Notice Check Bad For You

Description

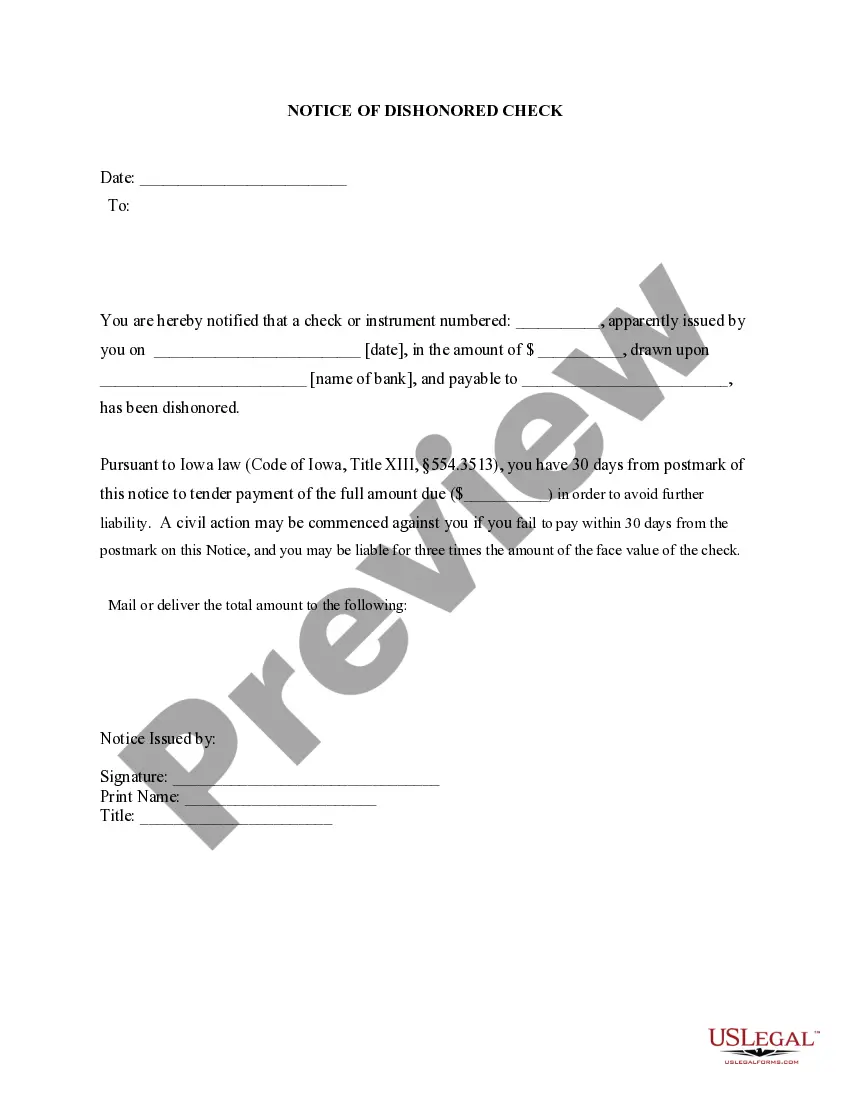

How to fill out Iowa Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

- If you're a returning user, simply log in to your account and download the template you need directly by clicking the Download button. Confirm your subscription is valid or renew it if necessary.

- For first-time users, start by browsing the extensive online library. Check the Preview mode and description of forms to ensure it fits your requirements and local jurisdiction.

- If the current document isn't suitable, use the Search tab to locate a more appropriate template that meets your needs.

- Select the correct document by clicking the Buy Now button. You'll need to register for an account to access the wide range of forms available.

- Proceed with the payment by entering your credit card information or using your PayPal account to finalize your subscription.

- Once your purchase is complete, download your form to your device. You can also access it anytime in the My Forms section.

US Legal Forms empowers both individuals and attorneys with a robust collection of legal documentation options. With over 85,000 forms readily available and expert assistance, you can be confident in the legality of your documents.

Don't leave your legal needs to chance. Start using US Legal Forms today to navigate your documentation smoothly!

Form popularity

FAQ

A bad check penalty varies by state, but it typically includes fines and possibly restitution of the check amount. In some cases, you may also face misdemeanor or felony charges, depending on the amount involved and your prior record. Understanding these penalties can help you avoid the pitfalls of a bad check, which is ultimately a finance management issue.

Yes, you can take legal action against someone who writes you a bad check. By filing a civil suit, you can potentially recover the amount owed along with any additional damages. It's crucial for you to gather evidence and documentation to support your claim; this can help strengthen your case.

Writing a bad check to the IRS is a serious matter, as it can result in penalties, including fines and interest on the unpaid amount. The IRS may also initiate collection efforts, which could escalate quickly. To avoid these consequences, consider reaching out to them for resolution, and be aware of how a bad check can impact your financial stability.

When someone writes you a bad check, your first step is to contact the writer to resolve the issue amicably. Keep clear records of the transaction and any communications. Should the problem persist, you can take legal action or report the incident to your local authorities, as ignoring it could cause more troubles for you later.

Writing a bad check can lead to serious legal repercussions, but it is typically considered a state crime. However, if the bad check crosses state lines, it may attract federal attention. It's important for you to understand that this can lead to significant fines and even imprisonment.

While it is not advisable to intentionally make a cheque bounce, factors such as insufficient funds or closing an account can lead to this outcome. If you receive a notice that a check is bad for you, it is crucial to understand the implications. Repairing your financial standing is essential, and platforms like USLegalForms can help you navigate these situations effectively. Always prioritize responsible cheque writing to avoid unnecessary complications.

The individual who wrote the bounced cheque usually faces the consequences, which can include fees from their bank and possible legal action from the payee. The payee may pursue recovery of the funds owed due to the notice that a check is bad for you. In some cases, partial criminal charges can apply, depending on the circumstances. Always be cautious when writing cheques to ensure you are financially capable of covering the amount.

Typically, a record of a bounced cheque can remain on your credit report for up to seven years. This negative mark can impact your credit score and make future transactions more difficult. It serves as a notice that a check is bad for you, which potential lenders might consider when assessing your financial responsibility. Clearing a bounced cheque as quickly as possible can help minimize this impact.

A cheque can bounce for various reasons, including insufficient funds in the account, a closed account, or mismatched signatures. When a bank identifies any discrepancies, it may refuse to process the payment. This situation creates a notice that a check is bad for you, affecting your financial reputation. To avoid bouncing cheques, always ensure you have adequate funds before writing one.

If someone writes you a bad check, you have several options for recourse. You can contact the check writer directly to request payment or negotiate a resolution. If needed, legal action can be pursued to recover your funds. Using platforms like US Legal Forms can simplify the process, providing the necessary documentation to navigate through the situation effectively.