Iowa Certification Of Trust Form

Description

Form popularity

FAQ

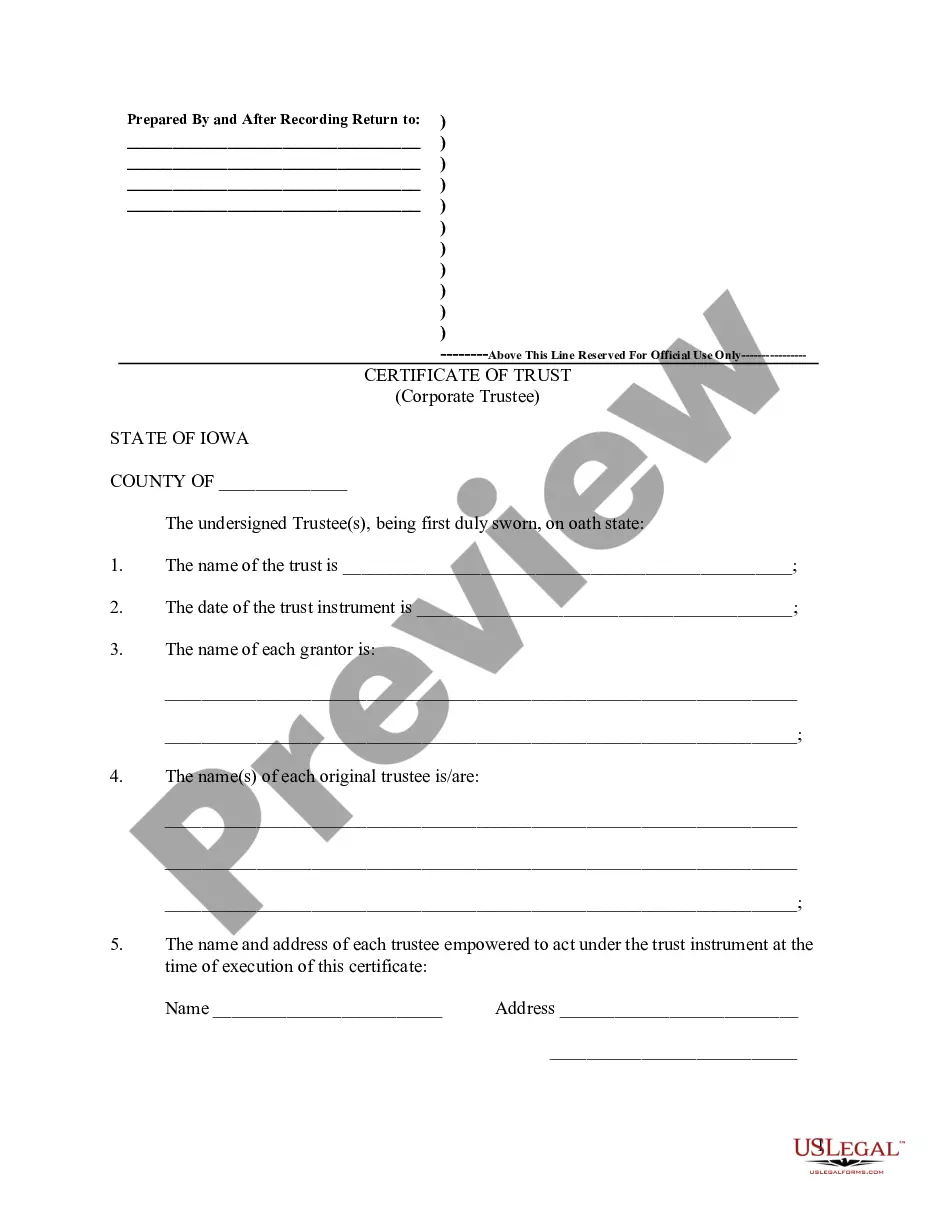

A certificate of trust is a summarized version of a trust that includes specific details without disclosing the entire trust document, while a declaration of trust is the full, detailed document establishing the trust's terms and conditions. The Iowa certification of trust form serves a unique purpose by providing a legal declaration of the trust's existence and its key components. Understanding this difference is essential for effective estate planning.

