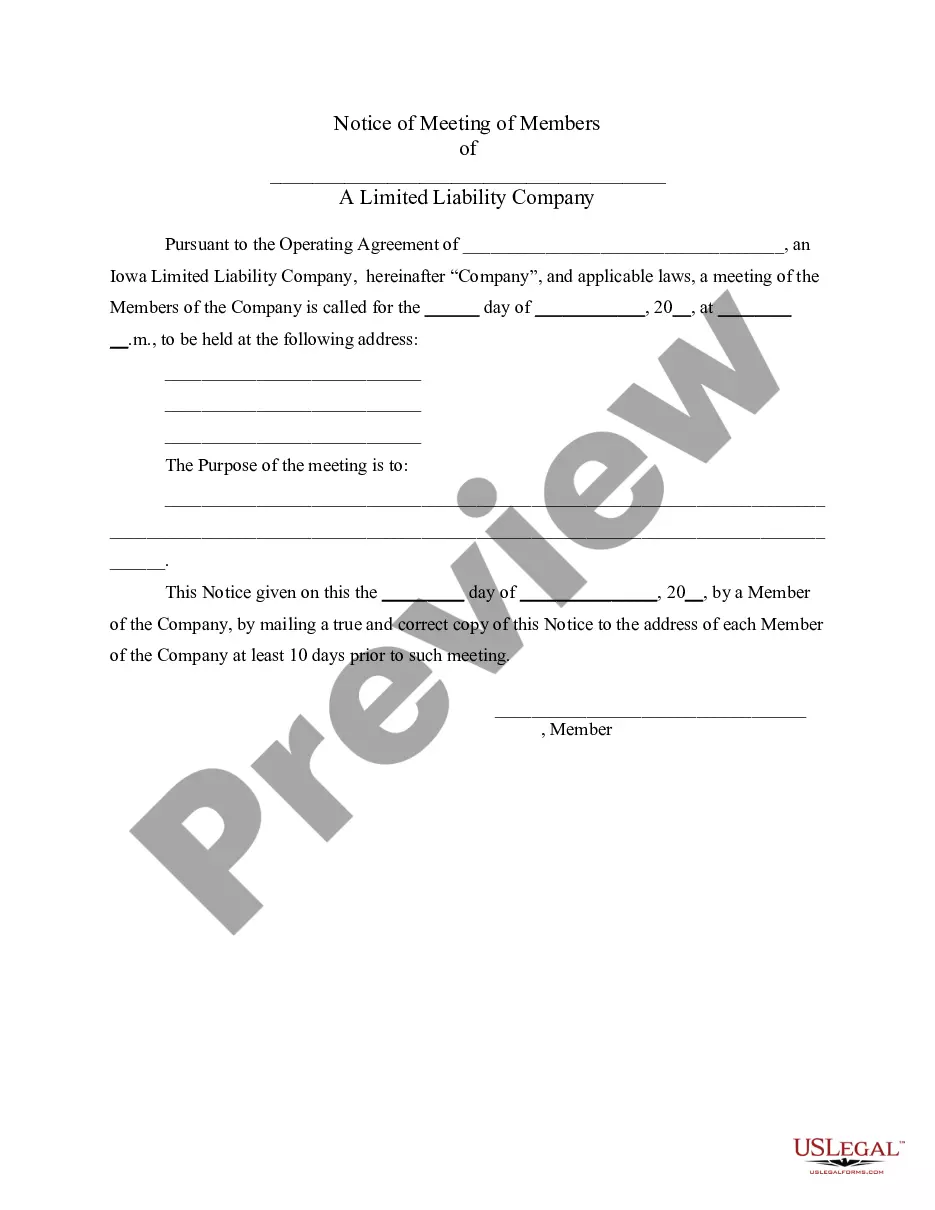

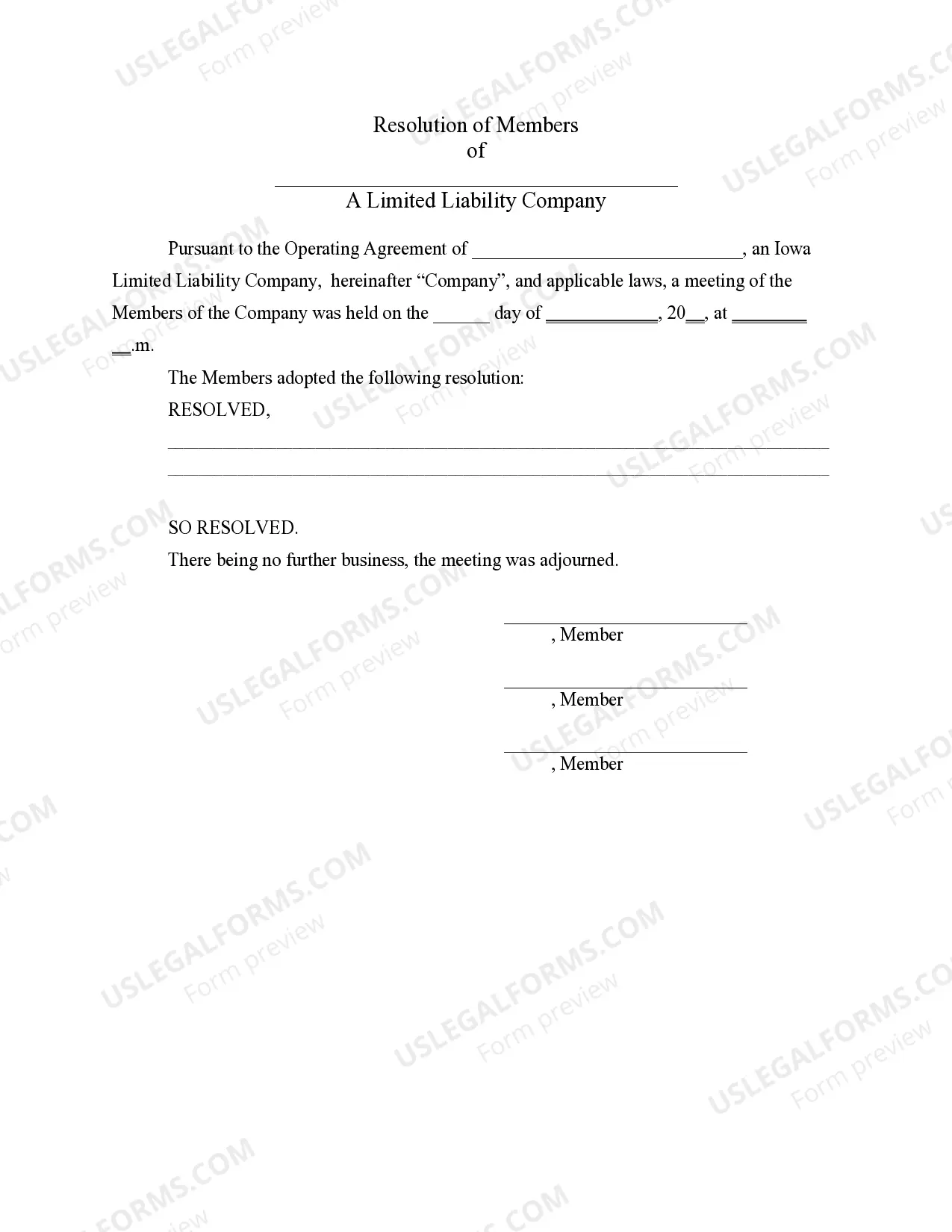

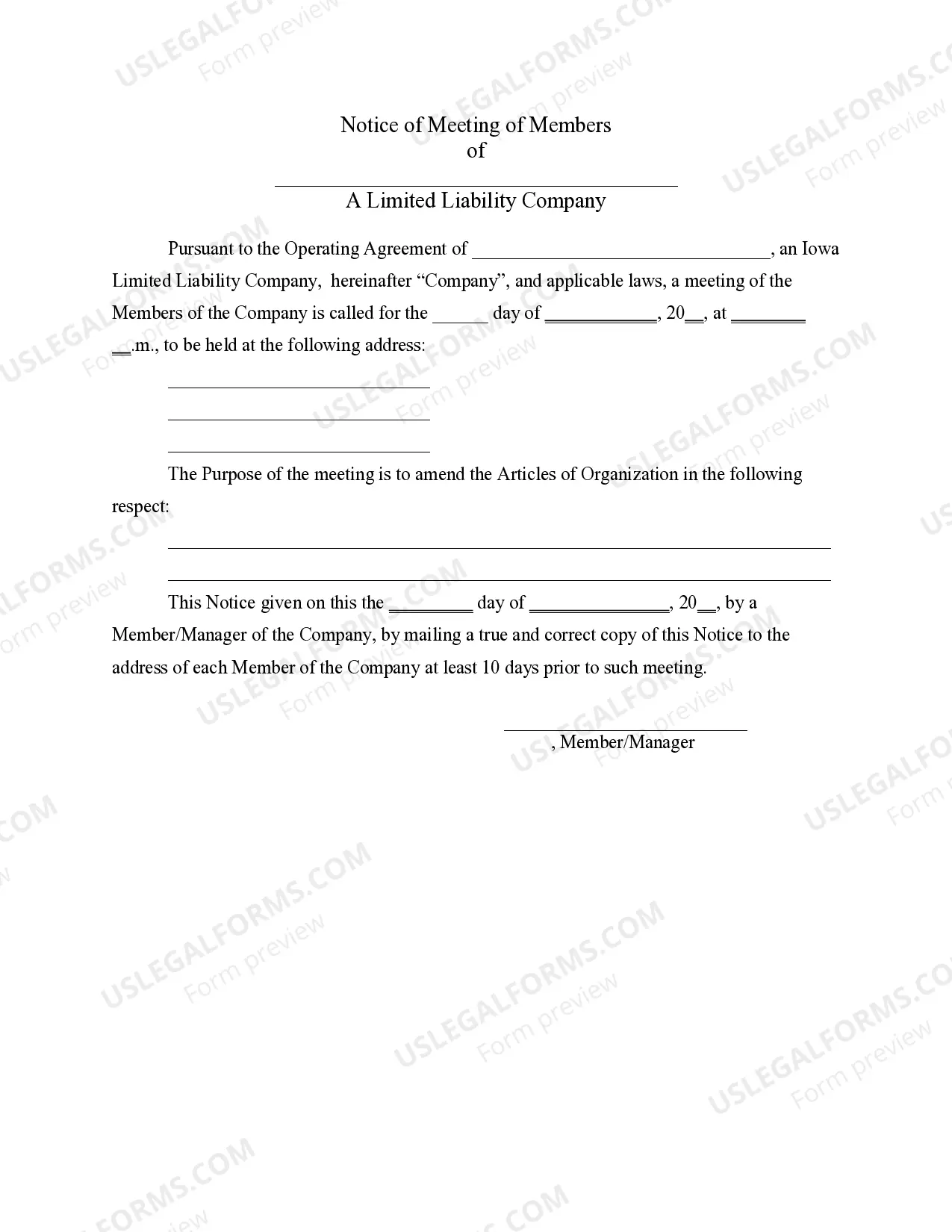

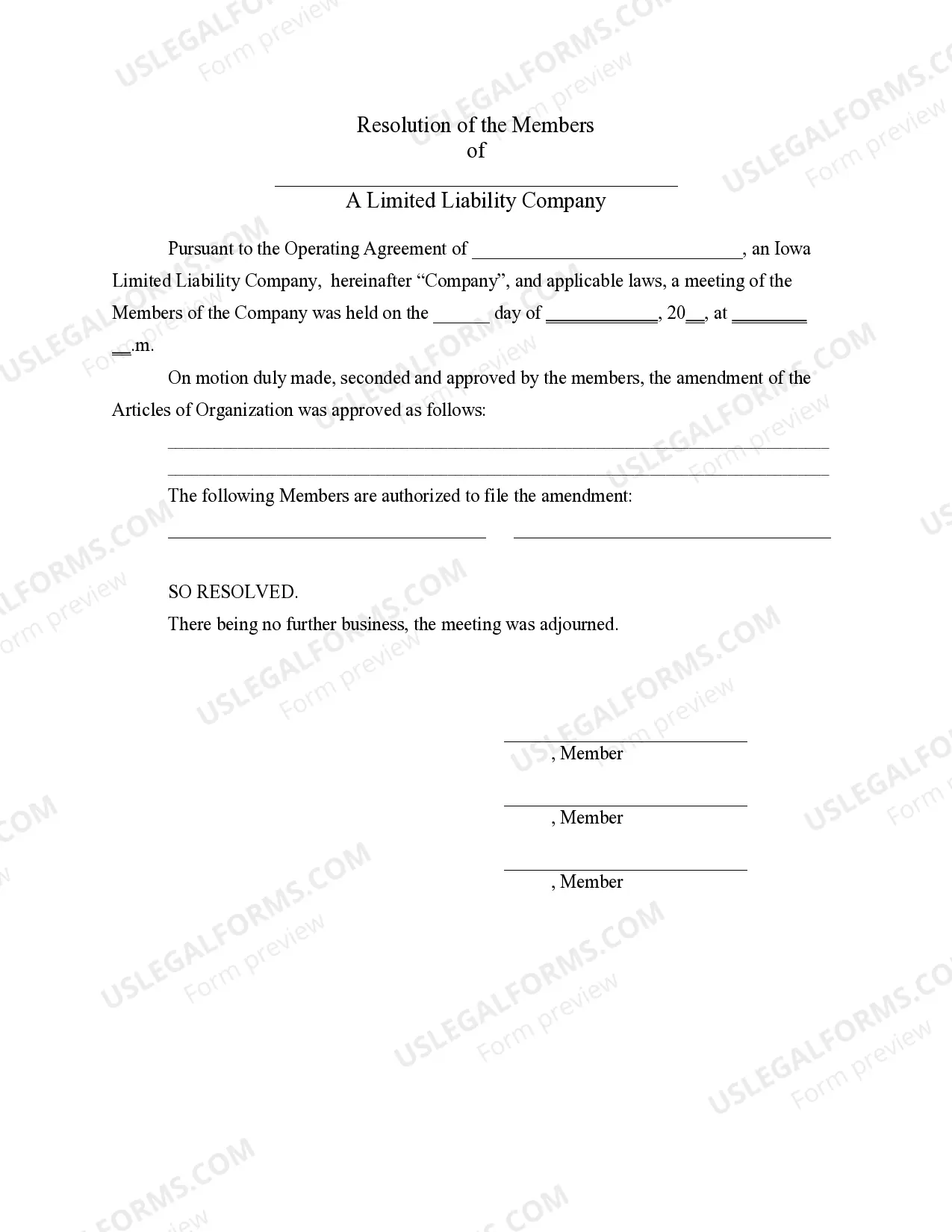

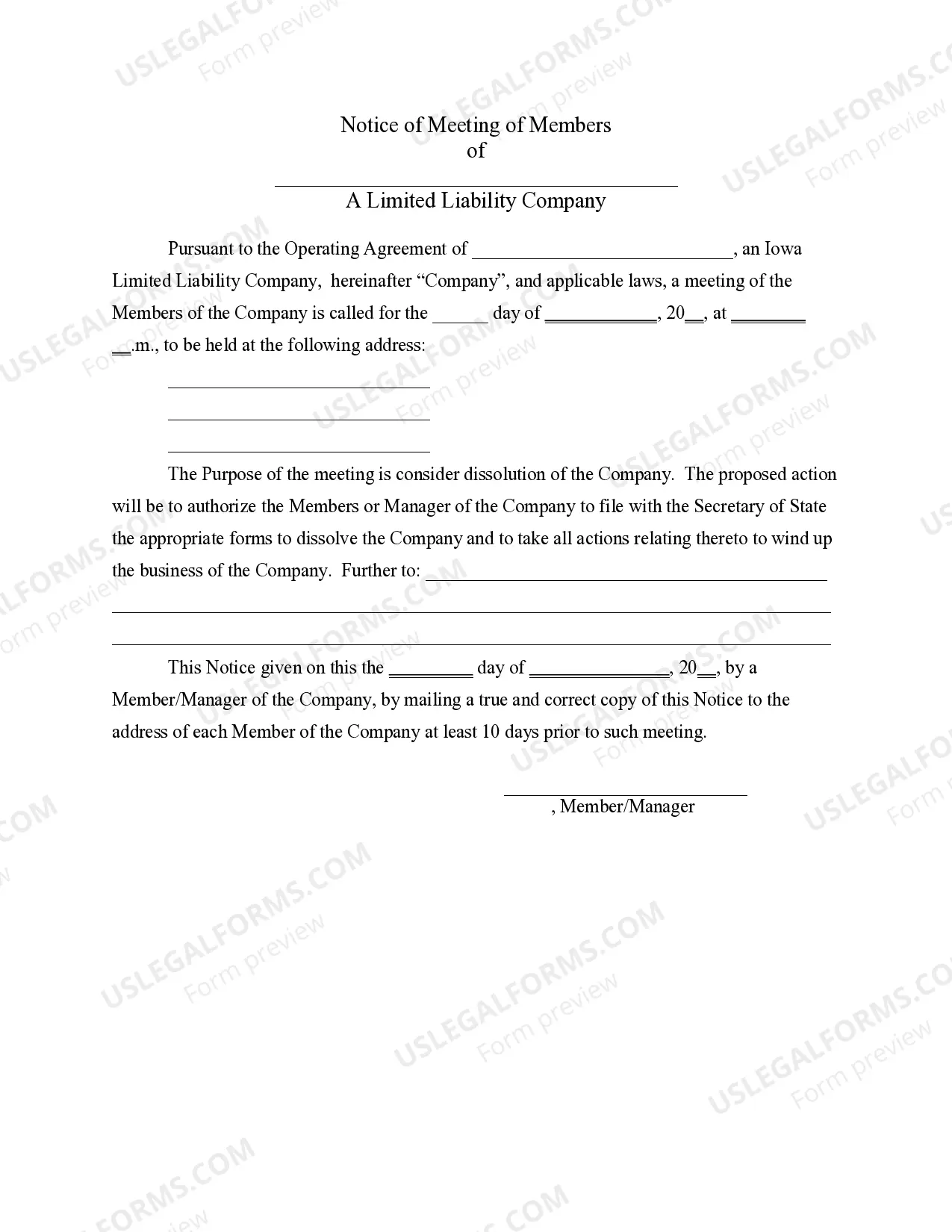

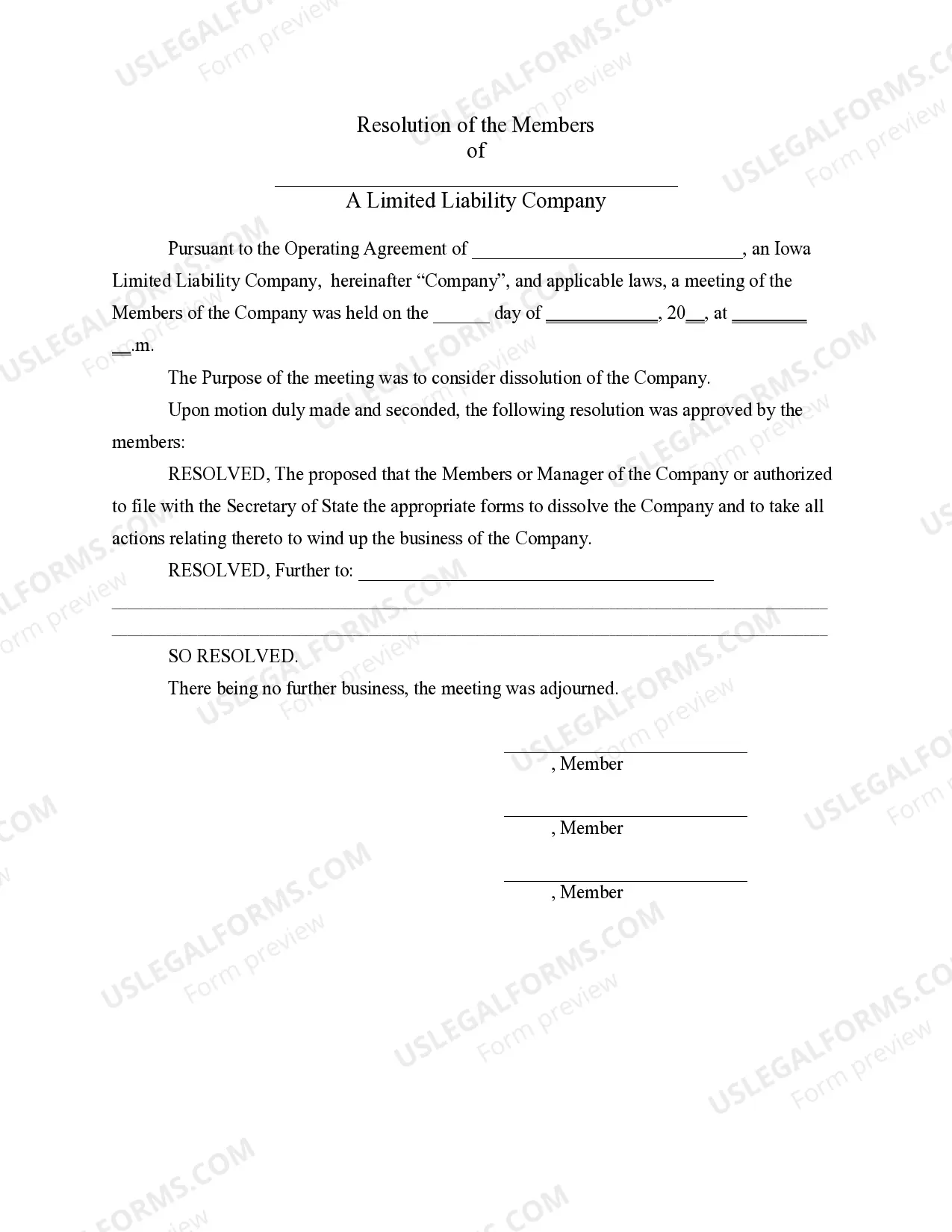

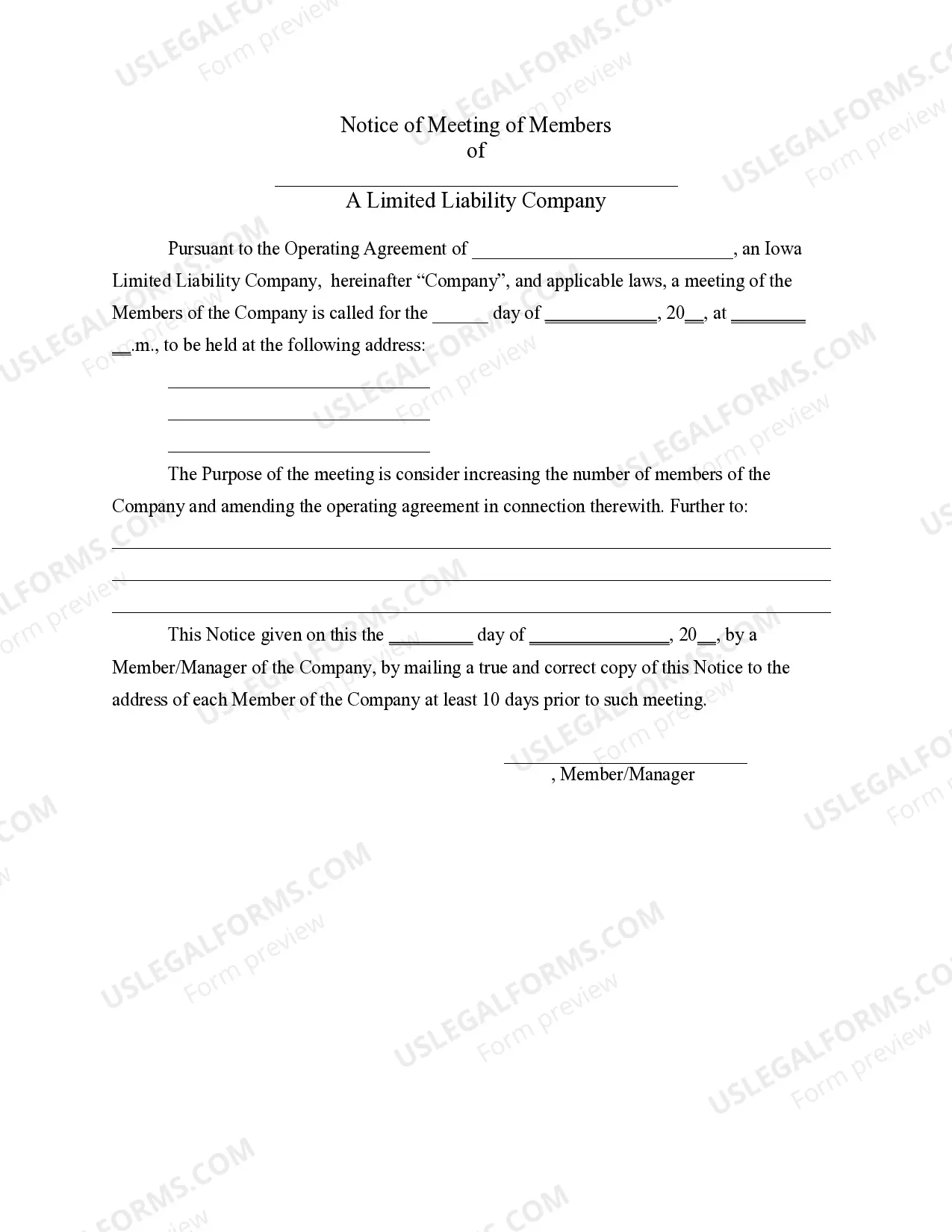

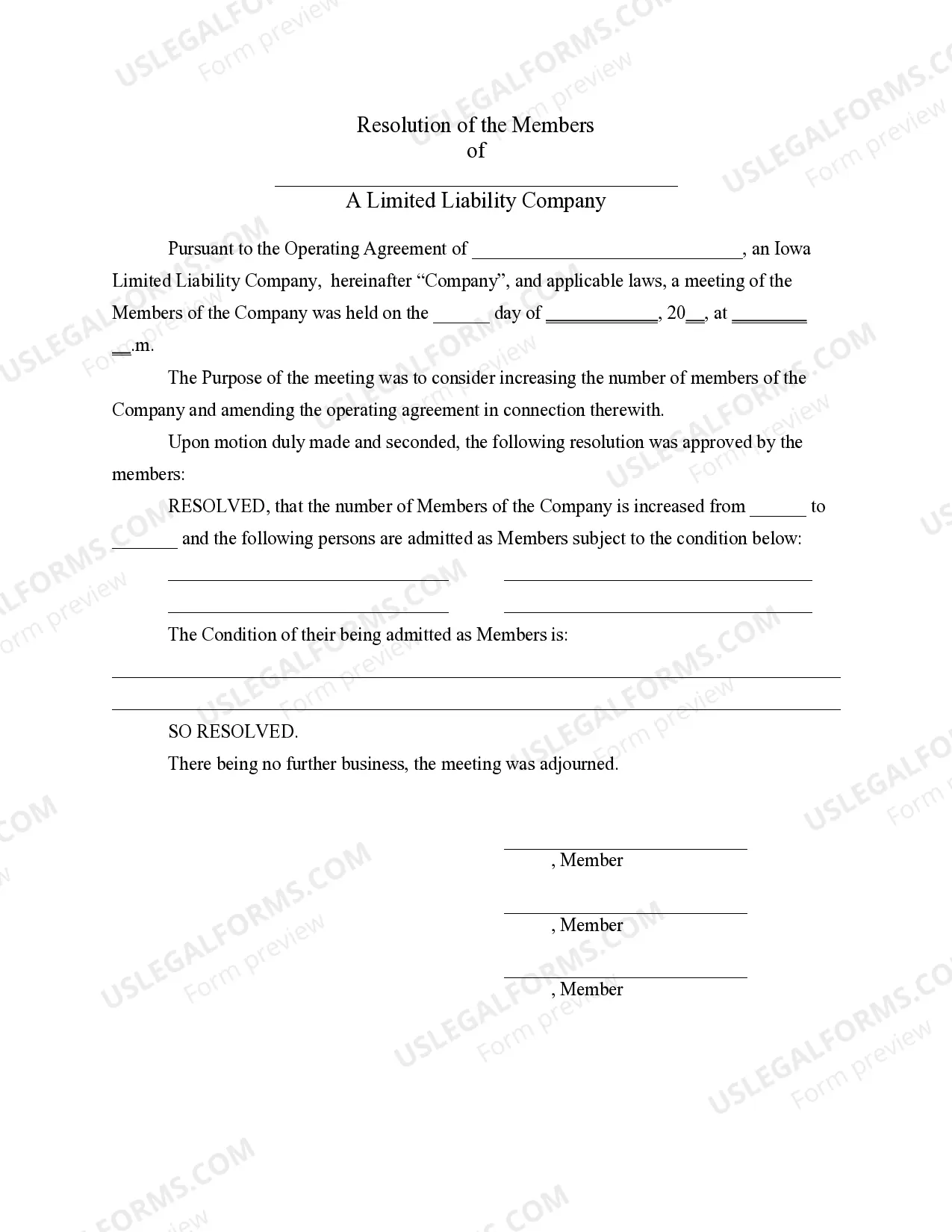

This LLC Notices, Resolutions and other Operations Forms Package contains over 15 forms for use in connection with the operation of a LLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, (16) Demand for Indemnity by Member/Manager and (17) Application for Tax Identification Number.

Form An Iowa Llc Withdrawal

Description

Form popularity

FAQ

To dissolve your LLC in Iowa, you must file a Certificate of Dissolution with the Secretary of State's office. Be sure to resolve any outstanding debts and obligations before initiating the dissolution process. Additionally, it's important to inform all relevant stakeholders about the closure of your business. Utilizing services from platforms like uslegalforms can simplify the steps required when you need to form an Iowa LLC withdrawal as part of your business transition.

The approval process for an LLC in Iowa typically takes about 3 to 4 weeks when you file online. If you submit your application through the mail, it may take longer, often up to 6 weeks. To expedite the process, consider using a business formation service that can handle all the details for you. This approach not only simplifies filing but also assists in cases like forming an Iowa LLC withdrawal when needed.

To file an LLC in Iowa, start by choosing a unique name for your business that complies with state regulations. Next, you will need to appoint a Registered Agent who will handle legal documents on behalf of your LLC. After that, you can prepare the necessary paperwork, which includes the Articles of Organization, and submit it to the Iowa Secretary of State's office, either online or by mail. If you're considering a Form an Iowa LLC withdrawal in the future, staying updated on these procedures will help you navigate any changes smoothly.

The process to form an Iowa LLC typically takes between 3 to 5 business days, depending on the submission method you choose. If you file online, it can expedite the process, as electronic submissions are often processed more quickly. Additionally, leveraging platforms like US Legal Forms can simplify this procedure, providing resources and guidance tailored to help you form an Iowa LLC withdrawal effectively. Remember, ensuring all necessary paperwork is in order can significantly reduce delays.

Canceling an LLC in Iowa involves submitting a certificate of cancellation to the Iowa Secretary of State's office. This action signifies your intent to form an Iowa LLC withdrawal and ceases all operations. Also, ensure all debts are settled and tax obligations are fulfilled to avoid complications. Using platforms like USLegalForms can simplify this process by providing the required forms and guidance.

To officially close an LLC, begin by holding a meeting with your members to approve the dissolution. Next, file the appropriate dissolution documents with the Iowa Secretary of State. This step is crucial to form an Iowa LLC withdrawal and protect against future liabilities. Remember to follow up with any final tax returns and notify creditors.

Reinstating a dissolved LLC in Iowa requires you to file an application for reinstatement with the Iowa Secretary of State. You will need to address any outstanding taxes or fees, which is essential to form an Iowa LLC withdrawal successfully. Upon approval, your LLC can operate again as if it never dissolved. It’s beneficial to use reliable resources like USLegalForms to guide you through this process.