Iowa Trust With Us Address

Description

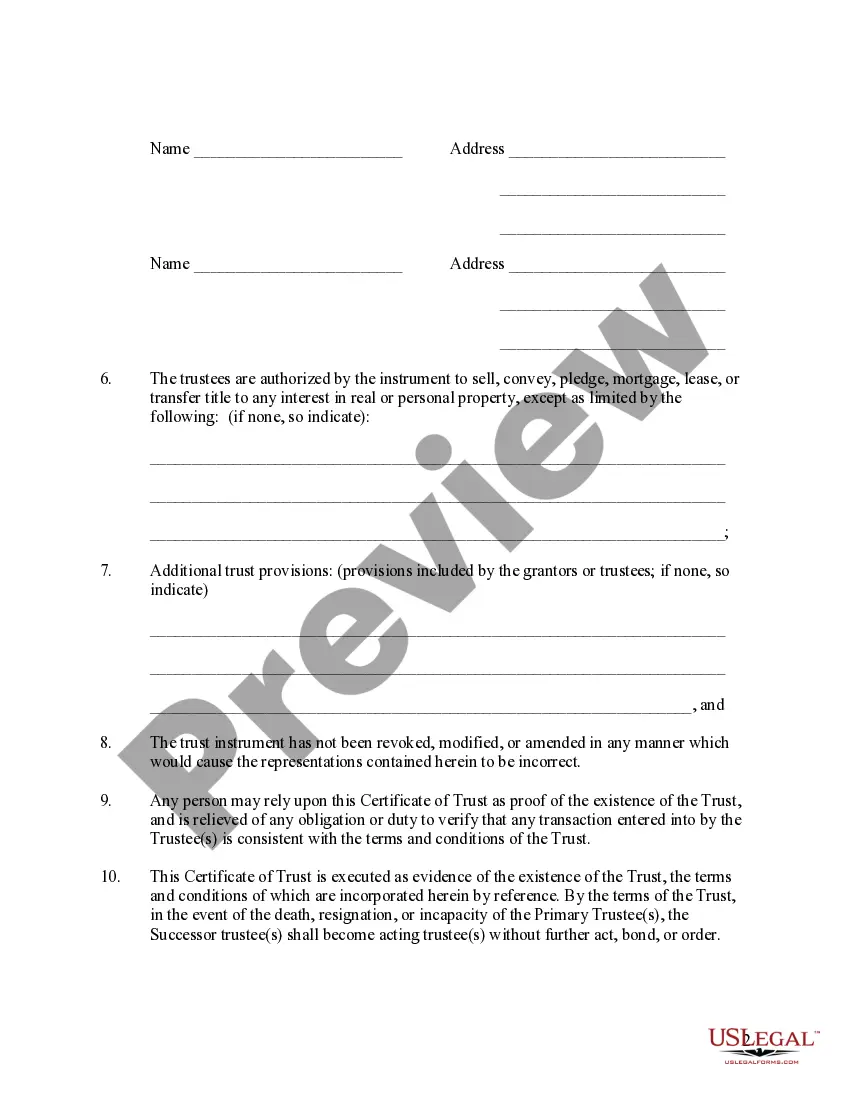

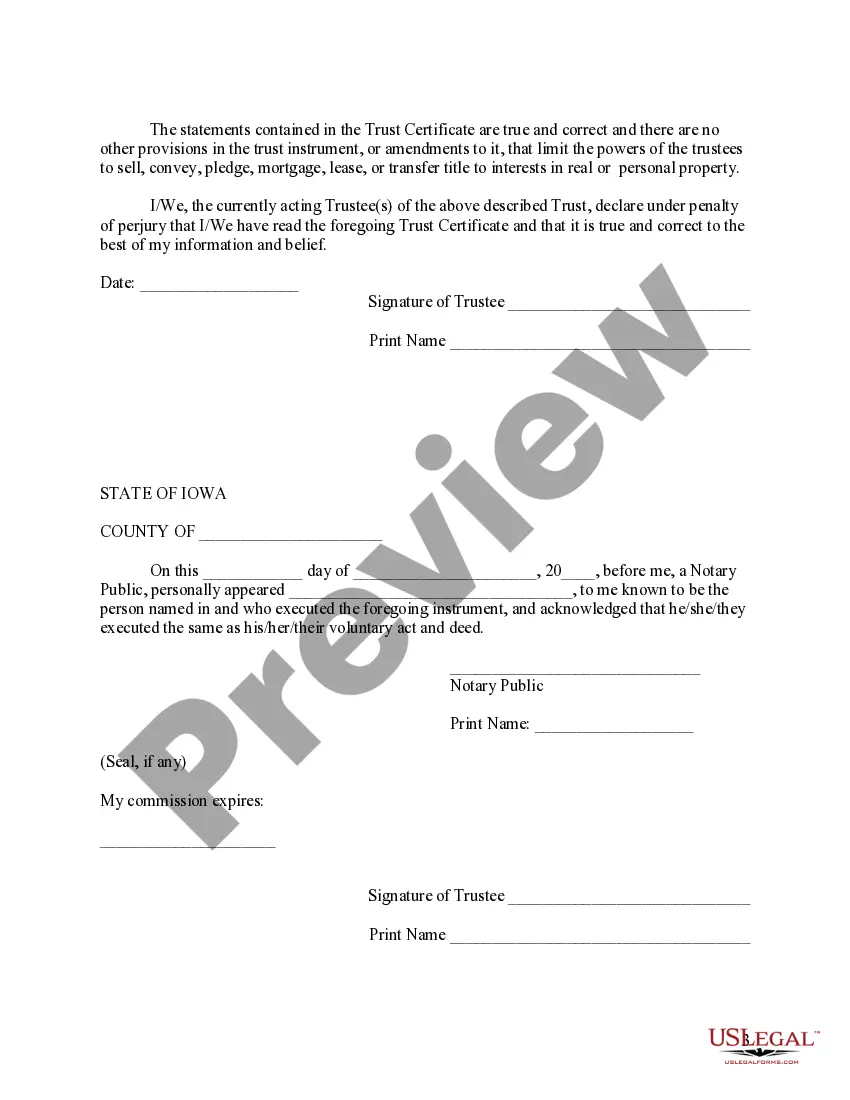

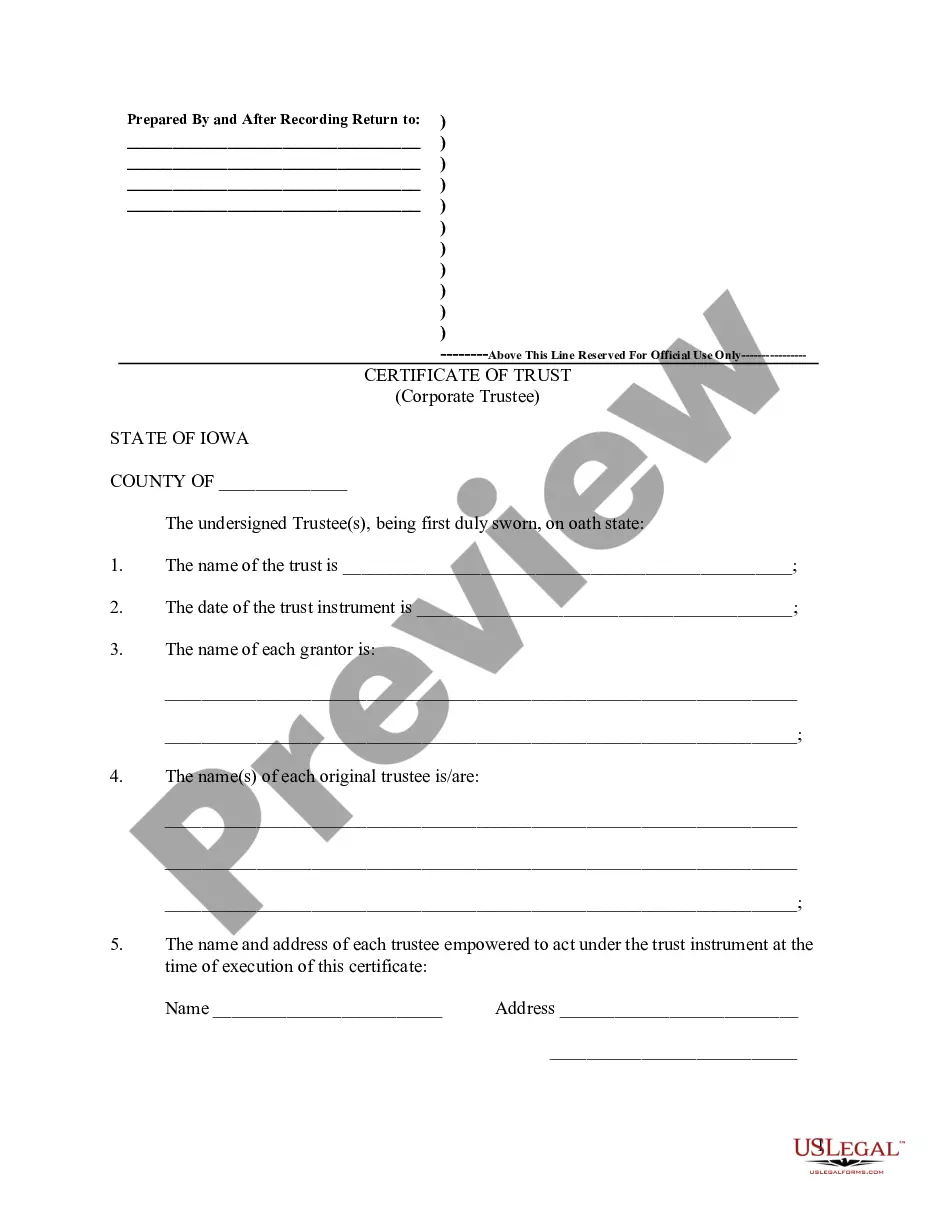

How to fill out Iowa Certificate Of Trust By Individual?

- If you are a returning user, log in to access your account and download the necessary form template. Ensure your subscription is up-to-date; if not, renew it as per your payment plan.

- For first-time users, begin by selecting the correct form for your needs. Review the preview mode and description to confirm it meets your jurisdiction's requirements.

- If adjustments are needed, utilize the Search tab to find alternative templates until you discover the one that suits your needs.

- Once you have the correct form, click 'Buy Now' and select your preferred subscription plan. Registration is required to unlock full access to our resources.

- Proceed to payment by entering your credit card information or using PayPal for your subscription purchase.

- Finally, download the form to your device, allowing you to fill it out at your convenience. You can always access it from the My Forms section in your profile.

US Legal Forms not only provides users with a robust collection of documents but also ensures that you are supported throughout the process of creating legally binding agreements.

Start your journey towards hassle-free legal documentation today. Explore our resources and trust US Legal Forms to simplify your legal needs!

Form popularity

FAQ

