Iowa Trust With The Seas

Description

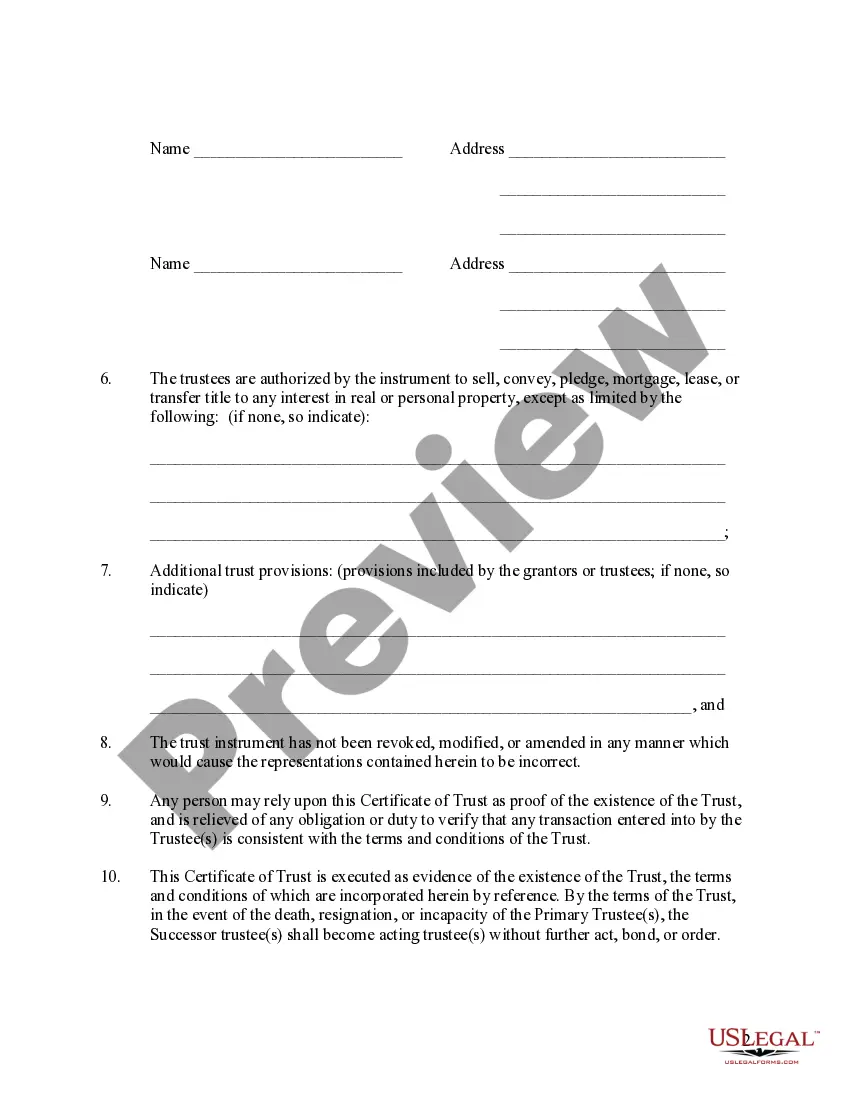

