Limited Lliability

Description

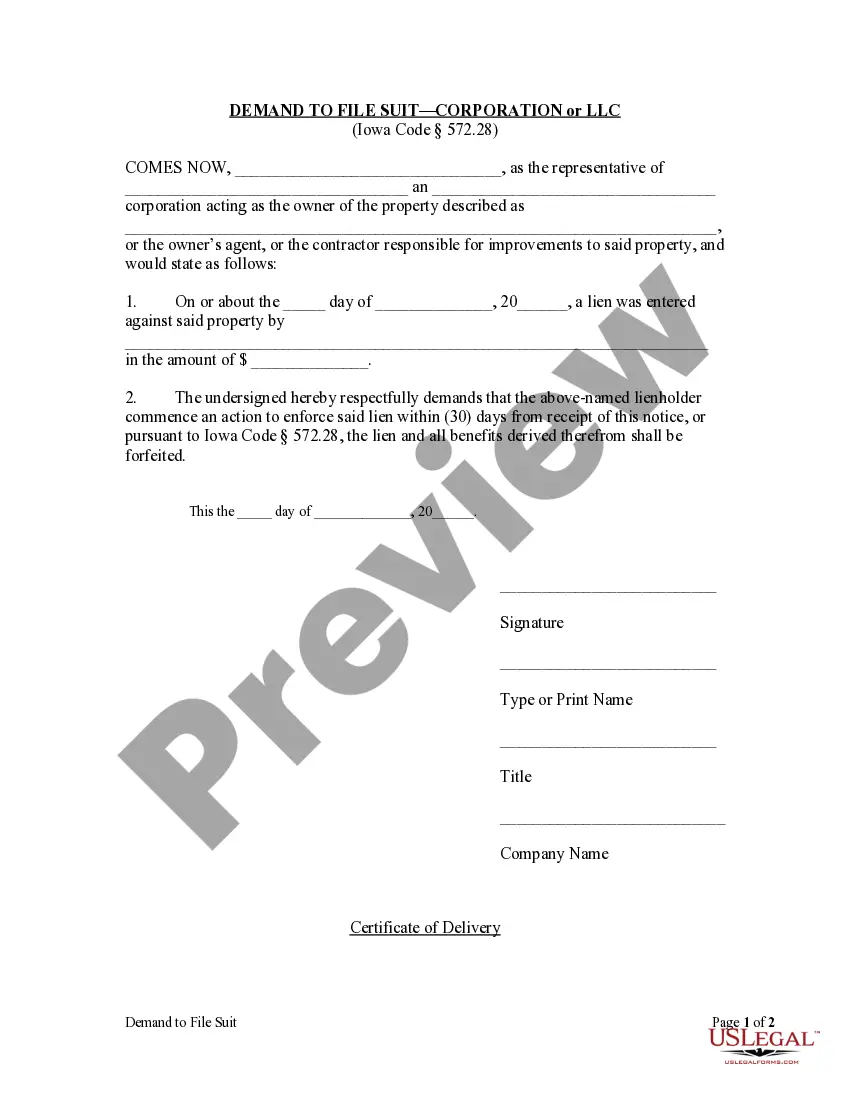

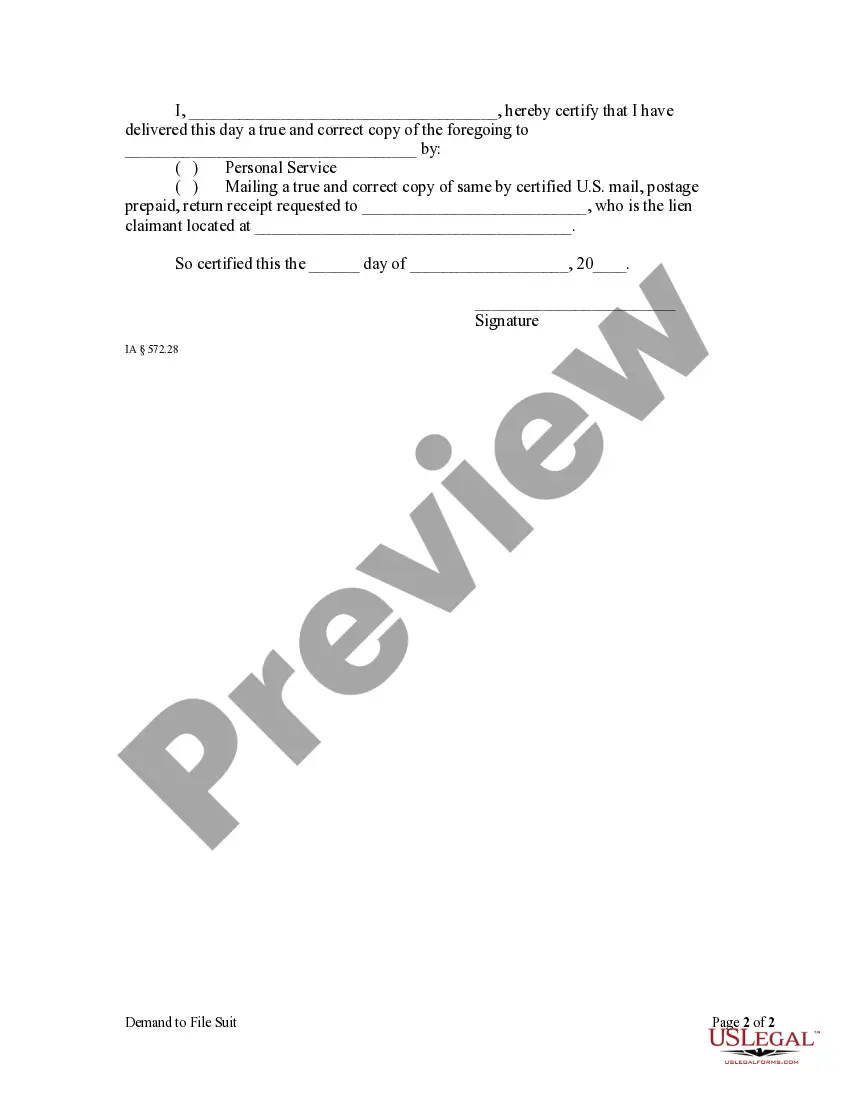

How to fill out Iowa Demand To File Suit By Corporation Or LLC?

- Log into your existing account on US Legal Forms by clicking here. Make sure your subscription is active to access your chosen forms.

- If you're a new user, start by reviewing the available templates in Preview mode to find the limited liability form that suits your specific needs based on your jurisdiction.

- Should you need a different template, utilize the Search feature at the top of the page to locate the correct document that meets your criteria.

- Once you've found the appropriate form, select the Buy Now button and choose your preferred subscription plan. You'll need to create an account to proceed.

- Complete your purchase using credit card details or your PayPal account to finalize your subscription.

- Finally, download the template onto your device and you can access it anytime from the My Forms section of your profile.

By following these steps, you can easily obtain the legal forms necessary for establishing limited liability, ensuring you have the necessary protections in place.

US Legal Forms empowers users to navigate legal processes smoothly, with an extensive collection of forms and expert assistance available. Start protecting your business today!

Form popularity

FAQ

Yes, you can form an LLC and leave it inactive. However, it’s important to remember that even inactive LLCs may have ongoing responsibilities, such as annual reports or fees. Maintaining the limited liability status is essential to ensure you protect your personal assets. If you wish to close the LLC, follow your state's dissolution process.

