Iowa Trust Draft For Sale

Description

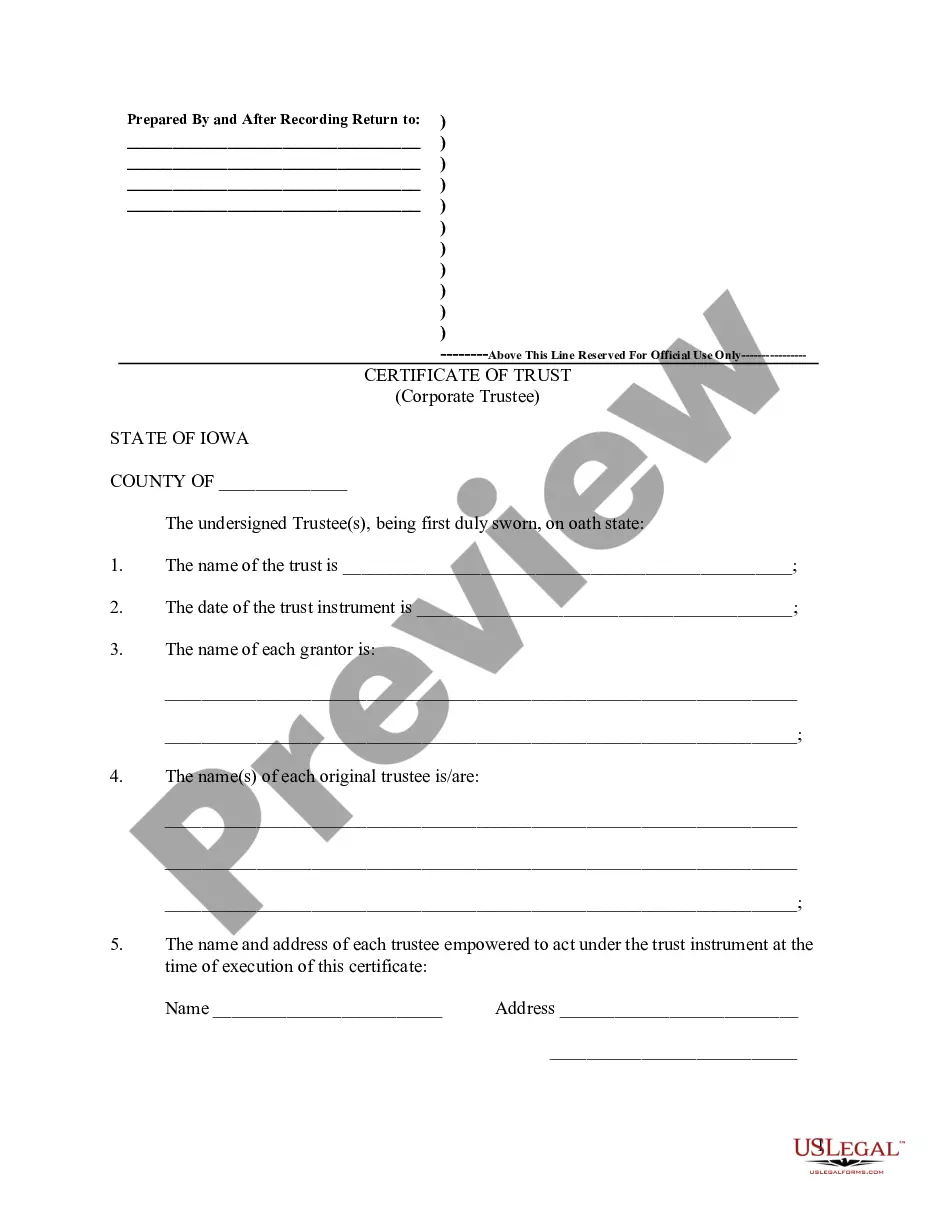

How to fill out Iowa Certificate Of Trust By Individual?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active; renew if necessary.

- For first-time users, start by browsing our extensive collection or search for 'Iowa trust draft.' Review the template preview to confirm it meets your legal requirements.

- If the selected template does not fit your needs, utilize the search function to explore more options until you find the perfect document.

- Once you've identified the right form, click the 'Buy Now' button. Choose a subscription plan that works for you and create your account to access our comprehensive library.

- Complete your purchase by entering your payment details using a credit card or PayPal.

- After payment confirmation, download your Iowa trust draft directly to your device. Access it anytime from the 'My Forms' section in your profile.

In conclusion, US Legal Forms is committed to empowering individuals and attorneys by providing a robust collection of over 85,000 legal forms, making the process of obtaining legal documents like an Iowa trust draft seamless and efficient.

