Iowa Estate Recovery Forms

Description

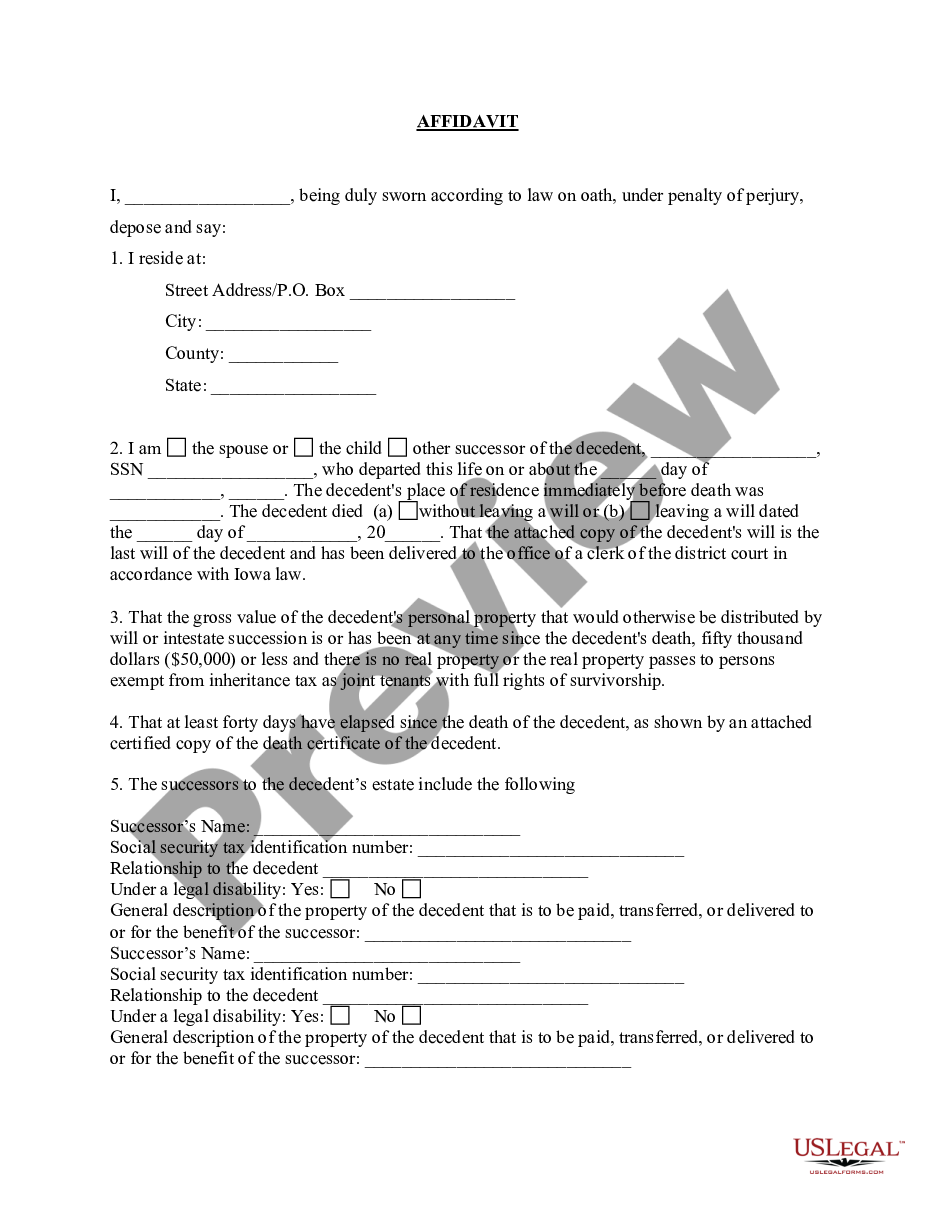

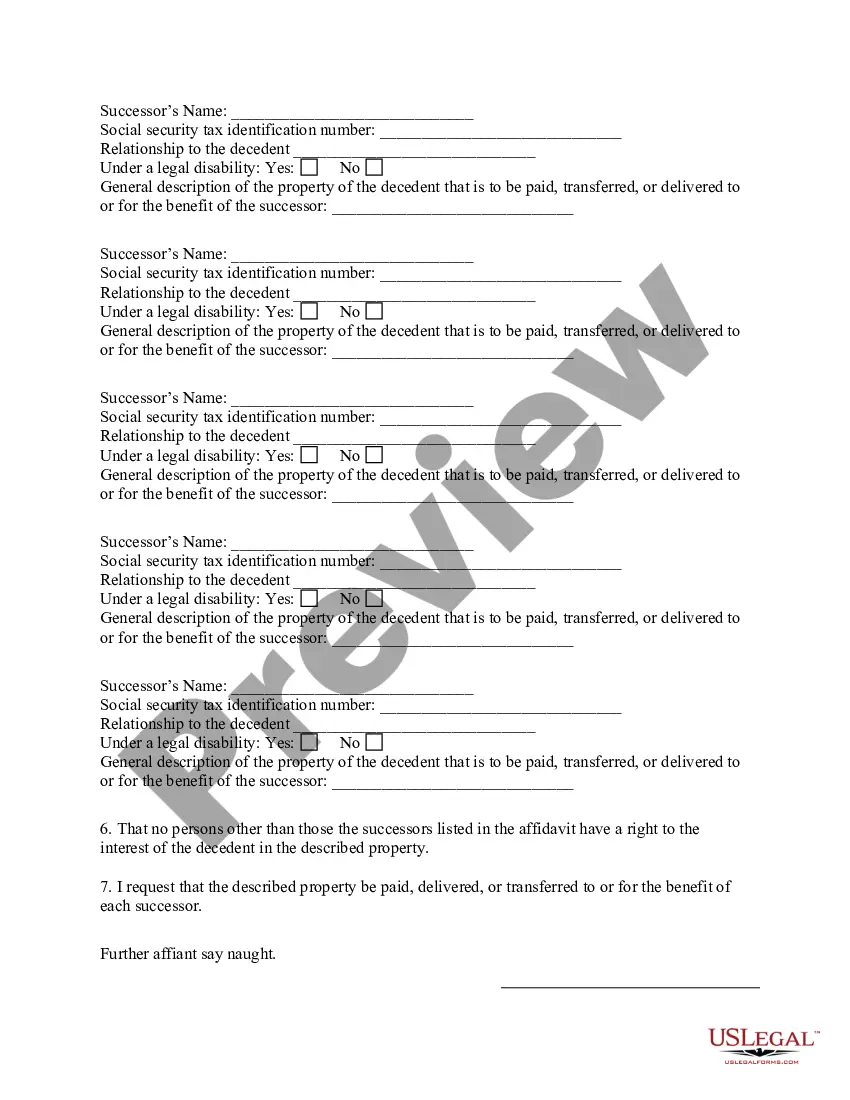

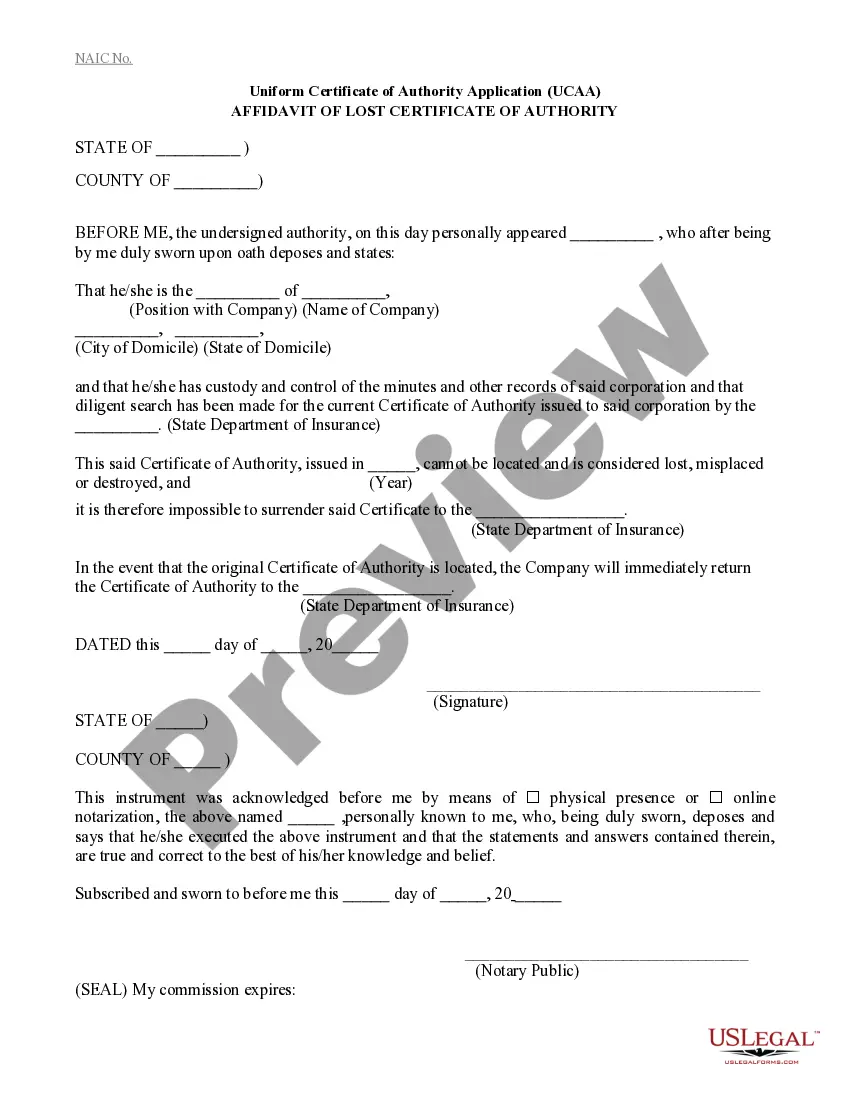

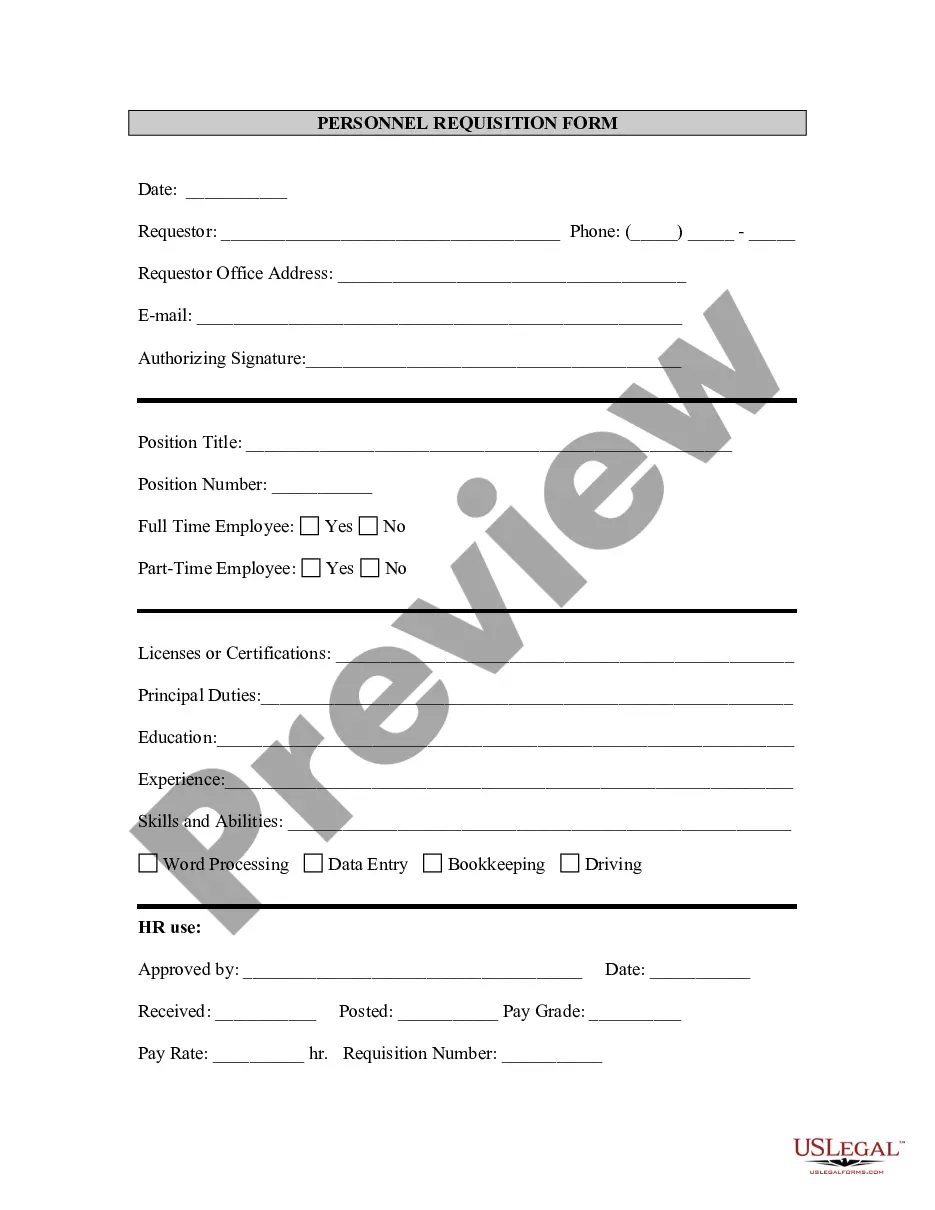

How to fill out Iowa Small Estate Affidavit For Personal Property Estates Not More Than $50,000?

There's no longer a need to spend hours searching for legal documents to satisfy your local state obligations.

US Legal Forms has gathered all of them in one place and enhanced their availability.

Our site offers over 85k templates for any business and individual legal matters categorized by state and purpose.

Filling out official documents according to federal and state guidelines is quick and easy with our platform. Experience US Legal Forms today to keep your files organized!

- All forms are expertly drafted and authenticated for legitimacy, assuring you of acquiring current Iowa Estate Recovery Forms.

- If you're already acquainted with our service and possess an account, ensure that your subscription is active prior to downloading any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all saved documents whenever necessary by accessing the My documents tab in your profile.

- If you are new to our service, the procedure will involve a few additional steps to complete.

