Iowa Small Estate Limit

Description

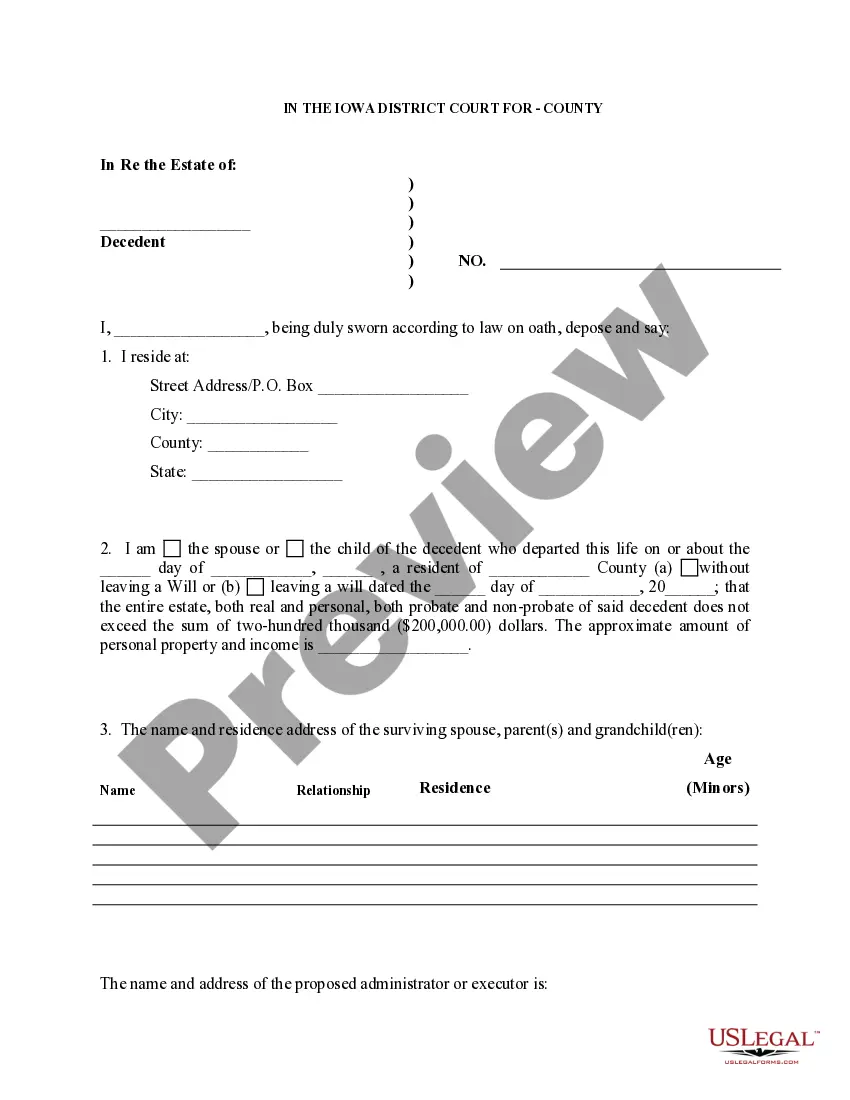

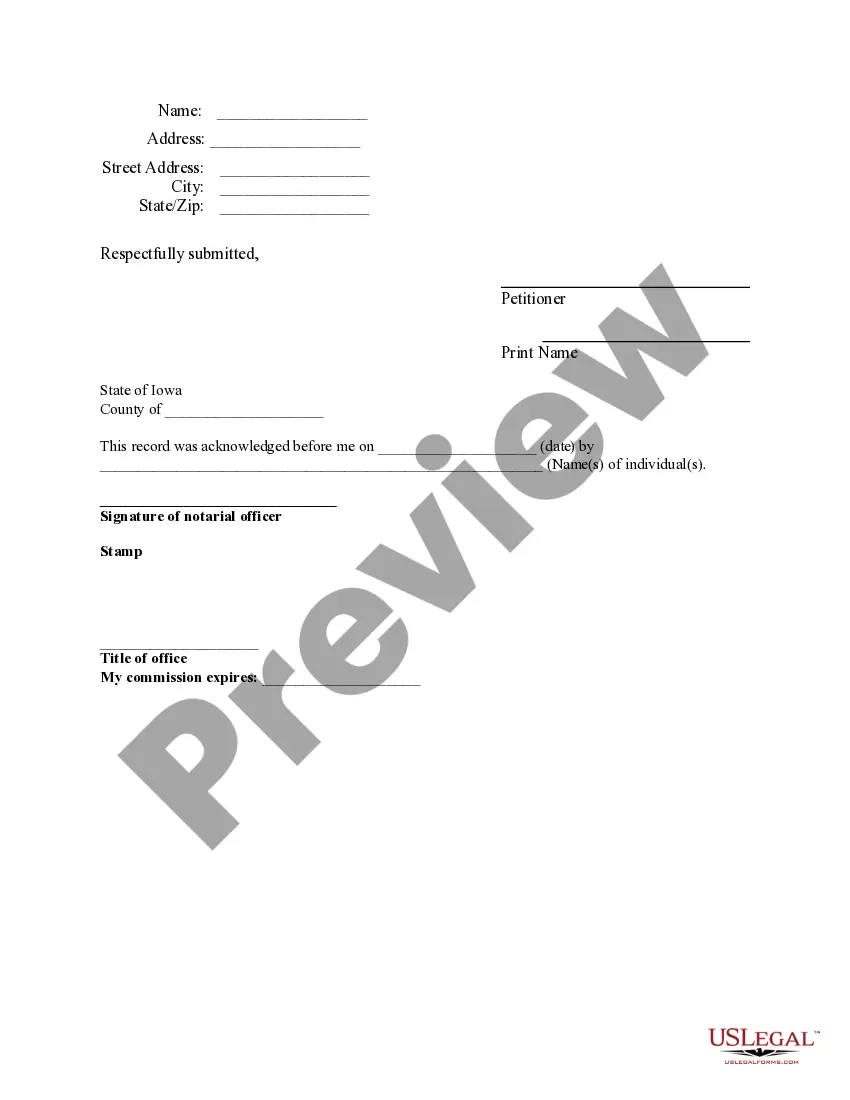

How to fill out Iowa Small Estate Affidavit For Estates Not More Than $200,000?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may require extensive research and substantial financial investment.

If you’re seeking a simpler and more cost-effective method for generating Iowa Small Estate Limit or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal matters.

