Iowa Trust Draft With Cop

Description

How to fill out Iowa Certificate Of Trust By Individual?

- Log in to your US Legal Forms account if you're a returning user. If you don't have an account, create one to access the templates.

- Search for the Iowa trust draft with cop in the online library. Review the form's preview and description to ensure it meets your requirements.

- If needed, utilize the search feature to find alternative templates that may better suit your situation.

- Once you find the correct form, click the 'Buy Now' button and select a subscription plan that fits your needs.

- Complete your purchase by entering your payment details or using your PayPal account.

- Download the form to save it on your device, and access it anytime from the 'My Forms' section in your profile.

By following these steps, you can easily access the necessary forms for your legal needs. US Legal Forms empowers you to create precise documentation with a vast library of over 85,000 fillable templates.

Start your legal journey today! Sign up with US Legal Forms to get the best resources for your Iowa trust draft with cop and ensure your documents are accurate.

Form popularity

FAQ

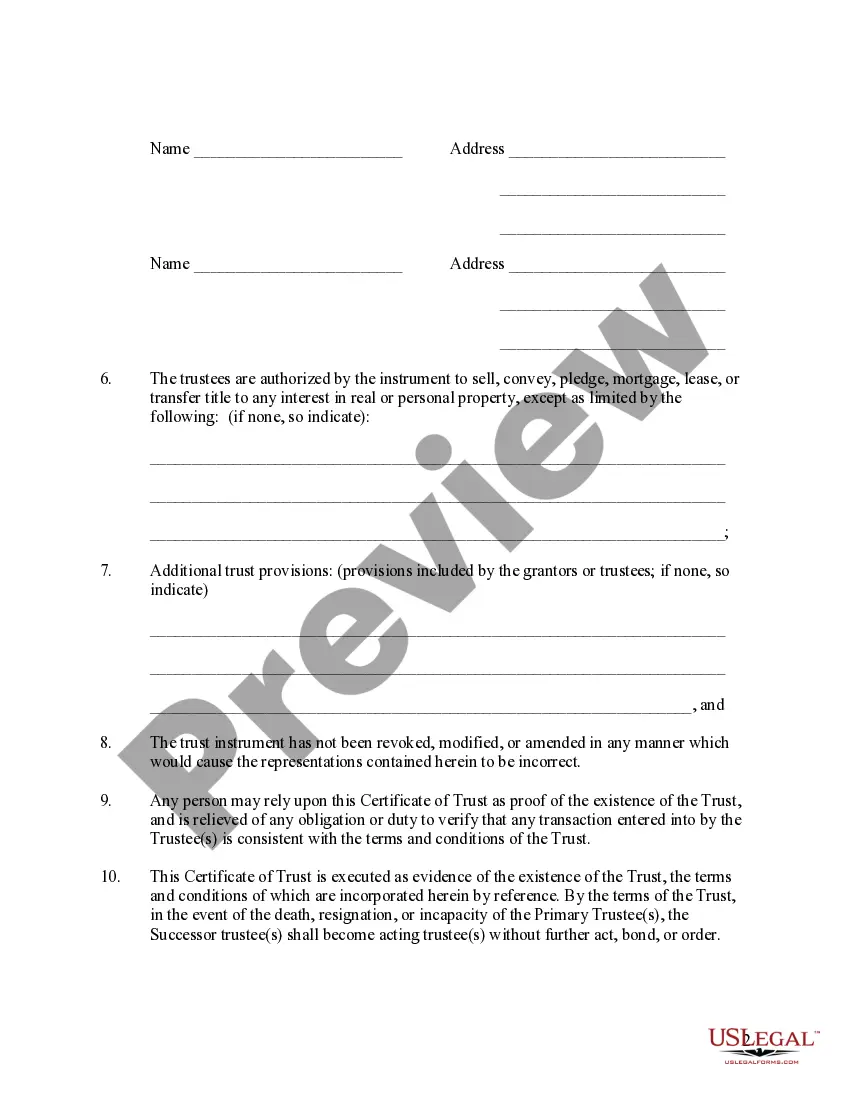

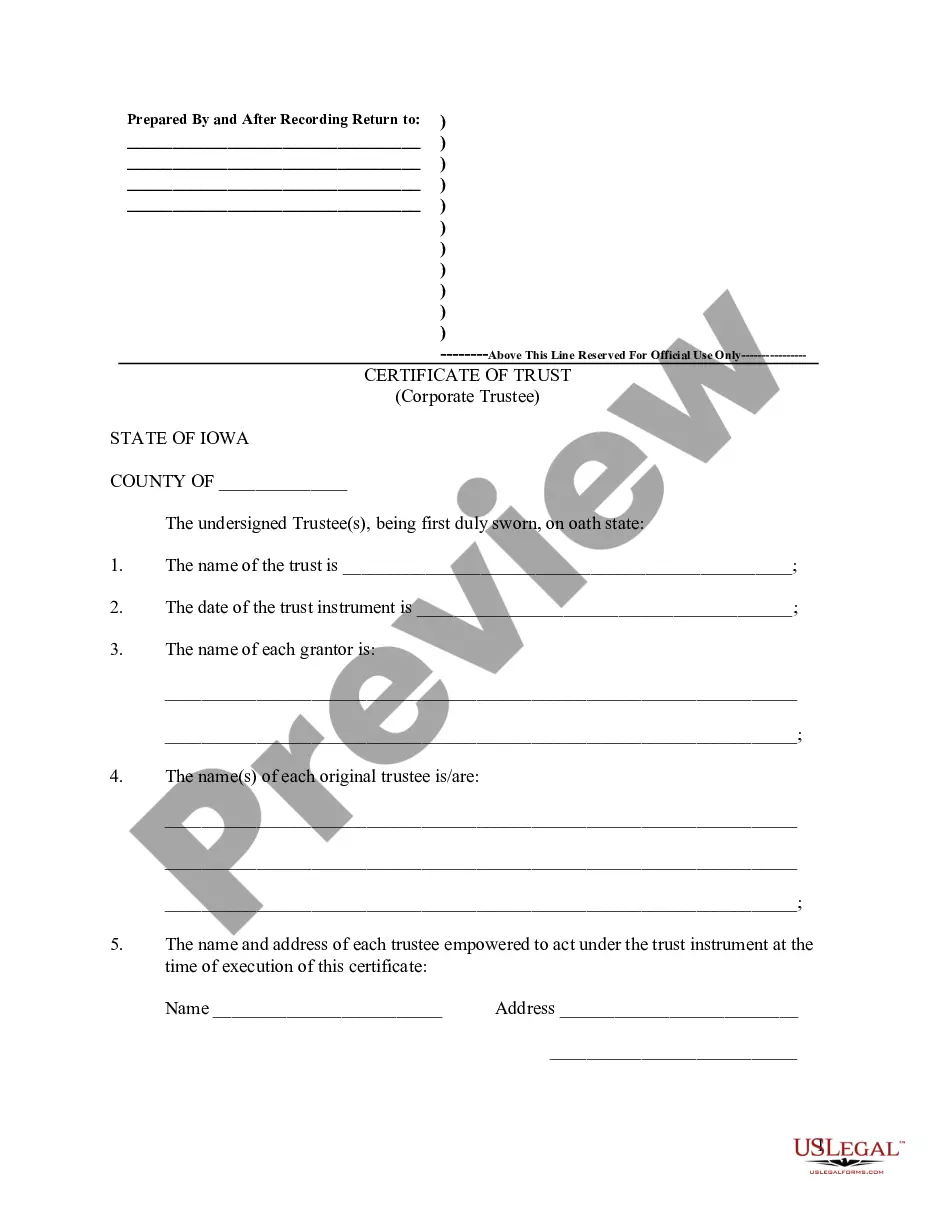

To start a trust in Iowa, identify the assets you wish to include and select a trustworthy individual or institution as your trustee. Next, prepare an Iowa trust draft with cop, which outlines the trust's terms and conditions clearly. Finally, fund the trust by transferring assets and ensure the required legal formalities are completed. Consulting with legal professionals can help guide you through this process.

You can obtain a certificate of trust from the trustee who created the trust. This document serves as proof of the trust's existence and can be critical for financial institutions and other entities. If you use an Iowa trust draft with cop, it often includes options for obtaining a certificate of trust easily. Ensure you keep this document accessible for future needs.

