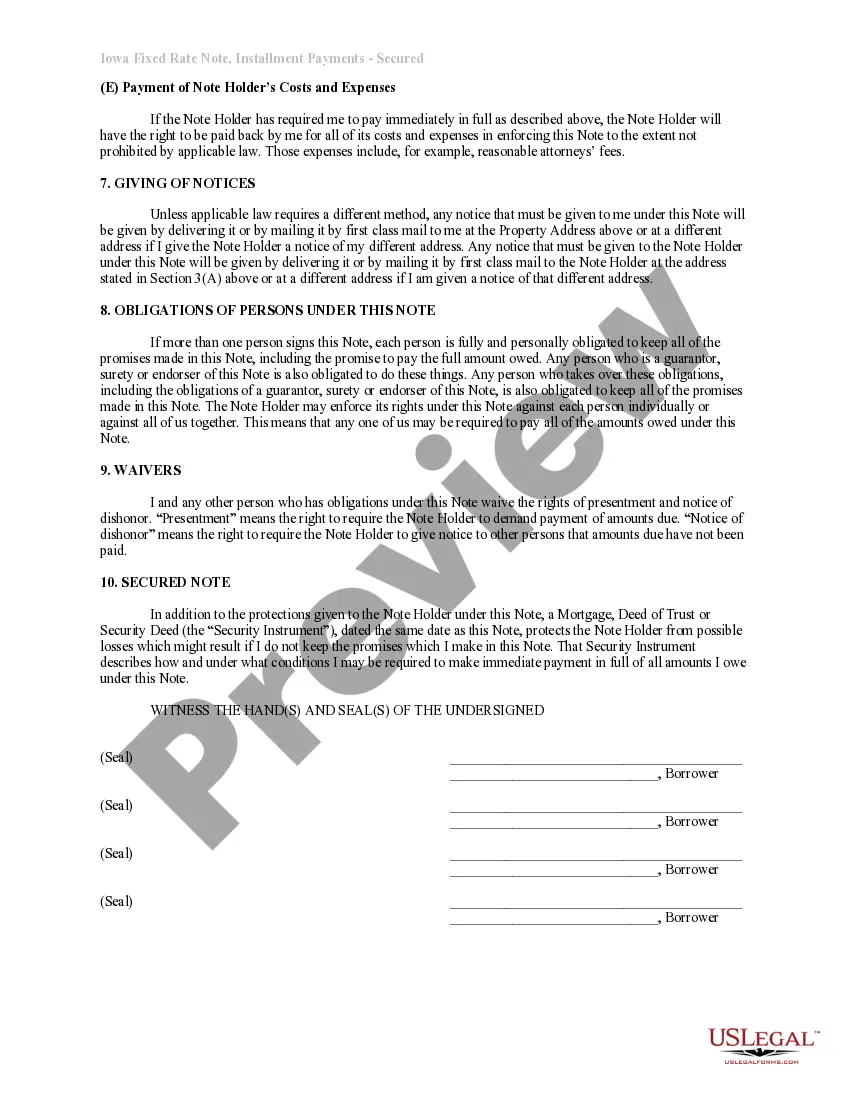

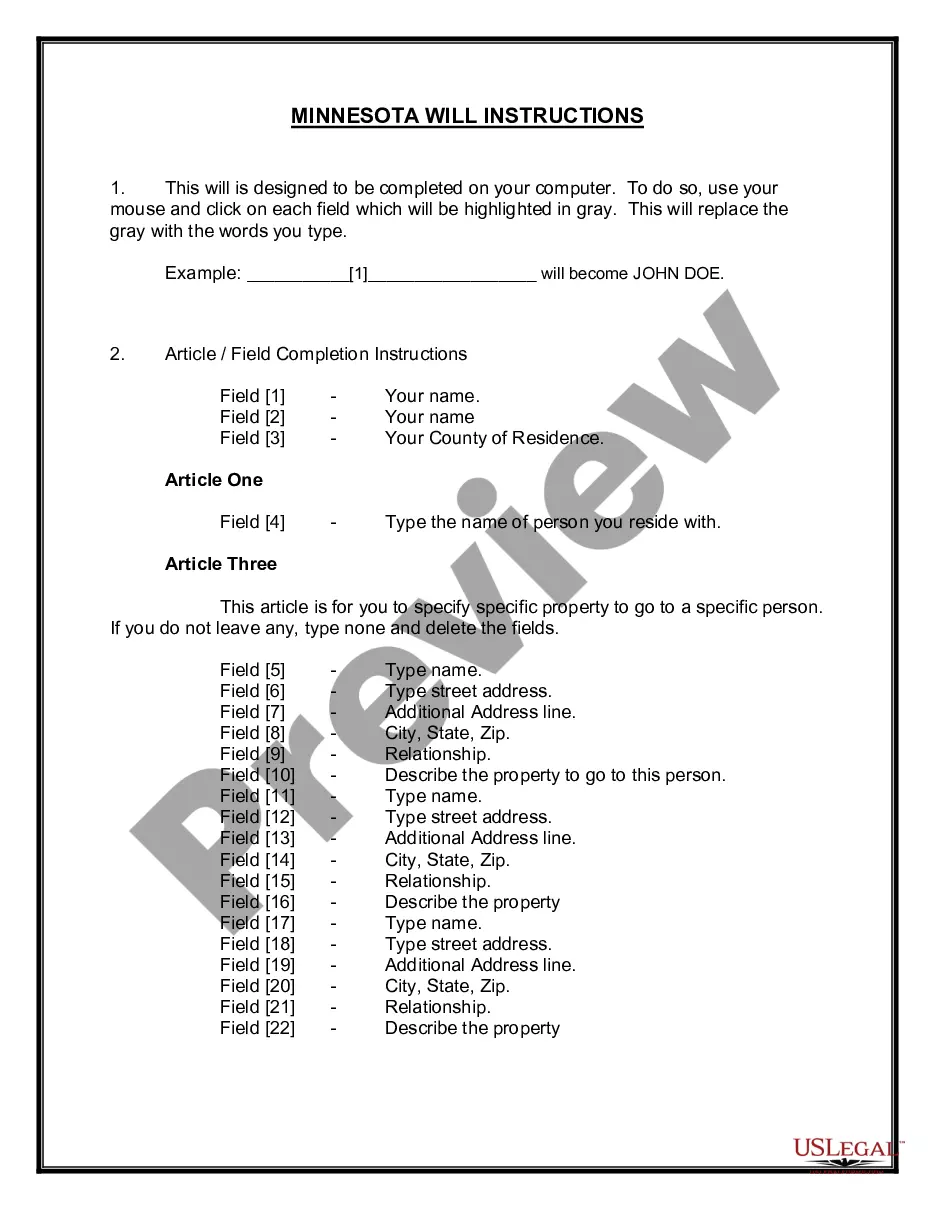

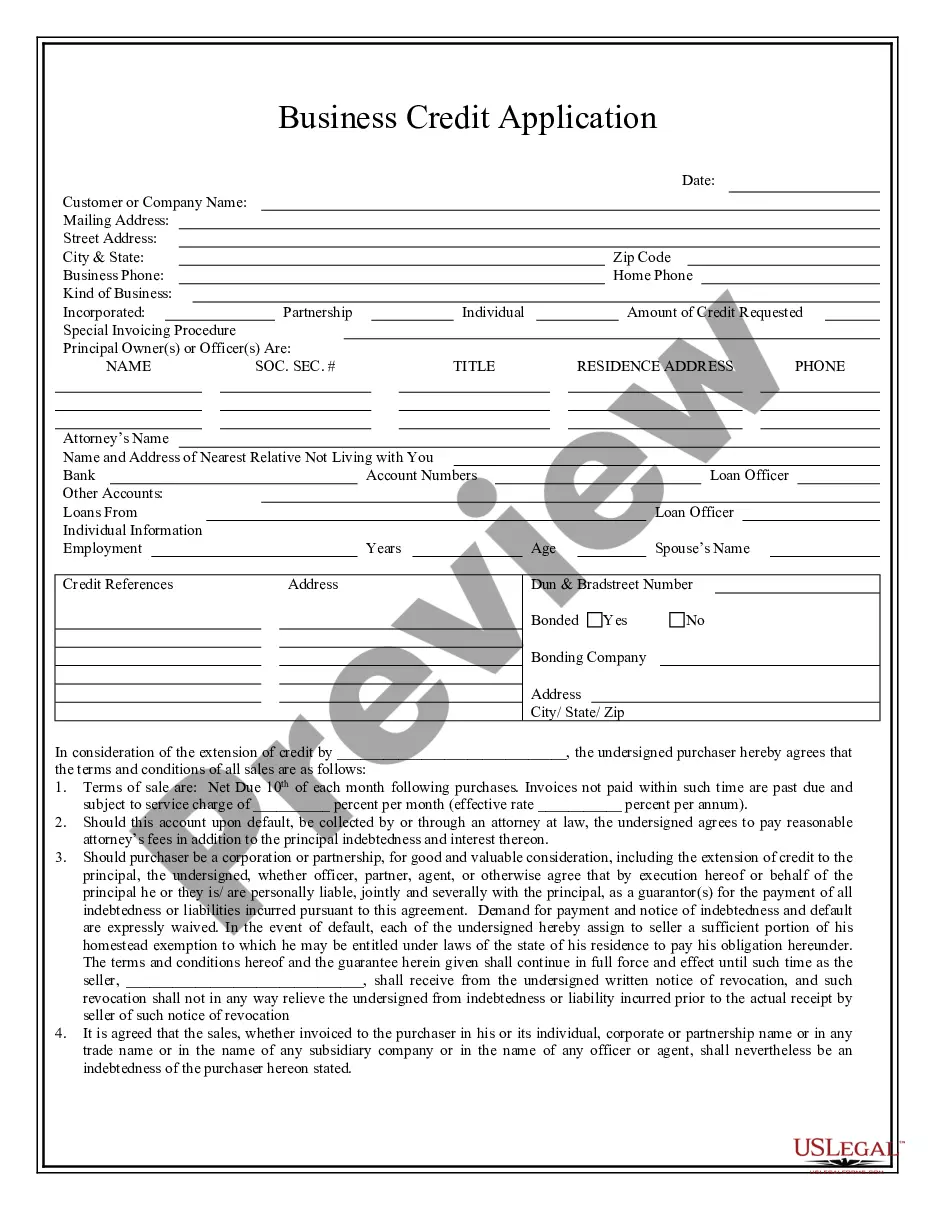

How to fill out Iowa Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

- If you're an existing user, log in to your account and locate the document you need. Ensure your subscription is active, and renew it if necessary.

