Iowa Trust With Us

Description

How to fill out Iowa Certificate Of Trust By Individual?

- If you're a returning user, log into your account to access and download the form you need. Ensure your subscription is current; if not, renew it based on your plan.

- For new users, start by exploring the Preview mode and descriptions of forms to find one that suits your needs and aligns with local jurisdiction requirements.

- If you encounter inconsistencies, utilize the Search tab to locate the appropriate document. Once confirmed, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You'll need to create an account to unlock access to the library.

- Complete your purchase by entering your credit card details or using PayPal to secure your subscription.

- Finally, download your chosen form and save it to your device. You can also access it later in the My Forms section of your profile.

With US Legal Forms, you gain entry to the largest collection of legal forms, designed to be user-friendly and accessible.

Start simplifying your legal process today, and trust Iowa with us for all your document needs!

Form popularity

FAQ

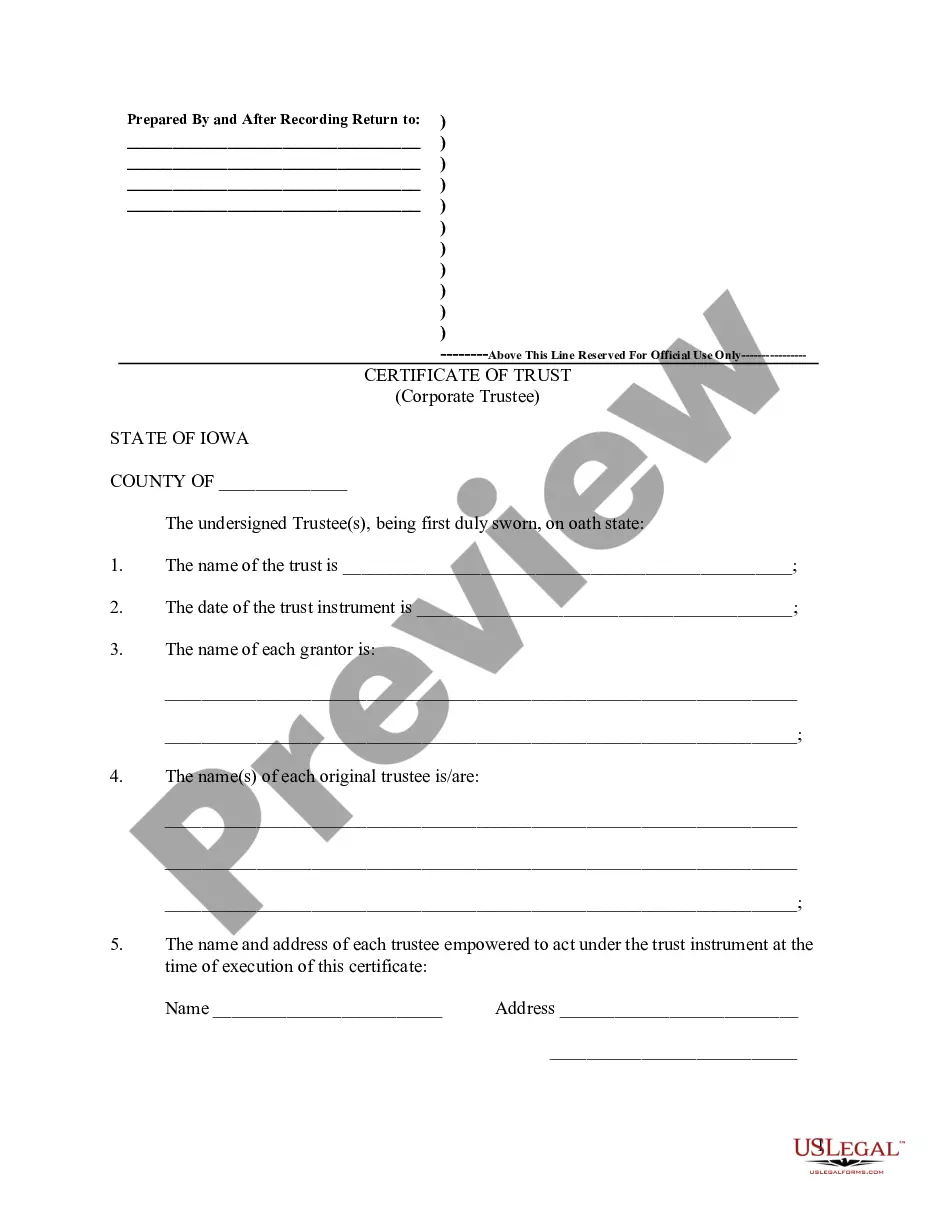

Establishing a trust in Iowa involves a few key steps. First, you need to decide on the type of trust that fits your needs. Next, you’ll create the trust document, outlining how the trust will function and who will manage it. With our services at uslegalforms, you can easily navigate this process and ensure your Iowa trust is set up correctly.