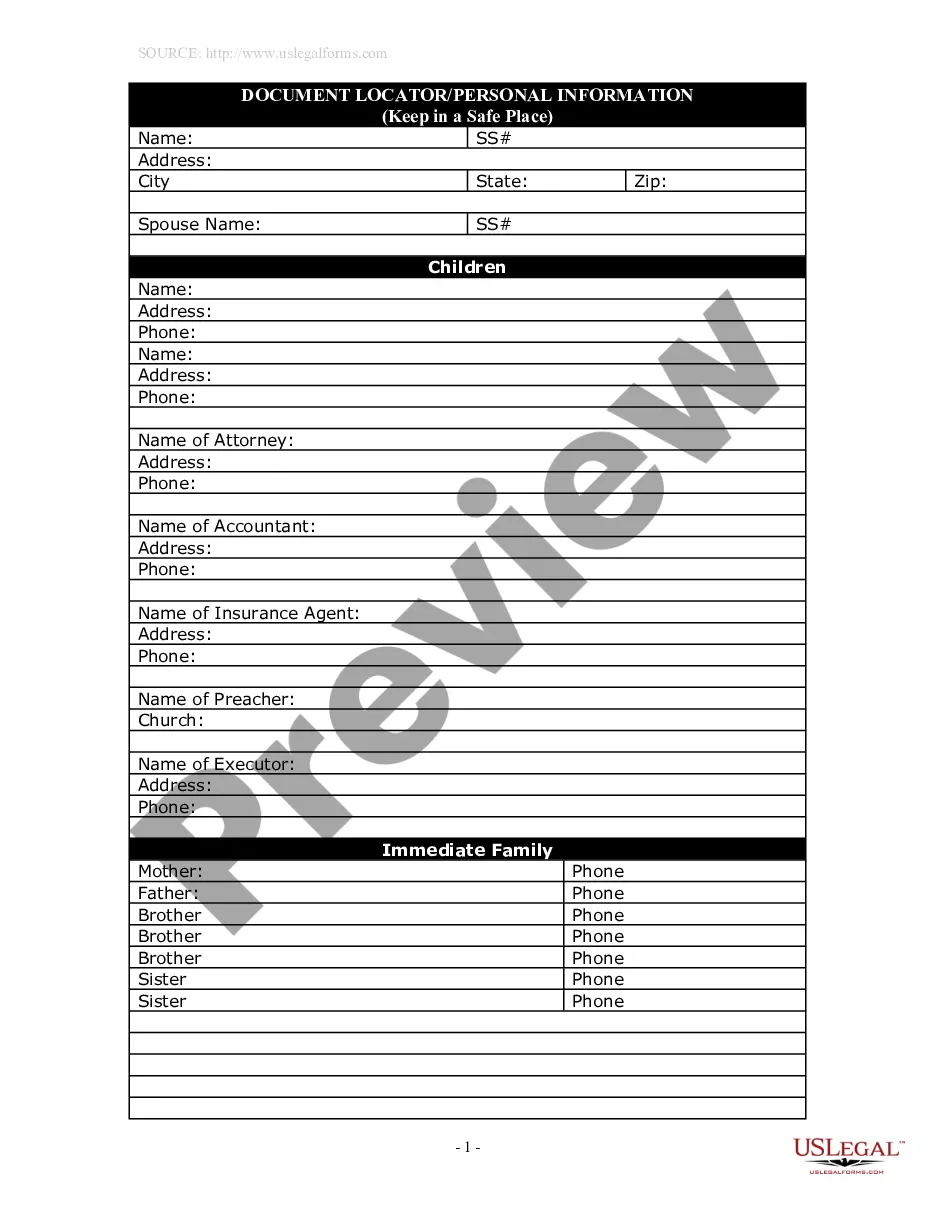

Examine the document preview and descriptions to confirm that you have the correct form. Ensure that the form you choose complies with the regulations and laws of your state and county. Select the most appropriate subscription plan to acquire the Iowa Small Estate Limit. Download the document, then complete, sign, and print it out. US Legal Forms has a solid reputation and over 25 years of expertise. Join us today and simplify the document execution process!

- With just a few clicks, you can quickly obtain state- and county-specific forms expertly prepared for you by our legal experts.

- Utilize our platform whenever you require a dependable and trustworthy service to swiftly find and download the Iowa Small Estate Limit.

- If you’re already familiar with our site and have set up an account, just Log In to your account, find the template, and download it or re-download it anytime later in the My documents section.

- Not registered yet? No problem. It only takes minutes to sign up and browse the library.

- But before diving straight into downloading Iowa Small Estate Limit, keep these tips in mind.

Form popularity

FAQ

The small estate limit in Iowa is currently set at $100,000 for the value of the estate's assets, excluding any real estate. If the total value of the estate falls below this limit, heirs can utilize a small estate affidavit to claim the assets without going through the full probate process. This limit helps streamline the estate settlement process, making it easier for families to manage their loved ones' affairs. For more details on the small estate limit and related forms, visit US Legal Forms to access comprehensive resources.

To file a small estate affidavit in Iowa, you first need to gather the necessary documentation, including a death certificate and a list of the deceased's assets. Next, you can complete the small estate affidavit form, which you can find on the US Legal Forms platform. After filling out the form, you must sign it in front of a notary public. Finally, file the affidavit with the probate court in the county where the deceased lived, provided the estate meets the Iowa small estate limit.

In Iowa, if an estate exceeds the Iowa small estate limit, it generally must go to probate. The specific limit determines whether the estate can be settled without court intervention. It's crucial to assess the value of your assets to understand your estate's standing. Using tools provided by platforms like USLegalForms can assist you in evaluating your estate and planning accordingly.