To obtain a certification of trust, you can either draft one yourself using templates available on platforms like UsLegalForms or consult an attorney who specializes in estate planning. Step-by-step guides are often included with templates to help simplify the process. Remember to include necessary details to ensure your Iowa certification of trust form is comprehensive and valid.

The relevant Iowa Code for a certificate of trust is found in Chapter 633A, which covers various statutes relating to trusts. Section 2201 and Section 2202 specifically discuss the provisions for creating and managing a trust, including details pertinent to your Iowa certification of trust form. Familiarity with these codes helps ensure that your trust is legally sound and effectively established.

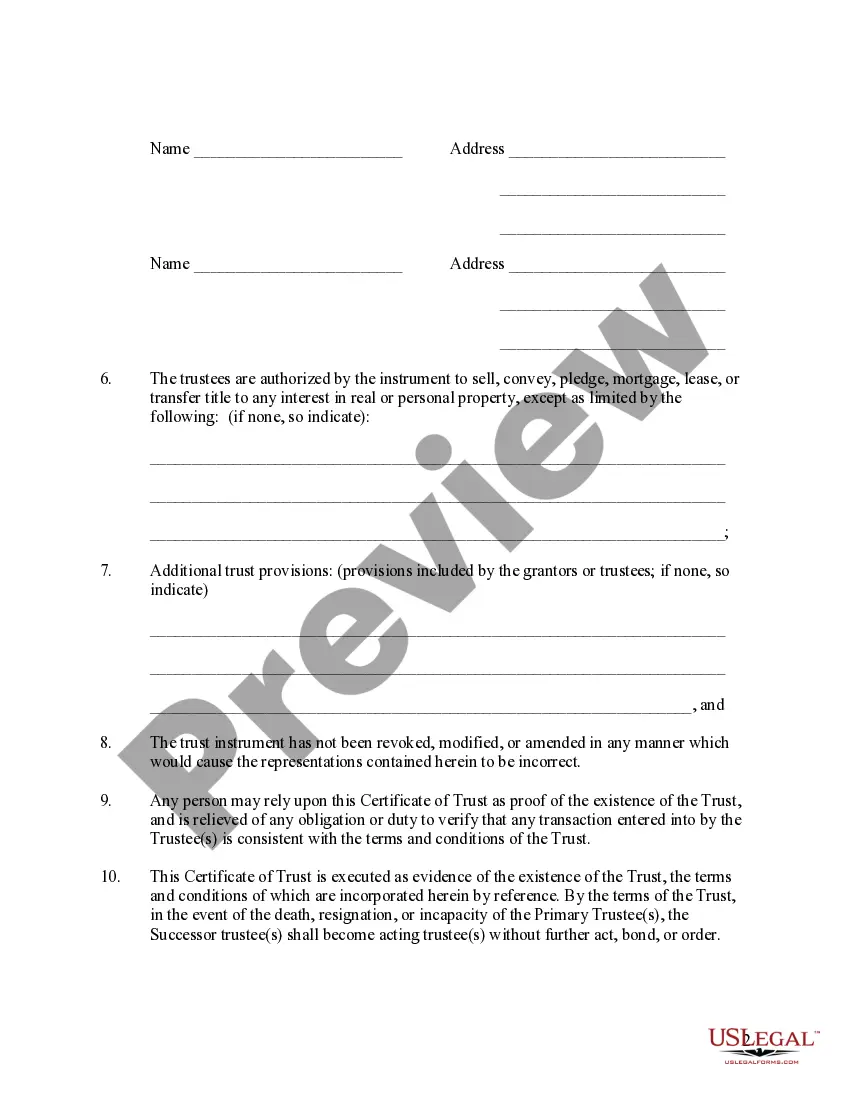

Typically, the trustee of a trust is responsible for creating the certificate of trust. This document outlines the essential details of the trust, including the powers granted to the trustee and the identities of the beneficiaries. Having a well-prepared Iowa certification of trust form is crucial for the efficient management of trust assets and ensuring compliance with Iowa law.

