Small Estate Affidavit Form Iowa Withholding

Description

How to fill out Iowa Small Estate Affidavit For Personal Property Estates Not More Than $50,000?

Legal papers management can be frustrating, even for knowledgeable specialists. When you are interested in a Small Estate Affidavit Form Iowa Withholding and do not get the time to commit looking for the right and up-to-date version, the processes could be nerve-racking. A robust web form library might be a gamechanger for everyone who wants to handle these situations effectively. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any requirements you might have, from personal to organization paperwork, all-in-one spot.

- Employ innovative resources to accomplish and manage your Small Estate Affidavit Form Iowa Withholding

- Gain access to a resource base of articles, guides and handbooks and resources related to your situation and needs

Save effort and time looking for the paperwork you need, and utilize US Legal Forms’ advanced search and Preview feature to get Small Estate Affidavit Form Iowa Withholding and get it. For those who have a membership, log in to the US Legal Forms profile, look for the form, and get it. Review your My Forms tab to view the paperwork you previously downloaded as well as manage your folders as you see fit.

Should it be the first time with US Legal Forms, register an account and get unrestricted access to all advantages of the platform. Listed below are the steps for taking after getting the form you need:

- Verify it is the correct form by previewing it and looking at its description.

- Be sure that the sample is accepted in your state or county.

- Select Buy Now once you are all set.

- Select a subscription plan.

- Find the format you need, and Download, complete, eSign, print out and send your document.

Take advantage of the US Legal Forms web library, backed with 25 years of expertise and trustworthiness. Change your everyday document administration in a smooth and intuitive process right now.

Form popularity

FAQ

How Long Do You Have to File Probate After Death? While there is no specific timeline, a person with possession of the will must file it after learning of the person's death. By filing the will promptly, you can begin the probate process as soon as possible.

Probate. In Iowa, a small estate is categorized based on the assets owned by the deceased at the time of death. To be considered a small estate, the sum of the assets must equal $200,000 or less.