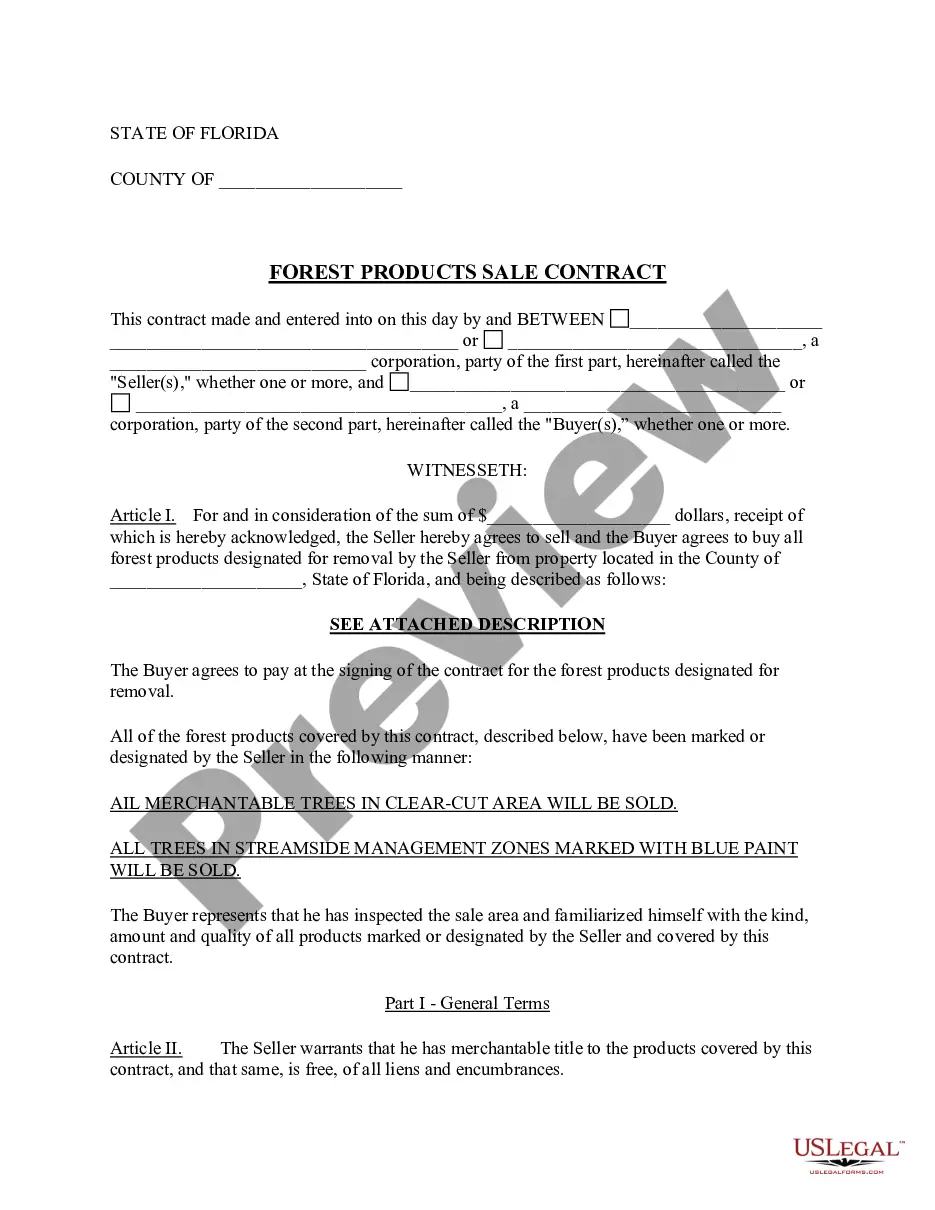

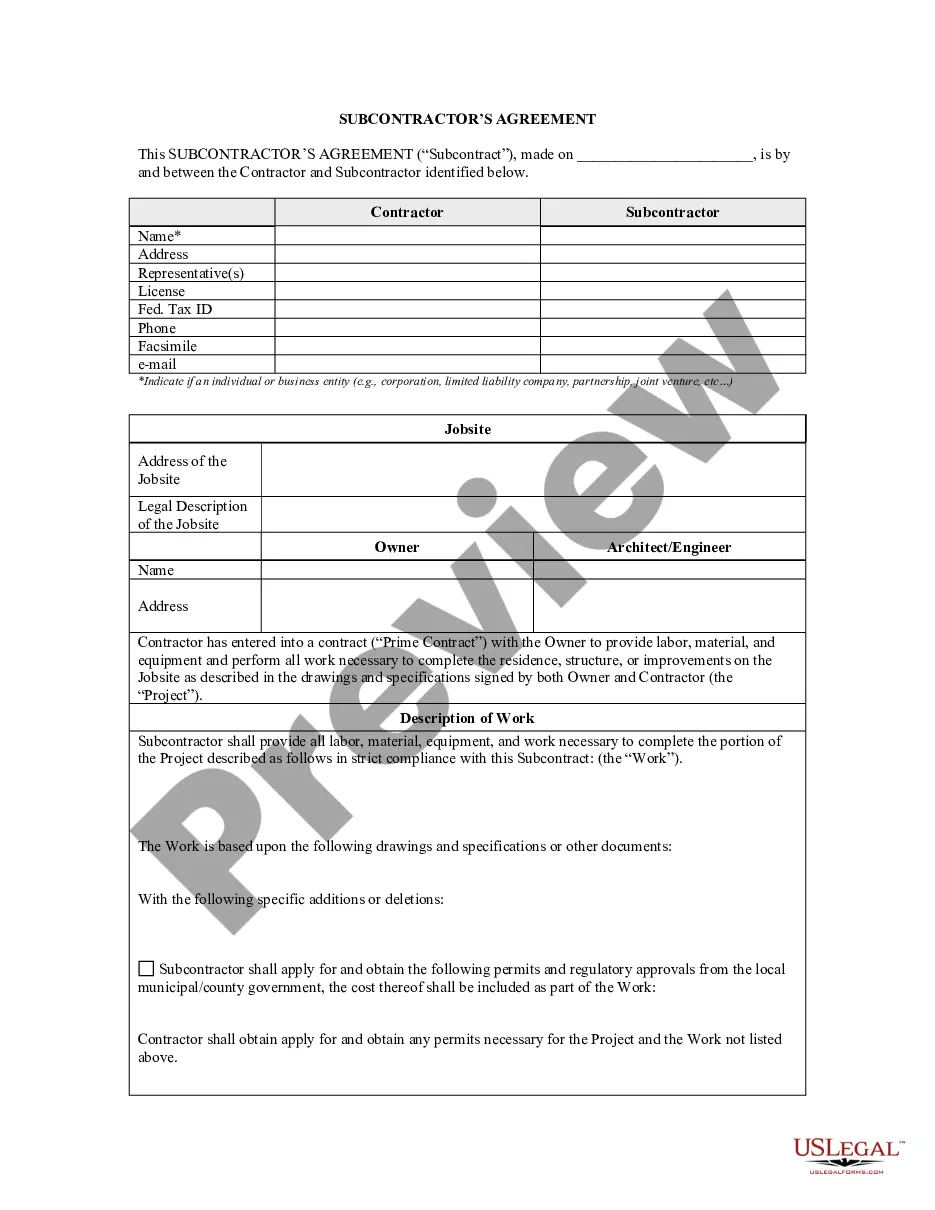

- Explore the Preview mode and check the form description to confirm it aligns with your needs and complies with local jurisdiction requirements.

- Should you need a different template, utilize the Search feature to find the appropriate form that addresses your specific circumstances.

- Proceed to purchase the document by clicking the Buy Now option, selecting your preferred subscription plan, and registering an account for resource access.

- Complete your transaction by providing your payment details, either via credit card or PayPal.

- Download the form directly to your device, making it accessible at any time later via the My Forms section of your profile.

In conclusion, US Legal Forms not only offers an extensive range of legal forms but also ensures that you can easily access expert support for precise document completion. Don't miss out on their features; start your journey towards hassle-free legal documentation.

Get started today and experience the benefits of US Legal Forms!

Form popularity

FAQ

You might want to consider getting rid of full coverage car insurance when your vehicle’s value decreases significantly, typically around the $5,000 mark. If you find that full coverage costs are draining your budget, it’s time to evaluate your options. Opting for liability insurance can help you secure low rates while providing necessary protection.

