Trust Executed Certificate With 0

Description

How to fill out Iowa Certificate Of Trust By Individual?

- If you're an existing user, log in to your account. Make sure your subscription is active and download the required form template by hitting the Download button.

- For first-time users, start by browsing the extensive library. Check the Preview mode and read the description of the forms to ensure it meets your jurisdiction's requirements.

- If the form isn’t right, use the Search tab to locate a suitable alternative. Confirm that the new document meets your needs and proceed to the following step.

- Purchase the document by clicking the Buy Now button. Select your preferred subscription plan and create an account to gain full access.

- Complete your transaction, providing payment details through a credit card or your PayPal account.

- Download the form and save it on your device. You can always find it later in your My Forms section.

US Legal Forms not only simplifies the process of acquiring legal documents but also ensures that users can rely on precision and compliance with legal standards.

Ready to take control of your legal needs? Start using US Legal Forms today and experience the ease of acquiring your trust executed certificate with 0 hassle.

Form popularity

FAQ

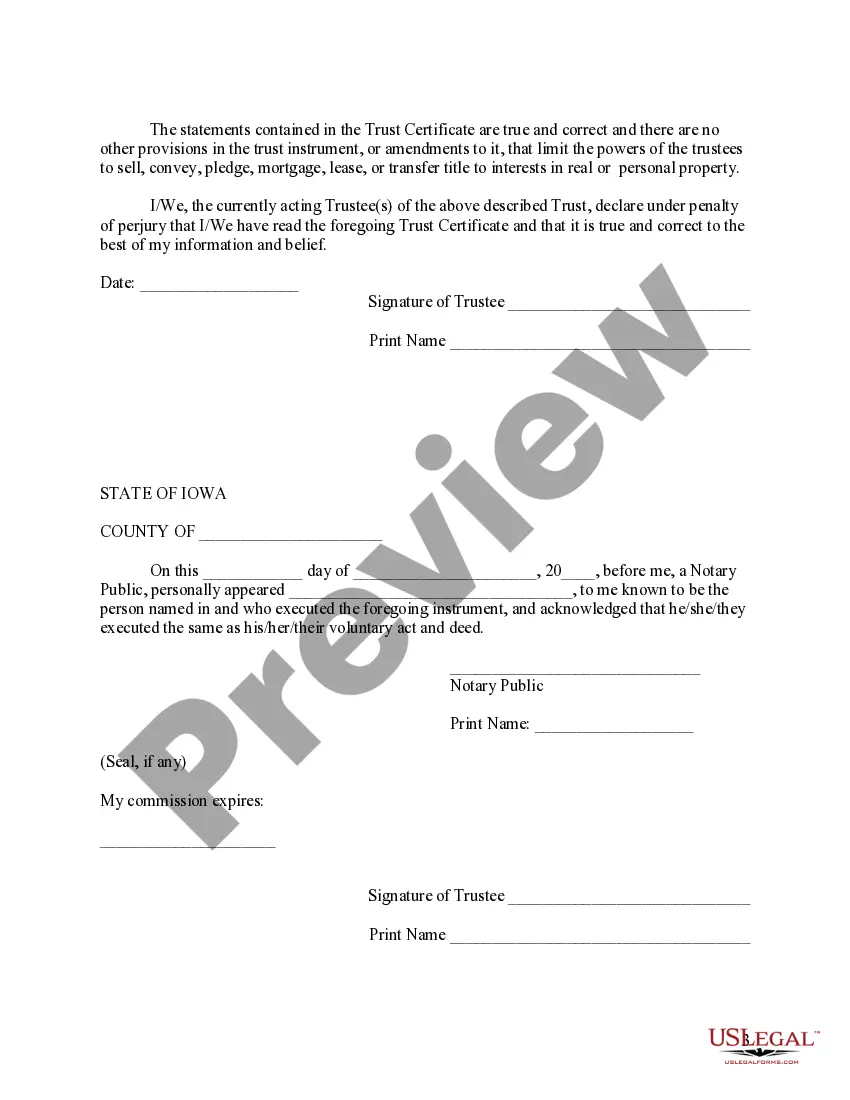

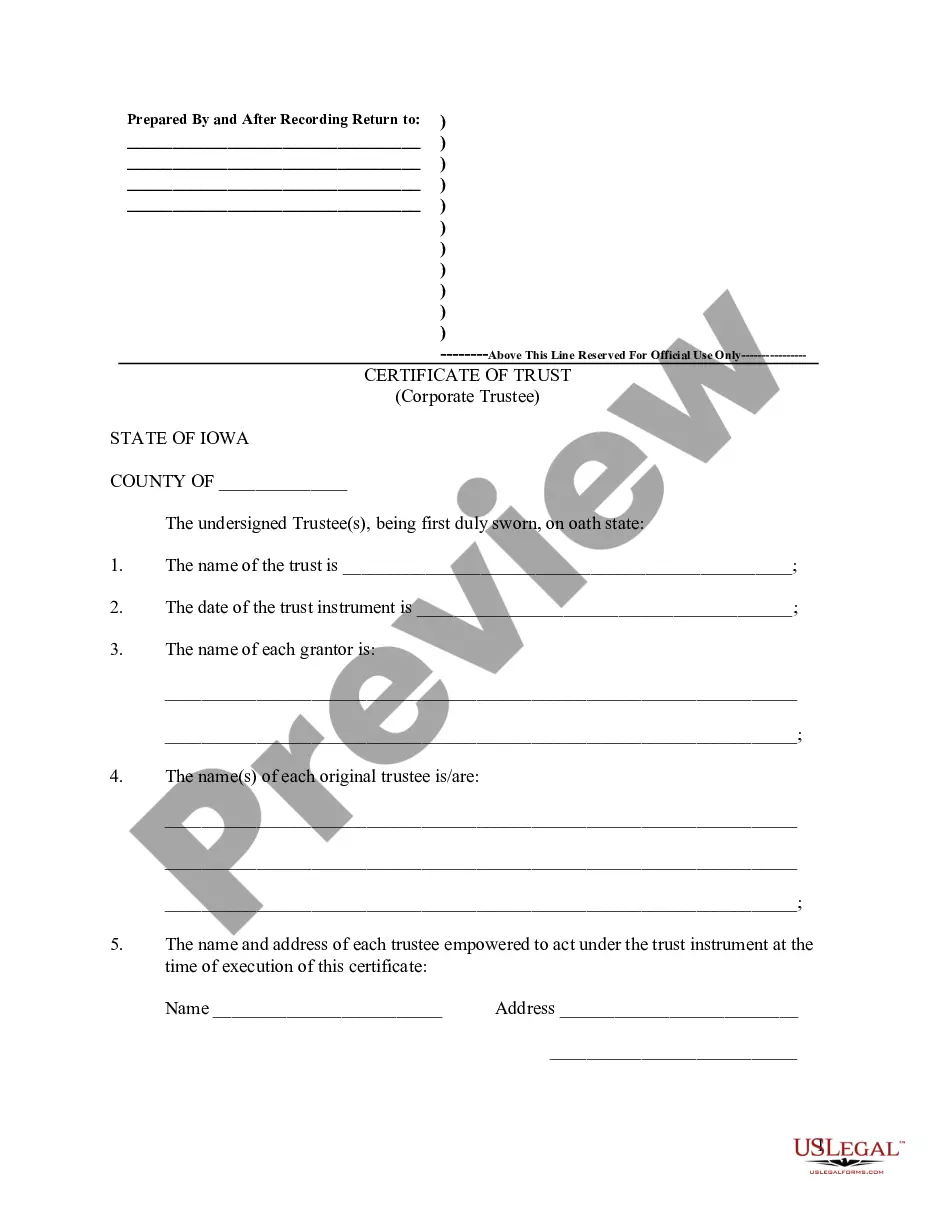

To record a certificate of trust, you typically need to file it with your state’s regulatory office or county recorder's office, depending on local laws. Make sure to include all relevant information, such as the trust's name, details of the trustee, and the date it was executed. Using a template for a Trust executed certificate with 0 from US Legal Forms can guide you through the proper recording process, ensuring all requirements are met for a valid certification.

Certifying a trust means creating a formal document that verifies the existence of the trust and outlines the powers of the trustee. This certification is often necessary when dealing with financial institutions or other entities that require proof of the trust. A Trust executed certificate with 0 ensures that all involved parties recognize the legal standing of the trust, making it easier to manage assets and fulfill fiduciary duties.

If there is no income generated by the trust, you generally are not required to file a final Form 1041. However, it is essential to check your specific state regulations, as they may have different requirements. Always consider consulting a tax professional or legal service, like US Legal Forms, to ensure compliance and avoid any potential issues regarding your Trust executed certificate with 0.

Yes, you can create your own certificate of trust, but it is important to ensure that it meets all legal requirements. It should clearly state the trust's name, date, and the trustee's authority. While you can draft it yourself, a Trust executed certificate with 0 that complies with state laws might be more easily achieved by utilizing services from US Legal Forms, ensuring your document is both valid and effective.

