I Trust

Description

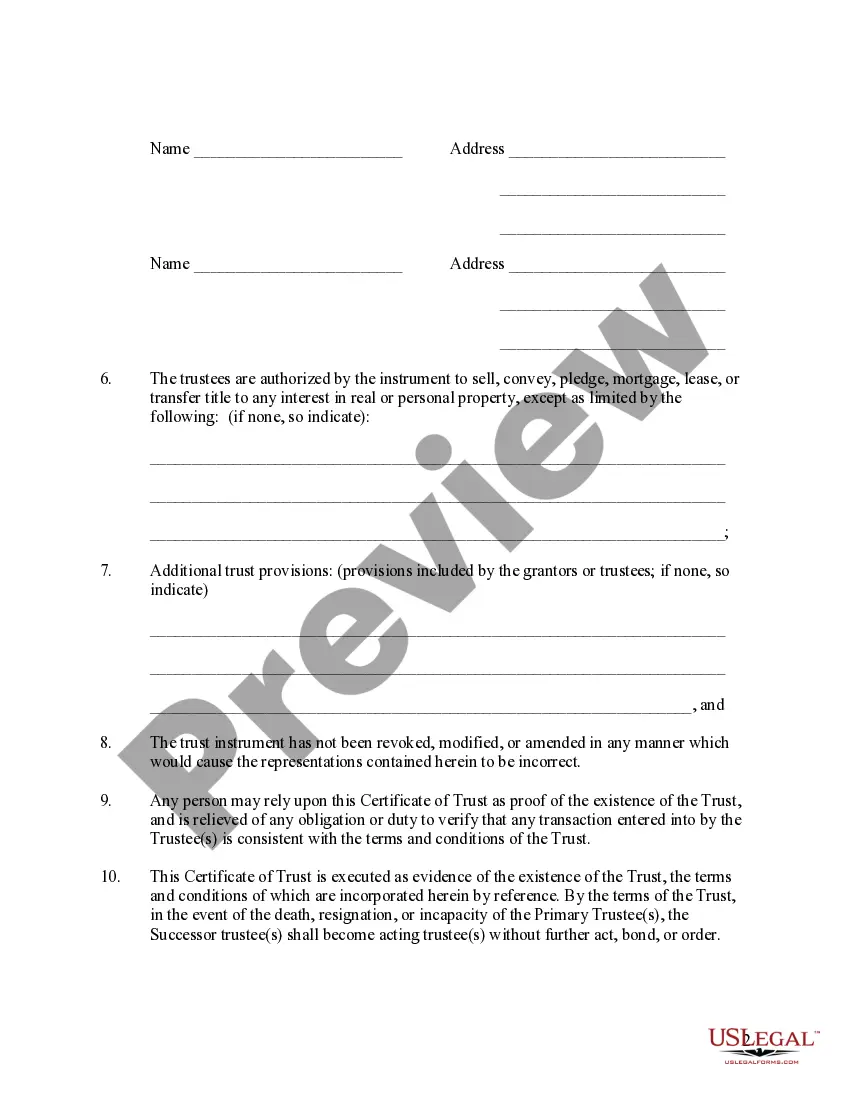

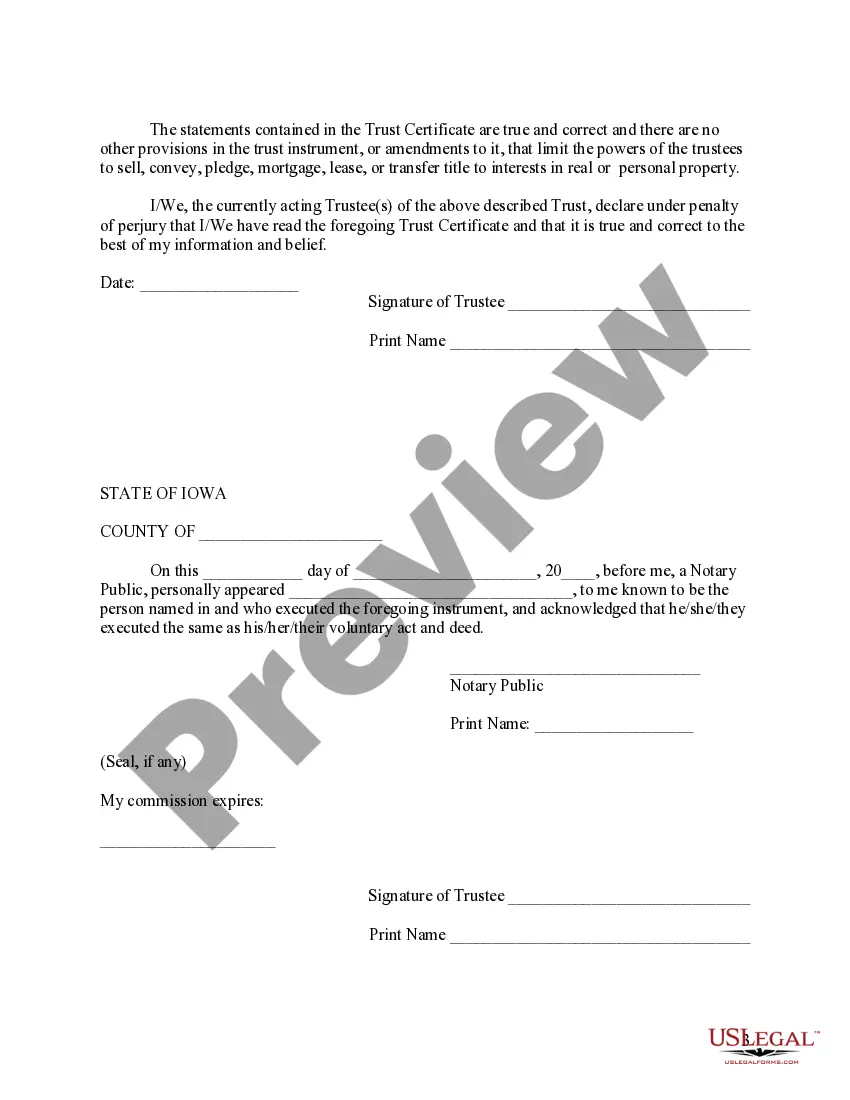

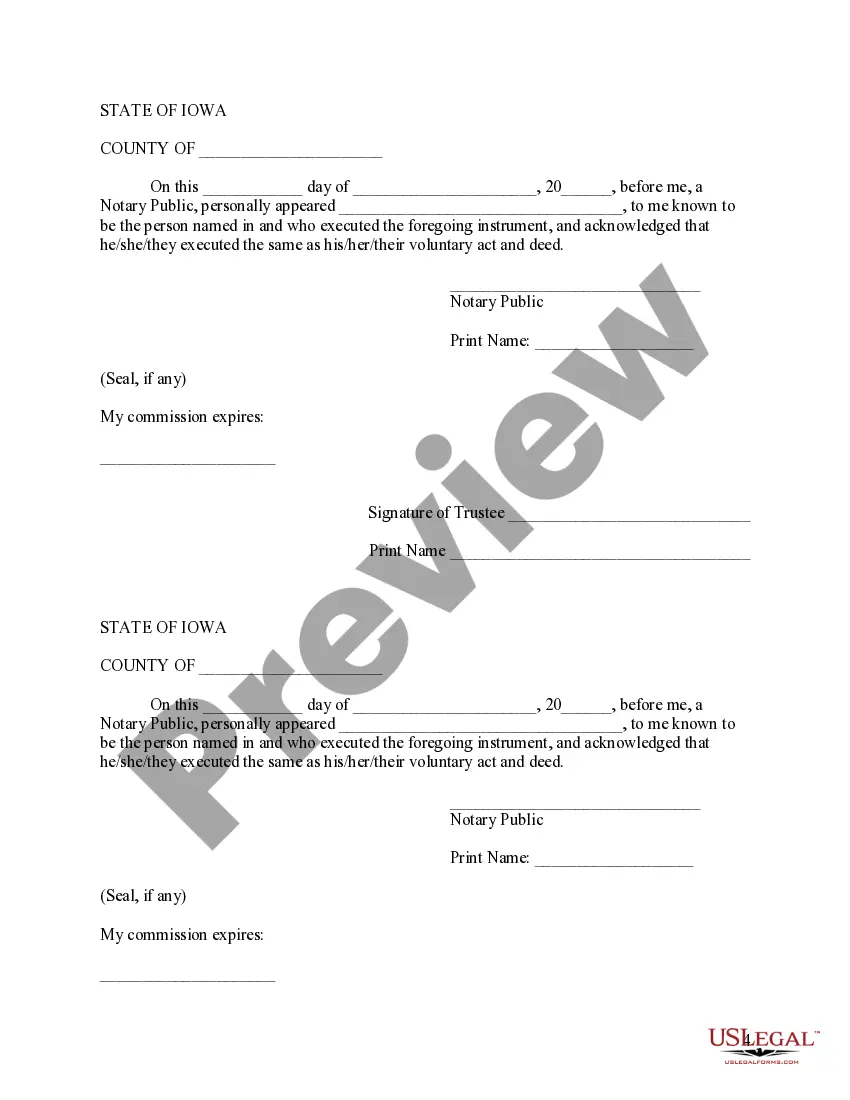

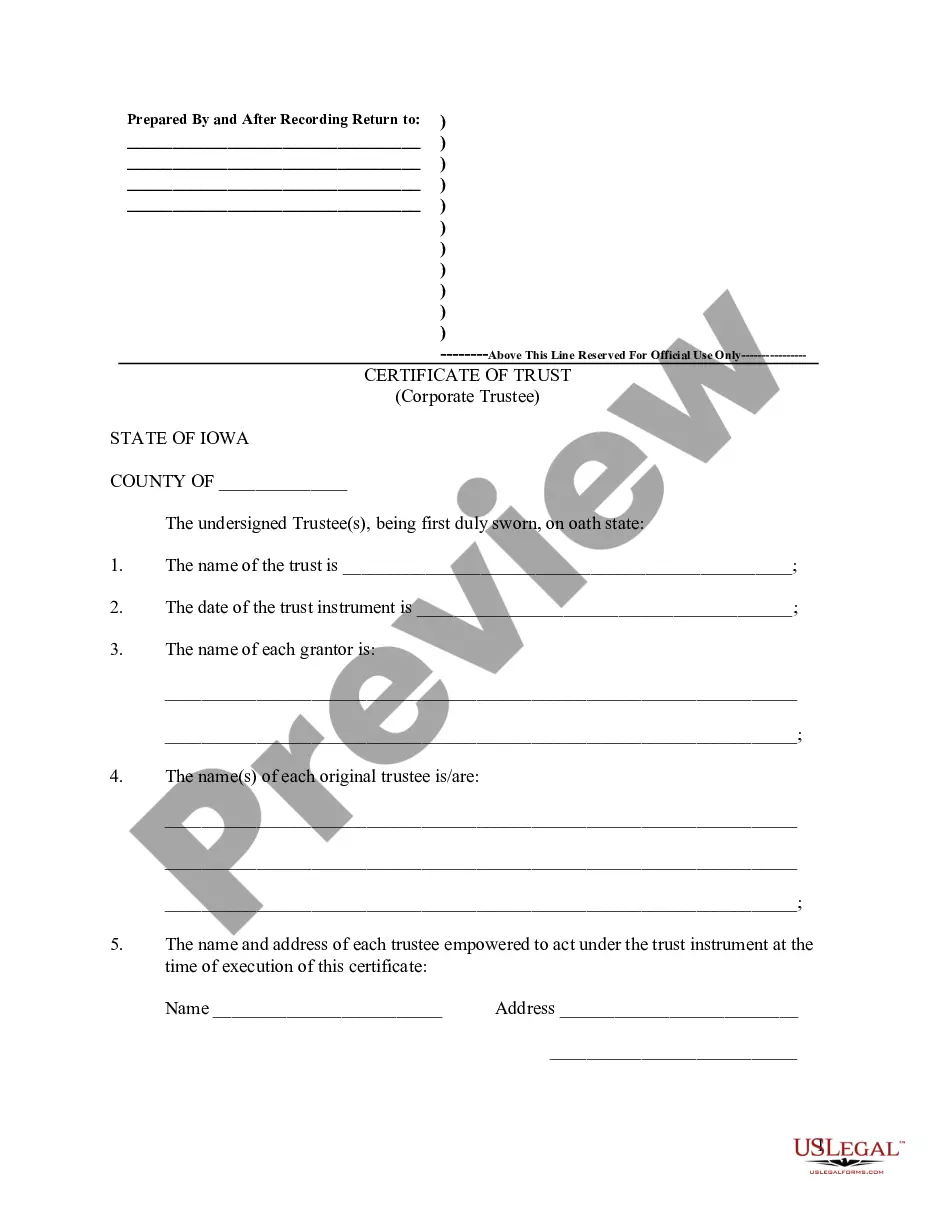

How to fill out Iowa Certificate Of Trust By Individual?

- If you're a returning user, log in to your account. Ensure your subscription is active before downloading the needed form template.

- For new users, start by checking the Preview mode and form descriptions. This ensures the document aligns with your requirements and local jurisdiction.

- If the required form isn't available, utilize the Search tab to find a different template that suits your needs.

- Once you locate the right document, click on the Buy Now button and select your preferred subscription plan. You'll need to create an account to access all resources.

- Finalize your purchase by entering your credit card information or using your PayPal account.

- Download your form and save it on your device. Access it anytime through the My Forms section.

Accessing legal documents is made simple with US Legal Forms, whether you’re a seasoned user or first-timer. The platform guarantees a seamless experience tailored to your requirements.

