Dissolution Dissolve Corporation With The Us

Description

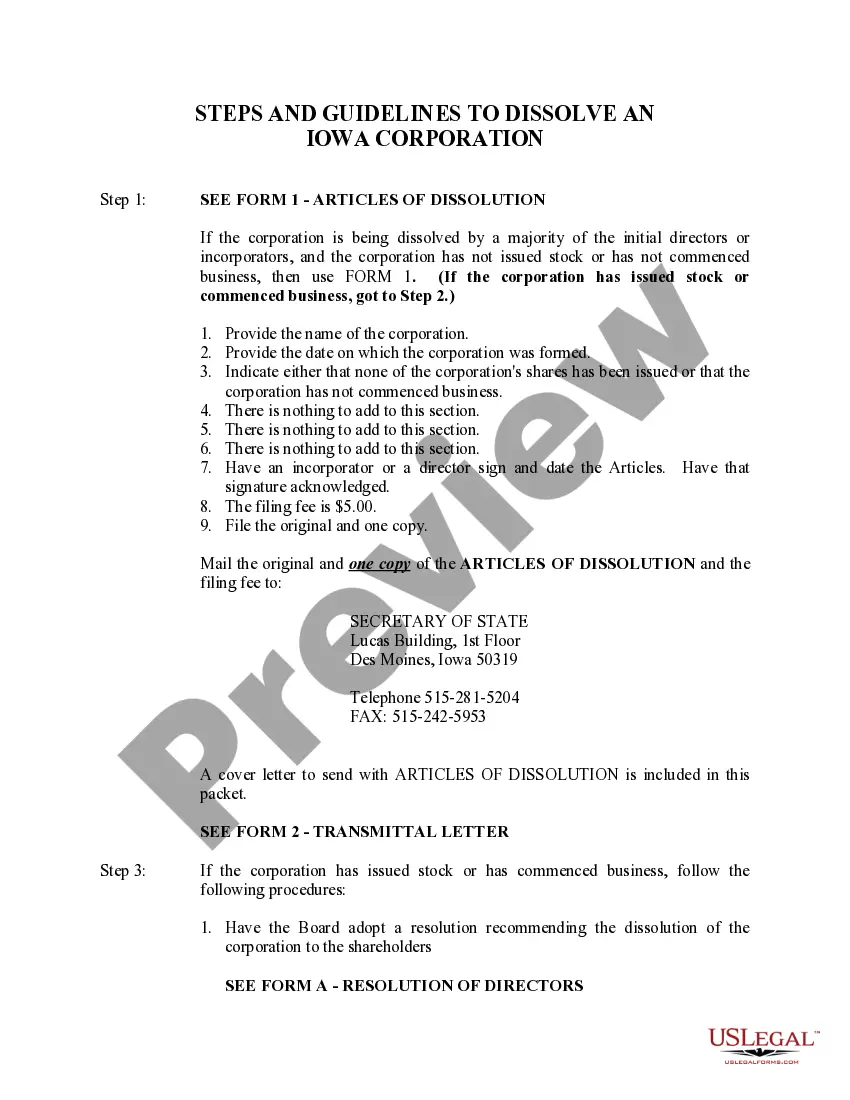

How to fill out Iowa Dissolution Package To Dissolve Corporation?

- If you're a returning user, log in to your account and download the necessary form from your dashboard. Confirm that your subscription is active; if not, renew it according to your plan.

- For new users, begin by exploring the Preview mode and detailed descriptions of form templates. Verify that the chosen form aligns with your state’s requirements.

- If there are any discrepancies, utilize the Search feature to find an alternative template that fits your needs.

- Once you've identified the correct document, click on 'Buy Now' and select the subscription plan that works for you. You'll need to create an account to gain access to this extensive library.

- Proceed to payment, entering your credit card information or opting for PayPal to finalize your subscription.

- After completing your purchase, download the form to your device. You can find this document anytime in the My Forms section of your profile.

In conclusion, using US Legal Forms simplifies the often complex process of dissolving a corporation. With numerous templates and support from legal experts, you can ensure the accuracy and legality of your documents. Start your journey today and take advantage of the comprehensive resources available.

Don't hesitate—visit US Legal Forms now to access the forms you need for a smooth dissolution process!

Form popularity

FAQ

When you consider a dissolution to dissolve your corporation with the U.S., it's essential to understand the paperwork involved. Filing Form 966 is crucial for S Corporations that choose to dissolve, as it informs the IRS of your intention. This form helps facilitate the process and ensures compliance with federal regulations. Using resources like USLegalForms can simplify this process, providing the necessary documents and guidance to navigate your dissolution smoothly.

When a corporation undergoes dissolution with the US, it ceases all operations and begins the process of winding up its affairs. This includes settling debts, distributing remaining assets to shareholders, and officially notifying stakeholders. The dissolution also provides legal protection to the corporation’s owners from future liabilities. Ensure you navigate this process smoothly by utilizing US Legal Forms to get the necessary documentation.

If you don’t file Form 966 during the dissolution of your corporation with the US, it can lead to potential penalties and complications. This form notifies the IRS of the dissolution, and failing to file it may result in delays or issues with your tax obligations. It's crucial to comply with this requirement to avoid future liabilities that could arise from not properly reporting your business closure. Consider using resources available at US Legal Forms to ensure correct filing.