To secure low rates on insurance, start by shopping around and comparing quotes from multiple providers. Look for discounts you may qualify for, such as bundling policies or having a clean driving record. Additionally, consider raising your deductibles; this can lower your premium significantly. Using tools from platforms like USLegalForms can also help streamline the process.

Although predicting future mortgage rates can be challenging, economic conditions will ultimately dictate them. Factors such as inflation, central bank policies, and market demand will influence rates. However, staying informed about these trends can help you spot opportunities to secure low rates when conditions improve.

Getting the lowest interest rate requires proactive measures on your part. Start by improving your credit score and maintaining a low debt-to-income ratio. Next, research various lenders and their offers, and consider negotiating terms with potential lenders to secure low rates that meet your needs.

The best way to find cheap insurance is to compare multiple quotes. Use online tools to gather estimates from different providers, ensuring you review coverage options carefully. Look for discounts that may apply to you, such as bundling multiple policies or maintaining a good driving record, which can help you secure low rates.

To achieve the lowest interest rate, focus on your creditworthiness. Review your credit report, correct any errors, and improve your credit score by paying bills on time. Also, shop around and compare interest rates from different lenders to ensure you secure low rates that fit your financial situation.

To secure low rates, start by maintaining a good credit score. Lenders often offer better interest rates to individuals with higher credit scores. Additionally, consider paying down existing debt and comparing offers from multiple lenders to find the best deal. In some cases, refinancing existing loans can also help you obtain a lower rate.

To obtain discounts on car insurance, inquire about available incentives such as safe driver discounts, good student discounts, or those available for military personnel. Providing proof of completed driver safety courses can also earn you reduced rates. Platforms like uslegalforms help you find insurance providers that offer secure-low-rates and discounts tailored to your profile.

You can save on car insurance by taking advantage of multi-policy discounts, maintaining a good credit rating, and considering usage-based insurance. Small changes in your lifestyle can lead to significant savings and help you find secure-low-rates. Using tools from uslegalforms, you can compare numerous options and pinpoint the best savings.

One effective way to keep your car insurance rate low is to maintain a clean driving history. Avoiding accidents and traffic violations can help you qualify for lower premiums. Regularly reviewing your policy and using platforms like uslegalforms may reveal opportunities for secure-low-rates based on your safe driving habits.