Start using US Legal Forms today and enjoy the ease of accessing thousands of legal documents with expert assistance available at your fingertips!

Form popularity

FAQ

Generally, assets like personal belongings that you want to retain control over during your lifetime should not go into a trust. Moreover, assets with transfer restrictions may not be suitable for this arrangement. I trust that reviewing your specific situation with a professional will clarify the best approach for your assets.

Certain assets typically should not be placed in a trust, such as retirement accounts and life insurance policies with designated beneficiaries. These assets can bypass probate and be directly passed to beneficiaries. I trust that knowing these details will help you make strategic decisions about asset management.

One risk of putting assets in a trust is losing direct control over those assets, as the trust becomes the legal owner. Additionally, there are costs associated with setting up and maintaining a trust. I trust that understanding these factors will help you make more informed decisions about your estate planning.

Putting your bank accounts in a trust can provide greater control over your assets after your passing. It can also help avoid the lengthy probate process. I trust that consulting with experts or using services like US Legal Forms can help you determine if this choice aligns with your financial goals.

A common mistake parents make is failing to communicate their intentions with their children. I trust that being open about the trust's purpose can prevent confusion and foster understanding. It’s essential to clearly outline the terms and expectations to avoid potential conflicts in the future.

Filling out a trust fund involves gathering your assets and deciding how you want to distribute them. You can start by listing all your valuable items and specifying the beneficiaries. I trust that using a reliable platform like US Legal Forms can simplify this process, providing you with the necessary templates and guidance to ensure accuracy.

The three key factors to build trust include clear communication, reliability, and vulnerability. Clear communication ensures everyone is on the same page. Reliability means following through with commitments, while vulnerability allows for honest interactions. Together, these elements establish a strong foundation of I trust.

The three pillars of trust are transparency, consistency, and empathy. Transparency means being open about intentions, while consistency involves maintaining reliable behavior over time. Empathy allows individuals to connect on a deeper level, making it easier to cultivate I trust in any relationship.

The 3 C's—competence, character, and connection—embody the foundation of trust. Competence refers to the skills and abilities one possesses. Character focuses on integrity and honesty, while connection highlights the emotional bonds formed. Together, they enhance the likelihood of forming strong I trust relationships.

Struggling to trust often stems from past experiences, fear of vulnerability, or unmet expectations. When previous relationships fail or betray trust, it can create barriers. Building I trust requires patience, self-awareness, and gradually overcoming these fears to create a secure foundation.