Trust Vs Will In Iowa

Description

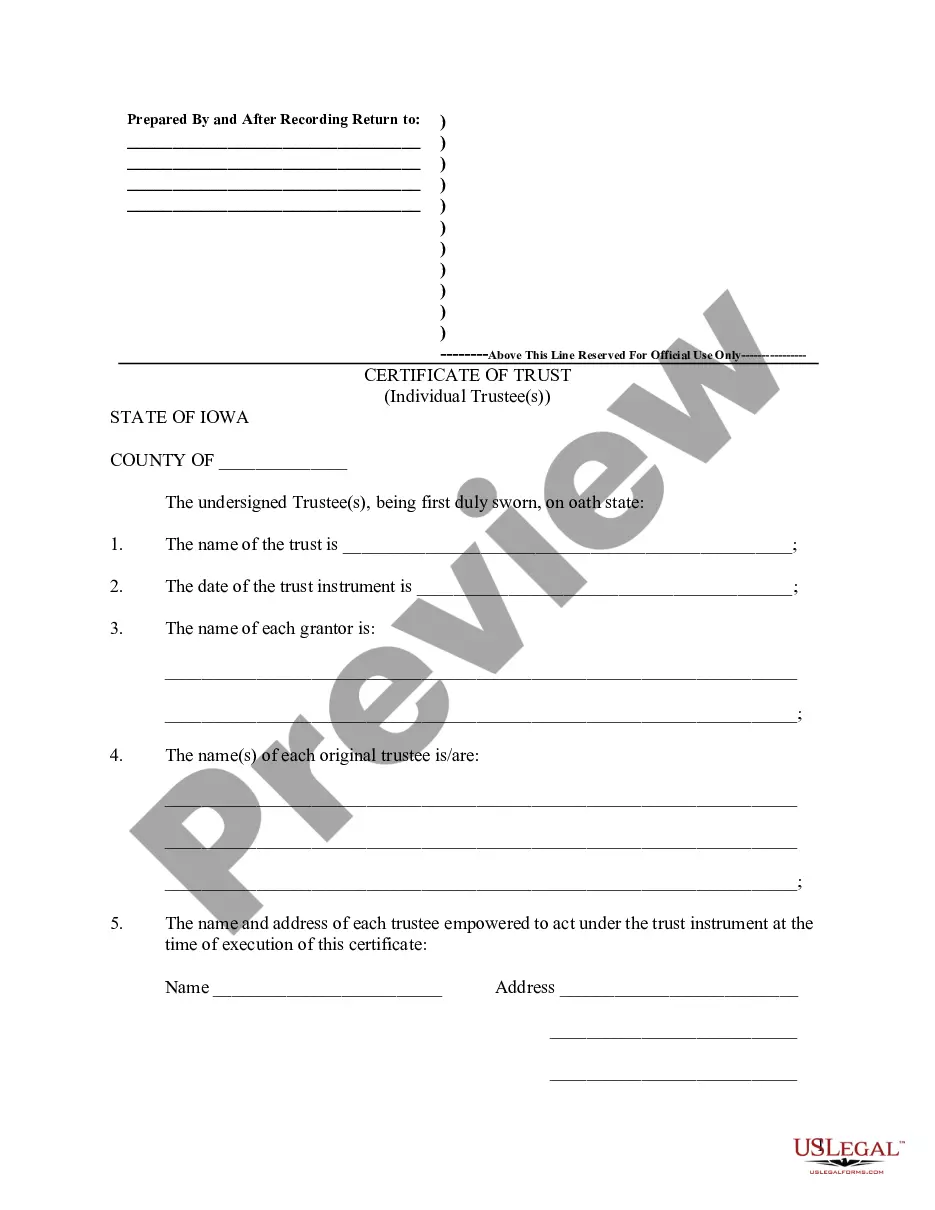

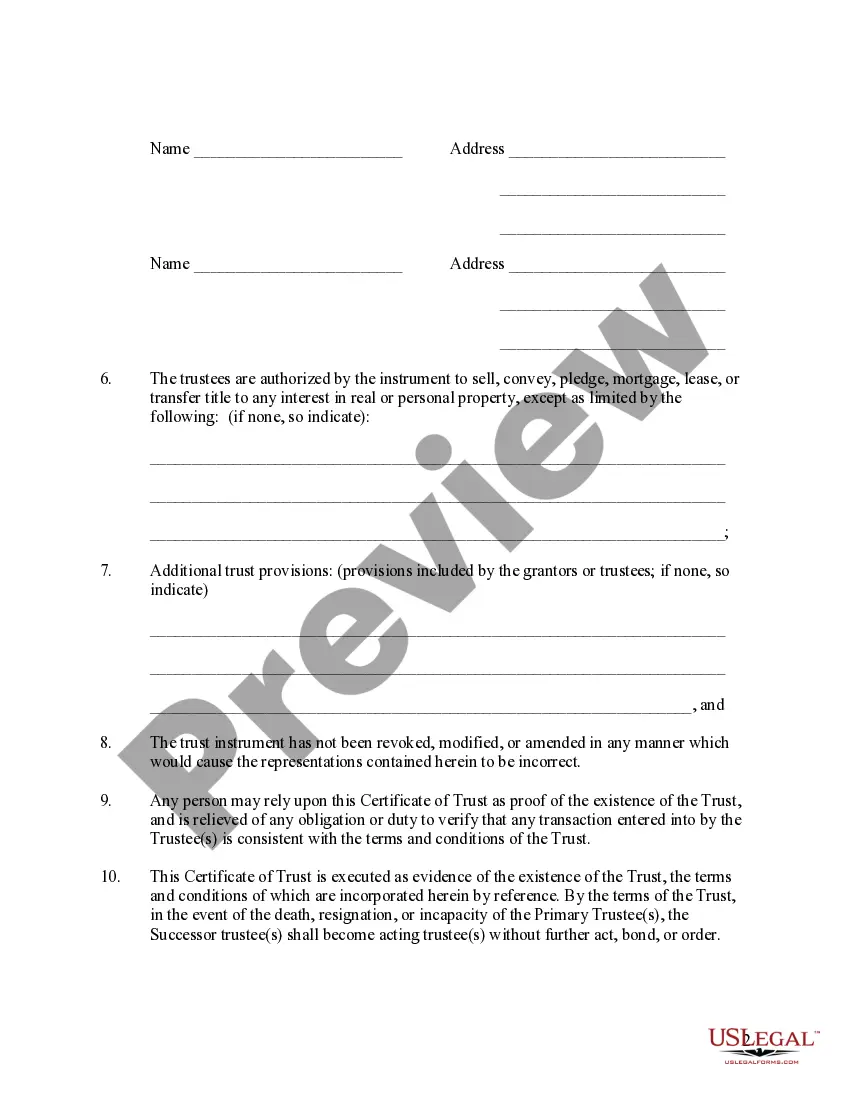

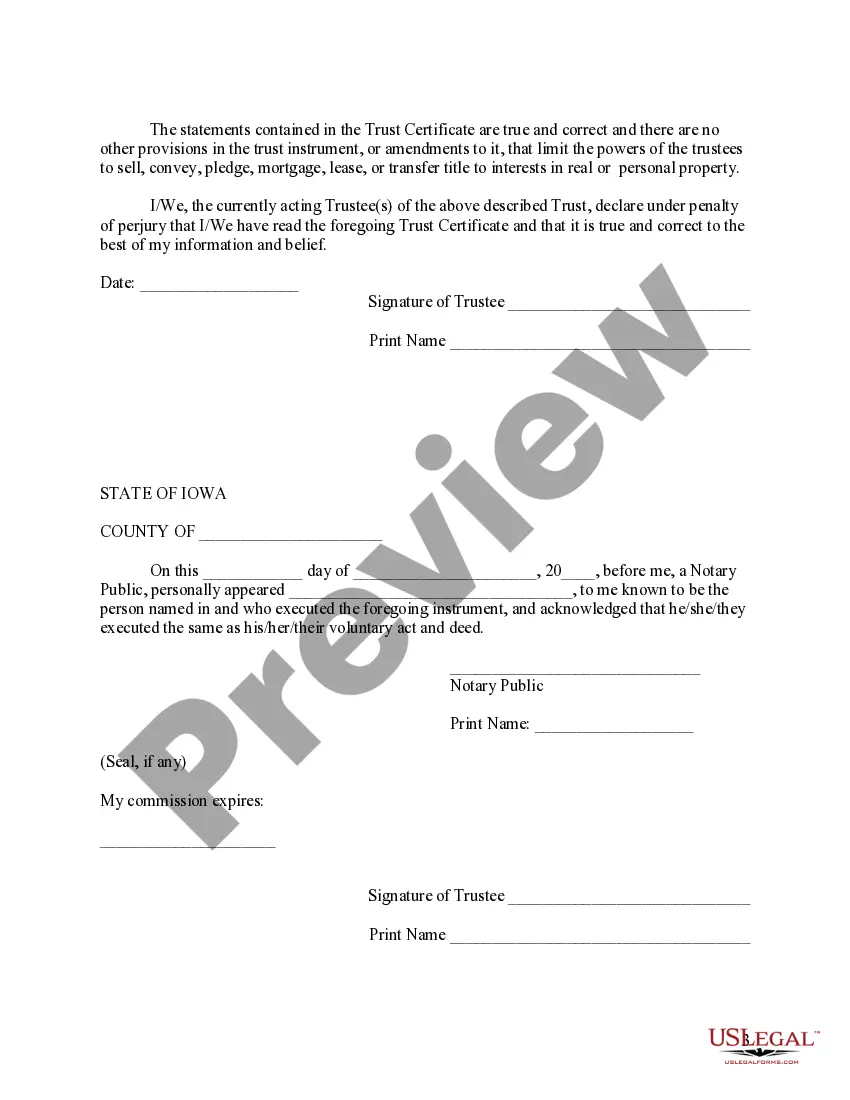