When considering estate planning in Iowa, a trust can offer several advantages over a will. An Iowa trust with us can help you avoid probate, which often leads to faster distribution of assets. Additionally, trusts provide privacy as they do not become public record, unlike wills. This can make your estate management smoother and more beneficial for your beneficiaries.

Iowa Trust and Savings Bank boasts significant assets, reflecting its strong presence in the market. This strength allows the bank to offer a wide range of financial products and services designed for your needs. Choosing Iowa Trust with us means you can rely on a well-established institution to support your financial journey confidently.

Iowa Trust is a prominent financial institution that focuses on building strong relationships with its clients. We offer various services, including savings accounts, loans, and wealth management, tailored to meet your specific financial needs. By partnering with Iowa Trust with us, you can achieve your financial goals while enjoying personalized service.

Zelle is often considered safer than Venmo for several reasons. With Zelle, funds transfer directly from bank to bank, which may offer added security since it uses your existing bank's protocols. When considering safety while managing your finances, it's essential to choose solutions like Iowa Trust that prioritize secure transactions.

The routing number for Iowa Trust and Savings Bank is essential for various banking transactions. You can use it to set up direct deposits, automatic payments, and wire transfers. To ensure accuracy, always verify the routing number by visiting the official Iowa Trust and Savings Bank website or contacting their customer service.

To form a trust in Iowa, begin by identifying your goals and the type of trust that fits your needs. You should draft a comprehensive trust agreement, which clearly outlines how assets will be managed and distributed. It’s beneficial to utilize resources like US Legal Forms for templates and legal advice, ensuring your plans for an Iowa trust with us are set up correctly and effectively.

