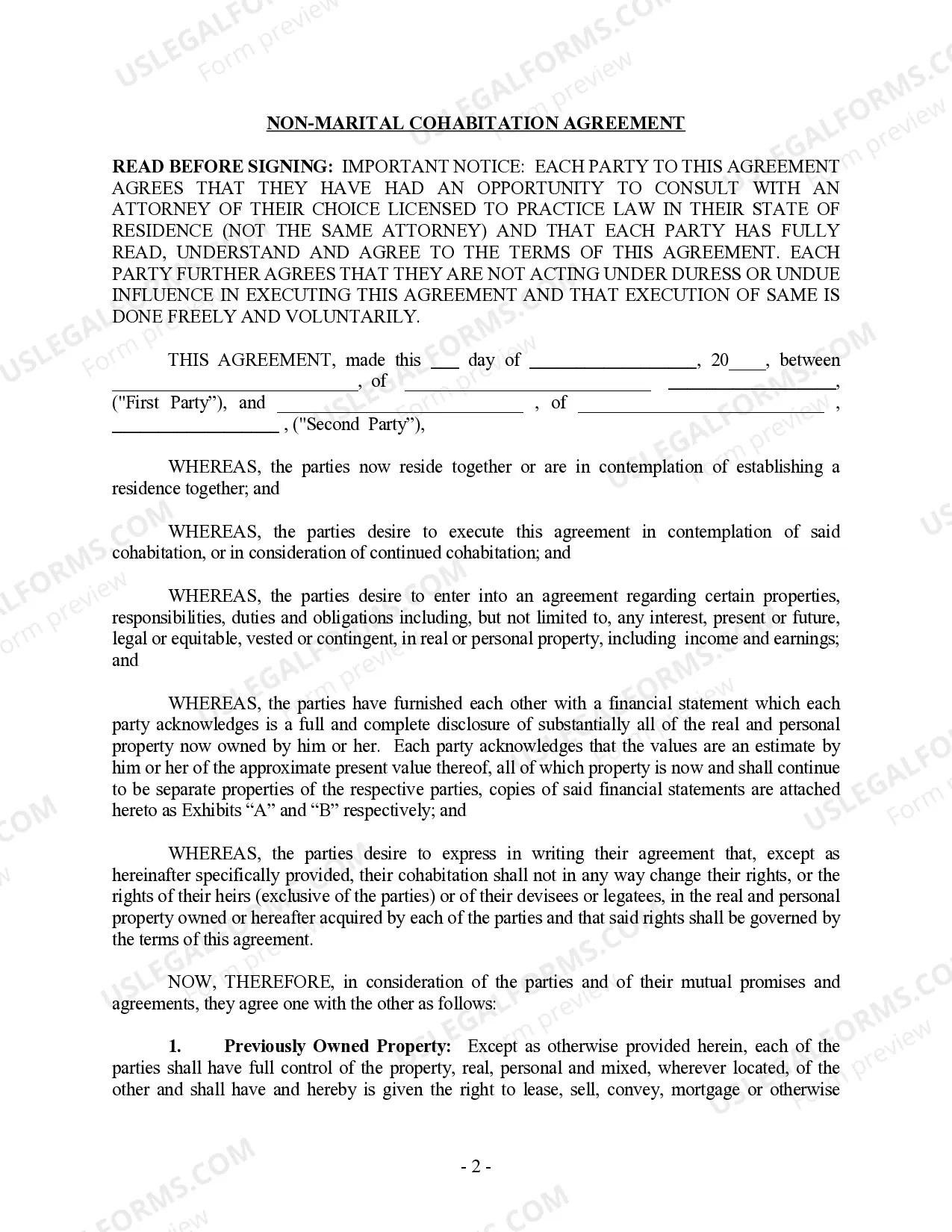

Non-Marital Cohabitation Agreement: Many disputes can arise from forming a living arrangement with another person. Expectations are often not clear causing disharmony and other problems.