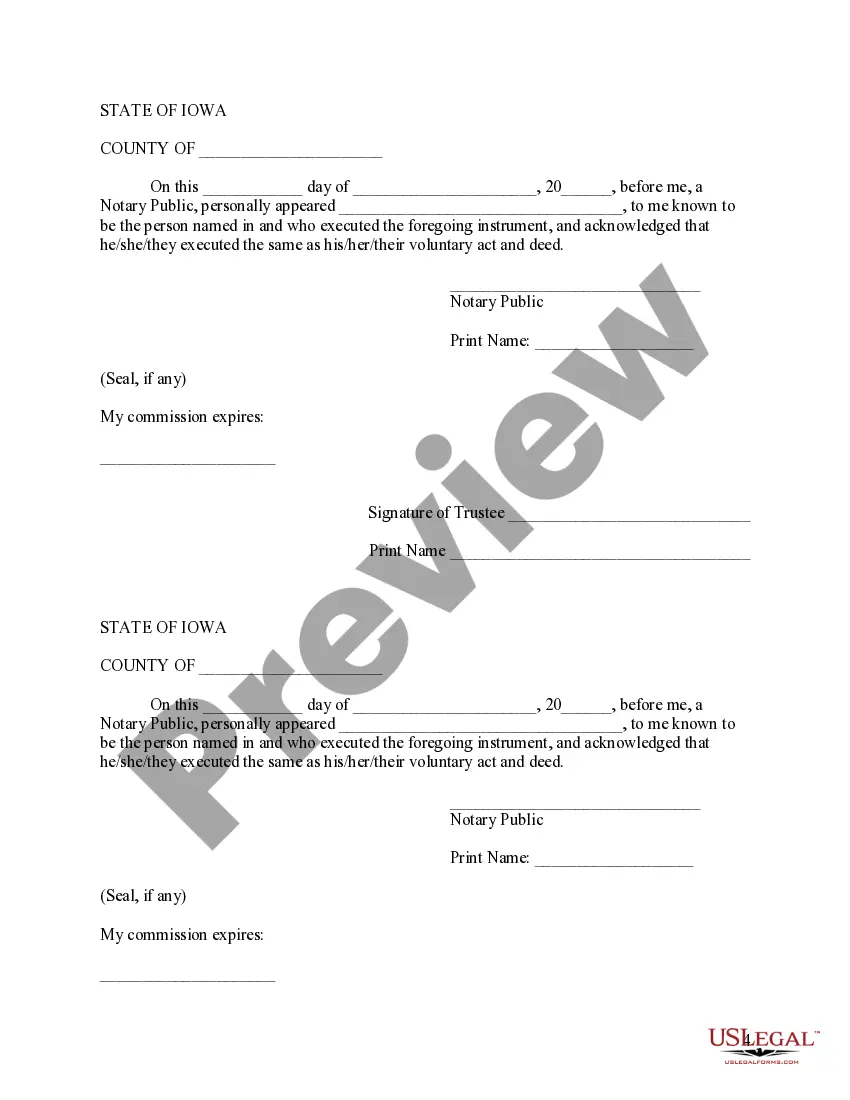

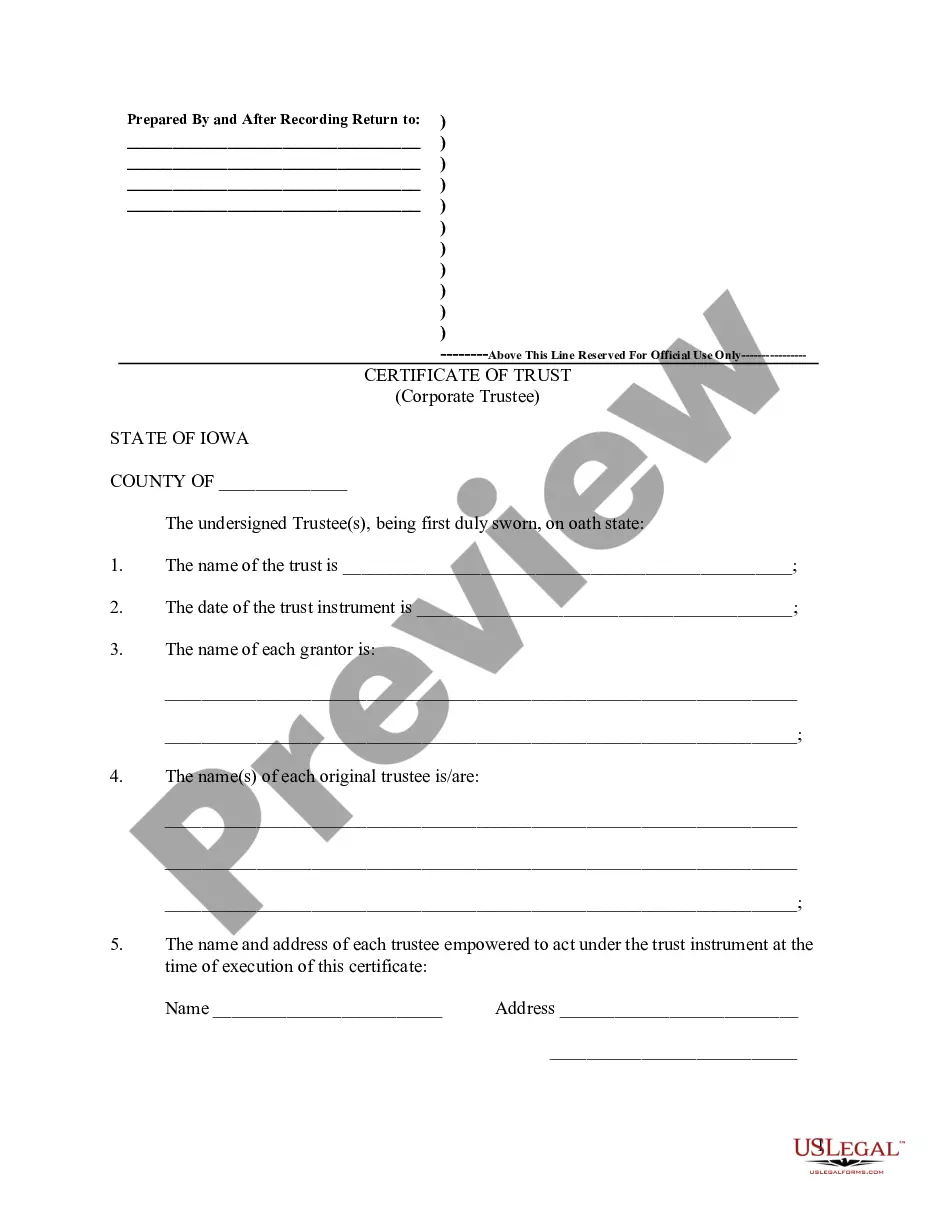

How to fill out Iowa Certificate Of Trust By Individual?

Dealing with legal paperwork and processes can be a lengthy addition to your schedule.

Trust Vs Will In Iowa and similar forms typically necessitate that you search for them and comprehend the optimal way to fill them out accurately.

Thus, whether you are managing financial, legal, or personal affairs, having a comprehensive and accessible online collection of forms readily available will greatly assist you.