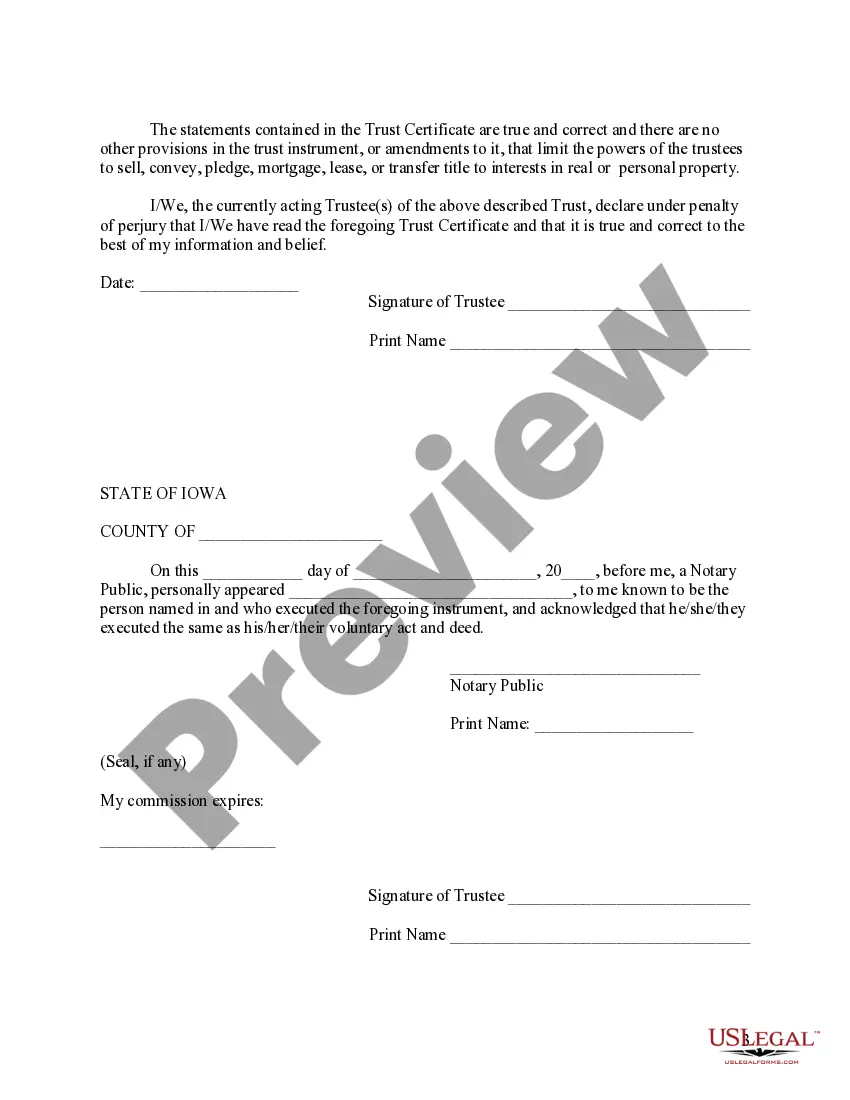

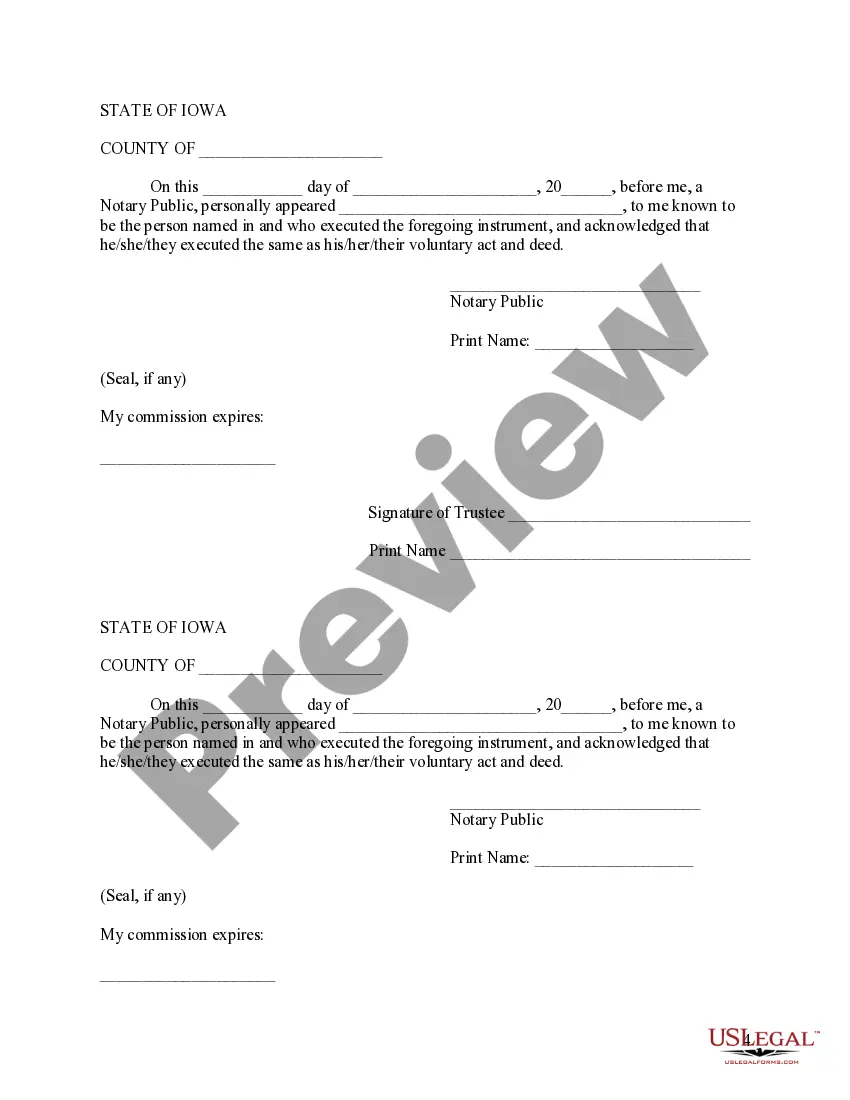