Start your journey today and create your Iowa trust draft with US Legal Forms to ensure your legal needs are met with precision.

Form popularity

FAQ

In Iowa, a property manager must deposit trust funds into a trust account managed by a licensed broker within five banking days. This rule helps ensure that trust funds are handled properly and transparently. If you’re in the market for an Iowa trust draft for sale, working with professionals can help you adhere to these important regulatory timelines.

In certain situations, a trustee can force the sale of a house, especially if it's deemed necessary for fulfilling the trust’s terms or settling debts. However, it typically requires adherence to the trust agreement and may involve discussions with beneficiaries. If you're exploring an Iowa trust draft for sale, understanding these parameters will help you navigate your options effectively.

A trustee has significant authority over an estate, including managing assets, making payments, and distributing resources. This power is granted by the trust document, which outlines their responsibilities. If you're interested in an Iowa trust draft for sale, this document will clarify the extent of the trustee’s authority and responsibilities.

Yes, a trustee can force a sale under specific circumstances, particularly if the trust agreement permits it. It's crucial for trustees to follow legal guidelines and often obtain permission from beneficiaries before proceeding. If you're considering an Iowa trust draft for sale, ensure that the conditions for sale are explicitly stated in your trust document.

One common mistake parents make when setting up a trust fund is failing to clearly define how assets will be distributed to beneficiaries. This can lead to confusion and conflict among family members later on. To avoid such pitfalls, consider using an Iowa trust draft for sale from uslegalforms, which can guide you in specifying terms effectively.

Yes, a gun trust is a specific type of trust that is designed to hold firearms and ensure compliance with laws regarding ownership and transfer. Unlike a general trust, a gun trust provides clear guidelines on the handling and inheritance of firearms. If you're interested in creating a gun trust, you might want to explore an Iowa trust draft for sale tailored to firearm regulations.

Iowa trust laws govern how trusts are established, managed, and enforced within the state. These laws cover important aspects such as trust property, beneficiary rights, and fiduciary duties. To ensure your trust aligns with Iowa laws, consider using a reliable Iowa trust draft for sale, which can simplify the legal complexities.

