Notice It

Description

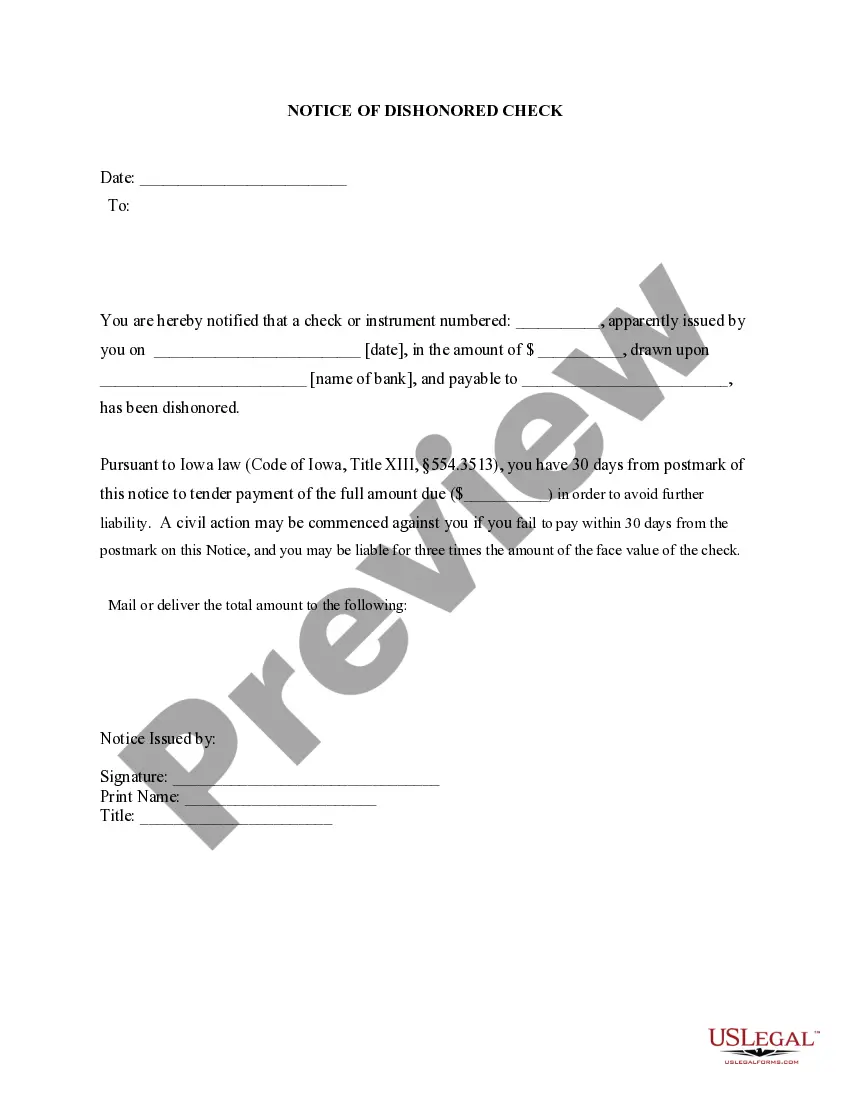

How to fill out Iowa Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

- If you're an existing user, log in to your account and check your subscription status before downloading the desired form.

- For new users, start by exploring the Preview mode and the form description to confirm you've selected the correct template that aligns with your jurisdiction requirements.

- If the current template doesn't meet your needs, utilize the Search tab at the top to find the appropriate document.

- Once you identify the right form, click the Buy Now button and select your preferred subscription plan to access our vast library.

- Complete your purchase by entering your credit card information or logging in to your PayPal account to finalize the transaction.

- After your purchase, download the form to your device. You can access it anytime from the My Forms section of your profile.

With comprehensive resources and expert assistance, US Legal Forms ensures that you can create precise legal documents quickly and affordably.

Don't wait any longer—visit US Legal Forms today and discover the ease of obtaining legal documents tailored to your needs!

Form popularity

FAQ

An IRS lock-in letter is typically triggered by discrepancies in your reported income on tax returns or failure to resolve tax discrepancies. When the IRS identifies certain inconsistencies, they issue this letter to ensure proper withholding of taxes. Responding promptly and providing necessary documentation is crucial to resolve the situation effectively.

To apply for an ITIN, complete Form W-7 and submit it along with your tax return to the IRS. You can also apply in person at designated IRS facilities or via mail. Our platform, US Legal Forms, can assist you in obtaining the necessary forms and guidance throughout the process.

A Taxpayer Identification Number (TIN) does not have an expiration date. However, if you do not use it for tax purposes or do not file tax returns regularly, the IRS may consider it inactive. Stay informed about your TIN's status to ensure you can easily file your taxes when needed.

To speak with a person at the IRS, you can call their helpline at the appropriate number for your needs. It's best to call during non-peak hours to reduce wait times. Prepare your information in advance, as this can help make your conversation more efficient.

To know if your EIN number is valid, check your IRS confirmation letter or access your account through the IRS website. The IRS maintains a record of all issued EINs, and you can contact them for further verification. Ensuring your EIN is active is crucial for maintaining business compliance.

Yes, an ITIN number can expire if it has not been used on a federal tax return for three consecutive years. Once expired, you will need to reapply for a new ITIN. Regularly checking the validity of your ITIN can help you stay compliant and avoid complications when filing your taxes.

To check if your ITIN is valid, you can refer to your official IRS documentation or contact the IRS directly. The IRS offers tools that allow you to verify the status of your ITIN through their online platforms. Always ensure that you remain compliant with IRS guidelines to avoid issues.

To determine if your ITIN is expired, check the last digits of your ITIN and the date on your tax returns. If you have not used your ITIN on a tax return for three consecutive years, it likely expired. You can also visit the IRS website for the latest updates on ITIN expiration statuses and details.

Evicting a tenant in Massachusetts can be challenging due to specific legal requirements and timelines. It typically involves multiple steps, including providing proper notice and potentially going through court procedures. Understanding the local laws can simplify this effort. For assistance, consider using resources like USLegalForms to ensure your notices are correctly formatted and legally compliant.

An example of notice writing could be a termination notice to a tenant. It should include the date, your name, the tenant's name, and a clear statement such as: 'This is to inform you that your lease will terminate on date.' Ensure you list the reasons for termination and any next steps clearly. Templates on platforms like USLegalForms can assist in crafting a proper notice.