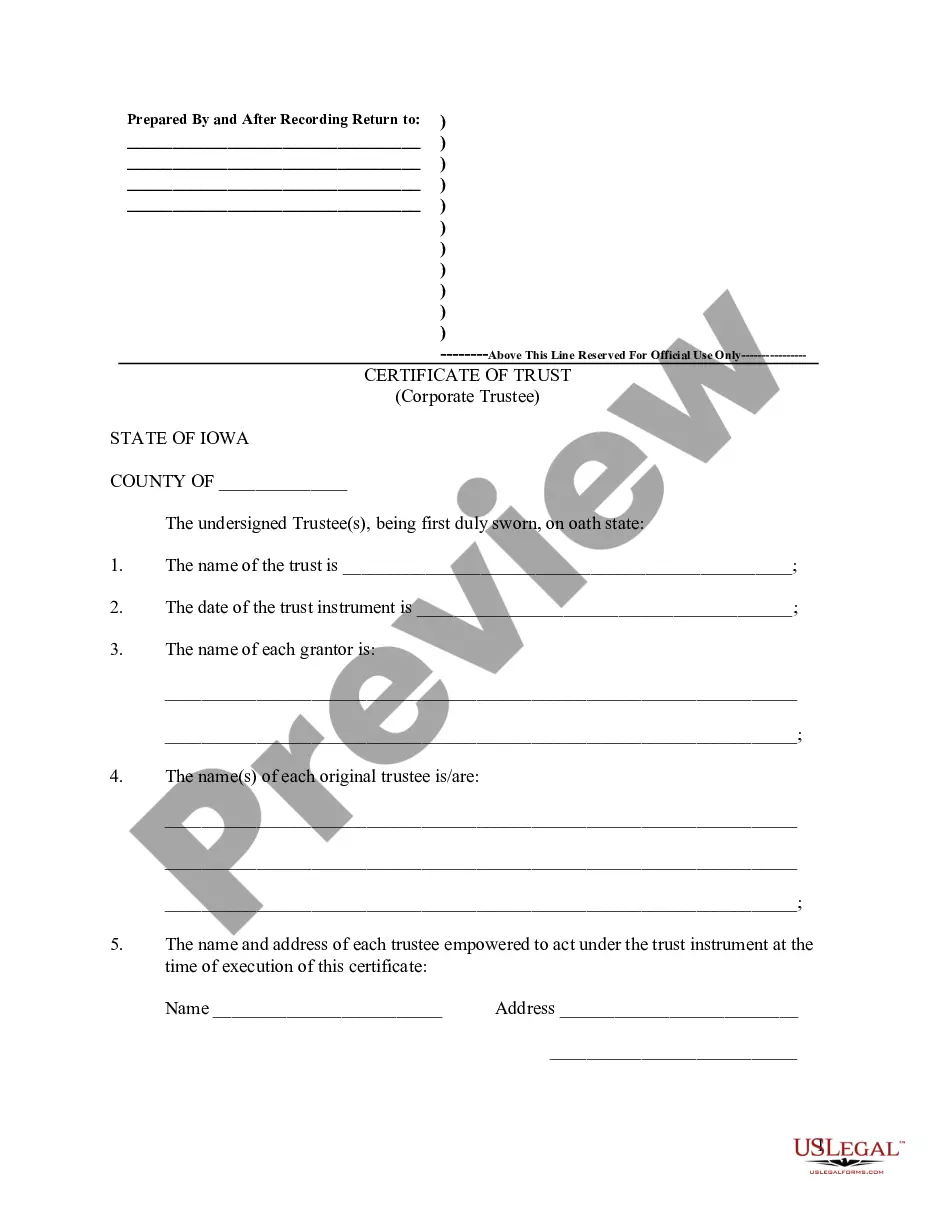

How to fill out Iowa Certificate Of Trust By Individual?