To establish a trust in Iowa, you need to create a legal document known as a trust agreement. This document should detail the assets involved, the beneficiaries, and the responsibilities of the trustee. Utilizing an Iowa trust draft with cop can simplify this process, as it provides a clear framework for creating a legally sound trust tailored to your needs. Don't forget to consult with legal professionals to ensure compliance with Iowa laws.

A certificate of trust serves as a summary document that verifies the existence of the trust and the authority of the trustee. This document is particularly useful for financial institutions or other parties who need reassurance of the trust's legitimacy without disclosing the entire Iowa trust draft with cop. It protects the privacy of the trust's details while facilitating transactions involving trust assets.

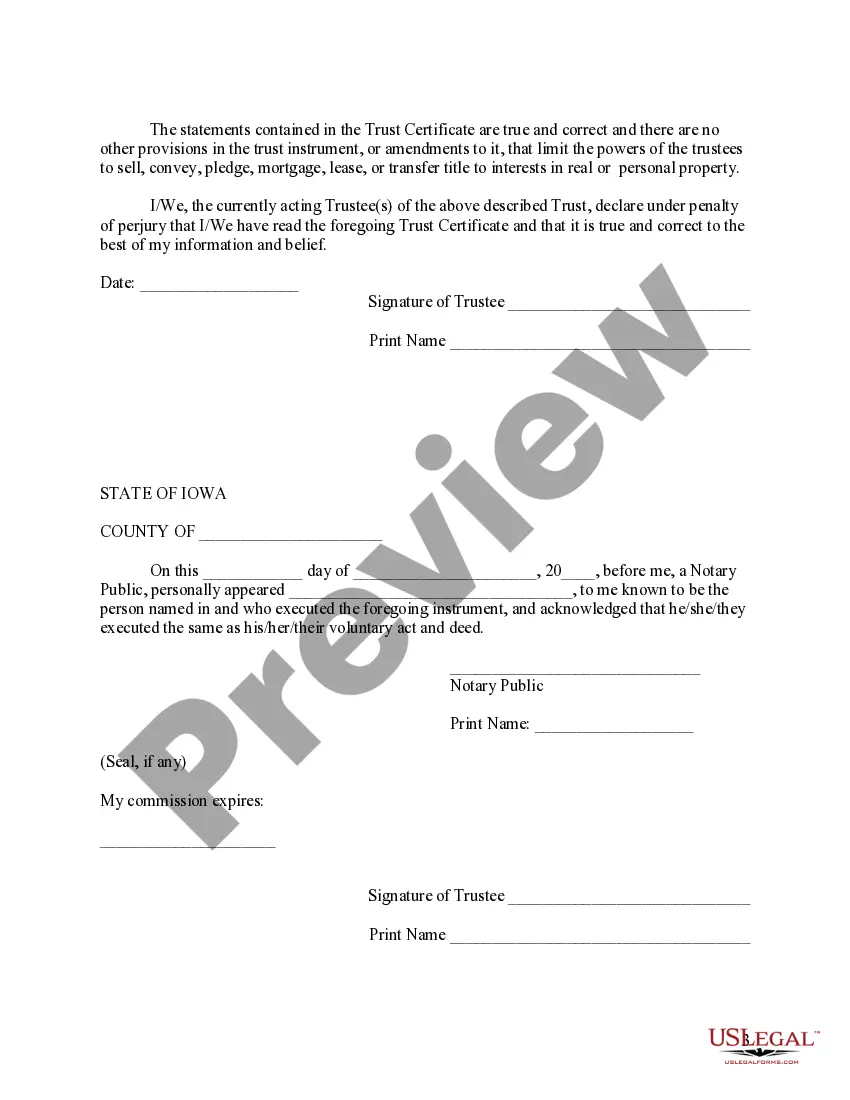

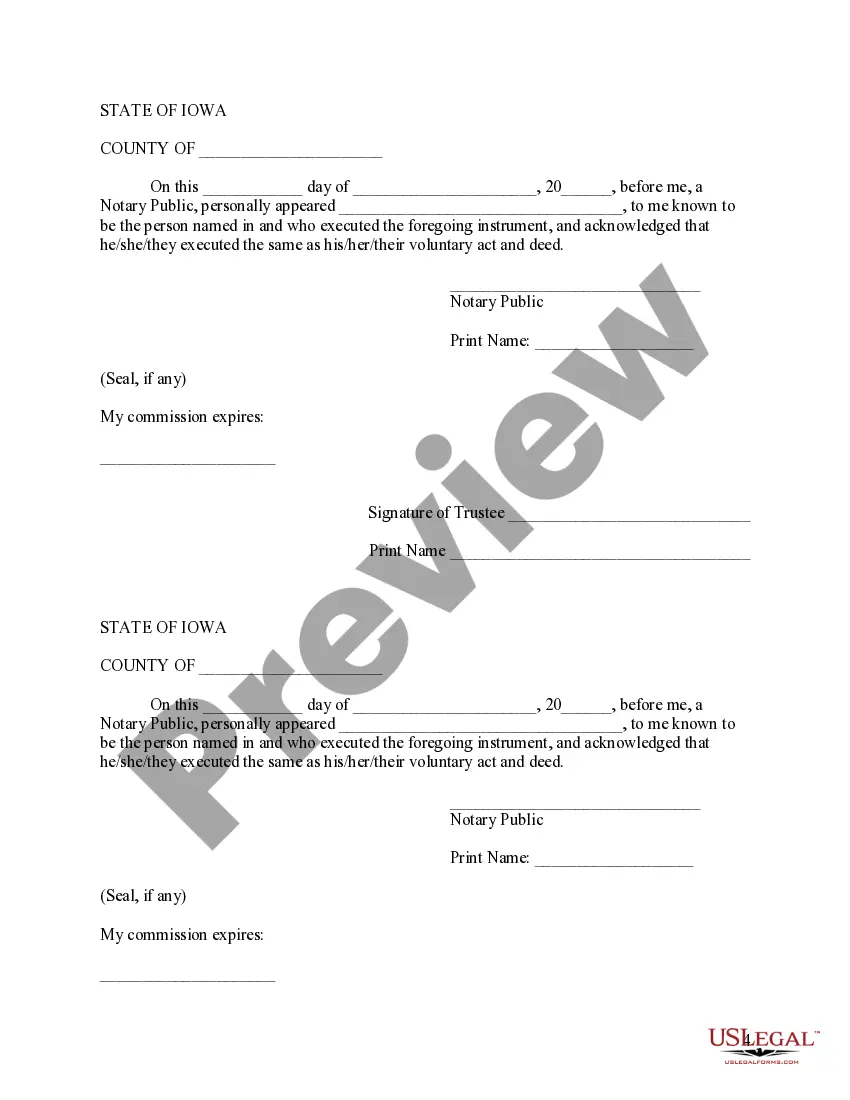

Yes, a trust can still be valid in Iowa without notarization, provided it meets the necessary criteria set by Iowa law. An Iowa trust draft with cop should have the required signatures to establish its legitimacy. However, while it isn't mandatory, notarizing may provide additional security against disputes. Consider the potential benefits of having your trust notarized for peace of mind.

To form a trust in Iowa, start by deciding on the type of trust you want, whether revocable or irrevocable. Next, draft the trust document, often known as an Iowa trust draft with cop, which outlines your wishes and stipulates how assets will be managed. Finally, transfer assets into the trust. Using an experienced platform like uslegalforms can simplify this process, ensuring compliance with local laws.

In Iowa, a trust does not necessarily require notarization to be valid, but it is often recommended. A properly executed Iowa trust draft with cop should include signatures from the grantor and witnesses to ensure its legitimacy. Notarizing can add an extra layer of protection against challenges. It's wise to consult with a professional to confirm the best practice for your situation.

Iowa trust laws govern the creation, administration, and termination of trusts. The laws provide flexibility for how an Iowa trust draft with cop can be structured, including revocable and irrevocable options. It’s essential to comply with state laws to ensure the trust is valid. For comprehensive guidance, consulting with a legal expert can provide clarity and security.

Yes, under Iowa law, beneficiaries are entitled to a copy of the trust document upon the grantor's death. This rule supports transparency and ensures that beneficiaries understand their rights and the terms of the trust. However, an Iowa trust draft with cop can vary, so it's important to detail sharing provisions within the document itself.

One common mistake parents make when setting up an Iowa trust draft with cop is not clearly defining their intentions for the trust. It's crucial to outline the goals, such as how and when beneficiaries will receive assets. Additionally, failing to update the trust as circumstances change can lead to confusion and unintended consequences. Engaging with a professional can help avoid these pitfalls.