A simple trust generally pays taxes on its income at the individual tax rates applicable in the state it is filed in; in Iowa, these rates can range based on the income earned. A simple trust is required to distribute all income to beneficiaries, who then report it on their personal tax returns. Understanding the nuances of the Iowa trust with us address can help ensure proper tax handling and compliance.

Trust income tax rates can appear high due to the graduated tax brackets that increase rapidly as income rises. Trusts often reach the highest tax brackets more quickly than individuals, which can lead to increased tax liability. By leveraging the Iowa trust with us address, you can explore options to minimize these tax burdens.

Trusts can be taxed based on their income, with rates varying by state and type of trust. In Iowa, trust income is subject to state and federal taxation. Understanding the tax implications and utilizing the Iowa trust with us address can help you effectively manage your tax responsibilities.

A trust typically files in the state where it is created or where the trust's assets are located. If the trust earns income in multiple states, it may need to file in each state. It's essential to review the Iowa trust with us address in the context of interstate trust matters to ensure compliance and optimize tax outcomes.

The trust tax rate in Iowa varies depending on the income level of the trust. Generally, tax rates can range from 0.36% to 8.53%. For specific tax situations, consider consulting with a tax advisor to understand how the Iowa trust with us address pertains to your trust's income.

One common mistake parents make when setting up a trust fund is not clearly outlining their wishes or instructions for the trust. This lack of clarity can lead to confusion and disputes among beneficiaries. To avoid this pitfall, it is crucial to document your intentions properly, and our service can assist you in creating a comprehensive Iowa trust with us address that reflects your desires.

Setting up a trust in Iowa involves several steps, including deciding on the type of trust you need and drafting the necessary documents. Consulting with a legal professional can help ensure that your trust meets legal requirements. Additionally, our platform can guide you through the process of establishing your Iowa trust with us address with ease and confidence.

When considering banking in Iowa, many people turn to Wells Fargo, which is among the most prominent banks in the state. They offer various financial services that help individuals manage their finances effectively. If you are thinking about setting up an Iowa trust with us address, it’s beneficial to partner with a trusted bank that understands your needs.

Certain individuals, such as those earning below specific income thresholds, may be exempt from Iowa withholding. Additionally, certain types of income may not require withholding. Staying informed about these exemptions helps in financial planning, particularly with regard to an Iowa trust with us address.

Yes, Iowa imposes nonresident withholding on certain types of income for nonresidents earning income in the state. This requirement applies to various sources and can impact both individuals and businesses. For detailed guidance, it’s beneficial to explore resources related to Iowa trust with us address.