To avoid probate in Iowa, consider strategies such as establishing a living trust or utilizing joint ownership for your assets. These methods allow your estate to bypass the probate process, making it more efficient for your beneficiaries. Additionally, staying within the Iowa small estate limit can help simplify the transfer of assets without court involvement. Explore resources like USLegalForms to find templates and guidance for setting up these arrangements.

A small estate in Iowa refers to an estate that falls below the Iowa small estate limit. Typically, this includes total assets such as real estate, personal property, and financial accounts that do not exceed this specified threshold. Understanding what counts as a small estate is essential for efficient estate planning. By knowing the limits, you can better prepare your estate for a smoother transition.

The new law in Iowa real estate introduces updated guidelines regarding the Iowa small estate limit. This change simplifies estate management for individuals with smaller assets, allowing for a more straightforward process. By raising the small estate limit, the law enables more estates to avoid the lengthy probate process. This change benefits many Iowa residents by making estate transfers faster and less costly.

Probate. In Iowa, a small estate is categorized based on the assets owned by the deceased at the time of death. To be considered a small estate, the sum of the assets must equal $200,000 or less.

If there is no real estate to transfer and the sum of the deceased assets is $50,000 or less, an eligible person can use a small estate affidavit, rather than going through probate. Iowa Code 633.356 establishes the requirements for a small estate affidavit.

IOWA CODE § 635.1. Where there is no will, a petition for small estate administration may be made by a surviving spouse, heirs of the decedent, creditors of the decedent, or any other persons showing good grounds therefor; if there is a will, such a petition may be filed by any interested person.

Updated on August 27th, 2022. An Iowa small estate affidavit, also known as an ?affidavit for distribution of property,? is a legal document that gives successors the right to distribute a deceased person's estate without the court's involvement.