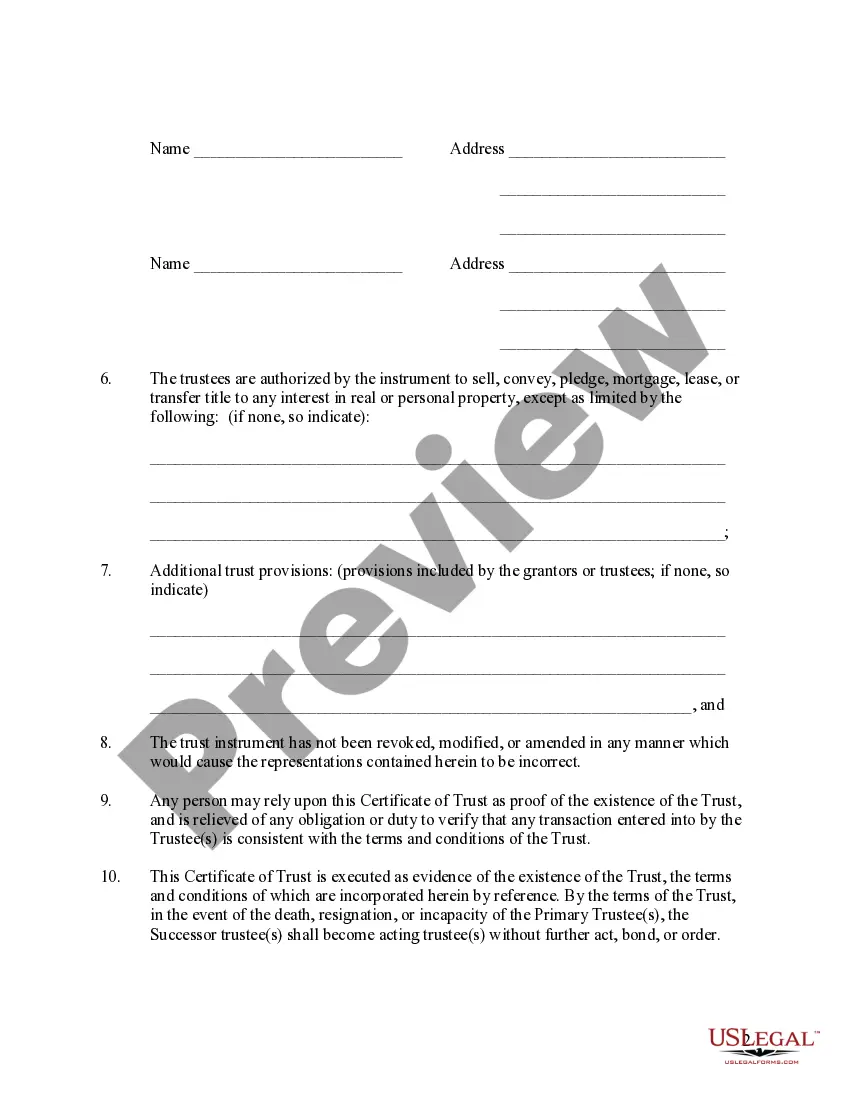

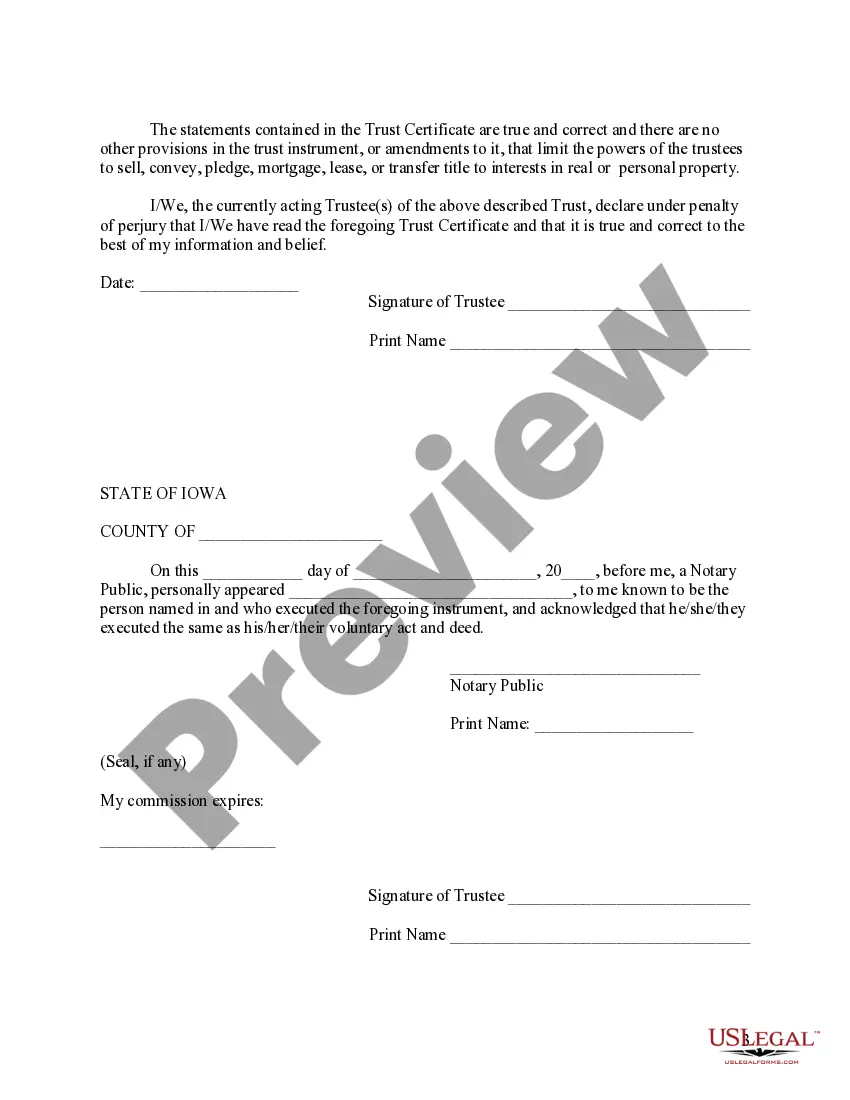

Filling out a trust fund typically involves providing detailed information about the assets you intend to place into the trust, such as property, bank accounts, and investments. Clear instructions on asset distribution and management are crucial for effective trust establishment. US Legal Forms provides templates and guidance to help you accurately complete your trust fund documentation and streamline your Iowa trust with us.

Iowa does not have a specific trust tax rate; instead, the tax rate depends on the income generated by the trust, which is taxed at the beneficiary's personal income tax rate. Trust income can be subject to various taxes, including federal income tax, depending on how distributions are handled. If you have questions about the tax implications for your Iowa trust with us, consulting with a tax advisor or using US Legal Forms can provide clarity.

To file income from a trust in Iowa, you will first need to determine whether the trust is revocable or irrevocable, as this impacts tax filing. Generally, you would report the income generated by the trust on your personal tax return. By utilizing US Legal Forms, you can access resources that guide you through the necessary forms and filings, ensuring you manage your Iowa trust with us correctly.