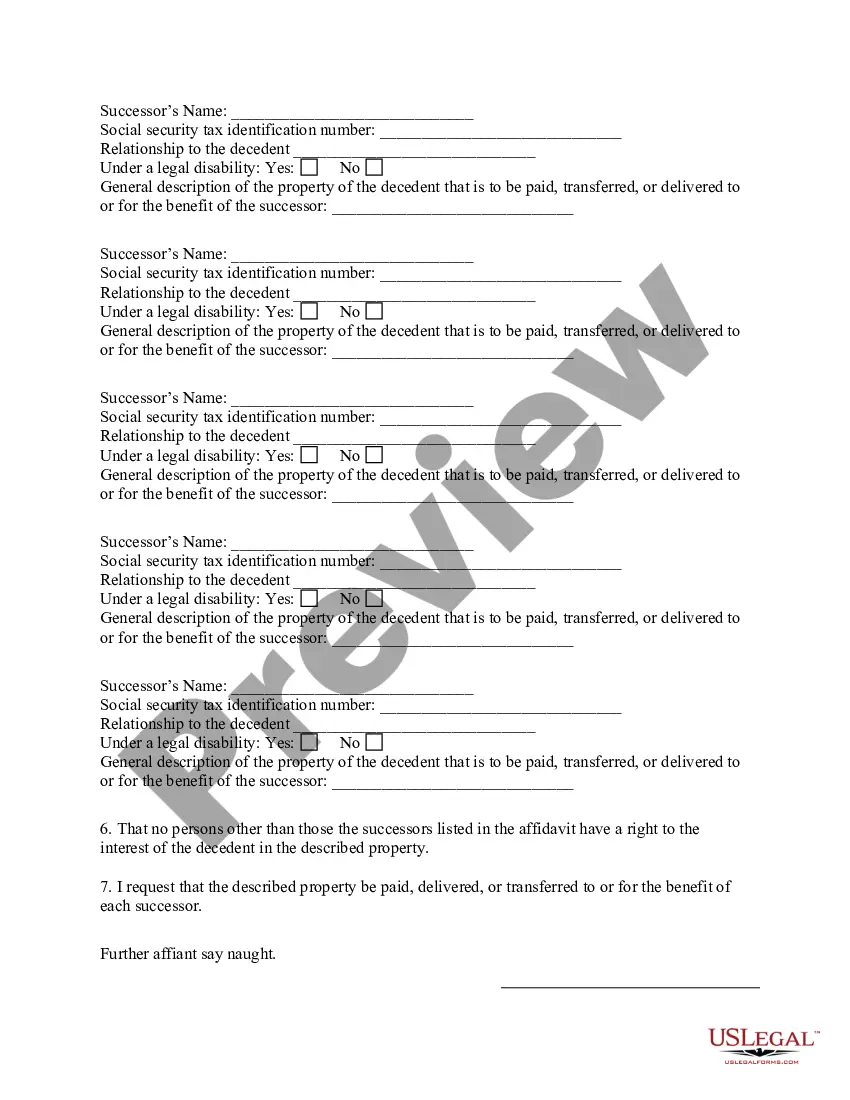

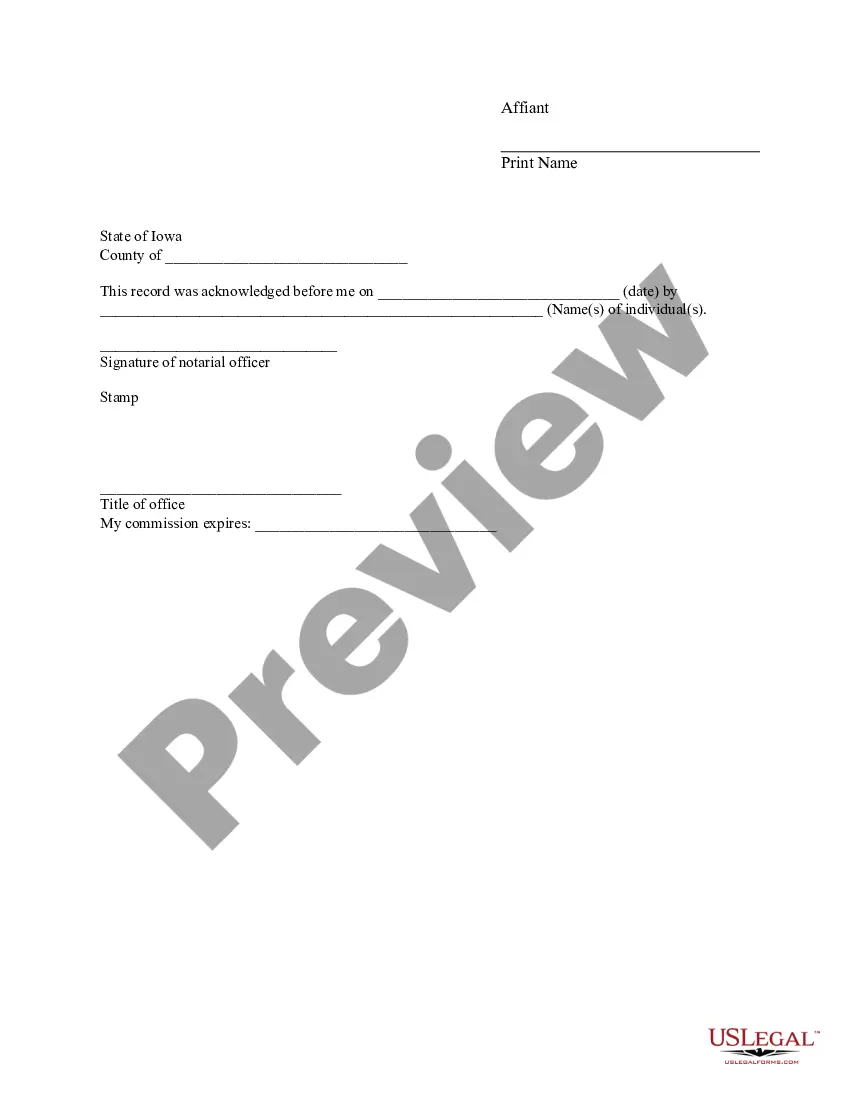

How to Write (1) Iowa Small Estate Distributee As Declarant. ... (2) Distributee Name. ... (3) Iowa Decedent Name. ... (4) Date Of Iowa Decedent Death. ... (5) County Of Iowa Decedent Death. ... (6) Distributee As Iowa Affiant. ... (7) Address Of Distributee/Iowa Affiant. ... (8) Description Of Iowa Decedent Asset.

If there is no real estate to transfer and the sum of the deceased assets is $50,000 or less, an eligible person can use a small estate affidavit, rather than going through probate. Iowa Code 633.356 establishes the requirements for a small estate affidavit.

Updated on August 27th, 2022. An Iowa small estate affidavit, also known as an ?affidavit for distribution of property,? is a legal document that gives successors the right to distribute a deceased person's estate without the court's involvement.