Yes, when you decide to dissolve your corporation with the US, it is important to cancel your Employer Identification Number (EIN). Leaving it active can lead to unnecessary tax liabilities in the future. In addition, canceling the EIN ensures that you won’t receive further correspondence from the IRS regarding that business. You can easily handle the EIN cancellation process through the US Legal Forms platform.

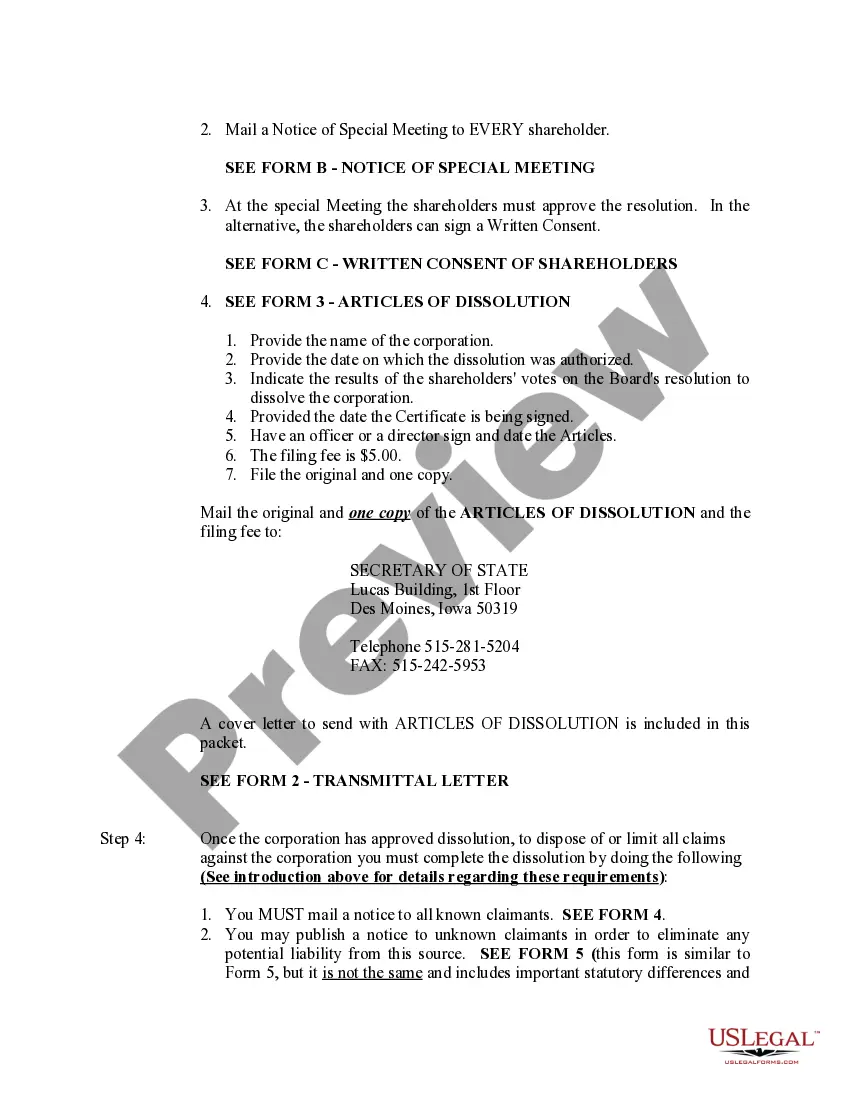

The first step in terminating a corporation involves obtaining approval from the shareholders during a formal meeting. Following approval, you must prepare and file the dissolution documents with the appropriate state agency. This initial step is essential to ensure that the dissolution process adheres to legal requirements. For assistance, consider using platforms like US Legal Forms that provide templates and guidance to dissolve a corporation with the US.

Dissolving a corporation may lead to various tax consequences, including potential capital gains taxes on assets distributed to shareholders. Shareholders may also need to report these distributions on their personal tax returns. Therefore, it is critical to understand these implications and plan accordingly. Consulting with tax professionals and using resources like US Legal Forms can help clarify the tax implications of your decision to dissolve a corporation with the US.

There are several methods for dissolving a corporation, including voluntary dissolution initiated by the shareholders or involuntary dissolution imposed by a court. The most common method is a voluntary dissolution, which requires a formal vote by shareholders and proper filing with state authorities. Using US Legal Forms can simplify this process, ensuring you have all necessary documents to dissolve a corporation with the US.

To dissolve a corporation in the USA, you need to follow specific steps depending on the state where your business operates. Generally, it involves filing dissolution documents with the Secretary of State, settling debts, and notifying stakeholders. For a seamless process, consider using platforms like US Legal Forms to ensure compliance with all legal requirements during the dissolution to dissolve a corporation with the US.

When you dissolve a corporation, the corporation's debts do not simply disappear. Creditors can still pursue the corporation for outstanding debts. However, if the corporation has no assets left, the creditors may not have recourse. It’s crucial to settle debts and notify creditors before proceeding with the dissolution to prevent further complications.

You can notify the IRS that your business is closed by filing your final tax return and indicating that it is the last return for your corporation. This step is essential to officially inform the IRS about your corporation’s closure. For a smoother process, consider using USLegalForms, which provides essential forms and guidance to effectively dissolve a corporation with the US.