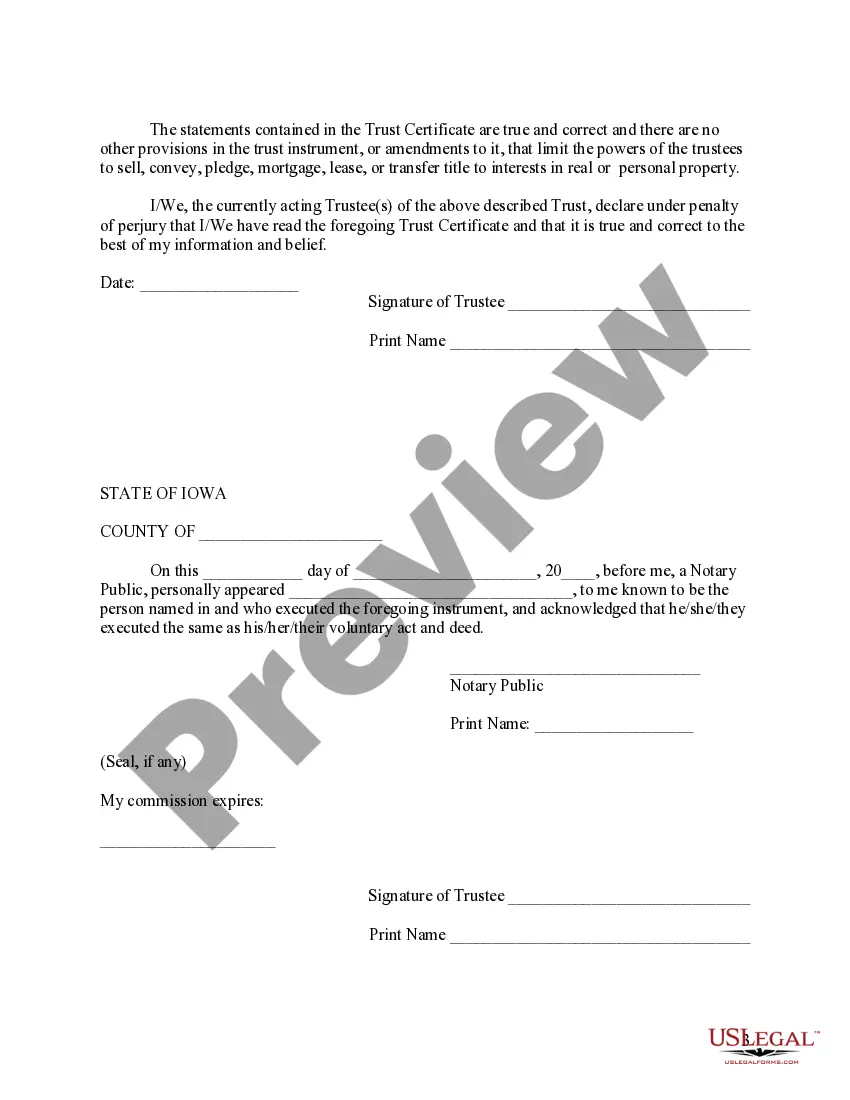

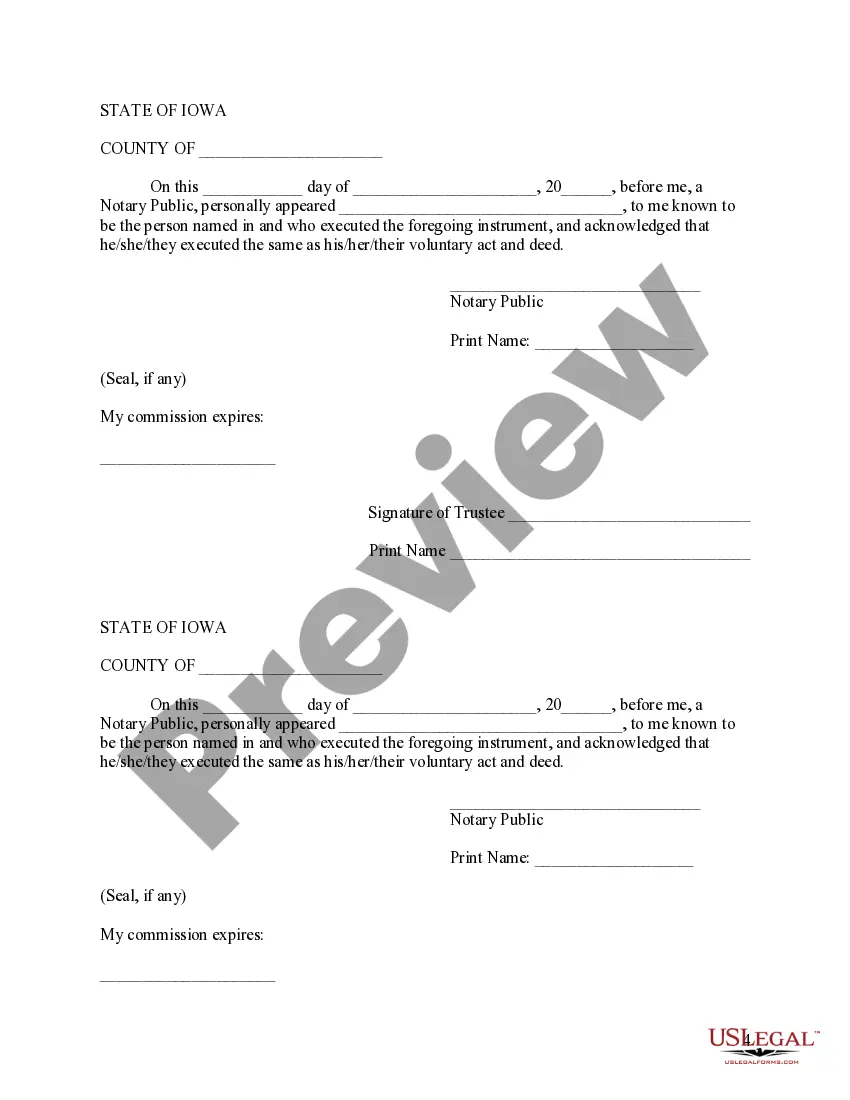

Yes, a trust can still be valid in Iowa even if it is not notarized, provided it meets all other legal requirements. However, the lack of notarization may lead to challenges in proving its validity if disputes arise. To bolster your trust's legitimacy, consider opting for an Iowa trust draft for sale that includes notarization steps.

To place a house in a trust in Iowa, you need to create a trust document and then transfer the property title into the trust's name. This involves filling out a new deed that lists the trust as the owner and submitting it to the county recorder's office. If you're looking for guidance while drafting this process, consider using an Iowa trust draft for sale from uslegalforms for a smooth experience.

In Iowa, while a trust does not legally require notarization to be valid, having it notarized can provide additional protection. Notarization helps establish the authenticity of the document and can prevent future disputes over its legitimacy. It is wise to consider having your Iowa trust draft notarized for peace of mind.