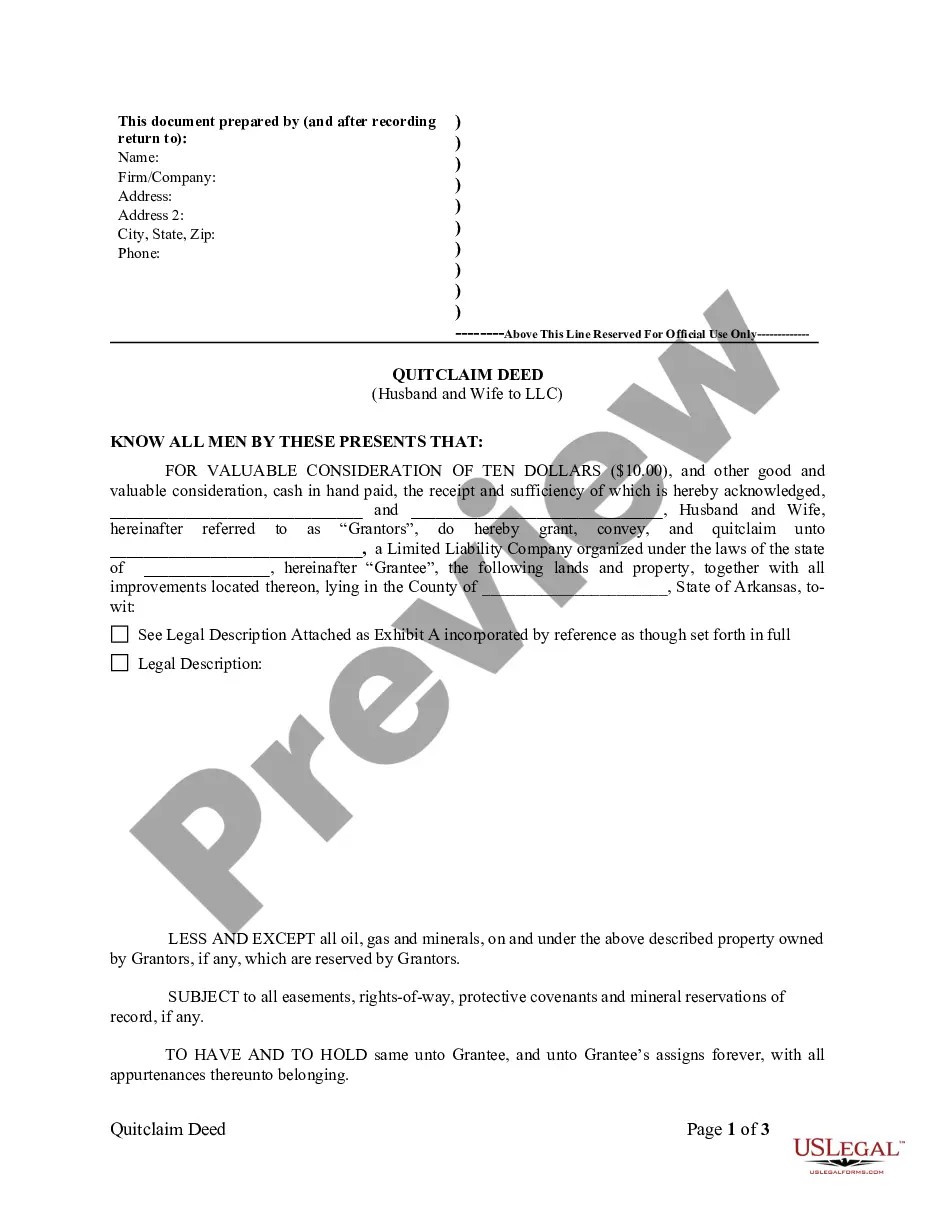

A common example of limited liability is when a business owner forms an LLC. By doing so, their personal assets, such as a home or savings, remain protected from business debts and lawsuits. If the LLC incurs debt or faces legal issues, creditors can only pursue the assets of the LLC, not the owner's personal property. This structure provides peace of mind.

If you don't file taxes for your LLC, you risk facing penalties and interest from the IRS. Your company may lose its limited liability status, which protects your personal assets. Additionally, it could lead to greater scrutiny from tax authorities, making future compliance more challenging. It's crucial to stay on top of all tax obligations for your LLC.

Yes, you can file your LLC separately from your personal taxes. By treating your LLC as a separate entity, you maintain the benefits of limited liability. This separation protects your personal assets in case of business liabilities. Ensure you follow the necessary steps to achieve this status when filing taxes.

The primary difference between limited and unlimited liabilities lies in the level of financial risk each entails. Limited liability protects personal assets and confines the owner’s responsibility to their investment in the business. In contrast, unlimited liability exposes owners to full financial responsibility, meaning their personal wealth can be used to cover business debts. Choosing the right structure is important, and US Legal Forms can guide you through the process.

Limited liability refers to a legal structure that protects business owners by limiting their financial risk to their investment in the business. This means that if the business encounters financial issues, owners typically do not have to use their personal assets to satisfy debts. It’s a key benefit for many entrepreneurs, allowing them to operate their businesses with more peace of mind.

Limited liability and unlimited liability are two different ways to describe an owner’s financial responsibility in a business. Limited liability ensures that owners are only accountable for their investments, while unlimited liability exposes them to full personal financial risk. Understanding these concepts is crucial, and platforms like US Legal Forms can help clarify your options when establishing a business structure that fits your needs.

In simple terms, limited liability means that a business owner’s financial responsibility is limited to the amount they invested in the business. This protects personal assets such as homes and savings from being taken to cover business debts. Overall, limited liability serves as a security measure for entrepreneurs, allowing them to take business risks without putting their personal wealth at stake.

A limited liability company (LLC) combines the features of a corporation and a partnership. It offers limited liability protection to its owners, meaning their personal assets are usually protected from business debts. Additionally, an LLC provides flexibility in management and tax options, making it an appealing choice for many entrepreneurs who want to safeguard their personal finances.

Unlimited liability means that a business owner is personally responsible for all debts and obligations of their business. This means that if the business fails, creditors can pursue the owner's personal assets to settle debts. For example, a sole proprietorship typically operates under unlimited liability, as the owner’s personal savings or belongings can be at risk in the event of financial trouble.