- Here's how newcomers can access the Iowa Estate Recovery Forms in our collection.

- Examine the page content thoroughly to confirm it includes the example you need.

- To do this, use the form description and preview options, if available.

Form popularity

FAQ

Not all estates in Iowa require probate. If an estate falls below a certain value or holds designated beneficiaries, you may not need to file Iowa estate recovery forms or go through the probate process. For simple estates, transferring assets directly to beneficiaries can be a more efficient option. Nonetheless, using Iowa estate recovery forms can help clarify your estate’s needs and ensure all necessary legal requirements are met.

An example of a claim against an estate could be unpaid medical bills for services rendered to the deceased prior to their passing. Creditor claims like these must be documented and submitted appropriately to the executor. For a clear process, refer to Iowa estate recovery forms, which provide essential guidance.

To file a claim against an estate in Iowa, prepare a claim detailing the nature of your demand, and send it to the estate's executor. Ensure you comply with the timelines set forth by Iowa law. You can refer to the Iowa estate recovery forms for guidance on what to include in your claim.

Yes, individuals can file a lawsuit against an estate if they believe they have a valid claim. However, it's crucial to follow the correct procedures and timelines specified by Iowa law. Using Iowa estate recovery forms can help clarify your position and streamline the process.

Yes, Iowa does have a small estate affidavit process for estates that qualify as small. If the estate's total value falls below a certain threshold, heirs may use this simplified method to access the assets without going through probate. This can be advantageous when utilizing Iowa estate recovery forms, as it may reduce the paperwork involved.

Certain assets are exempt from Medicaid estate recovery in Iowa, including the home if it is occupied by a surviving spouse or dependent. Personal belongings and a single vehicle used for transportation also remain exempt. It's important to note these exemptions when dealing with Iowa estate recovery forms to recognize what is protected.

To make a claim against an estate in Iowa, you must submit a written claim to the executor or administrator of the estate. Clearly outline the nature and amount of your claim. Utilizing Iowa estate recovery forms can streamline this process, ensuring you include all necessary details to uphold your claim.

In Iowa, you generally have six months from the date of the executor’s appointment to file a claim against an estate. This timeframe is essential for securing your rights as a creditor. Make sure to consult the Iowa estate recovery forms for any specific details related to your claim.

Avoiding Medicaid estate recovery in Iowa involves proactive planning, such as transferring assets ahead of time or utilizing estate planning tools effectively. Various strategies exist, including setting up trusts or making gifts to family members. By completing Iowa estate recovery forms, individuals can better manage their assets and reduce recovery risks. Professional guidance is highly recommended to develop a personalized plan.

To protect your assets from Medicaid in Iowa, you can consider a few strategies, such as gifting assets or establishing irrevocable trusts. It's essential to carefully plan and understand the timing involved, as certain transactions could affect eligibility. Using Iowa estate recovery forms can help clarify your intentions and ensure that your plans align with state regulations. Consulting a professional in estate planning can provide tailored advice.