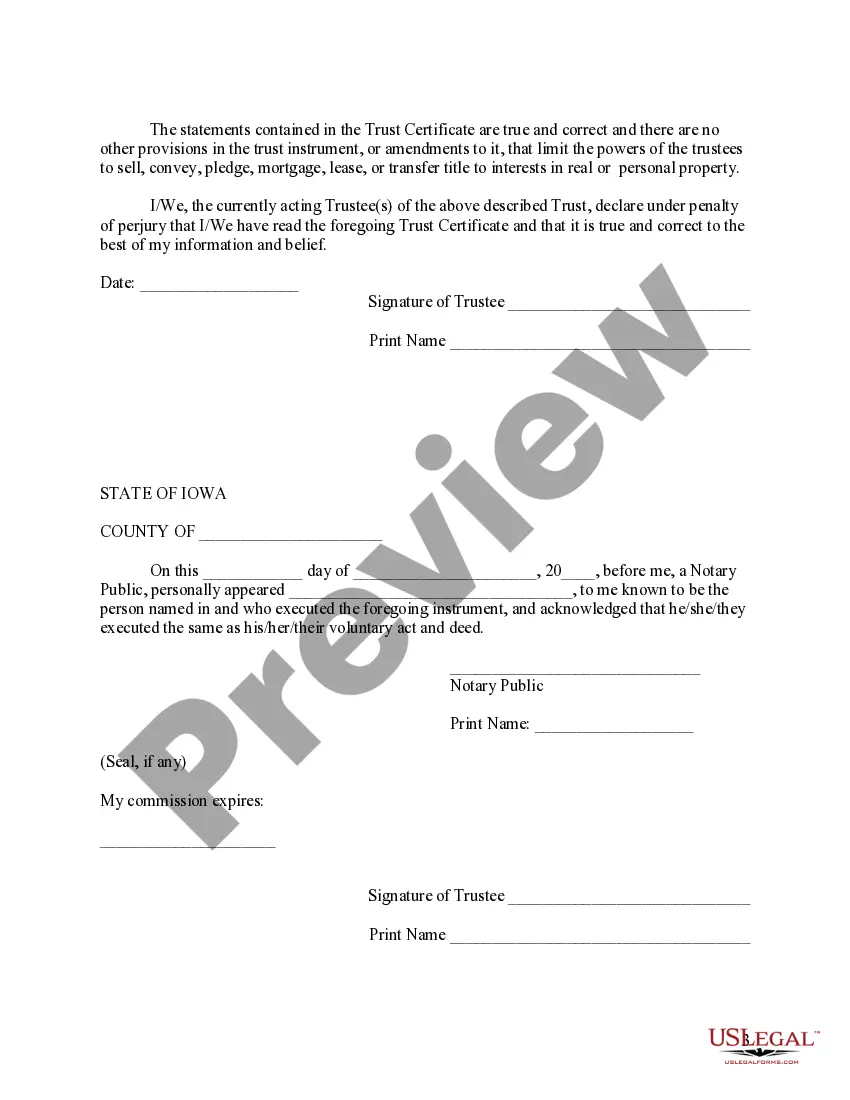

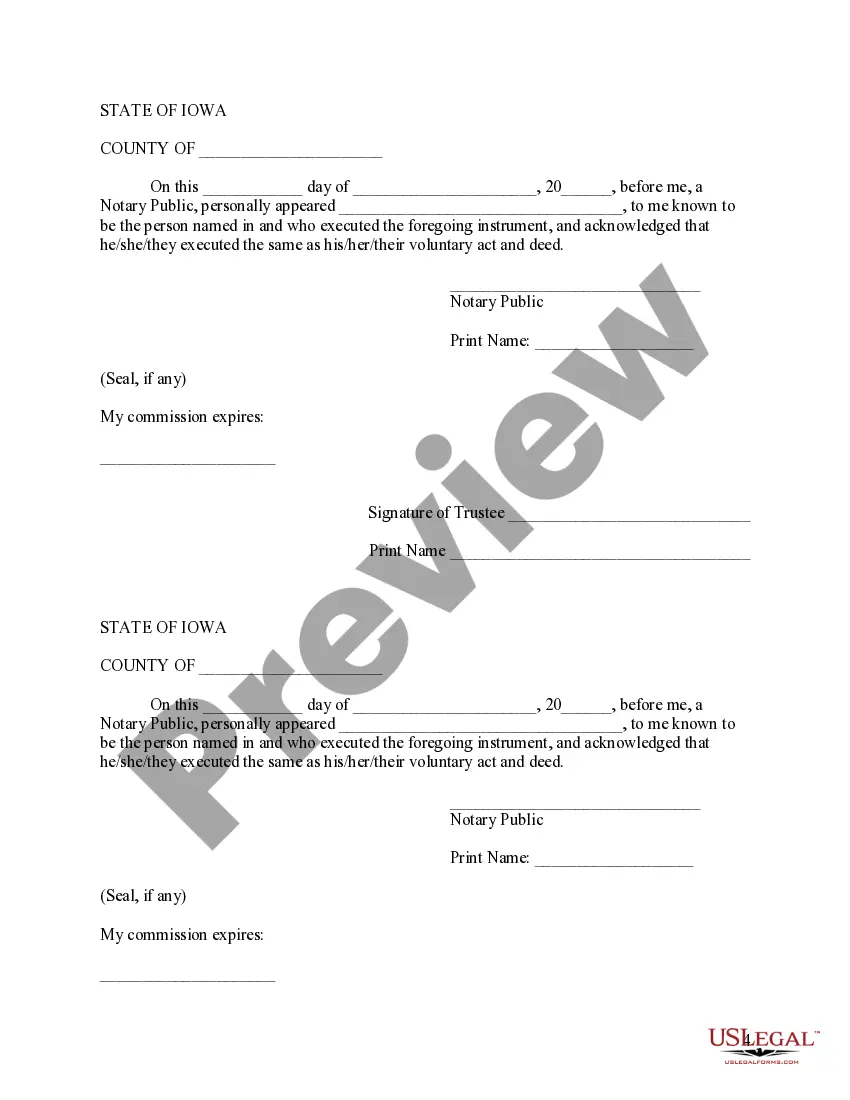

In Iowa, a trust does not necessarily need to be notarized; however, notarization can add an extra layer of validity to your Iowa certification of trust form. Although notarization is not a statutory requirement, having your document notarized may help in situations where proof of authenticity is needed. Always consult legal professionals for specific advice related to your situation.

You can obtain a certificate of trust through various sources, including legal service websites, such as UsLegalForms, which provides templates tailored for Iowa requirements. Additionally, consulting with an attorney who specializes in estate planning may offer personalized assistance in creating your Iowa certification of trust form. Understanding the right source can help ensure that your certificate is accurate and compliant.

To record a certificate of trust in Iowa, you typically need to file the completed Iowa certification of trust form with the appropriate county recorder's office. This process may vary slightly depending on the county, so it is wise to verify the specific requirements beforehand. Recording your certificate of trust provides public notice of the trust's existence and its key terms.

The code 633A 2202 in Iowa pertains to the regulations surrounding trusts and grants specific guidelines on how a certificate of trust should be drafted. This code is essential for those looking to establish a trust, as it clarifies the rights and responsibilities of the trustee. By adhering to this code and utilizing the Iowa certification of trust form, you can streamline the process of creating a legally recognized trust.

Both lawyers and accountants can play essential roles in setting up a trust, but it often starts with a lawyer. A lawyer understands the legal requirements and can help ensure that the trust complies with the law. An accountant can then provide valuable financial advice regarding taxes and asset management. Utilizing a platform like US Legal Forms makes it easy for both professionals to access the Iowa certification of trust form and streamline the process.

Anyone who establishes a trust can create a certificate of trust, typically the trustor or grantor. This is crucial for managing the trust’s assets and providing legal proof of the trust's existence. By completing an Iowa certification of trust form, you ensure that the trust can be recognized by banks, financial institutions, and other entities, allowing for smooth transactions.