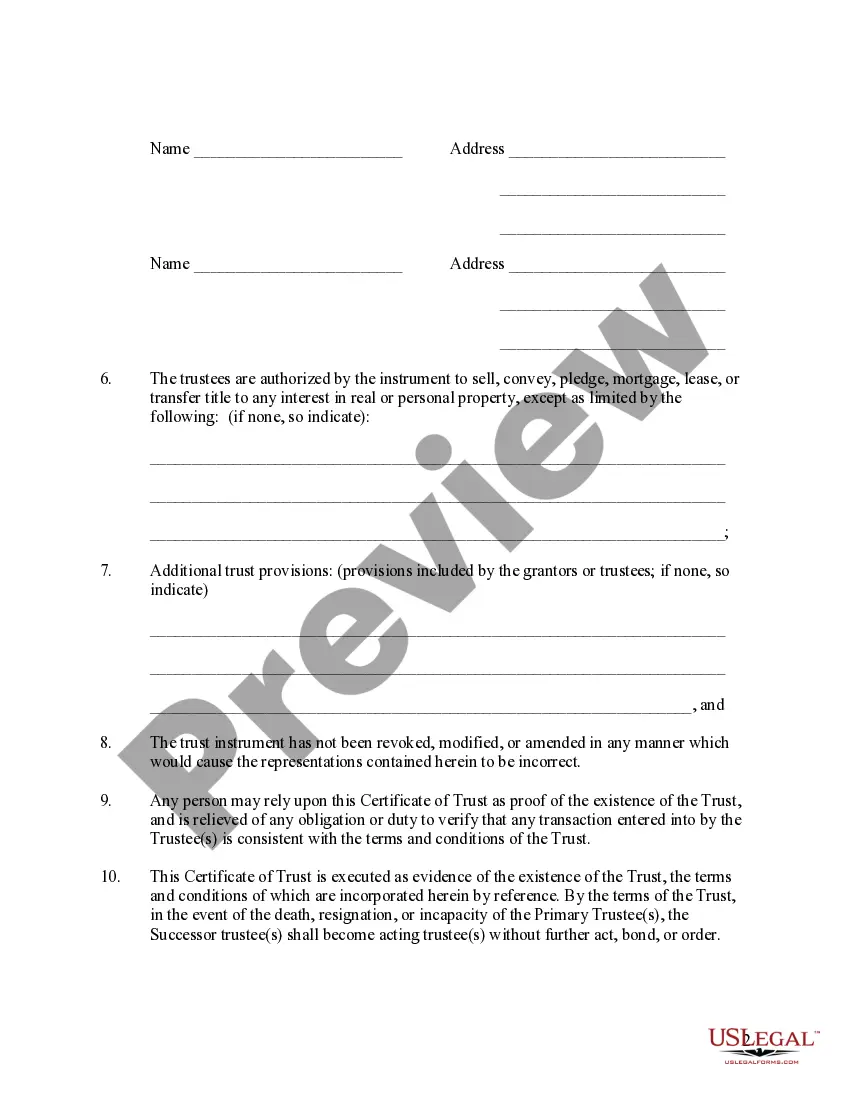

Filling out a trust certification involves gathering all necessary information about the trust and its terms. Start by including the trust's name, date of establishment, and the names of the trustees. Ensure you use a clear structure to present the details, such as the purpose of the trust and its beneficiaries. For creating a Trust executed certificate with 0, consider using platforms like US Legal Forms for structured guidance and templates.

To obtain a tax ID number for a trust after death, you need to fill out Form SS-4 and submit it to the IRS. This step is crucial for managing the trust's financial matters effectively. A Trust executed certificate with 0 can streamline this process and ensure all necessary documentation is in order.

An estate can claim the Section 121 exclusion if the decedent's residence meets certain criteria, including ownership and residence tests. The exclusion is typically available for properties sold during the estate administration period. Utilizing a Trust executed certificate with 0 can assist in verifying eligibility for claiming this exclusion.

You can report the Section 121 exclusion on your individual income tax return (Form 1040) in the capital gains section. It's essential that you complete the necessary schedules to reflect the exclusion properly. By incorporating a Trust executed certificate with 0 in your documentation, you can provide clarity and assurance about your reporting.

The section 121 loophole refers to the legal provisions that allow homeowners to exclude capital gains from the sale of their primary residence under certain conditions. This can lead to significant tax savings, especially when properties are sold within specific time frames. Using a Trust executed certificate with 0 can help navigate this loophole effectively.

To claim the section 121 exclusion, you must ensure that you meet the necessary requirements regarding ownership and use of the property. Typically, this involves using Form 1040 and reporting the exclusion as you file. Additionally, understanding the legitimacy of a Trust executed certificate with 0 can bolster your claims and safeguard your interests.