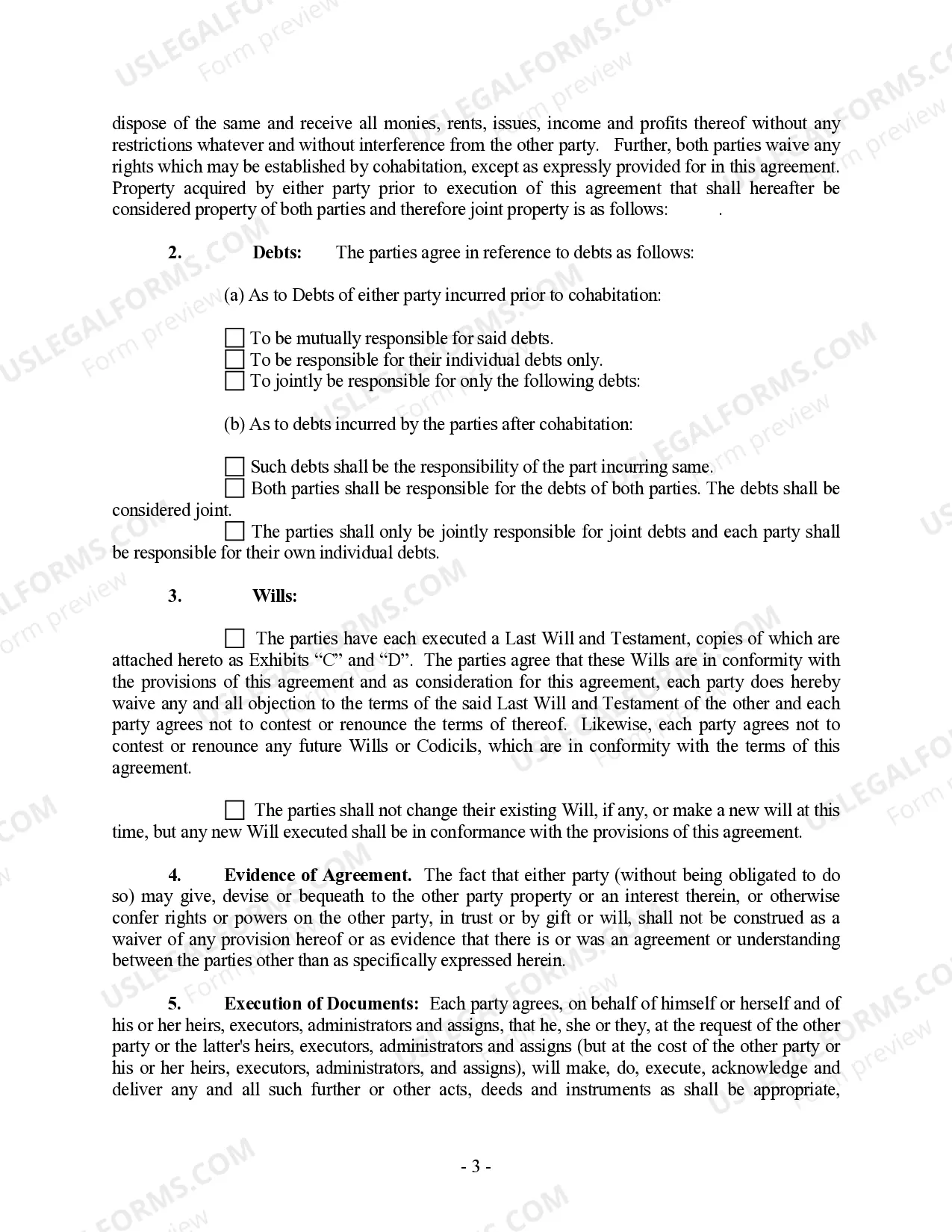

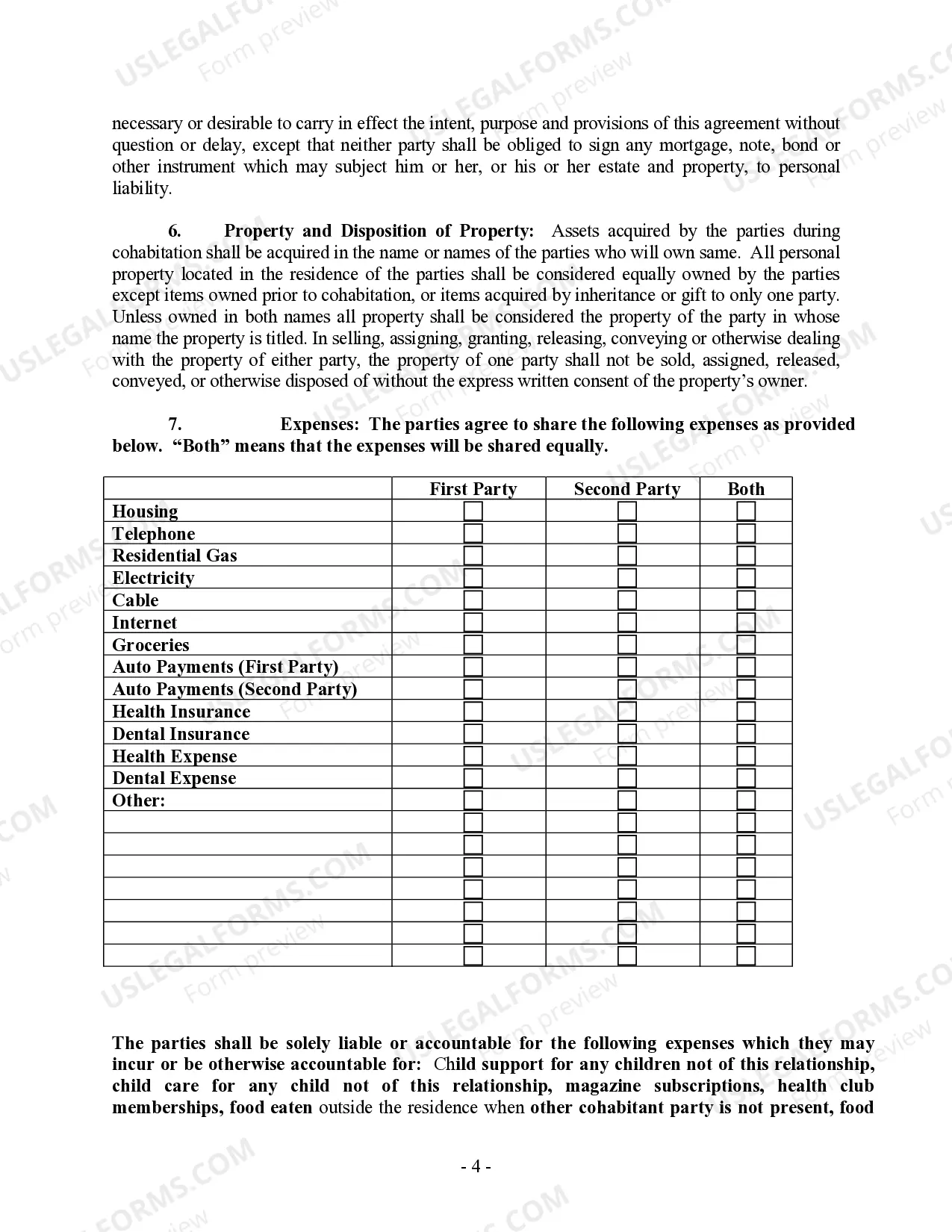

The Non-Marital Cohabitation Agreement helps clarify what is expected of each party. It contains provisions relating to expenses, assets and what happens if the parties discontinue the living arrangement, including ownership and division of property acquired during the course of the relationship.