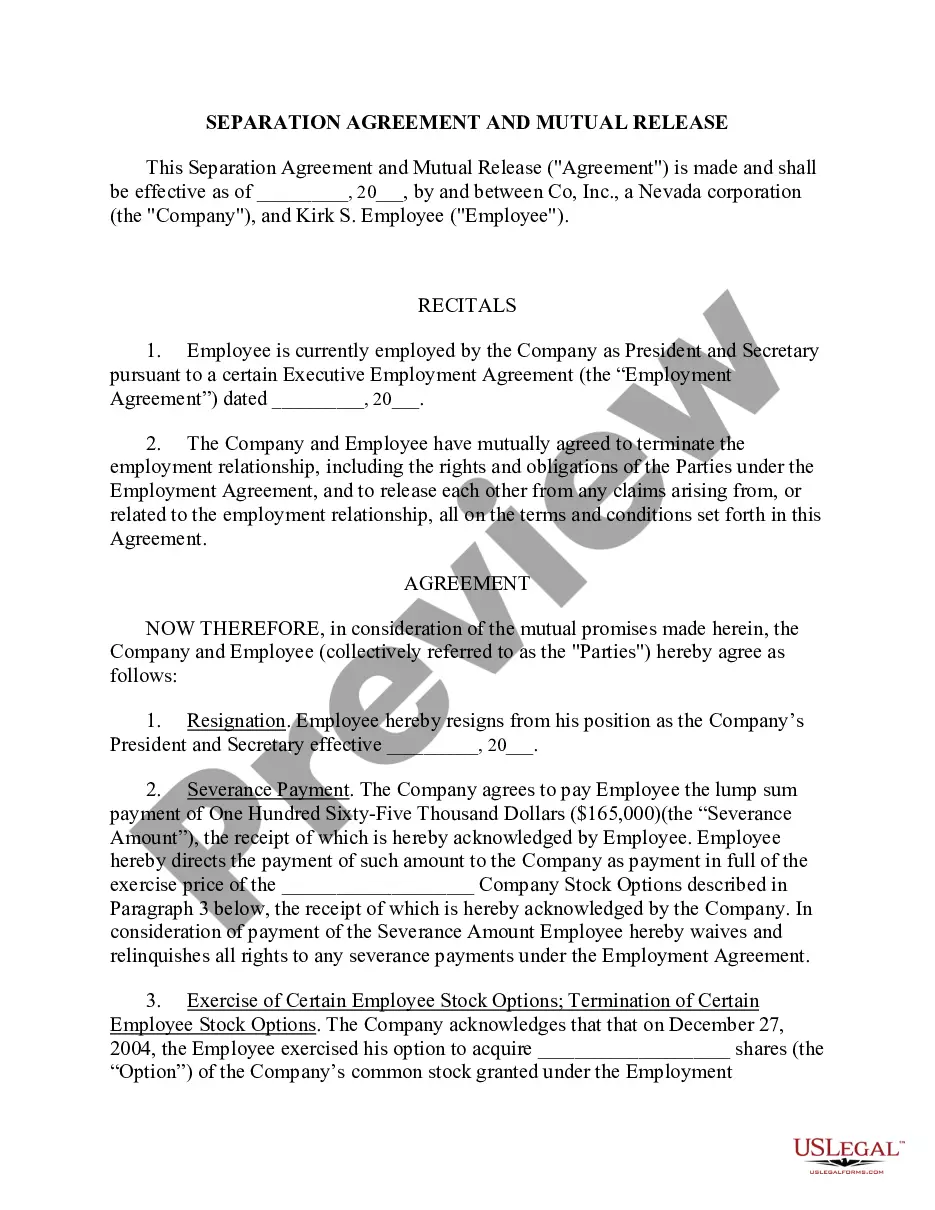

US Legal Forms is the premier online resource for legal templates, providing over 85,000 state-specific forms alongside various tools to help you complete your documents effortlessly.

Is this your first time using US Legal Forms? Sign up and create your account in just a few minutes to gain access to the form collection and Trust Vs Will In Iowa. Then, follow the steps below to fill out your form: Ensure you have identified the correct form using the Preview function and reviewing the form details. Select Buy Now when prepared, and pick the subscription plan that suits your requirements. Click Download and then complete, sign, and print the form. US Legal Forms has twenty-five years of expertise aiding clients in managing their legal documents. Find the form you need today and streamline any process without exerting unnecessary effort.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms offers state- and county-specific forms accessible at any time for download.

- Safeguard your document management procedures using a top-notch service that enables you to create any form within minutes with no extra or hidden fees.

- Simply Log In to your account, find Trust Vs Will In Iowa, and download it immediately from the My documents section.

- You can also retrieve previously downloaded forms.

Form popularity

FAQ

Understanding the Difference Between Wills & Trusts The will becomes effective upon your death. A living trust, on the other hand, is a legal arrangement in which you select a trustee to manage your assets and distribute them to your beneficiaries. The trustee must distribute the assets as you outline in your will.

Do I need a living trust in Iowa? An Iowa living trust can be a useful tool. One of the many benefits is the control it offers. While you are alive, you continue to maintain complete control over your assets, living in your home and using your money as you wish.

Key Takeaways. A will is a simple legal document that provides instructions on how to distribute property to beneficiaries after death, while a trust is a complex legal contract that allows you to transfer your property to an account to be managed by another person.

Four Reasons You Don't Need a (Revocable) Trust Probate avoidance is the only goal. While this is an admirable goal, a trust may not be the only way to avoid probate. ... You have straightforward wishes. ... You're motivated by tax savings or Medicaid eligibility. ... You're not great at follow-through.

How Do I Set Up A Living Trust In Iowa? Take inventory of the property that will be included in the trust. Name a successor trustee. Decide who will be the beneficiaries of the trust (those that will get the property after you die) Seek an attorney to help prepare the trust documents.