- Start by logging into your account if you are a returning user. Ensure your subscription is active; otherwise, renew it based on your payment plan.

- For first-time users, explore the Preview mode of the desired document. Verify that it meets your specific requirements and adheres to local jurisdiction regulations.

- If adjustments are necessary, utilize the Search tab to locate alternative templates that fit your criteria.

- Proceed to purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You will need to create an account for full access.

- Finalize your payment by entering your credit card information or using your PayPal account.

- Once your transaction is complete, download the form to your device for immediate use and access it anytime from the My Forms section of your profile.

US Legal Forms not only provides a robust collection of over 85,000 fillable legal forms but also gives you exclusive access to premium experts who can assist with form completion, ensuring accuracy and compliance.

In conclusion, US Legal Forms streamlines the process of obtaining essential legal documents. Don't wait any longer—get started today and empower yourself with the forms that protect your interests!

Form popularity

FAQ

To establish a trust in Iowa, start by defining your goals and choosing the right type of trust for your needs. Working with professionals can make the process smoother, and platforms like USLegalForms can guide you in drafting the necessary documents for an Iowa trust with the seas. Once your trust is created, fund it with the appropriate assets to ensure it serves its intended purpose. Finally, inform all relevant parties about the trust's existence and details.

Lawyers use trust accounts to manage client funds securely and transparently. An Iowa trust with the seas can help ensure that funds are held safely until they are needed for specific purposes, such as court fees or settlements. This practice builds trust between attorneys and clients, fostering a sense of security. Additionally, it complies with legal and ethical obligations, protecting client interests.

In Iowa, you typically have one year from the date of the trust's establishment to contest it. This timeframe allows you to challenge the validity of an Iowa trust with the seas if you believe it does not reflect the true intentions of the trust creator. However, consult a legal expert for precise guidance based on your situation. Knowing this timeframe helps you take timely action if needed.

The main purpose of a trust fund is to manage assets on behalf of a beneficiary. By setting up an Iowa trust with the seas, you can ensure that your assets are protected and distributed according to your wishes. Trust funds provide financial security and can be tailored to meet individual needs. They often help with estate planning, reducing taxes, and providing for loved ones.

Trust income tax rates can seem high because they are often taxed at the highest rate once income exceeds a certain threshold. In the context of an Iowa trust with the seas, this structure encourages careful planning around distributing income to beneficiaries. By doing so, you can potentially lower the overall tax burden on the trust's income.

In Iowa, the inheritance tax can range from 0% to 15% based on the value of the inheritance and the relationship to the deceased. For beneficiaries of an Iowa trust with the seas, understanding these percentages is vital for effective estate planning. This ensures that your heirs are well-informed about their potential tax obligations.

Filling out a trust fund is a crucial step for managing your assets within an Iowa trust with the seas. First, you need to determine the type of trust best suited for your needs. Next, gather necessary information such as asset details, beneficiaries, and distribution plans. Lastly, consider using platforms like US Legal Forms to simplify the process and ensure compliance with state laws.

When it comes to an Iowa trust with the seas, taxation depends on the type of trust you have. For instance, irrevocable trusts typically do not bring income directly to the grantor, making them a separate tax entity. Meanwhile, revocable trusts keep the income within the grantor's tax responsibilities. This can complicate your tax situation, so it's best to consult with a tax professional.

The trust tax rate in Iowa depends on the trust's income, with incremental tax brackets applying. While the rate can vary, understanding your specific situation is crucial. As an Iowa trust with the seas, it's wise to keep accurate records of income and distributions for tax purposes. Consulting a tax advisor can provide valuable insights into managing your trust's tax responsibilities effectively.

To set up an Iowa trust with the seas, you typically need to file a trust agreement, which outlines the terms of the trust. You might also need to complete specific forms related to your financial assets and beneficiaries. It’s essential to ensure you file all required documents accurately to avoid issues later. Platforms like USLegalForms offer templates that make this process more accessible.